The Unique Identification Authority of India issues every citizen of the country with a unique 12-digit number called the Aadhaar Card. Recognized as the world's largest biometric ID system, the Aadhaar serves as both the address and identity proof for every Indian citizen.

One can use the card to access important information from the government database, including address and contact information. Every Indian resident can enroll to obtain an Aadhaar card, from a newborn to a senior citizen. The enrolment process is brief and completely free of cost.

Once the process is complete, the concerned individual's details get uploaded permanently to the government database. It is important to note that one person can't own multiple Aadhaar cards. If you relocate or change your phone numbers, you're advised to update your Aadhaar.

The permanent account number (PAN) is issued as a card by the Indian Income Tax Department to any person who applies for it. It is a unique ten-character alphanumeric identifier that links all monetary transactions made by a particular entity or individual, thereby eliminating the risk of tax evasion.

PAN Card-holders who are either eligible to enroll for Aadhaar or already have one must inform the Income Tax Department about the same by linking these two cards together. Failure to do so will result in their PAN becoming inoperative.

Ways On how to link PAN with Aadhar Card

- Through the Income Tax e-filing site

- Sending an SMS to 567678 or 56161

- PAN Aadhaar Link by filling up the form

We'll take a detailed look at each of these methods in the following sections. But first, let's find out the deadline for the linking.

Deadline for linking Aadhaar Number to PAN Card

At the beginning of this year, the government set 31st March 2021 as the deadline to link Aadhaar and the PAN. However, on account of the Covid-19 Corona outbreak, the deadline was extended to 30th June 2021.

Now, the Finance Ministry has sealed 31st March 2022 as the final deadline, extending it by a full six months from the earlier deadline of 30th September 2021. Individuals failing to link these two documents by this date will find their PAN cards becoming inoperative from 1st April onwards.

As a result, they'll not be able to conduct any financial transaction. Further, the government might also levy penalties for violating the deadline. Only after completing the linking process can the cardholders make their PAN operative.

how to link pan card with aadhar card Online through e-Filing site?

The following steps will help you complete the process online through the e-Filing webpage:

