Whether you are looking at opening a bank account, purchasing your dream property, buying jewellery or motor vehicle, receiving your hard-earned salary or filling your Income Tax return, there is one mandatory document, which you must possess.

This key document is the PAN Card. PAN or permanent account number is a unique 10-digit alphanumeric identity allotted to each taxpayer by the Income Tax Department.

This card links all financial transactions made by a particular individual or entity, thereby preventing tax evasion by them. Moreover, a PAN Card is also accepted as valid proof of identity anywhere in the country.

Hence, it is very much evident that PAN is necessary for several financial and non-financial purposes.

Any citizen of India, PIOs (Persons of Indian Origin) as well as foreigners who come under the purview of the Income Tax Act, 1961 are eligible to apply for PAN. You can apply for PAN via UTI Infrastructure Technology And Services Limited (UTIITSL) or National Securities Depository Limited (NSDL) website.

In this article, we have simplified the process to know how to apply for PAN Card online.

How to Apply for PAN Card Online

The process of Appling PAN Card Online is simple and hassle-free. Depending on your convenience, you can choose any of these methods to apply for a PAN Card:

- Online on NSDL website

- Online on UTIITSL website

- Instant e-PAN from Aadhar card

- Offline channel

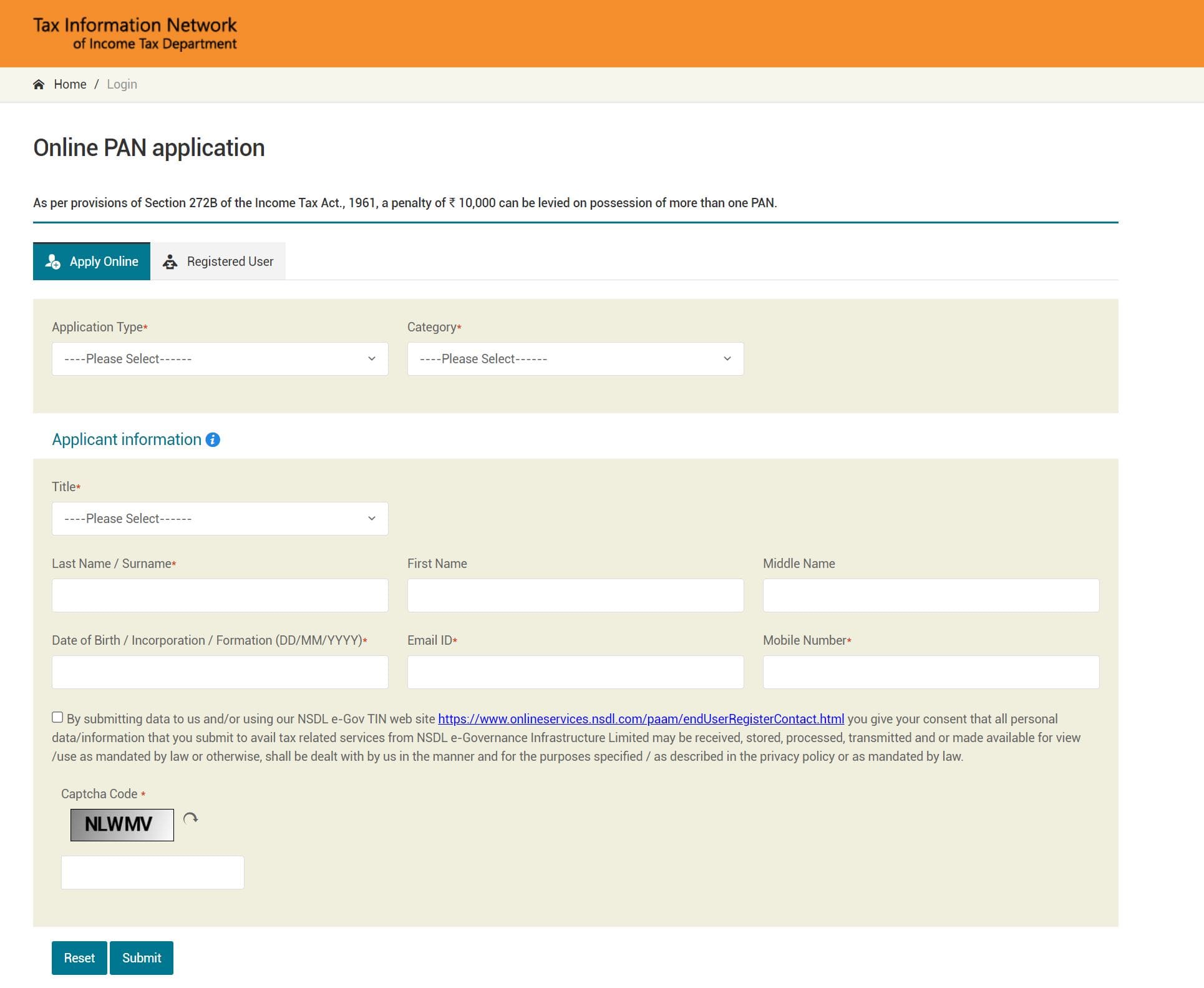

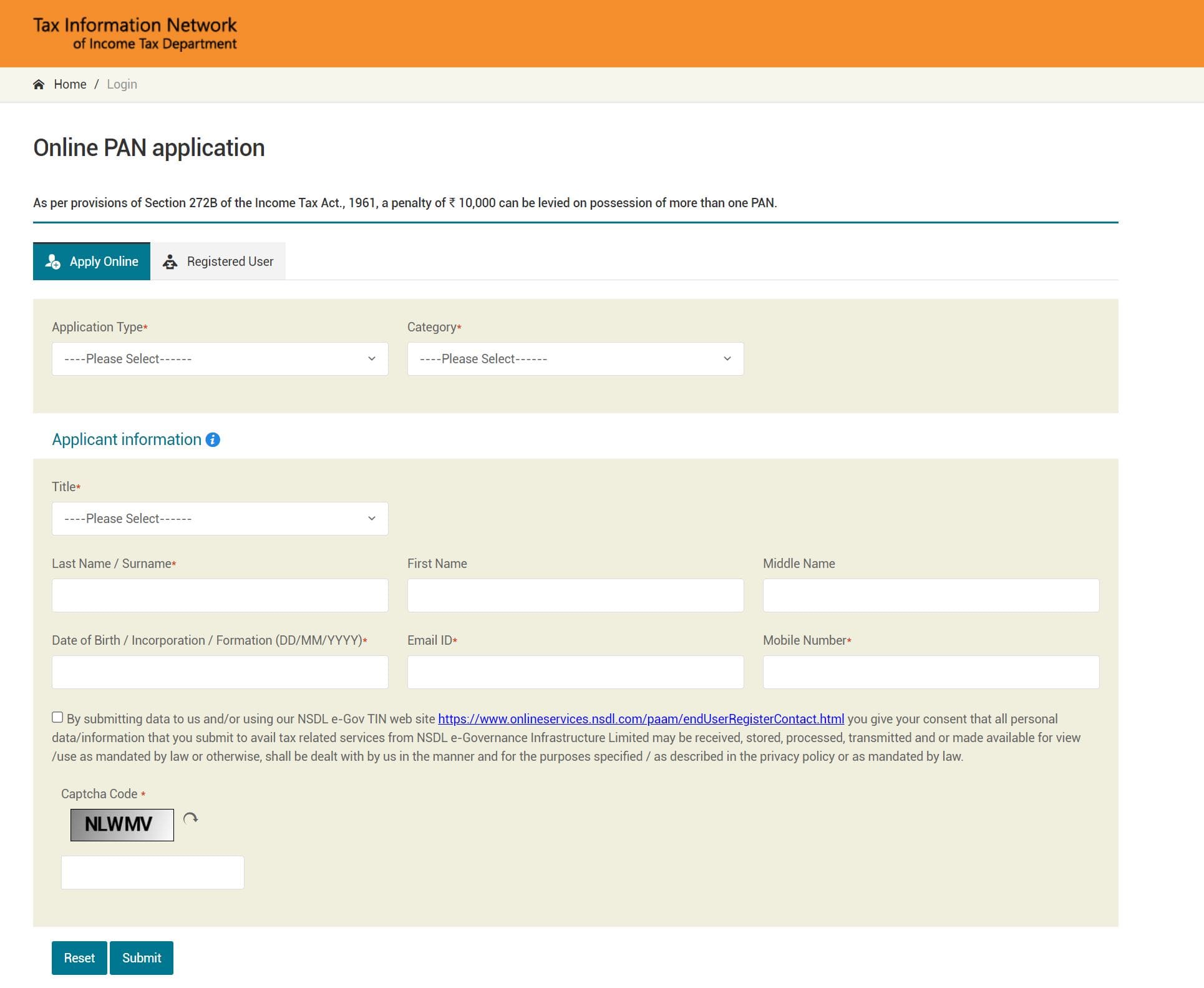

How To Make Pan Card Online Registration On NSDL Website

Step 2 - Choose the applicant type that best suits you - New PAN for Indian Citizen (Form 49A), New PAN for Foreign Citizen (Form 49AA) or change/correction in existing PAN data.

