Want to know know your pan number? Well you have landed on the right article, make sure to read the article to know how to check pan card number.

Section 139 ‘A’ of the Indian Tax Act, 1961, mandates a permanent account number, or PAN, for all earning adults in India. So, PAN is a 10-digit unique number issued by the Indian Government to identify taxpayers and keep track of their financial activities. When the Income Tax Department issues the PAN, they also give a PAN card as document proof.

The numbers in a PAN are specific and follow a pattern. The first three characters are alphabets. The fourth character identifies the type of cardholder. For example, the alphabet ‘P’ is used for individuals, ‘C’ for a company and so on.

The fifth character is the first letter of the taxpayer's last name if the PAN is for an individual. In the case of a non-individual PAN holder, the fifth character is the first letter of the holder’s name. The following four numbers are selected from 0001 to 9999.

Finally, the last character is an alphabet added as a check digit.

Know Your Pan Number By Aadhaar Number, DOB & Email

Finding your PAN Card details: Know Your PAN!

Thanks to the Digital India push, finding your PAN online is quick and easy today. In addition, you can now access the information from the Income Tax Department's website.

Here’s a breakdown of the myriad ways you can find your PAN info online:

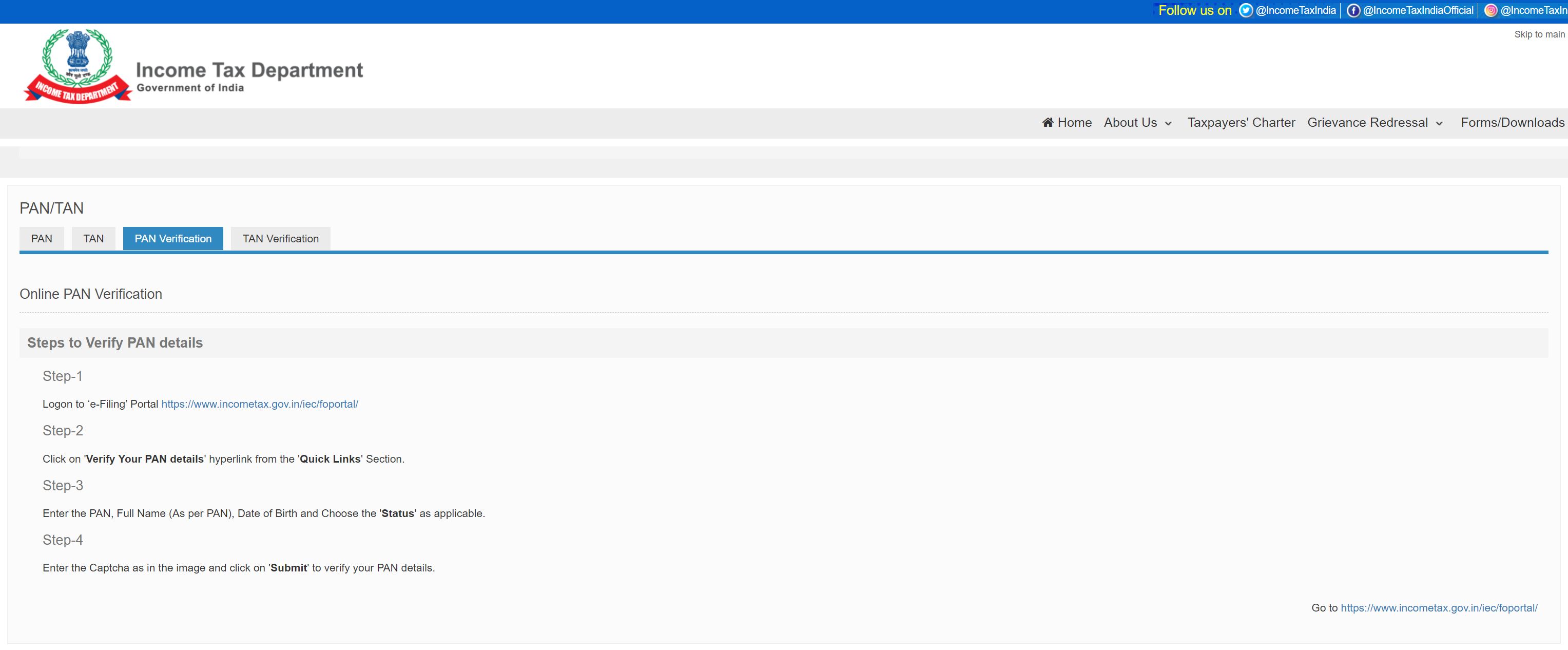

How To Check Pan Card Number From Income Tax Department's website

Once you register on the Income-Tax Department e-filing website, you can now view the information about your PAN. Follow the steps mentioned below:

