NBFC stands for Non-Banking Financial Company

A Non-Banking Financial Company (NBFC) is a company incorporated under the Companies Act, 1956 and engages in the business of making loans and advances, and in acquiring shares, stocks, bonds, debentures, securities.

The primary business of a company is financial activity when the company's financial assets make up more than 50 percent of the overall assets and the income generated from financial assets is more than 50 percent of the gross revenue.

In order to be registered as an NBFC, the company must meet both of these criteria.

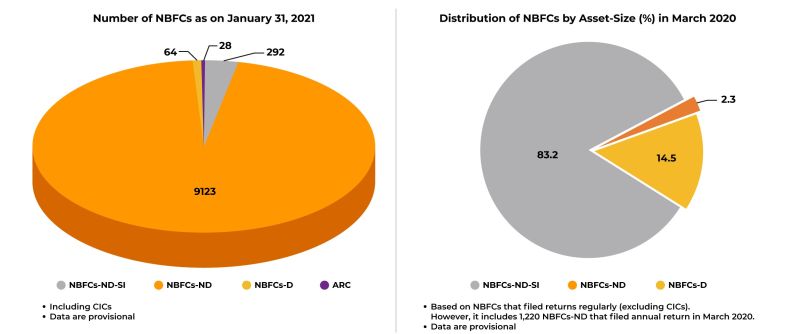

Non-banking financial companies registered with the RBI (As of January 2022) are in the astonishing number of 9000+ , Below is the statistic provided by RBI itself .

Source : RBI

Our Picks For Top NBFC In India :

Top 10 NBFC Companies in India

NBFC | Market Cap |

|---|---|

HBD Finance | ₹90,000 Cr |

Power Finance Corporation | ₹37,410 Cr |

Bajaj Finance LTD | ₹401,300 Cr |

Max Financial Services | ₹24,148 Cr |

LIC Housing Finance | ₹22,786 Cr |

Aditya Birla Capital LTD | ₹37,135 Cr |

Reliance Capital | ₹241 Cr |

Shriram Transport Finance Comapany LTD | ₹51,313 Cr |

Tata Capital Financial Services LTD | ₹7882.39 Cr |

L&T Finance Holdings LTD | ₹22,262 Cr |

List Of 10+ Top NBFC in India : Largest NBFC Companies in India

1. HDB Finance Services

The largest private-sector bank in India, HDFC Bank,

operates HDB Financial Services.

Through a network of more than 1,000 branches

spread across 22 states of India and three union territories.

It offers a variety of secured and non-secured financial products. HDFC Finance services is currently the best nbfc in India in 2022

It provides made up of secured and unsecured loans, including personal and business loans, loans to doctors, auto loans, gold loans, loans for new borrowers, loans for enterprise businesses, loans for consumer durables, construction equipment loans, new and used car loans, equipment loans, and tractor loans.

This company operates through two segments:

BPO Services and Lending Business.

A reputed Indian financial service provider with business segments including lending and a plethora of BPO services, HDB Finance Services is considered one of the fastest-growing financial companies in India.

details

2. Power Finance Corporation

A Navratna company, Power Finance Corporation Limited was founded in 1986 and has a Navratna status.

The company is headed by Rajeev Sharma who is also the Managing Director.

Power Finance Corporation Limited is a financial organization in the country that provides financial assistance to a number of power project as well as Solar energy projects.

Through this organization, power production, transmission, and distribution can be supported.

details

3. Bajaj Finance Ltd

As a part of Bajaj Holdings and Investments, Bajaj Finserv was founded in 2007 and has been operating since that time.

The company provides loans to doctors for the purpose of enhancing their career, home loans, gold loans, personal loans, business loans, and entrepreneur loans, and is a very popular finance company.

Bajaj Finserv does offer some other services besides these. These include wealth advisory services, lending services, and general insurance services.

The company operates more than 1400 branches

across the country with over 20.000 employees. Bajaj Finance is one of the Largest NBFC in India.

There is no doubt that Bajaj Finance Limited has one of the highest domestic credit ratings with an AAA/Stable rating for long-term borrowing, an A1+ rating for short-term borrowing, and an FAAA/Stable rating & MAAA (Stable) rating for its fixed deposit program.

The company has been assigned a Long Term Issuer Credit Rating of BB+/Positive by S&P Global Ratings and a Short Term Issuer Credit Rating of B.

details

4. Max Financial Services

As a part of the Max Group of companies, Max Financial Services Limited (MFS) is the holding company for Max Life, India's largest private life insurance company that is not related to a bank.

As far as life insurance companies are concerned, Max Life is India's fourth-largest.

Over the years, the company has established itself as a benchmark for the Life Insurance industry in India in several dimensions including

customer persistence, high-performance bancassurance and agency channels, skilled and tenured management, strong relationships with distribution partners, focus on long-term savings and protection products as well as superior cost management.

details

5. LIC Housing Finance

One of the largest companies involved in mortgage lending in India is LIC Housing Finance Limited (LIC HFL), a division of LIC Group. The company helps in providing home loans for the purpose of residence.