Step 3 - Next, choose from the categories available, i.e Individual, Association of Persons, Body of Individuals, Trust, Limited Liability Partnerships, Firm, Government, Hindu Undivided Family, Artificial Judicial Person, and Local Authority.

Step 4 - Fill in your personal details such as Name, Date of Birth/Incorporation, Email ID, Mobile number and Captcha code. Also, make sure that you read the note along with the checkbox before ticking it and then submit the form.

Step 5 - After successful submission of the form, click on the “Continue with the PAN Application Form” button to proceed forward.

Step 6 - In the next page, you will be asked for a few more details relating to Form 49 A or Form 49 AA. You also need to select whether you need a physical PAN Card or not. If you choose “Yes”, you have to pay fees as applicable.

In the next part of the form, enter the last four digits of your Aadhar number, your area code, AO Type and other contact details.

Step 7 - Now choose amongst the three options available to submit the documents. You can either forward application documents physically or submit them digitally through digital signature or you can even opt to submit the documents digitally through e-sign.

Step 8 - In the last section of the page, specify what documents you will be submitting as your identity, address, and date of birth proof. Post that, confirm the declaration, place, and date of application and then hit the submit button. Make sure that you make no mistakes.

Step 9 - Next, click on “Proceed”, which will redirect you to the payment page where you have the option to choose from the two modes of payments - Demand Draft or through net banking/debit/credit card.

Please note that if you choose Demand Draft, you will have to make a DD before you begin the application process as you have to provide the DD number, date of issue, amount, and the name of the bank from where DD is generated on the portal.

Step 10 - On successful payment, a downloadable acknowledgment receipt will be displayed. Make sure that you save and print this acknowledgment.

Step 11 - Next affix two recent color photographs (3.5 cm x 2.5 cm) in the space provided in the acknowledgment. The photographs should not be stapled or clipped to the acknowledgment.

Further, signature/left-hand thumb impression should be provided across the photo affixed on the left side of the acknowledgement in such a manner that a portion of the signature/impression is on the photo as well as on the acknowledgement receipt.

Step 12 - Once you are ready with the necessary documents, send them via courier or post to NSDL e-Gov at 'Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune - 411 016'.

Note that your acknowledgment, demand draft, if any, and proofs, should reach NSDL e-Gov within 15 days from the date of online application

Step 13 - The application shall be processed on receipt of relevant documents (acknowledgment and proofs) and realization of payment in case of demand drafts. On approval, you will receive your PAN number on your registered mobile number and email id.

How to Apply Online for PAN Card on UTIITSL Website

The procedure of how to apply for pan card online via UTIITSL website is again simple and very similar to the above-mentioned process for applying for PAN via NSDL website.

There’s a change only in the first step wherein you have to visit the UTIITSL website (https://www.pan.utiitsl.com/PAN) to begin the process; the other steps remain the same.

Fill in the details as required and submit the form. On successful payment, you will get an acknowledgement receipt. Take a print-out of it, paste your passport size photo and attach the required documents.

Courier the same to your nearest UTIITSL office. You can find the nearest branch of the UTIITSL office here (https://www.utiitsl.com/branchlocator).

How to Apply for an Instant e-PAN from Aadhar Card

This facility is for allotment of Instant e-PAN for those applicants who possess a valid Aadhaar number. PAN is issued in PDF format to applicants, which is free of cost. The process is quick, simple and hassle-free -

Step 1 - Please visit the e-filing website of the Income Tax Department (www.incometaxindiaefiling.gov.in).

Step 2 - Click the link, 'Instant PAN through Aadhaar'.

Step 3 - Next select the option, 'Get New PAN'.

Step 4 - Fill in your Aadhaar in the space provided, enter captcha and confirm. You will receive an OTP on the registered Aadhaar mobile number; submit this OTP in the text box on the webpage.

