Stockbrokers : Stockbrokers are agents charged with buying and selling orders submitted by an investor in exchange for a commission or fee

Looking for a best broker to invest in us stocks from india?

Great! You have reached the right place; we are here to help you, make sure to read the article carefully to know the best us stock brokers in India

Are you a smart and savvy investor in India who is looking to diversify their portfolio and invest in the US stock markets? You have come to the right place.

Investing in stocks of top American companies such as Apple, Amazon, Facebook, Tesla or Google is not as difficult or intimidating as many assume.

Here, we will guide you on how to invest in the US stock market from India and tell you about the best trading platforms as well.

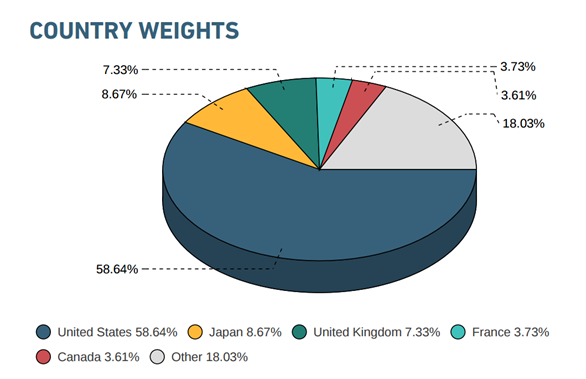

The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across all 23 developed markets countries [ Performance of other countries in comparison to America ]

Source : MSCI

List Of Best Broker To Invest In US Stocks From India

Broker Name | Download Link | Minimum Deposit | Inactivity Fee |

|---|---|---|---|

₹100 | No Inactivity Fee | ||

$100 | No Inactivity Fee | ||

0 | ₹100 | ||

₹35 | No Inactivity Fee | ||

₹25 | No Inactivity Fee | ||

0 | ₹500 | ||

TD Ameritrade | 0 | No Inactivity Fee | |

Fidelity | 0 | No Inactivity Fee | |

Charles Schwab | 0 | No Inactivity Fee | |

E*Trade | 0 | No Inactivity Fee |

Our Top Picks For Best US brokers in india to Invest in US Stocks :

You can also read :

10 Best Broker To Invest In US Stocks From India : US Stock Brokers In India

1. TD Ameritrade

This investing platform is great for brand-new investors. It has zero commission on trades, top-notch educational programming and a great user experience on the mobile app.

It also has several useful tools, reliable security and affordable pricing. TD Ameritrade in one of the best US Broker in India.

Perks- It provides top educational resources, thinkorswim trade engine, detailed and comprehensive research on the stock market. It requires no minimum deposit and has an excellent customer support system.

Details:

2. Fidelity

This investing platform is for everyday investors. It caters to both new and experienced investors. It gives personalized advice to novice investors.

Users can benefit from its numerous tools, extensive stock research and educational resources ,

because of its user interface and many usefull tools , Fidelity is easily best platform to invest in us stocks from india.

Perks- It has easy order entry and a downloadable program that streams data in real-time called Active Trader Pro. It also has a custom trading interface and various tools and resources that ensure a smooth experience.

Details:

3. Charles Schwab

Currently one of the best brokerage and trading platforms, it is for diverse investors including expert and casual investors.

It provides calculators and research and educational tools among others. Its acquisition with TD Ameritrade has brought in millions of new customers.

because of its acquisition with TD Ameritrade many new customers are from global markets such as India , making it the best us stock brokers in India along side with TD Ameritrade.

Perks- It has great educational resources, calculators and research on stocks. It has reliable screeners for ETFs, stocks as well as mutual funds. The acquisition with TD Ameritrade has resulted in the thinkorswim trade engine being available to Charles Schwab customers.

Details:

4. Interactive Brokers

This streamlined investing platform is perfect for professional and seasoned investors. It focuses on creating broad market access, low pricing and great execution of trade.

Investors using this platform can trade on futures, stocks, options, forex, funds and bonds.

A feature called Impact Dashboard allows investors to engage in SRI (socially responsible investing). Interactive Global Traders makes it much faster and easier to invest in us stocks from India.

Perks- It has low commission rates and low margin rates, international trading and zero transaction fees for mutual funds. It allows trading on futures, stocks, options, forex, funds and bonds from a single account. There is access to 135 markets in total.