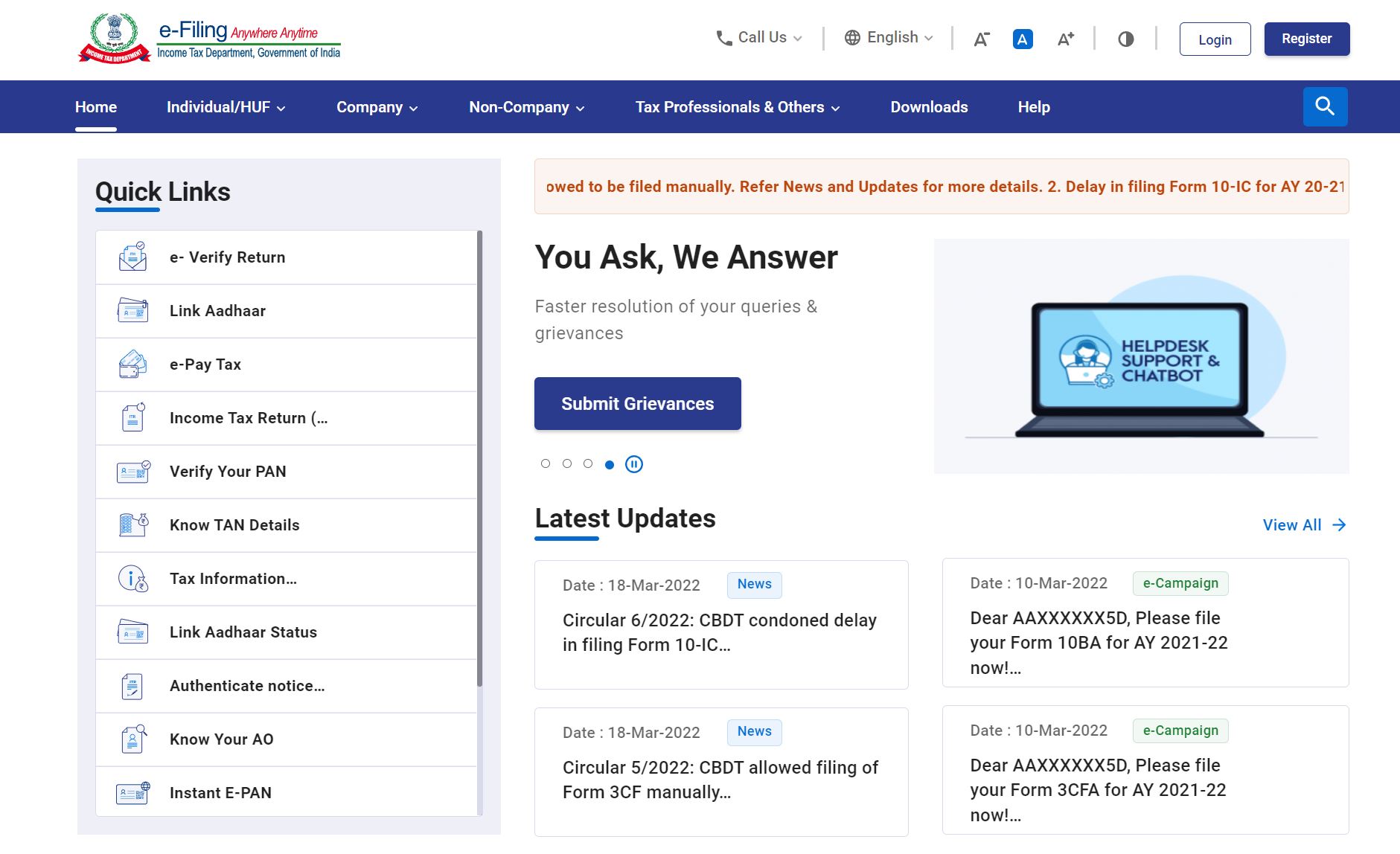

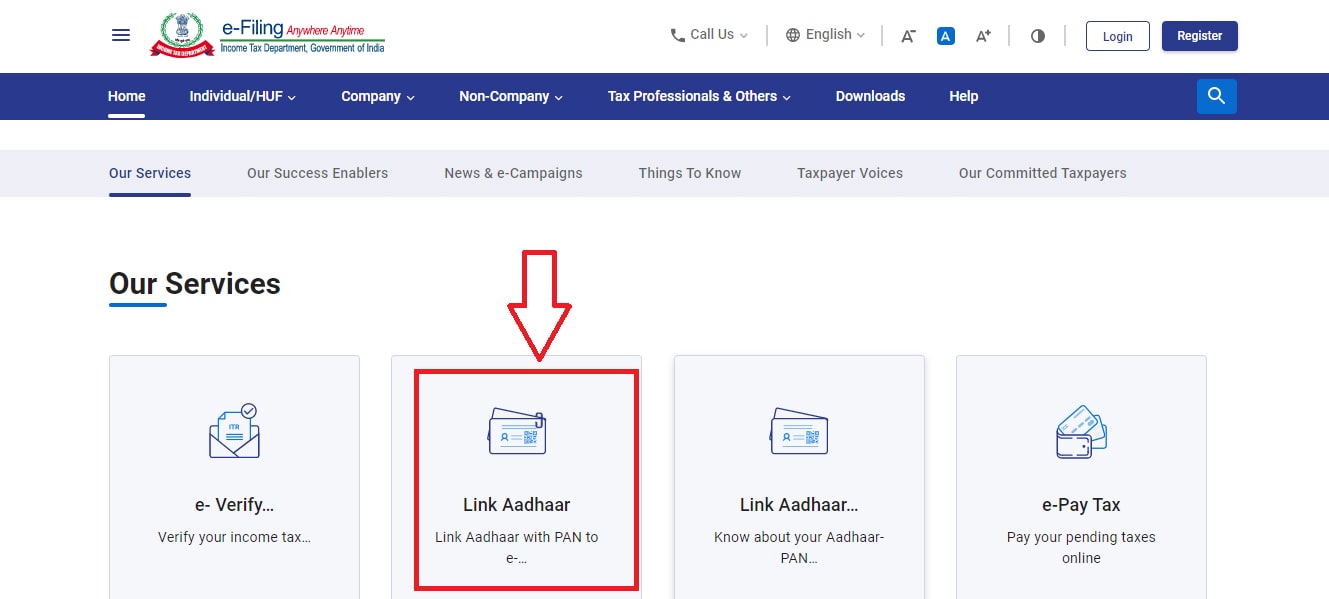

Step 1: Open the Income Tax e-Filing page. Navigate to quick links and under there, click on 'Link Aadhaar.'

