Want to know about how to download pan card online Well, don't worry you came to the right place, check our easy-to-read article on how to download pan card online through NSDL, UTI & UTIITSL

Hello Reader! You might have come across a situation where you needed to provide PAN card details urgently, but you didn’t have its copy with you, or you didn’t even have your PAN card. This article has the solution to such problems.

PAN or Permanent Account Number is a unique alphanumeric code of 10 digits issued to a person who carries on any financial activity in India. PAN card is mandatory for every assesses who pays tax.

What is e-PAN?

e-PAN is an electronic or virtual form of PAN card that contains the PAN card details. It is a valid document that can be used wherever a PAN card is required to be furnished. There are two websites to download e-PAN, NSDL and UTIITSL pan card

e-PAN includes the following details:

Permanent Account Number

Name

Father’s Name

Photograph

QR code

Date of Birth

Gender

Signature

Methods to Download PAN card online:

There are two methods to download a PAN card online. One is through the NSDL portal, and another is through the UTIITSL portal. e-PAN can be downloaded free of cost within one month of a new application or application for any modification in PAN.

If a person has applied for pan card download nsdl service, they can download e-PAN from the same portal. It is possible to download e-PAN from UTIITSL for that person, but only by applying for a PAN card Reprint on the UTIITSL portal. The exact process is applicable for UTIITSL applicants.

Steps to Download e-PAN through UTIITSL:

If a PAN card application is made through UTIITSL, e-PAN can be downloaded online. An additional fee of Rs. 8.26 (including taxes) is charged by UTIITSL for downloading e-PAN after 30 days of issuance of PAN card. Otherwise, no additional payment is charged.

e-PAN can be downloaded through the UTIITSL portal by following the below steps:

Step-1: Visit the Facility to download the e-PAN card page of the UTIITSL portal.

Step-2: Enter the details as required, such as PAN, DOB/DOI, GSTIN (optional)

Step-3: Enter the captcha(security code) as appearing on the screen.

Step-4: Check whether the mobile number and email ID mentioned against the PAN is correct, then enter the captcha and tick the declaration given.

Step-5: You will be provided with an option to send the OTP on either mobile number, email, or both. Select the mode of OTP, click on ‘Generate OTP,’ and then OTP will be sent to the selected option.

Step-6: Enter the OTP as received and click on ‘Submit.’

If you are downloading e-PAN after one month of issuing a PAN card, you will be directed to another page to pay an additional fee through online mode.

Step-7: On successful processing, e-PAN can be downloaded by you.

Steps to Download e-PAN through NSDL portal:

If a PAN card is obtained through applying on the NSDL website, then e-PAN can be downloaded from the same website. But e-PAN can’t be downloaded from the NSDL website after one month of application (for both new and correction applications).

e-PAN can be downloaded from the NSDL portal with two options:

- Via Acknowledgement number

- Via PAN and Date of Birth

Applicants can select the option of whether they want to get the hardcopy of their PAN card to be delivered to their residential address or not. But e-PAN will be sent through email in both options.

That’s why it is necessary to provide an email ID on which e-PAN will be sent. This option is available for both new and correction applications.

