Want to know best discount broker in india ?

Well you have landed on the right article. Hey! Do you know someone who doesn’t like to save money? No…? Me, neither.

We all believe in saving money, reducing extra expenses, and having more pocket money. Similarly, for investors, in the world of the share market, there is a way to limit your brokerage expenses.

Yes, you read it right. You can play it smart with discount brokers in India and get the maximum benefit of their platforms. Let’s know, how.

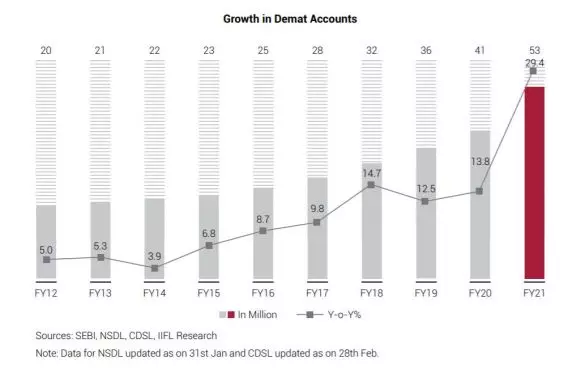

In January 2021, a lot of people in India opened new accounts for buying and selling stocks through discount brokers. Actually, 1.7 million new accounts were opened in just one month, which is a really big increase

Source : indiancompanies

Top discount brokers in india

App Name | Download Link | Sign Up Bonus | Earn Per Referral |

|---|---|---|---|

Up To ₹500 Cashback | Up to ₹250 | ||

Up to ₹100 | Up to 1000 Refer Reward | ||

Free Demat Account | Voucher Up to ₹5000 | ||

Free Demat Account | 300 Reward Points | ||

Free Demat Account | Up to ₹300 Cashback | ||

Free Demat Account | Up to ₹450 | ||

Free Demat Account | ₹20* per order brokerage |

Here's Our Top Pick For best discount broker in india :

Also Read :

Top 10+ Best Discount Brokers in India (Updated 2023)

In this competitive market, it can be tough to pick the best discount broker. All the discount broking platforms are constantly improving themselves to lead the marker.

However, there are some pros and some cons to each platform. Here, we have created a list of the top 12 discount brokers in India so you can make the right decision in your investment journey.

1. Zerodha

Zerodha contributes to more than 15% of daily retail trading volume in India across the Indian Stock Market.

The founder, Nitin Kamath bought the biggest discount broker platform in India in 2010.

According to the NSE reports in December 2021, Zerodha is the Biggest Stockbroking firm in India.

The reports are based on the number of active clients.

It outranks most traditional broking corporates like HDFC Securities, ICICI Direct, and Sharekhan.

Zerodha is also a member of BSE, NSE, MCX, and MCX-SX.

Account opening process:

- Go to zerodha.com and click on Sign Up Now, or click on the link given below.

- Enter your mobile number and verify with the OTP.

- Enter your details i.e., your name and your email id.

- Next, enter your PAN details and DOB.

- Click on Continue and you’ll be redirected to the payment page.

- Pay INR 200 as an account opening fee using a UPI ID or debit/credit card/ net banking/ wallet.

- After that, you’ll have to continue to DigiLocker.

- Enter your Aadhar Number.

- Verify with the OTP and click on Allow. This will allow Zerodha to access your Aadhar data.

- The next step is to enter your profile details i.e., family background, income background, trading experience, occupation, etc.

- After that, link your bank account using IFSC Number or UPI Id.

- Verify yourself with the Webcam verification.

- Upload the required documents.

- Sign the document with an e-sign.

- Your account will be ready within 24 hours.

Brokerage Charges

Charges | Brokerage |

|---|---|

Stock Market Segment | Margin |

Equity Delivery | No Margin |

Intraday Equity | Up to 20 times |

Equity Futures | 40% of the normal margin (NRML) |

Equity Options | No margin |

Currency Futures | 40% of the normal margin (NRML) |

Currency Options | No margin |

Commodity | 40% of the normal margin (NRML) |

Features

2. Upstox

Initially, named RKSV in 2012, Upstox was rebranded in 2015 and changes name to Upstox.