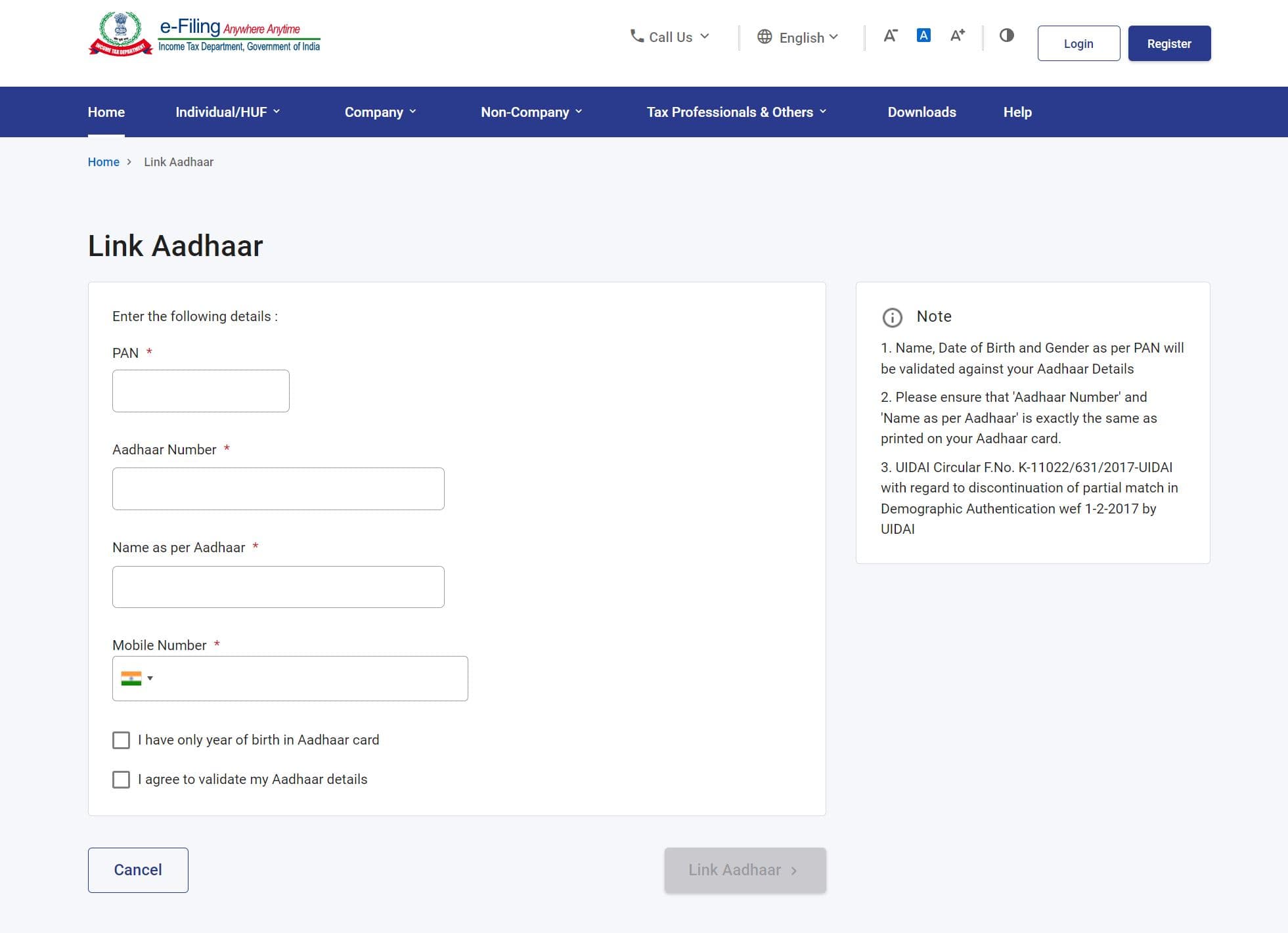

Step 2: On the dialog box that appears, enter the Aadhaar number and your PAN. Fill out your name as exactly mentioned on your Aadhaar card. Additionally, also provide your mobile number.

Step 3: If your Aadhaar card only has your year of birth, you will have to select the checkbox that reads, 'I have only the Year of birth in the Aadhaar Card.'

Step 4: Next, tick the box that says, 'I agree to validate my Aadhaar details.' Without clicking on this checkbox, you can't proceed further with your Aadhaar linking.