Details:

5. E*TRADE

One of the first trading platforms in the US, E*TRADE is suitable for all kinds of investors from a novice to an expert. It has option trades, ETFs and zero commissions.

Users can access three downloadable web platforms and two mobile apps that cater to different investment needs and wants.

Its extensive collection of educational resources makes it an excellent choice for new investors.

Perks- It has highly intuitive and advanced mobile applications. There are zero commissions on trading. There is access to mutual funds and ETFs, IRA investing and more. It also has a large library of educational resources and various investment selections for both experienced and new investors.

Details:

How To Trade In International Market From India?

You can go through stock exchanges such as NASDAQ and the New York Stock Exchange (NYSE). There are two ways to invest in the US stock market from India-

Direct investments

Indirect investments

Direct Investments

Direct investments help open an overseas trading account. You can do this with either a domestic or a foreign trade broker. Opening an overseas trading account with a domestic broker

Domestic brokers often have working relationships with brokers in the US. They act as your intermediary to carry out trades. You can open your overseas trading account in India with any domestic broker by submitting the required KYC documents.

However, there are some disadvantages of going through a domestic broker. You may face restrictions on investment vehicles, the number of trades you can participate in, etc. You may also incur high brokerage charges and fees associated with currency conversion.

Opening an overseas trading account with a foreign broker ,You can work with a foreign broker who has a strong presence in India. Some examples of popular and trusted brokers are TD Ameritrade, Fidelity and Charles Schwab.

Here too, you need to be aware of all possible charges you may incur before selecting a broker. You might also want to look out for minimum deposit amounts.

Indirect Investments

You can indirectly invest in US stocks via three channels-

- Mutual funds

- Exchange-Traded Funds (ETFs)

- Investing via new-age Apps

- Mutual funds

You do not need to open an overseas trading account to invest in US stocks if you use mutual funds. You don’t even need to have a minimum deposit. Plus, you can choose from a variety of mutual funds.

Exchange-Traded Funds (ETFs)

ETFs are investment funds that are traded in the stock exchange. While mostly similar to mutual funds, ETFs are traded on the stock exchange throughout the day. ETFs could include stocks, gold bars, currencies or other assets.

They are available through both direct and indirect routes. You can purchase American ETFs through international or domestic brokers or invest in Indian ETFs with international indices.

Investing via new-age apps

The iOS App Store and Google Play Store feature many apps that you can use to invest in the US stock market from India. However, some apps may prohibit intraday trading due to regulations and/or restrictions.

Best International Online Brokers in India

There are many trading platforms that you can use to invest in US stocks from India. Here are the top picks-

TD Ameritrade

Fidelity

Charles Schwab

Interactive Brokers

E*TRADE

Pros of investing in US stocks

There are numerous benefits to investing in the US stock market such as-

- Diversifying your investment portfolio- American stocks allow you to diversify your portfolio. As the old saying goes—don’t put all your eggs in one basket. The market is unpredictable and hence the importance of a diverse investment portfolio to mitigate risks cannot be stressed enough.

Expanding your portfolio, especially in the US stock market, is a great way to increase returns from your investments. As a bonus, investing in US stocks can help you improve your exposure to the American economy. - Extra gains from Dollar appreciation- When the exchange rate for USD and INR goes up, Indian investors in the US stock market can gain financially. This is in addition to any profits from the stock markets themselves.

For example, when the exchange rate for USD to INR went up from 47 INR in 2011 to 74 INR in 2020, it resulted in a 36% gain for investors. - Better returns compared to the Indian stock market- This is one of the main reasons for Indians to diversify into the US stock market. US stock markets generally tend to be more stable and yield higher profits for investors when compared to the Indian stock market.

- More selection of high potential companies- The US stock market offers a wide range of exciting, top, global companies including Apple, Amazon, Facebook, Google and Tesla to name a few from the tech industry. There are also many stocks in top pharma and industrial companies. Indian investors can earn massive gains from investing in these stocks.

Cons of investing in foreign stocks

Although there are many pros to investing in foreign stocks, including US stocks, there are several cons, such as-

- High charges- The brokerage charges for international or US stocks will be in the respective currency and may turn out to be a lot for Indian investors. In addition, there may also be high maintenance charges at the end of the year. Look into all such charges before opening your account.