The main objective of the company is to provide long-term financing to individuals to assist them in buying, building, or repairing houses or flats .

In addition, the company also provides financing for the purpose of repairing and renovating existing houses and flats.

Besides granting loans on existing properties to businesses and individuals, the NBFC also offers financing on existing properties to professionals for purchases or construction of Clinics, Nursing Homes, Diagnostic Centres, Office spaces, and also for the purchase of equipment.

details

6. Aditya Birla Capital Ltd

NBFC Aditya Birla Finance Limited belongs to Aditya Birla Financial Services,

which is a company incorporated in 1991 and a member of the Aditya Birla Group of Companies considered to be on of the best companies in India.

It ranks among the top five largest private diversified NBFCs in India, registered with the Reserve Bank of India as a systemically important non-deposit accepting NBFC.

There is a comprehensive range of solutions offered by the company,

from corporate finance to commercial mortgages, and from capital markets to structured finance.

The company manages a portfolio of assets worth more than Rs. 3000 billion through its subsidiaries and joint ventures and as of December 31, 2019, had a loan book of Rs601 billion (including housing).

details

7. Reliance Capital

Reliance Capital is a constituent of the MSCI Global Small Cap Index, a group of companies that are owned by the Reliance Group of companies.

In the private sector, it is one of the most valuable and prominent financial service companies in India.

As a company, Reliance Capital has interests in many areas of financial services, including life, health, and general insurance; distribution of

financial products; commercial, consumer, and residential loans; equities and commodities brokerage; asset reconstruction; wealth management services; proprietary investments and other activities in financial services.

Located across India, the company has over 20 million customers, and its workforce, as of the first week of May 2017, numbered approximately 15,595 people.

In addition to Anmol Ambani, the executive director, Amitabh Jhunjhunwala serves as the vice-chairman of Reliance Capital and Anil Ambani is the chairman of Reliance Capital, as is Anil Ambani, the promoter of Reliance Group.

details

8. Shriram Transport Finance Company Ltd

A subsidiary company of Shriram Transport Finance Company Limited, the company provides financing for commercial and business vehicles, in addition to others.

Established in 1979, the company has been providing funding services for a wide range of assets, including Light Duty Trucks, Heavy Duty Trucks, Mini Trucks, Passenger Vehicles, Construction Vehicles, and Farm Equipment.

General insurance, stock broking, mutual funds, and general protection are some of the areas in which the company specializes.

The Company provides hire-purchase loans and has therefore restricted its business operations to the field of finance for vehicles, as the unit has witnessed consistent growth in this sector and as trucks are assets that generate cash flow on a continuous basis with a very short gestation period.

Its operations are based primarily in South India, where the Company has an established presence.

details

9. Tata Capital Financial Services Ltd

Tata Capital Financial Services Limited is one of India's leading non-banking financial companies. Tata Sons Limited was established in 2007, and it is part of the Tata Group.

With TCFS, you are dealing with a one-stop financial service provider that provides a range of products and services that are customized to suit your specific needs, whether you are retail, institutional or corporate.

With the RBI, it is registered as a non-banking financial company (NBFC) specializing in non-deposit accepting operations.

In addition to the many products offered by TCFS to individuals, families, and businesses, the company also distributes and markets Tata Cards and has products in the area of Mutual funds , commercial finance, infrastructure finance, wealth management, and consumer loans.

details

10. L&T Finance Holdings Ltd

At the bottom position in Top 10 NBFC in India we have L&T. Established in 1994, LT Finance Limited is one of the most significant players in the non-banking financial sector of India.

The company is headquartered in Mumbai and delivers funding services to a wide range of sectors such as trade, industry, and agriculture as well as lending services for commercial vehicles, personal vehicles, and corporate loans.

There are more than

ten lakh people served by the company.

As part of the Economic Times awards, L & T was the winner of the "Company of the Year" award in 2010. With the help of the Company's financial solutions, the Company is able to serve its clients in multiple sectors, including Business , rural, housing, infrastructure, and mutual funds.

details

11. Mahindra & Mahindra Financial Services Ltd

MMFSL (Mahindra & Mahindra Financial Services Limited) is one of the largest domestic financial services companies.

With over 1000 branches all over the country and a customer base of over 3 million.

One of the most renowned groups in the world, MMFSL has two affiliates that offer services in the field of insurance and rural housing financing.

In addition to providing gold mutual funds, vehicle advances, corporate advances, home credit, and working capital advances, the company also specializes in offering many other types of advances.

As a financial services provider, the Company specializes in financing new and used cars, trucks, tractors, and commercial vehicles.

This company is involved in the provision of a wide range of financial services, including housing finance, personal loans, lending to small and medium enterprises, insurance brokerage, and mutual fund distribution.

The Company is providing different low and middle-income families the opportunity to build their own homes through its housing finance subsidiary, Mahindra Rural Housing Finance Limited (MHRFL).