It become popular when leading investors like Ratan Tata and Kalaari Capital supported and promoted it.

Upstox is a secure trading platform for investors who believe in high margins and low brokerage.

They offer a high-tech trading platform and are the second biggest stockbroker in India after Zerodha.

Account opening process:

- Visit the Upstox account opening page.

- Enter your email address, and mobile number, and create a password.

- Enter your PAN Card, or Aadhar card and verify with OTP.

- Pay the account opening fee and upload the required documents.

- Review, confirm and submit the application.

- You’ll receive a User ID and password within 24 hours.

Upstox offers free equity delivery trades. It charges 0.05% or up to INR 20 per order for intraday trading on NSE, BSE, MCX, and F & O.

The brokerage charges are INR 20 irrespective of the order volume.

Brokerage Charges

Charges | Brokerage |

|---|---|

Delivery Charges | INR 0 |

Intraday Trading | 0.05% or INR 20/ executed trade (whichever is low) |

Futures Trading Charges | 0.05% or INR 20/ (whichever is low) per order |

Options Trading Charges | INR 20/ trade |

Features

3. 5Paisa

To compete with the high competing discount broking industry,

IIFL (India Infoline) launched 5paisa as the cheapest stock brokerage platform in India.

It is a Public Limited Company that also provides recommendations and advisory services.

Account opening process:

- 5paisa offers a paperless account opening facility that usually takes about an hour.

- Go to 5paisa.com and enter your mobile number.

- Fill in your personal details.

- Fill in your bank details.

- Upload your photo, Aadhar card, and cancelled cheque.

- Pay the account opening fee.

- E-Sign your form.

Brokerage Charges

Charges | Brokerage |

|---|---|

Delivery Trading | INR 20 per trade |

Intraday Trading | INR 20 per trade |

Equity Futures | INR 20 per trade |

Equity Options | INR 20 per trade |

Currency Futures | INR 20 per trade |

Currency Options | INR 20 per trade |

Features

4. Angel One

With over 5 million happy clients in more than 1800 cities in India,

Angel One is thriving in the broking industry for over 30 years now. It was founded in 1987 as a full-services broker.

However, being adaptive to the modern trading world, it changed its business model in November 2019.

Earlier, it used to offer percentage brokerage on flat rates but now, it competes with discount brokers like Zerodha, Upstox, Grow, 5paisa, etc.

Account opening process:

With Angel One, you can open your account in 2 ways.

- Online - through digital KYC

- Offline - by visiting the Angel Branch office or Sub-broker

Brokerage Charges

Charges | Brokerage |

|---|---|

Delivery charges | INR 0 |

Intraday Trading | Flat INR 20 Per Trade |

Equity F&O | Flat INR 20 Per Trade |

Currency F&O | Flat INR 20 Per Trade |

Commodity F&O | Flat INR 20 Per Trade |

Features

5. Groww

Groww is a newer entrant but the fastest-growing platform in the discount broking industry.

It was first launched in 2016 as a mutual fund investment platform.

Later, with the high demand for equity trading, it started offering equity trading services along with some others.

It is a brand name of Netbillion Technology Private Limited which is a member of BSE and NSE and a SEBI registered stockbroker.

The philosophy of this startup is “Investing should be as simple as online shopping”.

Account opening process:

- Download the Groww application or open the Groww web portal.

- Register with phone number and email Id.

- Verify with OTP.

- Enter PAN card details, and bank details and complete the setup.

- Read details and click to agree.

- Click on Open Stock Account and additional required details.

- Upload your signature and e-Sign the account opening form.

- Verify the Aadhar number and enter OTP to complete the process.

- Your account will be activated within a few hours after this process.

Brokerage Charges

Charges | Brokerage |

|---|---|

Brokerage Charges | INR 20 or 0.05% per executed trade (Whichever is lower) |

Equity Delivery Trading | |

Equity Intraday Trading |

Features

6. Paytm Money

Paytm has been a well-established banking platform for over years. It got approval in 2019 by SEBI to become a discount broker.

After demonetization, it started offering mutual funds, pension services, SIPs, and other banking services.