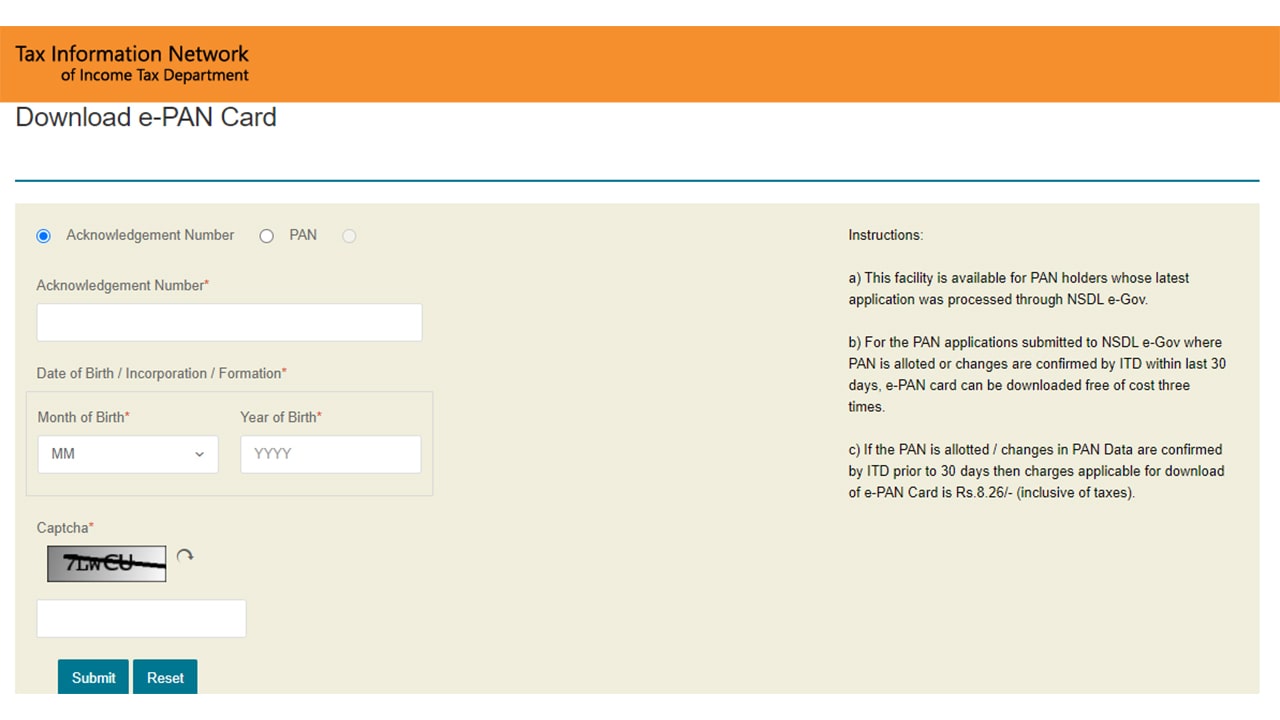

Steps to Download e-PAN through NSDL (Via Acknowledgement number):

The step-by-step process for downloading e-PAN through the NSDL portal via Acknowledgement number is as follows:

Step-1: Visit the Download e-PAN card page of the NSDL portal and select the ‘Acknowledgement number’ option.

Step-2: Enter the Acknowledgement number, DOB/DOI, and captcha appearing on the screen.

Step-3: Click on ‘Submit,’ and you will be directed to the next page.

Step-4: Check whether the mobile number and email ID displayed on the screen are correct.

Step-5: Here also, you need to select the mode of OTP and then click on ‘Generate OTP.’

Step-6: Enter the OTP and proceed.

Now, you will be able to download a PDF copy of the e-PAN.

Steps to Download ePAN through NSDL (Via PAN and Date of Birth):

The process of downloading e-PAN through the NSDL portal via PAN and Date of Birth is given below:

Step-1: Visit the Download e-PAN card page of the NSDL portal and select the ‘PAN’ option.

Step-2: Enter the PAN details, Aadhaar number, DOB/DOI, GSTIN(optional), tick the declaration given, and enter the captcha.

Step-3: Click on ‘Submit,’ and an OTP will be sent to the registered mobile number.

Step-4: Enter the OTP and click on ‘Start’ to begin the validation process.

Step-5: After completion of the Validation process, you will be able to download PAN.

You need to enter the password, which is your date of birth, to open the PDF copy downloaded.

Steps to Download e-PAN through Aadhaar Number:

There is an alternative way to download a duplicate copy of the PAN card, i.e., Reprint PAN card through the Aadhaar card, which is offered by NSDL e-Gov. It can be downloaded by following the below-mentioned steps:

Step-1: Visit Request for Reprint of PAN card page of NSDL portal.

Step-2: Enter the PAN details, DOB/DOI, Aadhaar Number, GSTIN(optional).

Step-3: Read the declaration carefully, tick to proceed further, and enter the captcha.

Step-4: Click on ‘Submit,’ and you will be directed to a new page.

Step-5: Check the details displayed on the page, select the mode of OTP and click on ‘Generate OTP.’

Step-6: Enter the OTP received and click on ‘Validate.’

The request to reprint the PAN card will then be submitted to the NSDL department.