Step 5: You'll observe the 'Link Aadhaar' button in the bottom right corner of the dialog box getting enabled now. Click on it to continue.

Step 6: Upon clicking, you'll receive a 6-digit OTP (One Time Password) on your registered mobile number.

Step 7: Enter this OTP on the verification window on the site.

Step 8: Upon ensuring that you have entered the correct OTP, click on the 'Validate' button.

Step 9: A notification will appear on your screen saying that the linking is successful.

The above set of steps illustrates how you can complete the linking without logging in to your account on the e-Filing site. Wondering how you can link them by logging in? Read the steps listed below!

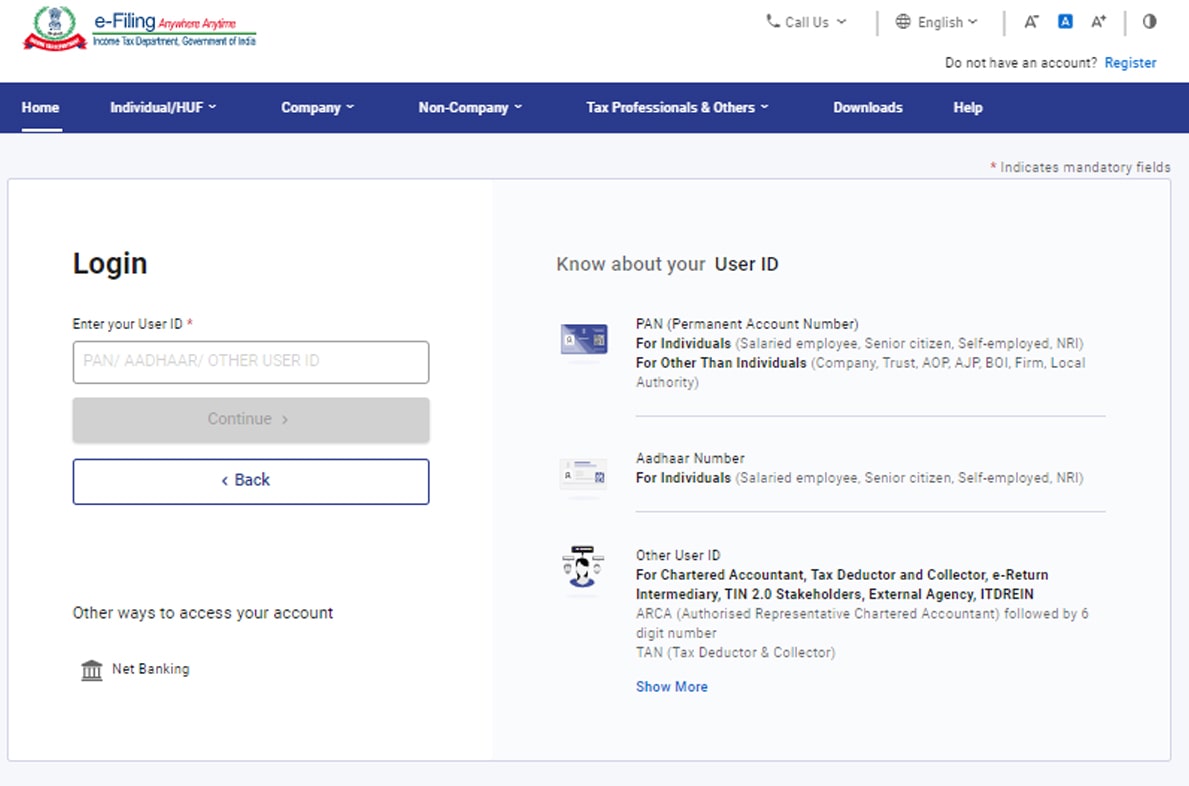

Step 1: Start by registering yourself on the income tax e-Filing portal if you haven't already.

Step 2: Enter your User ID to log in to the portal.