Paytm has built a simple, yet powerful mobile application and web portal for trading along with research and analysis.

Account opening process:

Paytm Money account opening process is completely online. You can open a Paytm money account with 4 stages:

- KYC verification

- Stock Market Onboarding

- Account Opening Form

- Registration with the exchange

Account opening and maintenance charges

Paytm money charges INR 200 as account opening charges. There are no depository account maintenance changes.

However, it does charge INR 1 per day as platform charges. This amount is billed annually for the days when the exchange is open.

Paytm Money

Charges | Delivery Charges | Intraday Charges |

|---|---|---|

Brokerage | Rs. 0.01/- per executed order | 0.05% of turnover or Rs. 10/-, whichever is lower |

Exchange Turnover Charges | 0.00325% of turnover for NSE and 0.003% of turnover for BSE | 0.00325% of turnover for NSE and 0.003% of turnover for BSE |

GST | 18% on Brokerage and Exchange Turnover Charges | 18% on Brokerage and Exchange Turnover Charges |

Security Transaction Charges (STT) | 0.1% of turnover on buying and sell orders | 0.025% of turnover on sell orders |

SEBI Turnover Fees | 0.0005% of turnover | 0.0005% of turnover |

Stamp Duty | 0.015% of turnover on buy orders | 0.003% of turnover on buy orders |

Features

7. Kotak Securities

Kotak Securities is a part of Kotak Group. It has been a traditional full-service brokerage firm.

However, it entered the discount brokerage industry in November 2020 with the Trade Free Plan.

In its Trade Free Plan, Kotak Securities announced the first zero brokerage intraday trading across segments

Which is also known as the free Intraday Trading (FIT) Plan.

Account opening process:

To open a Kotak Securities Demagt account, one has to visit here and follow the given process.

Brokerage Charges

Charges | Brokerage |

|---|---|

Intraday Brokerage Charges (Equity) | FREE |

Delivery Brokerage Charges | 0.25% of Transaction |

Features

8. Trade Smart Online

A venture by VNS Finance & capital Limited, Trade Smart Online is an over 25 years old discount broker in India.

It is a reliable trading platform that offers low brokerage and high-speed trading.

It offers 2 optional trading plans for investors involving Power Trading Plan and Value Trading Plan.

A client can pick a plan as per their preferences as they have different charges and services included.

There are no hidden charges in any of these plans.

Account opening process:

- There are 3 ways to Trade a Smart Online trading account.

- Online account opening

- By downloading account opening forms

- By requesting account opening forms via courier.

Account opening and maintenance charges

Trade smart online charges a higher amount for opening Demat & Trading account as compared to most discount brokers in India.

Also, it does not charge any maintenance fee for the first year but starts charging a fee from the second year onwards.

Brokerage Charges

Trading Segment | Brokerage for Value Trading Plan | Brokerage for Power Trading Plan |

|---|---|---|

Equity delivery | 0.07% | INR 15/ finished order |

Equity Futures | 0.007% | INR 15 per finished order |

Equity Intraday | 0.007% | INR 15 per finished order |

Options | Rs. 7 per lot | INR 15 per finished order |

Commodities | 0.007% | INR 15 per finished order |

Currency | 0.007% | INR 15 per finished order |

Features

9. SAMCO

Established in 2015, SAMCO is another discount broker that does not charge a fee for account opening and maintenance.

It supports trading in BSE, NSE, MCX, MSEI, and NCDEX.

SAMCO allows customers to get 4X delivery leverage in the cash market,

And 80X leverage for Nifty, 33X leverage for stocks, and 60X leverage for commodities.

It supports calls. However, there are separate charges for trading through call.

Account opening process:

There are 3 ways to SAMCO trading account.

- Paperless online account opening through eKYC and Aadhar eSign

- By downloading PDF forms

- Visit SAMCO Mumbai Office Branch

Brokerage Charges

Charges | Brokerage |

|---|---|

Delivery Trading | 0.20% or ₹20 per trade whichever is lower |

Intraday Trading | 0.02% or ₹20 per trade whichever is lower |

Features

10. Wisdom Capital

Incorporated in 2013, Wisdom Capital is one of the excellent discount broking platforms in India for providing several features.

