Permanent Account Number (PAN) is a 10-digit alphanumeric number issued by the Income Tax Department of India as a laminated card. The Permanent Account Number (PAN) is a one-of-a-kind identifier for an individual/entity valid throughout India.

Once assigned to someone, the Permanent Account Number is unaffected by changes in name, address within/across Indian states, or other reasons. AFZPK7190K is an example of a standard Permanent Account Number.

The following logic underpins the array of numbers and alphabets:

How to Track PAN card Status

To get a new PAN card, you must fill out Form 49A or 49AA. The answer to this question is whether or not you are an Indian citizen.

People who don't have a PAN card or haven't tried to get one. Take these steps:

Step 1: There is a section on the NSDL website that you can look at called "Online PAN Application."

Step 2: In order to change your PAN or get a new PAN card, fill out Form 49A (Indian Citizens) or Form 49AA (non-Indian citizens) (foreign Citizens).

Step 3: Choose a group. It's possible to choose your business type. You can start a business by yourself or with other people. There are options for trusts, limited liability partnerships, and firms to choose from when we choose a business type.

Step 4: It doesn't take long to write down your title, last name, first name, middle name, and date of birth/incorporation in DDMMYYY format, as well as your email address and your phone number. Verify the given Captcha code. Send in the form.

Step 5: You'll get a thank you note with a token number in it on the next page, so keep reading. This page says, "Continue with PAN Application Form." To move on to the next step, click "Continue."

Step 6: If you want, you can send the documents in any way that works for you. You can also choose how to do it. If you want to send application documents in person, you can do so. You can also send them digitally through e-sign.

Step 7: This is the same page where you should say what proofs you are giving to show who you are, where you live, and when you were born so that people can verify your identity. There should be a second look at a declaration to ensure it was made, where, and when. Send the form after you check it. You should not do anything wrong.

Step 8: It's time to move on. To do so, click "Proceed." You will be taken to see how to pay there. In Bill Desk, choose between a Demand Draft and a payment made through Bill Desk, then click "Pay Bill."

Step 9: People who want to pay with a Demand Draft first, will need to know the number, date, and amount of your DD. Your DD also has to come from a recognized bank.

Step 10: You can pay for things with your debit or credit card if you use Bill-desk to pay. It's also possible to pay with your debit card or credit card if you want.

Step 11: "I agree with the service terms," then pay. To get a PAN number, you will have to pay different fees based on whether or not you send your documents to NSDL or put them on the internet.

Step 12: When you pay with a credit card or bank account, you'll get a receipt that says you paid.

Step 13: Afterwards, a letter or package should be sent to send the documents that show that the payment was made. They don't need to be put together or cut together. You must sign across the picture that you put next to it on the receipt.

Please don't write on the picture on the right. Please sign the box. Ensure the person who signs it is someone the government has approved.

Methods To Track PAN Card Status

1. Check PAN Status Through Telephone

Once you apply for a PAN card, the application is typically processed within 15 working days. Utilize the 15-digit acknowledgment number to track pan card status.

You can simply verify the status through telephone —

2. Track Your PAN Application Status Using Call

The second option you can go for PAN card status check by mobile number. It's also an easy way to keep track of the PAN app.

The applicant must call the TIN call center at 020-27218080 and provide the 15-digit acknowledgment number to obtain an update on the current application status of the PAN card.

3. Check PAN Card Status Through SMS

You may check the status of your PAN card by SMS. Within three days of submitting the application form, you may check the status of your new or missing PAN card.

Send an SMS to the number "57575" with the text "NSDLPAN," followed by the 15-digit acknowledgment number, to utilize this technique. You will instantly receive an SMS alerting you of your PAN Card status.