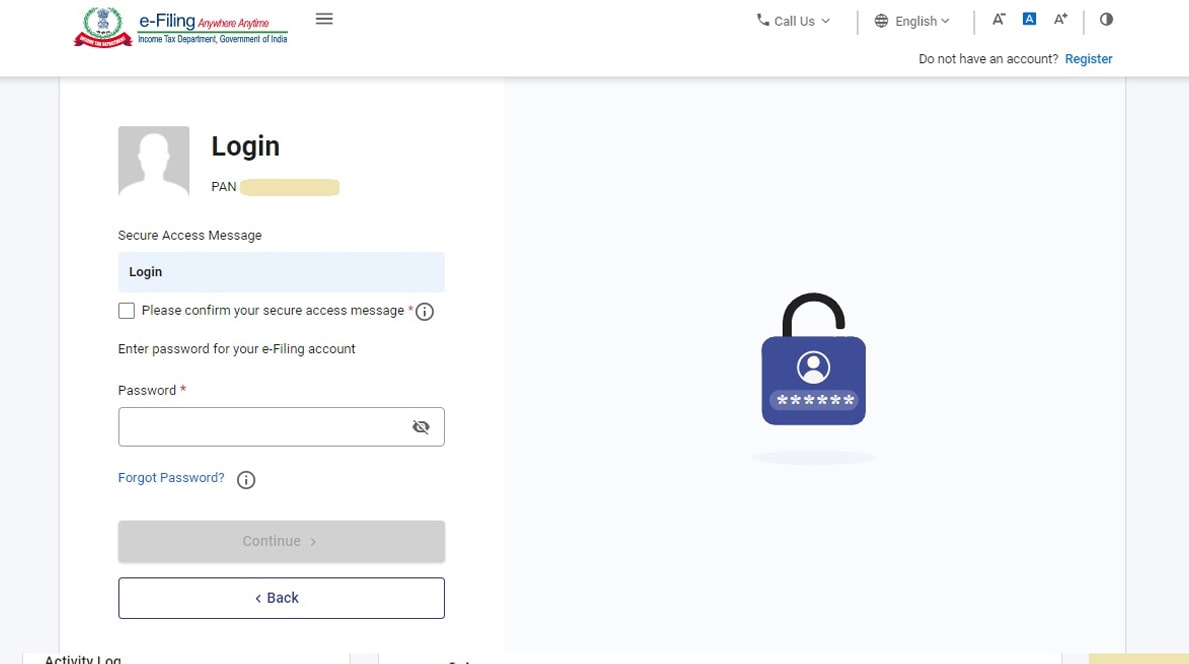

Step 3: A secure access message will appear on your screen. Confirm it and enter your password.

Step 4: Next, click on the 'Continue' button to proceed further.

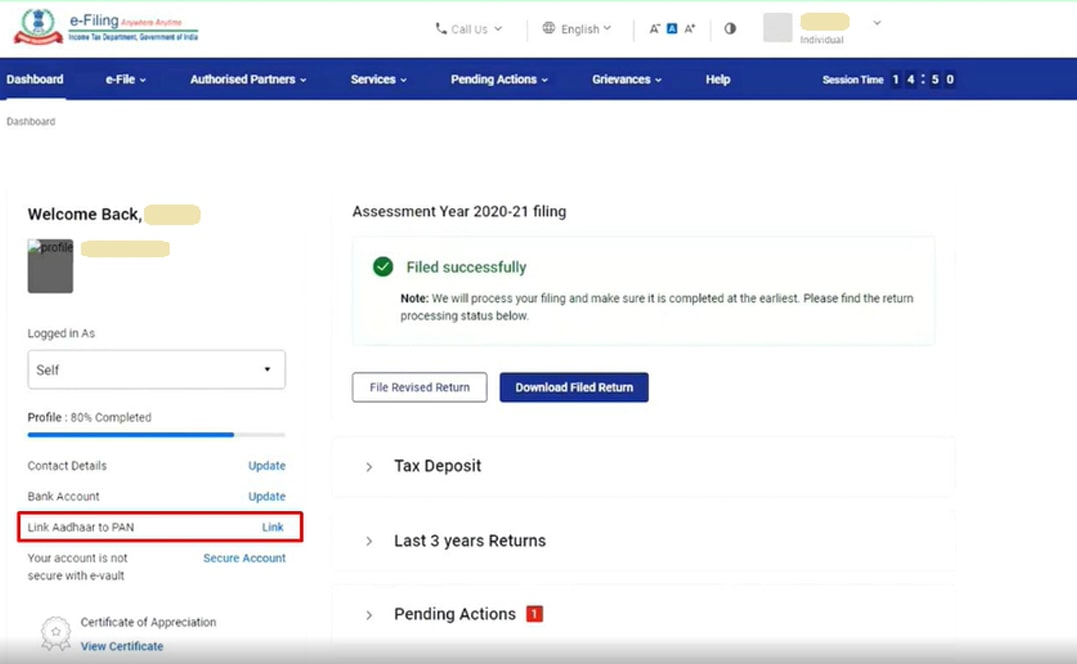

Step 5: Once logged in, click on the 'Link Aadhaar' option under quick links. You can also find this option by navigating to 'My Profile,' and clicking on 'Personal Details.'