Step 5 - After submission, an acknowledgement number will be generated. Please keep this acknowledgement number for future reference.

Step 6 - The e-KYC data of that Aadhaar number is exchanged with the Unique Identification Authority of India (UIDAI) after which you will be allotted an instant e-PAN. The entire process is not supposed to take more than 10 minutes.

Step 7 - On successful completion, a message will be sent to your registered mobile number and e-mail id. You can download your PAN in PDF format by submitting the Aadhaar number at "Check Status/ Download PAN".

You will also get the PAN in PDF format by email, if your email id is registered with the Aadhaar database.

How to Apply for PAN offline

Step 1 - Go to the official NSDL website (https://www.tin-nsdl.com/).

Step 2 - Select 'Application Type'. Choose ‘Form 49A’, if you are a resident and ‘Form 49AA’, if you are a non-resident individual.

Step 3 - Download this form. Fill it and affix two passport size photographs. Don’t forget to attach self-attested photocopies of proofs with the form.

Step 4 - Pay the fee in the form of demand draft in favour of ‘NSDL – PAN’, payable at Mumbai.

Step 5 - Mention ‘APPLICATION FOR PAN-N-Acknowledgement Number’ superscripted on the envelope of the application form.

The application has to be sent to:

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411016

Fee charged for applying for PAN card Online

The fee payable for PAN Card may vary from case to case, as it depends on the following conditions:

Whether you have an Indian communication address or foreign communication address;

Choice of getting a Physical PAN Card along with e-PAN Card; and

Whether you have opter for e-KYC & e-sign or physical mode.

The details are as follows:

Physical PAN Card & e-PAN Card | ||

PAN Card Dispatch | Mode of PAN Application | Processing Fee Including GST |

Indian address | e-KYC & e-Sign paperless application/e-Sign scanned based | ₹ 101 |

Physical Mode | ₹ 107 | |

Foreign address | e-Sign scanned based | ₹ 1011 |

Physical Mode | ₹ 1017 | |

Only e-PAN Card | |

Mode of PAN application | Processing Fee Including GST |

e-KYC & e-Sign paperless application/e-Sign scanned based | ₹ 66 |

Physical mode | ₹ 72 |

Documents required for applying for a PAN card online

In order to ensure that your PAN Card application is approved without any rejections, make sure that you provide all the correct documents as required in the form. Below is a table that provides a list of documents, which are acceptable as proof for your Date of Birth, Address and Identity:

Date of Birth Proof for Applying for a PAN Card Online

Photocopy of any of the documents below can work as proof for Date of Birth:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proof of Address Required to Apply for PAN Card

Photocopy of any one of these documents |

|

| |

| |

| |

| |

| |

| |

| |

Photocopy of these documents (not over three months) |

|

| |

| |

| |

| |

| |

| |

Original documents |

|

|

Proof of Identity Required to Apply for PAN Card

Photocopy of any one document |

|

| |

| |

| |

| |

| |

| |

| |

| |

Originals |

|

|

Frequently Asked Questions

1. Can I apply for a PAN card on my mobile?

The answer to your question "how to apply pan card in mobile" is Yes, you can easily apply for a PAN Card via mobile. Visit NSDL or UTIITSL website for the application process. If you have an Aadhar card, you can also visit the Income Tax portal and apply for an instant e-PAN free of cost.

2. How can I get a PAN card online immediately?

The government has started an instant e-PAN facility for all those who possess a valid Aadhaar number and have a mobile number registered in the UIDAI database.

You just need to visit the e-filing website of the Income Tax Department and click on “Instant PAN through Aadhaar'”. After completing the form and OTP verification, you can get your PAN Card.

3. Can I get a PAN Card in 2 days?

The process of getting Aadhaar card within 2 days is as follows:

- Go to the NSDL website and select the applicant type.

- Next, proceed to fill in all the details.

- Upload the relevant documents, pay the fee and submit the form.

- On successful payment, you will receive an acknowledgement number, which can be used to track the status of your application.

- You will receive your PAN Card through a registered post once the details submitted by you have been verified and processed.

4. Can we make a PAN Card before 18?

Yes, one can apply for a PAN Card before 18 too. The process is simple and similar to applying for a PAN Card by adults. However, a parent should fill out the application form for minors.

5. Where do I send my PAN card application form?

You can courier your PAN card application form along with relevant annexures to the following address:

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411016