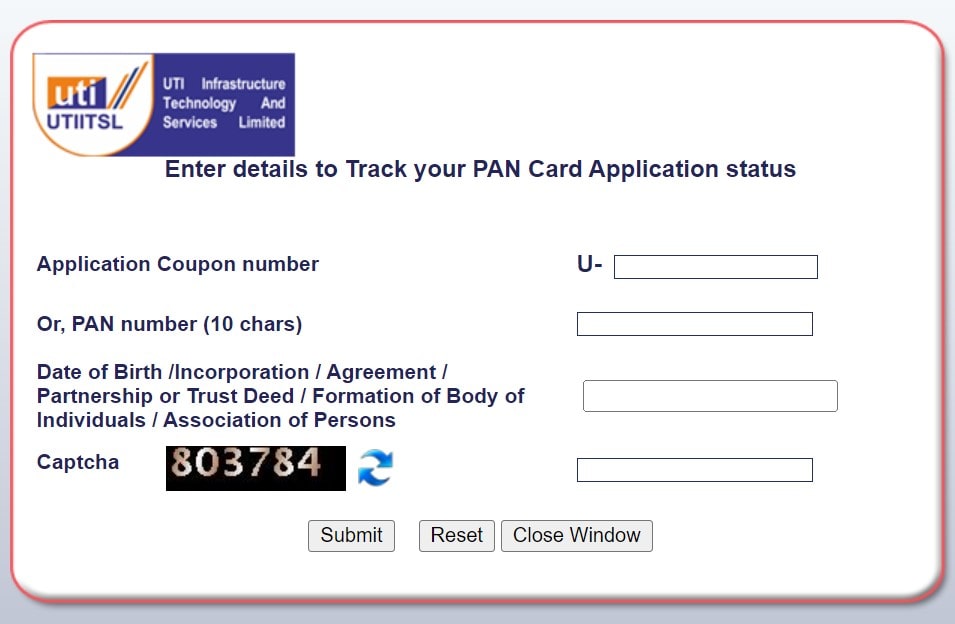

4. Check PAN Card Status By UTIITSL

Steps to Track Utiitsl PAN Card Status Online

Keep your application coupon number available when you have to track pan card status on UTIITSL. The following are the steps for verifying the status:

- 1You may find more information at https://www.trackpan.utiitsl.com/PANONLINE/#forward.

- 2Enter the application's promo code.

- 3Enter your ten-digit PAN number if you have forgotten your PAN Application Coupon Number.

- 4Fill in the date of birth/incorporation/agreement, and so on.

- 5Enter the PAN Card Transaction Status Captcha Code and hit the "Submit" button.

- 6The transaction status of your PAN Card will be displayed on the screen.

The PAN Card is issued within 15 working days after receiving the application. If you have not received your PAN Card within the specified time limit, you can check the progress of your application by entering a 15-digit acknowledgment number.