how to find pan card number Via Income Tax Department's website

Forgot pan number/forgot pan card number? And don't know how to know pan card number? You can still access the same from the e-filing portal using your registered name and date of birth.

Point to be noted, though: earlier, the e-filing portal had a section called ‘Know your PAN,’ which is now unavailable. However, you can follow these steps:

how to find pan number by email

You can also find your PAN using your email:

How to find your PAN by the mobile app

You may learn about your PAN by using the Indian PAN Card smartphone app. Follow these steps to use the application:

How to find your PAN issue date

The PAN card issue date is printed in the bottom right corner of the PAN card. The date is mentioned in the DD/MM/YY format without space.

How to find your PAN status

To know the status of your PAN, follow the steps below:

How to find the status of a PAN card transaction

Use the process below to monitor the status of a PAN card transaction:

What are the advantages of PAN?

The Government of India has made it mandatory for all people to obtain PAN. The following are some of the most common needs for and uses of the PAN:

PAN is essential if the taxpayer does any financial activities

Financial activities can include buying and selling a vehicle, acquiring real estate, and so on. Moreover, PAN is essential for financial activities like:

What are the documents required for a PAN application

While applying for a PAN, taxpayers need supporting documents, including form 49A. These are the documents:

What are the different forms of PAN cards

A PAN card form is an application form for the allotment of a PAN number and PAN card. Having a PAN card is essential as all Indian nationals need a valid PAN card to carry out financial transactions.

Even Indians living outside the country who wish to trade or transact in India must have a PAN card. The different forms of PAN cards are:

A PAN card is an important government document for all Indian nationals. Form 49A is applicable for individual PAN holders.

You can apply for a PAN through online and offline modes. It is even possible to get an instant PAN card delivered straight to your email within minutes.

Frequently Asked Questions

Q1. How can I find my PAN?

You can find your PAN and details by registering on the income-tax portal. To register, use basic information, including your full name, date of birth, and mobile number. If already registered, log in to your account and visit the profile section.

Q2. Does a minor require a PAN card?

A citizen who is less than 18-years-old is a minor in the eye of law. If at all, a minor person needs a PAN number, the person can quote the PAN card of their father/mother/guardian when required. So, a minor does not generally require a PAN card unless they have any income chargeable to income tax.

Q3. How can I know my PAN through CIN?

CIN or Corporate Identification Number is a unique number for identifying companies in India. If you know the CIN, you can find the entity’s PAN online. The CIN has the year of incorporation of the company. The income-tax portal has a ‘Know your TAN’ section to insert the company name and the date of incorporation to know the TAN and PAN.

Q4. From where should I submit the PAN application?

You can submit the PAN application online or offline. To file online, fill in the application and submit by paying the required fee. Alternatively, you can download the application form and take a printout. Then, fill out the form and send it through the post with supporting documents and a DD of Rs 107. The form must be sent to the income-tax PAN services unit in Pune.

Q5. Is there a Tatkal facility for the allotment of PAN?

If you require an instant or tatkal PAN, you can visit the income-tax portal and apply for an instant e-PAN card. However, the applicant must have a valid Aadhaar card and mobile number to proceed with the application.

Once you provide the details, an OTP will be sent to the number provided. Then, the PAN is e-signed using the signature on the Aadhaar card. After submitting the form, the e-PAN is digitally sent to the applicant.

I hope you liked our article on know your pan number, and it must have solved your queries such as How to check pan card details by aadhaar number, how to find my pan card number or how to know your pan number by aadhar card.

if you have any comments or suggestions do share them in the comments below.