It offers trading in stocks, commodities, currency, and future & options on BSE, NSE, MCX, and NCDEX.

It offers the least brokerage and high margin to clients.

Account opening process:

There are 3 ways to open an account with Wisdom Capital.

- Request Online Account Opening

- Request Offline Account Opening

- Request a Soft copy via email

Brokerage Charges

Plans | Charges | Brokerage |

|---|---|---|

| Brokerage in all segments | Zero |

Pro Plan | Delivery trading brokerage | 0.005% of the transaction |

Intraday trading brokerage | 0.005% of the transaction | |

Others | INR 9 per trade | |

Ultimate Plan | Delivery trading brokerage | 0.007% of the transaction |

Intraday trading brokerage | 0.007% of the transaction | |

Others | INR 15 per trade |

Features

11. Tradejini

Tradejini is a Bangalore-based discount broking startup that was incorporated in 2012.

It charges brokerage as low as 0.01% or INR 20 - whichever is lower per executed order.

With a single integrated platform, one can trade on BSE, NSE, MCX, and MSEI.

Account opening process:

One can open a Tradejini trading account online or by visiting its Bangalore office.

Brokerage Charges

Trading | Brokerage |

|---|---|

Delivery Trading | 0.10% or ₹20/ trade |

Intraday Trading | 0.01% or ₹20/ trade |

Features

12. Fyers

Fyers is a word for “Focus Your Energy and Reform the Self”. The statement is to represent the core philosophy of the brand.

Account opening process:

There are 2 ways to Fyers trading account.

- By requesting application forms

- By visiting Fyers Bangalore office

Brokerage Charges

No Delivery Trading

Intraday Trading: INR 20 per executed order.

Features

what are discount brokers?

Discount brokers are online stock broker platforms that allow a user to trade with low brokerage and high speed. However, these companies do not provide any investment advice or analysis to the client.

They provide discounted rates for trading. Unlike traditional brokers, discount brokers avail of a fixed brokerage rate for each trade. The usual rate ranges around INR 10-20.

Earlier, only people with high income could afford to invest in the stock market due to the high commission fees charged by the full-service providers.

But today, as the internet has come to an explosion, the stock market is more accessible to people with smaller capital.

Benefits of Discount Brokerage Services

Low Brokerage & Zero Commission: While full-services typical brokers charge high brokerage, discount brokers are saviors and charge the minimum brokerage.

Traditional brokers charge a commission fee as high as 0.25%-0.7% of the transaction value of delivery transactions but discount brokers do not charge any commission fee at all.

Better Tech: Discount brokers eliminate the hurdle of paperwork and offer convenient services. It saves costs for both clients and the broker’s business model.

Time & Efficiency: Discount brokers in India are quick and efficient for modern investors. So that users can trade with no lag.

Analytical Tools: Some discount brokers avail of analytical tools to study and analyze the market. You do not necessarily need an advisor and study the market on your own.

Conclusion

As an investor, you need a highly trusted platform that fulfills all your trading requirements. You should go with the one that charges low brokerage, high tech facilities, and low annual maintenance.

Also, consider the number of active users in recent years to make the right decision. Apart from this, set your priorities right, and look for the trading option you believe in.

I hope you liked our article on discount brokers India, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Question

1. Which is the cheapest discount broker in India?

Paytm Money is the cheapest discount broker in India. The brokerage charges of Paytm money are as low as INR 10.

Apart from Paytm Money, a person who looks for low brokerage can opt for Zerodha, Angel One, 5Paisa, Upstox, etc.

2. Are discount brokers safe in India?

Yes. Discount brokers are safe in India. These platforms are highly regulated and keep the stocks with depositories.

With the high increase in the discount broking industry, full-service providers like Kotak Securities, Sharekhan, and ICICI Securities have also started offering discount broking services.

3. Who is the number 1 in India?

According to the current reports, Zerodha is the number 1 discount broker in India.

4.Which are the best discount broker in india ?

Here is the complete list of Best Discount Brokers in India :

- Upstox

- Groww

- Zerodha

- 5Paisa

- Angle One

- PayTm Money

- Kotak Securities