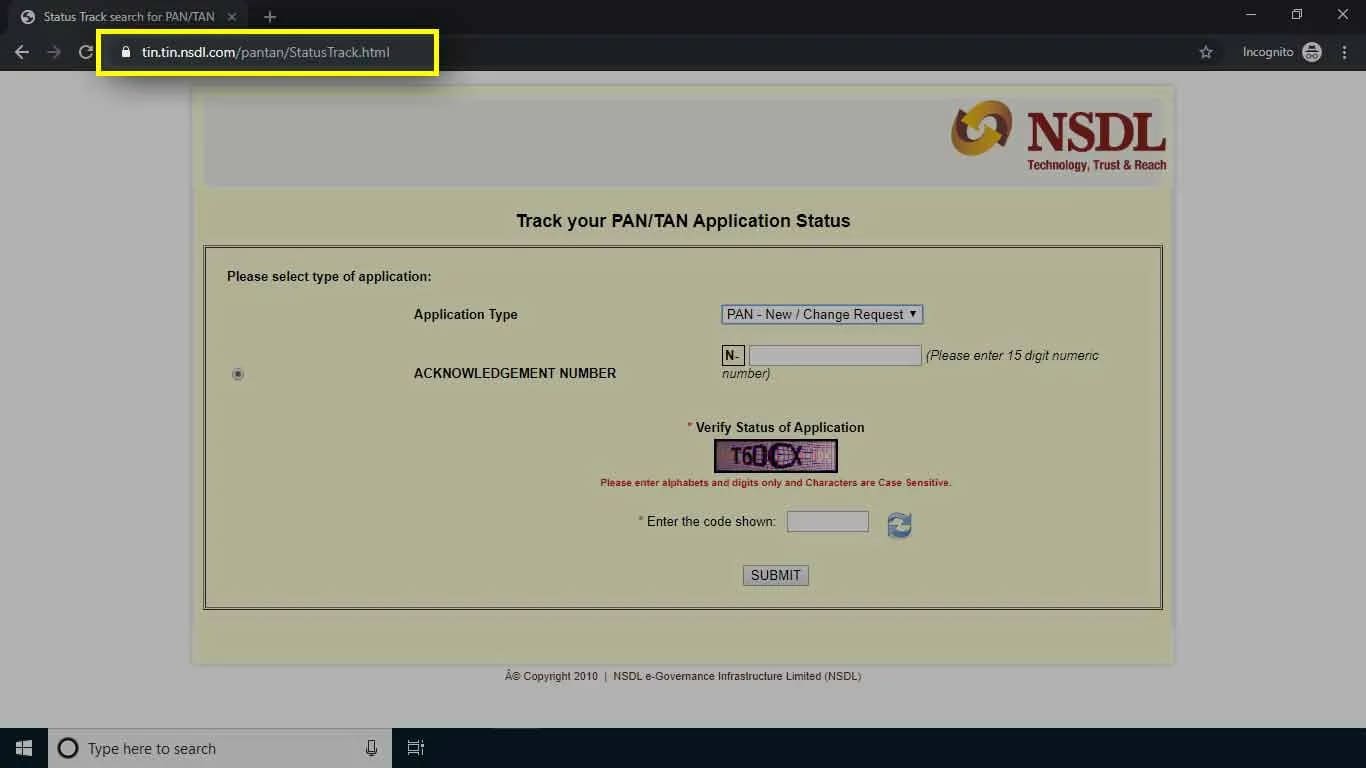

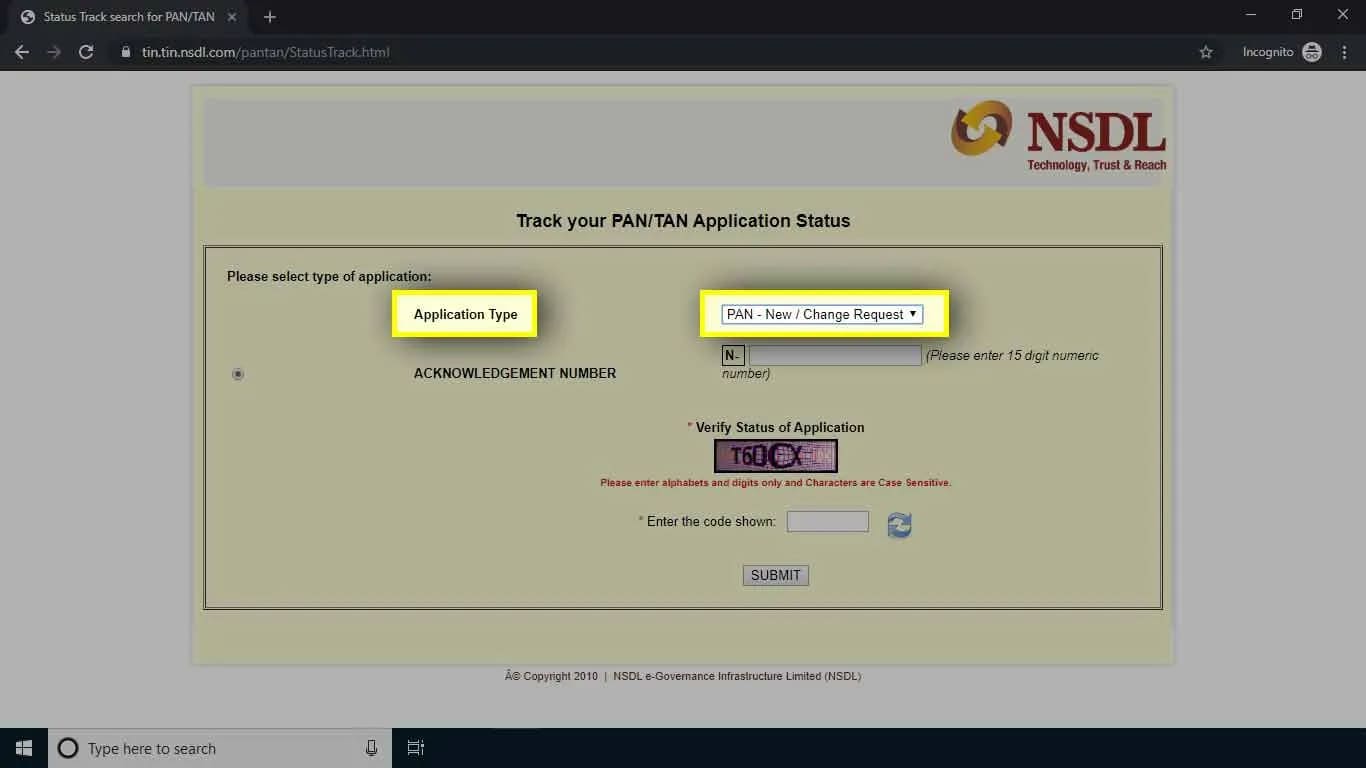

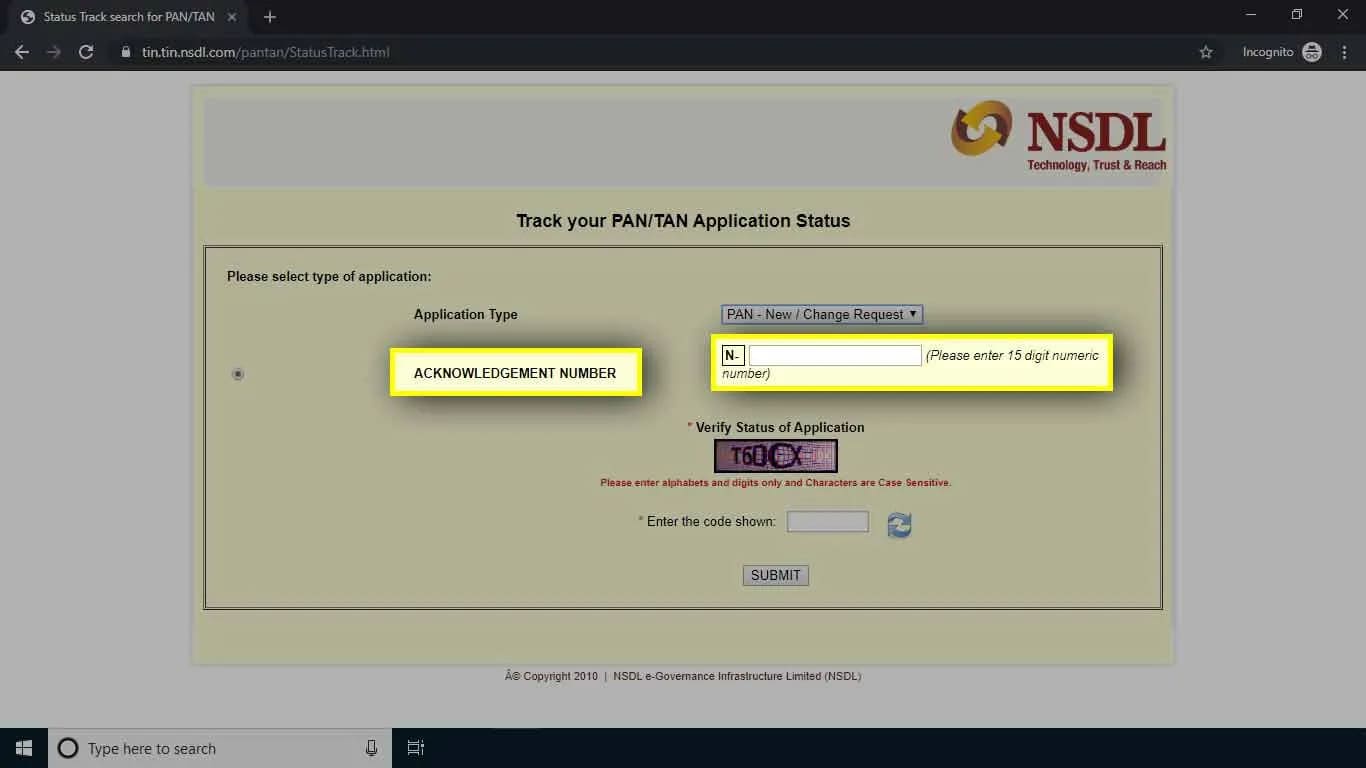

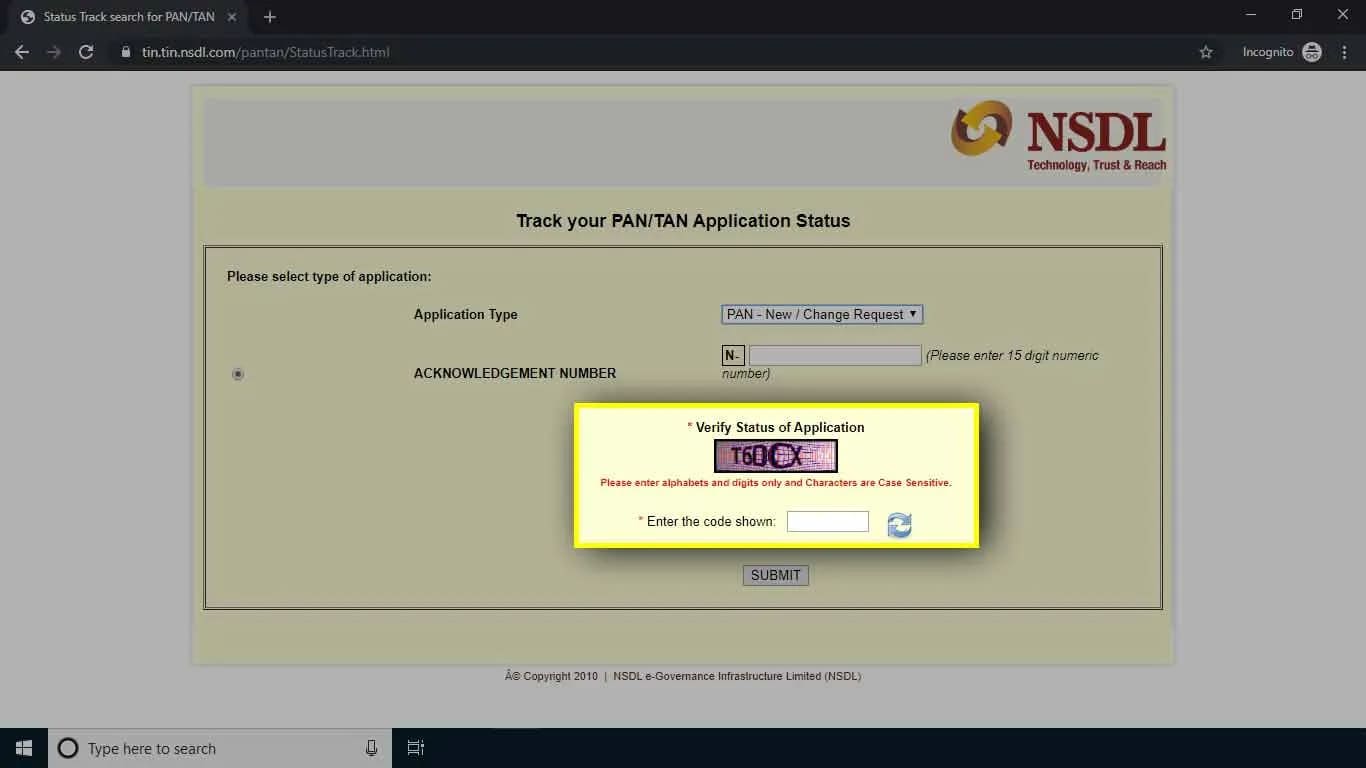

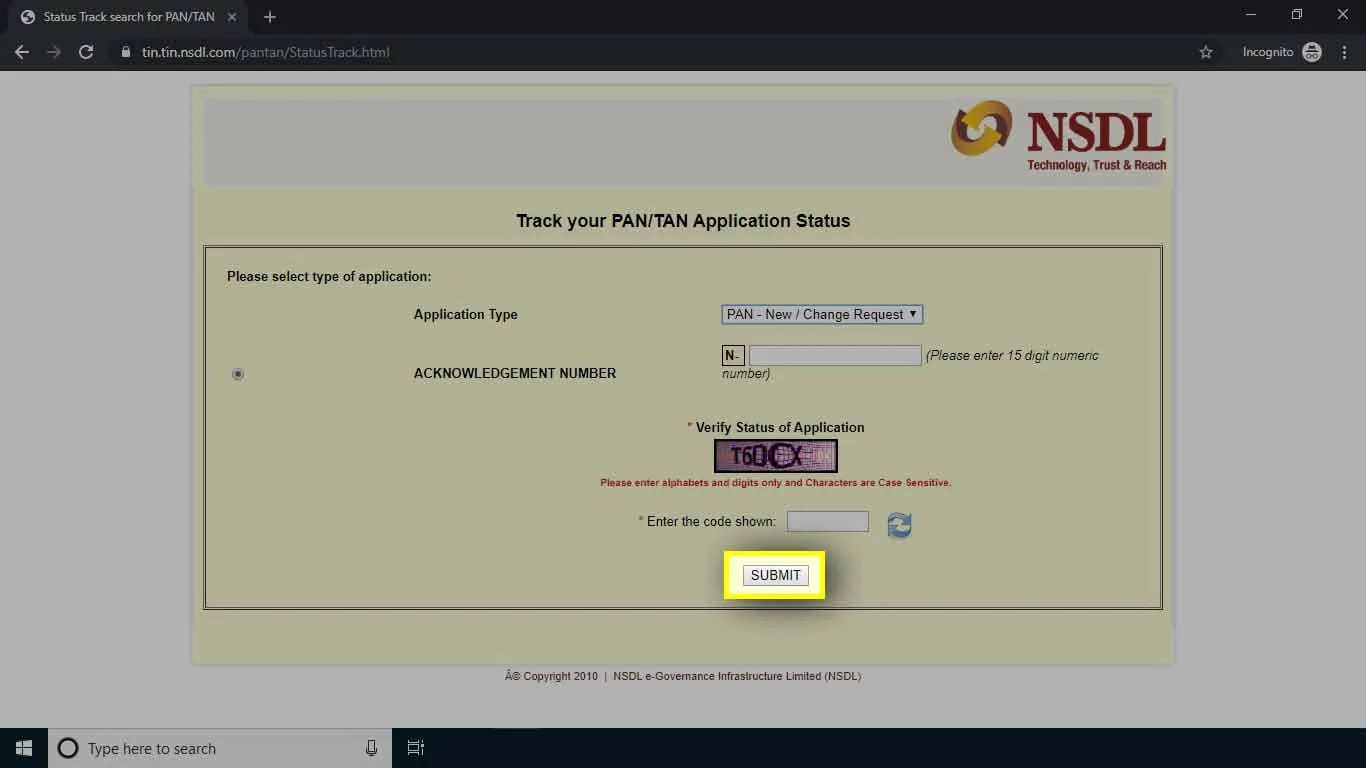