Step 6: Fill out the details that are asked of you on the screen. Some details would have already been filled out based on the data you provided when registering on the site.

Step 7: Verify if the pre-entered details are correct and then click on the 'I agree to validate my Aadhaar details' checkbox.

Step 8: Now, click on the 'Link Aadhaar' button. A message will appear on your screen saying that the process is complete.

How to link the PAN number with Aadhaar via an SMS

Here's what you need to do to link the two numbers via an SMS. You need to send a message, as given below:

- Send a text message in this manner: UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN>. For instance, if your Aadhaar is 456712390862 and your PAN is HPFBA6432L, then your message will read 'UIDPAN 456712390862 HPFBA6432L.'

- Use your registered mobile number to text the following numbers - 567678 or 56161.

That’s it. The process is complete.

Link Aadhaar-PAN manually by filling up a form

If you are unsure about completing this documentation online, or if you don’t have access to the online portal, don’t worry. In that case, you can always complete the linking by visiting the service centers of NSDL (National Securities Depository Limited), PAN, or UTIITSL (UTI Infrastructure Technology And Services Limited) and filling up a form manually.

To complete the process, you'll have to carry copies of your PAN and Aadhaar to the center and fill Annexure-1. Unlike the online processes, however, here, you'll be charged a small fee If you need any corrections to your PAN or Aadhaar.

For making corrections to your PAN Card, you will have to pay Rs. 110, and for correcting the Aadhaar details, a fee of Rs. 25 is applicable.

Importance of Linking PAN Card with Aadhaar Card

Linking these two numbers will keep your PAN from becoming inoperative. You can make your financial transactions in a hassle-free manner. Some of the other benefits are stated below:

- When your PAN is linked to your Aadhaar, it allows the government to keep tabs on all your taxable financial transactions. Since the government can maintain a documentation of all the transactions of a particular individual or entity, it reduces the risk of people trying to evade paying their taxes.

- It eliminates the scope of an individual or entity possessing multiple PAN Cards. Such attempts usually intend to commit financial fraud or escape taxes.

When a person has multiple PAN Cards, they can use any to pay the taxes applicable to only one while dodging the rest. Thus, when their PAN is linked to the Aadhaar, the government will receive an alert of any suspicious transactions and can deal with them. - If you link these cards, you will no longer be required to provide any proof of having filed your income tax returns. Subsequently, the entire process becomes that much more convenient for you.

- You will receive a summarized detail of all the taxes levied on you. In turn, you can produce this documentation in the future should there happen to be any discrepancies.

I hope you have learnt how to link pan with aadhar after reading this article.

Frequently Asked Questions

Q1. How do I link PAN and Aadhaar if there is a mismatch in name or date of birth?

If there happens to be a complete mismatch between the names on your PAN and Aadhaar cards, you'll have to make the correction on the PAN and Aadhaar databases. If there's a partial or minor mismatch, you can resolve it during the Aadhaar linking process on the IT webpage. You'll be sent an OTP on the number registered on your Aadhaar. You can use this for verification purposes.

Q2. Can I file my ITR if my PAN and Aadhaar are not linked?

Your tax returns will not be processed unless your PAN and Aadhaar are linked. If you don't have an Aadhaar number, you can make use of your Aadhaar enrollment number too. However, at a later stage, you'll have to complete the linking process nonetheless.

Q3. How to link PAN with Aadhar card online?

You can link your Aadhaar with the PAN card online by visiting the Income Tax Department's page. You can either login or do this without logging in. Ensure that you have your registered mobile phone handy, as you will receive an OTP on this number to complete the process.

Q4. What details should I check when linking my PAN with my Aadhaar card?

You need to check the main details, i.e., your full name, birth date, and gender, while linking your PAN with your Aadhaar card are your name, date of birth, and your gender. If there's any mismatch regarding these details between your PAN and Aadhaar, you must resolve them at the earliest.

Q5. Can we link Aadhaar with the PAN without login?

Yes, you can link your Aadhaar with the PAN on the e-Filing site without logging in to your account. You can do so by using the 'Link Aadhaar' option under quick links on the portal. You simply need to fill in your details and keep your mobile phone with you for the OTP.