Furthermore, the Company distributes mutual funds, offers fixed deposit schemes, and provides personal loans.

details

12. Edelweiss Financial Services Ltd

Edelweiss is one of India's leading financial services conglomerates offering a comprehensive range of financial services to a broad client base within India as well as other parts of the world.

According to the Top NBFC Company list in India based on turnover, this company is in the sixth position.

- Credit

- Investment & Advisory (Wealth Management)

- Insurance (Life, General)

Its experience spans the breadth of India's multiple consumption facets, from industrial giants to multinational corporations to small and medium-sized companies and the average household in both urban and rural areas.

details

13. Sundaram Finance Ltd

Sri T. S. Santhanam, one of the Founders, saw that hire-purchase finance in India would have a great future when he founded Sundaram Finance in 1954.

It is among one of the top 50 NBFC in India . This company was started in the year 1988 with a paid-up capital of Rs. 2 lakhs and promoted by Madras Motor & General Insurance Company, before it became a nationalized company in 1971, one of the largest insurers in India.

In keeping with its ideal of protecting and enhancing shareholders' value, Sundaram Finance embraces the philosophy of Growth, Quality, and Profitability.

A number of community-oriented activities are conducted by Sundaram Finance as well as its subsidiaries exemplifying its commitment to society.

The company's major initiatives focus on health, education, the environment, and preserving and promoting the country's rich culture and heritage.

details

14. Manappuram Finance Ltd

One of the leading gold loan NBFCs in India is Manappuram Finance Ltd.

Promoted by Shri. V.P. Nandakumar, who is the current MD & CEO of the company, was born into the company back in 1949 when his late father Mr. V.C. Padmanabhan established it in the coastal village of Valapad (Thrissur District) of Kerala.

Among the activities that the firm was engaged in were pawnbroking and money lending on a modest scale.

In 1986, after his father passed away, Shri Nandakumar took over the reins of the business. On the basis of turnover, it ranks ninth in the list of top non-banking financial companies in India.

Throughout the years, the story has been one of unparalleled growth, and many milestones have been achieved. Manappuram Finance Ltd. has grown at an astonishing rate since it was founded in 1992.

The company has 4351 branch offices (including those of its subsidiaries) spread across 28 states and the union territories of India.

The company has a total of Rs. 194.38 billion in assets under management (AUM) and a workforce of 25,610 employees.

details

15. Muthoot Finance Ltd

A modest trading business was started by Muthoot Group in the remote village of Kozhencherry in Kerala

more than 100 years ago as a modest trading business.

A non-banking finance company, Muthoot Finance, is the largest gold loan NBFC in India.

Based on turnover, it is ranked eighth in the list of Top NBFC Finance companies in India.

It has evolved over the decades, becoming a flourishing business conglomerate with a presence in India's small and large towns encompassing

20 diversified divisions with over 4480 branches across the country.

With its 132 years of experience in providing vital financial services to millions of disadvantaged Indians, we have contributed to the attainment of financial inclusion in India, even in the most remote and rural areas.

details

Conclusion

According to the financial needs of the Indians, there are wide opportunities for NBFC companies in almost all relevant sectors. Companies that adopt a futuristic approach will be able to benefit from the opportunities.

The NBFCs are having the privilege of offering small-ticket loans to the disadvantaged but deserving sections of society by targeting rural and backward areas.

Through their support of small-scale businesses and companies, non-bank financial companies have emerged as one of the largest employers in the country.

In order for the non-banking financial companies to maintain their growth and momentum, it is important to keep upgrading.

frequently asked question

O1.Which are the Top 10 Best NBFC in India in 2022?

Here is the list for the top 10 NBFC in India :

- HDB Finance Services

- Power Finance Corporation

- Bajaj Finance LTD

- Max Financial Services

- LIC Housing Finance

- Aditya Birla Capital LTD

- Reliance Capital

- Shriram Transport Finance Company LTD

- Tata Capital Financial Services LTD

- L&T Finance Holdings LTD

Q2. Which is the best NBFC in India?

LIC HFC is the best NBFC in India. It is one of the largest companies involved in mortgage lending in India is LIC Housing Finance Limited (LIC HFL), a division of LIC Group.

The NBFC provide long-term financing to individuals to assist them in buying, building, or repairing houses or flats for the purpose of residence.

Q3. Who is the No 1 finance company in India?

Bajaj Finance Limited is the No 1 finance company in India. The company provides loans to doctors for the purpose of enhancing their career, home loans, gold loans, personal loans, business loans, and entrepreneur loans, and is a very popular finance company.

Bajaj Finserv does offer some other services besides these. These include wealth advisory services, lending services, and general insurance services.

Q4. Which is the strongest NBFC stock?

HDFC is the strongest NBFC stock. The company is also ranked number one in the nation for housing finance. It has been operating since 1977.

Q5. How many NBFCs are present in India?

According to reports by the Reserve Bank of India, 9,507 non-banking financial companies (NBFCs) were operational as of January 31, 2021.

Over one-third of these companies belong to the non-deposit category, and of these, nearly 300 companies manage over 80 percent of the total NBFC asset volume.