A Permanent Account Number (PAN) is one of the most essential documents for citizens of India. Besides being used for income-tax filing, a PAN card also acts as identity proof. Are you facing trouble finding your PAN details on the internet? Continue reading to know how to check pan card details easily.

Other related articles: How to Track your PAN Card Status, PAN Card Customer Care Number, PAN Card Customer Care Number

How to check pan card details

One can get caught up in situations where you need to access your PAN card details on the internet.

You can show your PAN card details online at many digital and physical checkpoints if you do not have the physical card with you.

A PAN card keeps track of the financial activities of the cardholder. PAN card has several use cases like income tax filings, ID card, DOB proof, etc.

Every citizen that pays tax to the Income Tax Department has a unique PAN card, and each PAN card has a unique number of 10 characters.

While a PAN card is a physical card, it can also be searched online via the official website. You can do PAN card search by name , address, DOB, and other online methods. As a responsible citizen, you should know the legal method to find your PAN card details online.

Make sure that you use the official website to access your PAN card details online. Using unreliable websites may lead to the loss of sensitive data.

However, you can check the PAN card details online only after you have received the physical card. If you haven’t received your PAN card, please apply for one immediately.

Let’s look at the process of applying for a PAN card before knowing how to search for PAN details online.

The process to register for a PAN card

If you carry out financial activities, you need to apply for a PAN card. Do you know that you cannot make a deposit or withdrawal of more than INR 50,000 from banks without a PAN card? The Government of India allows citizens to apply for a PAN card online/offline. Once you have applied for a PAN card, you can track your card status online.

The steps for applying for a PAN card online are as follows:

Step 1 👉 Go to the NSDL e-Gov online portal for filing a PAN application. Follow the direct link - TIN (tin-nsdl.com)

Step 2 👉 Locate the PAN application and start your PAN application process online.

Step 3 👉 Submit the documents asked on the online portal after scanning. You must also submit two passport size photographs while applying for a PAN card online.

Step 4 👉 Pay the PAN card fee to start your application process.

Step 5 👉 Your unique PAN card will be delivered to your home address in about 15 days from the application.

You can apply for a PAN card offline in simple steps that are:

Step 1 👉 NSDL has established many PAN centers across the country to facilitate people. You can visit a nearby PAN center to apply for your unique PAN card.

Step 2 👉

Submit all the required documents and photographs to the PAN center.

Step 3 👉 Pay the PAN card application fee to the official present at the PAN center.

Step 4 👉 Your unique PAN card will be delivered to your communication address in around 15 days.

What are the details available on a PAN card?

A PAN card has several details that identify a person. The plastic card will have several personal details on the front side.

At the back of a PAN card, you can find the contact address of the NSDL service unit. One should know what details are mentioned on their PAN card. Here are the details mentioned on a PAN card:

- The name of the owner of the PAN card is given on top.

- The PAN holder’s father’s name is mentioned next on the PAN card.

- The holders’ date of birth will also be mentioned on the PAN card in the DD/MM/YYYY format.

- The unique PAN Card number (alphanumeric) of 10 characters is mentioned on a PAN card.

- The PAN card will also have a passport size photograph of the individual.

- Your PAN card will also contain your registered signature.

Methods to access PAN card details online

There are several ways to access your PAN details online. For physical/digital checkpoints, PAN card details from the official website are only considered to be true. By visiting unregistered websites, you can get yourself in trouble. Cybercriminals tend to access sensitive information of users via unreliable sites.

Different methods to check your PAN card details online are as follows:

1. Accessing PAN card details via name and DOB

NSDL does not offer any services to check the PAN card details directly via your name and DOB. However, you can use your name and DOB to access the PAN verification process. Via the PAN verification process, you can access your PAN card details when needed. The steps for PAN card verification via your name and DOB is as follows:

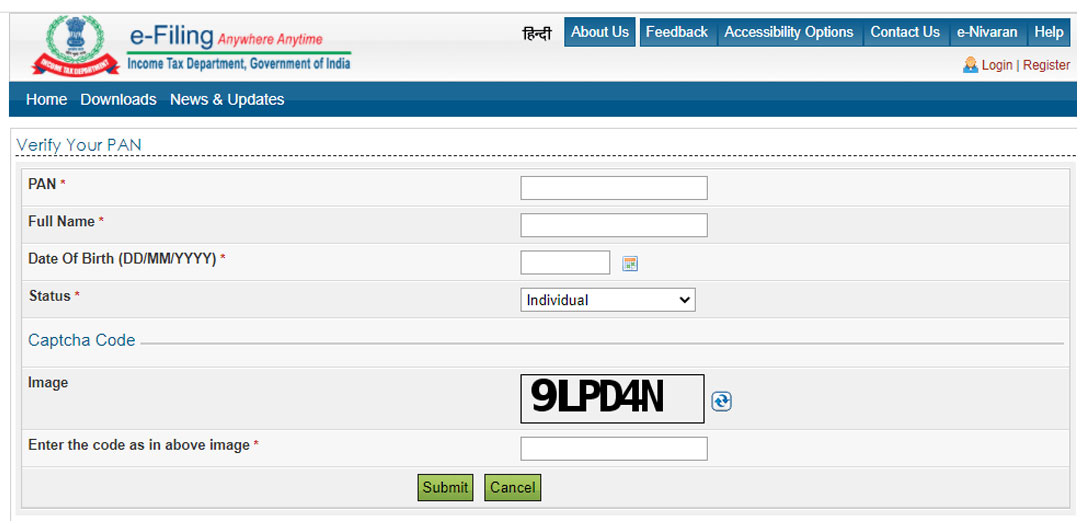

STEP 1 👉 Visit the official portal of income tax filing, i.e., https://www.incometaxindiaefiling.gov.in/home.

STEP 2 👉 On the homepage, you will find a ‘Quick Links’ section. Under the same section, you have to click on the ‘Verify your PAN Details’ button.

STEP 3 👉 You will be asked for several details like PAN card number, account holder full name, DOB, and registered mobile number. Make sure you enter each detail accurately for the PAN verification process.

STEP 4 👉 After entering the aforementioned details, you will have to select your PAN status. Some PAN status options are a body of individuals, HUF, an artificial juridical person.

STEP 5 👉 You will have to enter the captcha code correctly and tap the ‘Submit’ icon to start the verification process.

STEP 6 👉 You will be redirected to a new webpage that tells you whether the PAN details match the official database. On the same webpage, you can access your complete PAN details.

2. Accessing PAN Card details by PAN number

You can also access your PAN card details via your PAN number. Again, make sure that you visit the official website to access your PAN details via the PAN number. The steps to find PAN details via the PAN card number are as follows:

STEP 1 👉 Visit the official income tax filing website, i.e., https://www.incometaxindiaefiling.gov.in/home.

STEP 2 👉 Click on the ‘Register Yourself’ icon visible on the homepage and enter your unique PAN number.

STEP 3 👉 Enter the other details asked on the official website and tap the ‘Submit’ button.

STEP 4 👉 You will receive an account activation email shortly.

STEP 5 👉 Once your account has been activated, click on the ‘My Account’ icon and click on ‘PAN Details’. All the PAN-related information will be displayed to the user immediately.

3. Accessing the registered address in your PAN card

The Indian government allows PAN cardholders to check for their registered address. The physical PAN card will not contain your registered address. The process for registered PAN card address check are as follows:

STEP 1 👉 Visit https://www.incometaxindiaefiling.gov.in/home and search for the ‘Registered User?’ option.

STEP 2 👉 Under the Registered User section, you will have to enter the PAN number and tap the ‘Continue’ icon.

STEP 3 👉 On the next webpage, you will have to enter other PAN details. Once all details are entered, a confirmation email will be sent to the PAN cardholder.

STEP 4 👉 Under the ‘Profile Setting’, click on ‘PAN Details’ to access your registered address.

Conclusion

PAN is an important document that you should carry with you on important trips. Even if you don’t carry your physical PAN card with you, you should know how to check pan card details online.

It is also recommended that one should have a scanned copy of the PAN card in their multimedia devices. Besides income tax filing, you can also show your PAN card as identity proof when required. Access your PAN card details via official sources now!

Frequently Asked Questions

Q1. How many types of PAN are available?

The Indian government issues two types of PAN cards. The first type of PAN card is for Indian citizens, while the second type of PAN card is for foreign residents. Foreign investors, company owners, and NRIs need to apply for a PAN card in India.

Any foreign individual involved in financial activities in India needs to apply for a PAN card.

Q2. Who is required to keep a PAN?

If your annual income exceeds the minimum tax slab, you need a PAN card. Any company, trust, or business organization that earns more than INR 5,00,000 has to possess a PAN card. There are restrictions on the amount for financial transactions in the country.

If you want to make financial transactions more than the permissible limit, you need to have a PAN card. All adults over the age of 18 years can use a PAN card as proof of identity.

Q3. Can a person hold more than one PAN?

Under no circumstances can a person hold more than one PAN. PAN is a unique card that stores information regarding the financial activities of a person. By owning more than one PAN card, you are giving signs of tax evasion.

Similar to a person, a company can possess only one registered PAN card. If you are found with more than one PAN card, the minimum punishment is a fine of INR 10,000.

Q4. Can I check my PAN card details by PAN number?

You cannot directly check your PAN card details only via your PAN number. However, you can follow the PAN verification process on the official income tax filing website to access PAN card details via PAN number.

You will have to register yourself on the official website and receive a confirmation mail. After the confirmation email has arrived, you can access your PAN details under the ‘My Account’ section.

Q5. What is the last date to link the Aadhar card and PAN card?

It is now mandatory for PAN cardholders to link their Aadhar and PAN cards. The previous date for linking Aadhar and PAN cards was the 30th of September 2021. However, most users have not linked their PAN card and Aadhar card. It is why the government of India has increased the last date to 31st March 2022.