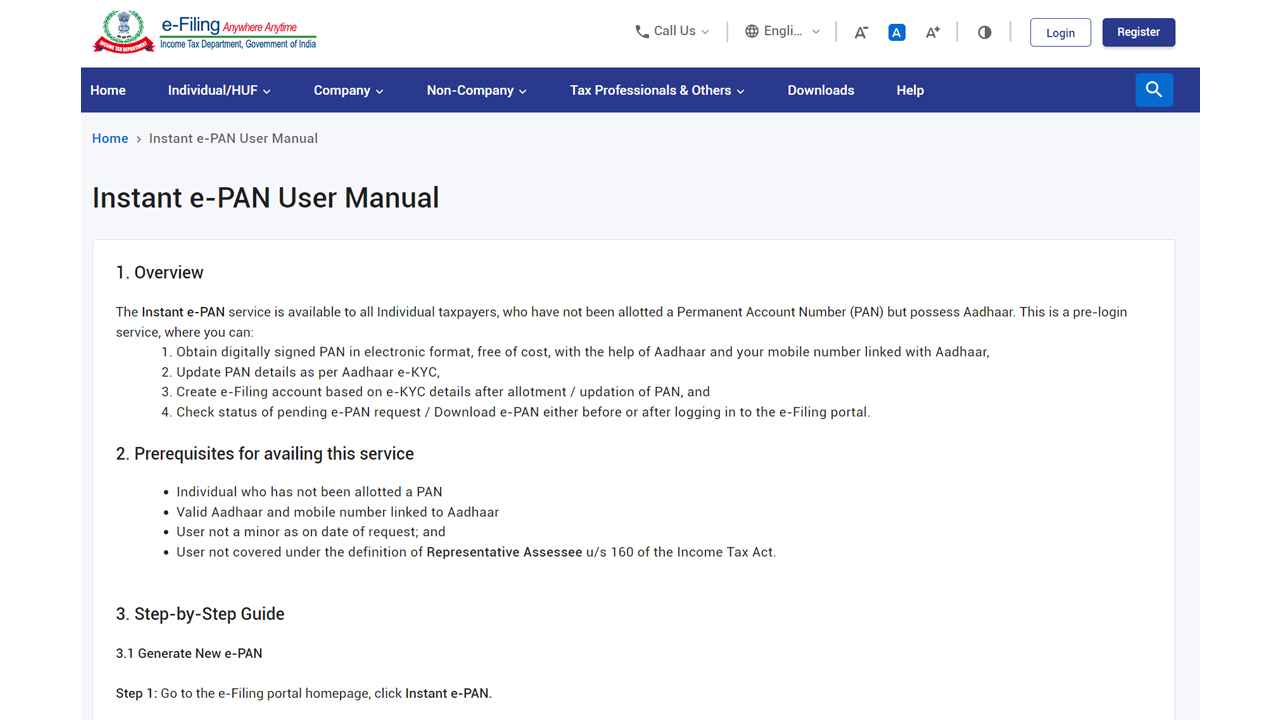

Steps to Download e-PAN through Income tax portal:

How to download E PAN card through the Income-tax portal, first, you need to apply for Instant PAN by the following process:

Step-1: Visit the Income-tax portal.

Step-2: Select the ‘Instant e-PAN’ option in the ‘Quick Links’ Tab on the screen.

Step-3: Click on the ‘Get New PAN’ tab.

Step-4: Enter the Aadhaar number, tick the ‘I Confirm that’ and click on ‘Continue.’

Step-5: On the OTP Validation page, tick the declaration, click on ‘Continue,’ then an OTP will be sent on the registered mobile number linked with Aadhaar.

Step-6: Enter the OTP received.

After proceeding, an Acknowledgement number will be sent via SMS and email.

For downloading the e-PAN, the following process needs to be followed:

Step-1: Visit the Income-tax portal.

Step-2: Select the ‘Instant e-PAN’ option in the ‘Quick Links’ Tab on the screen.

Step-3: Click on the ‘Check Status/Download PAN’ tab.

Step-4: Enter Aadhaar number and click on ‘Continue.’ An OTP will be sent on a registered mobile number.

Step-5: Enter the OTP, tick the declaration and click on ‘Continue.’