5. Check PAN Card Status Through NSDL

- 1Visit the NSDL's official website.

- 2Select the 'Track your PAN' option

- 3Choose an application type.

- 4Enter the number from your acknowledgment letter here (15 digits).

- 5Enter the supplied code.

- 6When you click the submit button, the status of your PAN card will be shown.

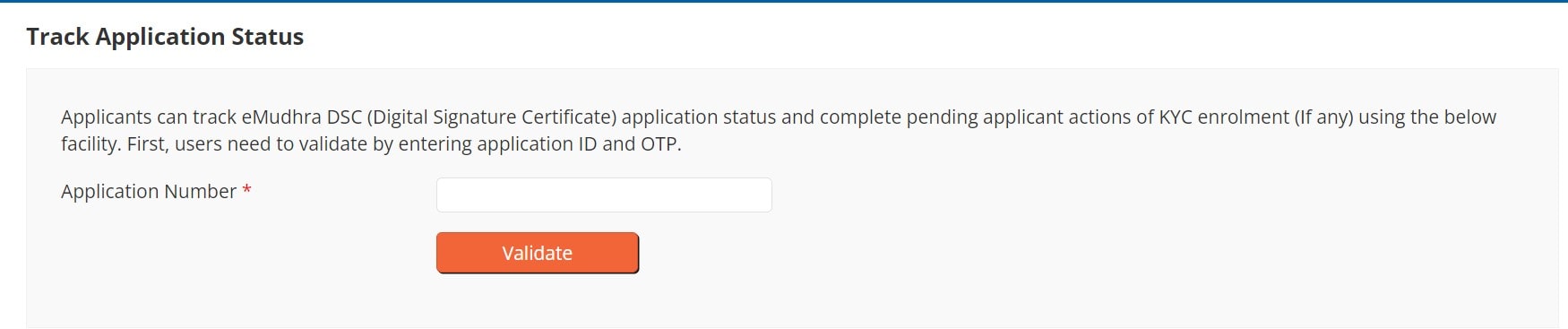

6. Check PAN Card Status By eMudhra

- 1Navigate to the eMudhra website.

- 3You must now provide your 'Application number' (which was obtained when you applied for a PAN) as well as your 'Date of Birth.'