- Gains vary with the exchange rate- While currency gains can be great from an Indian investor’s point of view, the opposite is true as well. Just as you gain from higher exchange rates, you also lose with dips in the exchange rates. For example, a dip in the dollar exchange rate from 68 INR to 62 INR over one year can result in a loss of 8.8%.

- An upper limit to investment amount from India- The Reserve Bank of India’s Liberalised Remittance Scheme (LRS) currently allows Indian citizens to invest only up to 250,000 USD overseas per year. That could translate to Rs. 1.7 crore a year. This may be a good amount for new and casual investors but not for experienced and sophisticated investors.

What are the different charges involved while investing in US stocks?

As mentioned above, it is important to be aware of all the possible charges incurred when investing in US stocks from India. Following are some charges you might come across-

- Tax collected at source- For transactions over Rs. 7,00,000, a 5% TCS or tax collected at source is levied. The tax applies to any amount over the 7-lakh limit and does not include the 7 lakh.

- Capital gains and dividend tax- In the US, dividend tax for Indian investors is 25%. There is no tax on the capital gains from your investments, but you are required to pay a capital gains tax in India.

- Bank charges- These include foreign exchange conversion fees as well as transfer and transaction fees. There may also be initial charges for setting up your trading account.

- Brokerage fee- It is a fee charged when you buy and sell stocks through brokerage firms. This varies from firm to firm.

Foreign exchange rate- They can affect not only your gains but also the cost of stocks and number of units that are allotted.

Things to remember before investing in US stocks from India

There are many things to look into before you decide to invest in US stocks as this can be a risky financial step.

Consider whether you have enough time and experience to invest in a market such as the US stock market. For many Indians, it can be a big financial risk that is generally not advised for novice investors.

Beware of the charges and taxes involved. Some of the most common ones have been listed above but there could be other hidden charges which you must be aware of before opening your trading account.

Investing is more profitable than trading owing to the high charges. Long-term investments also allow you to earn better returns in the long run.

Do not invest huge amounts when you are just starting out. Start with a small amount and work your way up as you gain experience in the stock market.

Investing in US stocks is a great option for those who want to diversify their portfolios and increase their gains. There are many online platforms with plenty of educational resources to help you along the way. However, be aware of the charges, pros and cons of your target stock market, whether in the US or elsewhere.

frequently asked question

1. Is investing in US stocks regulated? Are Indians allowed to invest in US stocks?

Investing in the US stock market from India is regulated by the Reserve Bank of India’s Liberalised Remittance Scheme (LRS). Currently, LRS allows Indian citizens to invest up to 250,000 USD a year in US or foreign stocks.

The Reserve Bank of India’s Liberalised Remittance Scheme (LRS) allows Indian citizens to invest in US stocks or ETFs.

2. Can I do day trading in the US stock market from India?

Yes, the Reserve Bank of India’s Liberalised Remittance Scheme (LRS) allows Indian citizens to do day trading in the US stock market from India. However, this does not include margin trade. Keep in mind that day trading in the US stock markets is extremely volatile and financially risky.

3. Can I invest in NASDAQ from India?

Yes, Indian citizens can invest in NASDAQ from India. However, this comes with a catch. You can only invest in NASDAQ from India via a brokerage firm. Additionally, you are required to open an overseas trading account to do this.

You are also permitted to invest in the New York Stock Exchange (NYSE) from India.

4. How can I trade US options from India?

To trade US options from India, you will need to have an overseas trading account with an international broker. This broker must be registered in the US. Indian brokerages such as ICICI Direct also help you invest in US stocks from India through overseas trading accounts.

5. Which app is best for the US stock market in India?

There are many apps available in India that will enable you to invest in the US stock market. Vested, the most popular app, was the first Indian app that gave Indian residents access to US stock markets. It has perks like zero commission and zero brokerage fees. Other apps include INDmoney and Groww.

I hope you liked our article on best broker to invest in us stocks from India, and it must have solved your queries such as us stock brokers in India, Indian broker for us stocks, etrade India or can i trade in us market from in India

if you have any comments or suggestions do share them in the comments below.

5.Which are the best brokers to invest in US Stocks from India in 2022 ?

Here is the list of brokers to in US Stocks from India :

- Groww

- Upstox

- INDMoney

- ICICI Direct

- HDFC Securities

- Kotak Securities

- TD Ameritrade

- Fidelity

- Interactive Broker

- Charles Schwab

- E*Trade