After successful validation of OTP, you will be able to see the status or download e-PAN.

For a further detailed process with the demo, you can visit the link: https://www.incometax.gov.in/iec/foportal/help/how-to-generate-instant-e-pan

Eligibility to apply for e-PAN:

Following Criteria must be fulfilled to apply for e-PAN:

You must have an Aadhaar card.

The Aadhaar card must be updated.

Mobile number must be linked with Aadhaar card.

You should not have PAN (A person who has obtained more than one PAN card will be liable to be imposed a fine up to Rs. 10000)

You should be an individual taxpayer.

You should be an Indian citizen.

Documents required to Download PAN card:

To download the PAN card, the applicant must have an updated Aadhaar card and residential address proof such as the Aadhaar card, Voter ID, Utility Bill, or Driving license.

How to Download PAN Card Form?

If the applicant is an Indian Citizen, then Form 49A will be applicable, and if the applicant is an NRI, then Form 49AA will be applicable.

- First, take out the print of the respective form and fill in the details required in capital letters.

- Ensure that one box is left after completion of one word and before starting of next word.

- Applicants can fill in the details of AO code, AO number, AO type by finding it through the link: https://tin.tin.nsdl.com/pan/servlet/AOSearch .

- Fields having an asterisk (*) mark means that it is mandatory to fill that field.

- Then the photograph of size 3.5 cm x 2.5 cm is to be affixed in the space provided in the form. The photograph should be stuck and not stapled or attached using a clip.

- After that, the applicant needs to sign the form in the space provided. The signature must be done within the box.

- An option to sign with the impression of the left thumb is also available, but the application must be attested by a Gazetted Officer or Magistrate under an official stamp and seal in such a case.

- In case the applicant has a Representative Assessee, then the details need to be provided in column 14 of the form.

- The application then can be submitted at the NSDL center or UTI center, or any entity which is authorized to receive the PAN card applications.

- For customer care contact details, you can visit https://www.tin-nsdl.com/nsdl-addresses. html for NSDL and https://www.utiitsl.com/branchlocator for UTIITSL.

Conclusion

Generally, the PAN card is allotted within 21 working days after the application is submitted. But under the Fast track process, e-PAN can be obtained within 48 hours of the submission of the application through online mode. e-PAN has various uses similar to regular PAN cards.

It can be stored on a computer or smartphone. It can be downloaded from anywhere using the internet service through the official websites mentioned above.

Also, there are various options available through which e-PAN can be downloaded, such as Permanent Account Number, Date of Birth, Aadhaar number, Acknowledgement number, etc.

I hope you have learnt how to download pan card after reading this article.

Frequently Asked Questions

1. How do I download my existing e-PAN card?

You can download your existing e-PAN card through the NSDL website or UTIITSL website by following the steps mentioned in the article.

If you are downloading e-PAN within 30 days from the allotment of PAN card, then you can download e-PAN free of cost up to three times through the NSDL website as well as the UTIITSL website.

2. Can I download a virtual PAN card?

Yes, you can download a virtual PAN card. Virtual PAN is nothing but an e-PAN card that can be downloaded online. The process by which a Virtual PAN card can be downloaded is mentioned above in the article.

You must have the documents as required to download a virtual PAN card. The list of documents required is also provided in this article.

3. How To Download PAN Card With Aadhaar?

Yes, a PAN card can be downloaded with the help of an Aadhaar card. This facility is made available by NSDL e-Gov. Another way of downloading a PAN card with Aadhaar is through the Income-tax portal, in which Instant e-PAN through the Aadhaar card option is available.

4. Is e-PAN card valid?

Yes, the e-PAN card is valid, just like the original/regular PAN card. The e-PAN card is nothing but a soft copy of the PAN card. Both documents have the same validity as both are issued by the same authorities but through different media.

e-PAN contains the same details as in the PAN card. Hence, e-PAN is also a valid document.

5. How can I open a PAN card PDF?

The e-PAN card PDF is password protected for security purposes. The password to open your e-PAN card PDF is your Date of Birth. The Date of Birth is to be entered in the format DDMMYYYY without using any symbol.

Without entering the correct password, the PDF file can’t be opened.

I Hope you liked our article on how to download pan card online through NSDL, UTI & UTIITSL