- 4Enter the captcha code that appears in the box

- 5When you click 'Submit,' you're done

7. Check PAN Card Status Through Name And Date Of Birth

There is currently no way to verify your PAN Card transaction or application status just based on your date of birth; however, you may check your PAN Card data by confirming your PAN by providing your name and date of birth using the steps described below:

Process for PAN card status check by name & Date of birth:

- 1To access the official Income Tax E-Filing website, go to https://www.incometaxindiaefiling.gov.in/home.

- 2Select 'Verify your PAN Details' from the "Quick Links" section.

- 3Enter information like your PAN number, complete name, and birthdate.

- 4Choose the appropriate status.

- 5Enter the Captcha code to validate the information.

- 6Then click on the "Submit" button.

- 7A new page will show on the screen with the statement, "Your PAN is Active, and the information matches the PAN Database."

8. Check PAN Card Status By Aadhaar Number

- 1Visit the Income Tax Department's official website, or just enter https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/ePANStatus.html?lang=eng into your browser.

- 2Please put your Aadhaar Number here (12 digits).

- 3Enter the Captcha Code.

- 4Hit the "Submit" button.

- 5The status of your PAN Card will be displayed on the screen using your PAN Number.

Your mobile number must be linked to your Aadhaar Card for OTP authentication.

9. Check PAN Card Status Without An Acknowledgment Number

You may use it to monitor the progress of PAN card generation/update. The acknowledgment number may also be used to download the licenseePAN card from the NSDL and UTIITSL websites within one month of receiving the new/updated PAN card.

The TIN-NSDL has offered adequate opportunities for applicants to verify the status of their PAN cards online.

Users can visit the site to verify a new or duplicate PAN card status without providing an acknowledgment number. Follow the procedures below to verify the status of a PAN card based on a person's name and date of birth:

- 1Visit the TIN-NSDL official website.

- 2Select "PAN – New/Change Request “ in the Application Type column."

- 3To check the status of your PAN card without an acknowledgment number, go to the Name section.

- 4Enter your Last Name, First Name, Middle Name, and Date of Birth, then click the "Submit" button to find out your status.

Frequently Asked Questions

1. Your application is received and is under verification; what does this PAN status mean?

This is one of the PAN Card application process stages, which signifies that your given papers are currently being examined, and your PAN Card will be processed as soon as they are.

2. What is the validity of a PAN card?

PAN cards are valid for a lifetime. Here's how to check the validity of your PAN Card:

3. How to link the Aadhaar number to PAN?

Linking your Pan to Aadhaar has become mandatory. This is an essential step since it permits your tax returns to be processed. If you make a financial transaction of rs.50,000 or more, you must also link your pan to aadhaar. Here's how to connect your pan to your aadhaar:

4. What are the documents required to be submitted with a PAN application form?

For Individuals who are Citizens of India:

Proof of Identity | Proof of Address | Proof of Date of Birth or Age |

Aadhaar Card | Aadhaar Card | Pension payment order |

Voter ID card | Voter ID card | The Municipal Authority or any certified Registrar's office issued birth certificates |

Documents Required for PAN Application by a Foreigner:

Identity Proof | Address Proof | Proof of Date of Birth or Age |

Aadhaar Card | Aadhaar Card | Aadhaar Card |

Passport | Passport | Passport |

Documents Required for PAN Application by Companies:

Documents Required for a Firm (Including a Limited Liability Partnership) Registered or Formed in India to Apply for a PAN Card:

Documents Required for Trusts Registered or Formed in India to Apply for a PAN Card:

- Trust Agreement

- Charity Commissioner issues Registration Number Certificate

- Registration certificate provided by the Registrar of Firms, or a copy of the Partnership Deed

Registration Certificate issued in India, or a copy of the authorization granted by Indian authorities to establish the trust in India

Documents Required for PAN Application by an Association of Persons Registered in India:

- Certificate of Registration Number granted by the Charity Commissioner, the Registrar of Cooperative Societies, or any other Competent Authority

- Agreement; or

- Any other document issued by the State Government Department or Central Government establishes the person's identification and address.

5. Can I possess more than one PAN card?

PAN, or Permanent Account Number, is a 10-digit alphanumeric identifier assigned by the Income Tax Department. It acts as a means of identification.

On the other hand, individuals should have no more than one PAN. A person or organization is only permitted to have one PAN Number.