Want to know what are the Fundsindia Review ? Then, you have landed on the right article. In this Fundsindia review article, we're going to explain all the aspects of SimplySAVE credit card.

Most shareholders send their periodic or lump-sum payments to dealers online and in real life. But have you ever considered what might follow if the financial intermediation organization or web application experienced fluctuation?

That happened at Wealth India Financial Services, which operates the Fundsindia internet site and is one of India's top fund manager sales channels. FundsIndia (founded in 2009) is a digital investing platform based in Chennai, Tamil Nadu.

Initially designed for mutual fund schemes, it gradually expanded to include equities, corporate fixed deposits, bonds, and other investment products. In a nutshell, FundsIndia is your one-stop-shop for wealth creation.

You may deposit, monitor, and retrieve any mutual fund investments at your leisure using a singular FundsIndia profile available for free.

With no actual documentation, you may set up an account on the FundsIndia website, choose an investment portfolio from their ranking of the top 50 funds, and click on the application to invest.

Continue reading this Fundsindia Review to learn how your assets are safe and how these websites serve merely as middlemen.

FundsIndia offers

- Mutual Fund Investment:-

- Budgetary guidance with an objective in mind that assists you in making the greatest investment selections to develop wealth.

- The fully digital and rapid procedures allow you to invest quickly with your Aadhaar number

- Money Mitr, India's friendliest Robo adviser, provides instant customized suggestions.

- Dedicated advisers that assist you in creating portfolios on demand, reviewing and managing your assets by phone, e-mail, chat, and Skype.

- Our research team provides fund assessments and suggestions to assist you in making sound investing decisions.

- Flexible Systematic Investment Plans (SIPs), quick portfolio evaluations, trigger-based investing, Value-averaging Investment Plans (VIPs), and other innovative tools are available.

- Equities:-

- Utilize cutting-edge technologies such as Buy Today Sell Tomorrow (BTST) and 5 Day Gross margin.

- Trade-in equity bundles produced and suggested by their research team, or build your stock combinations.

- You may trade in the marketplaces with 5 Days Margins for up to 4x your daily allowance at interest levels as low as 18%.

- You wouldn't have to wait T+2 days for exchanges to finalize your purchase/sale deals with Buy Today Sell Tomorrow (BTST).

- Be the first to have company market fundamental and technical analysis study reports.

- Super Savings Account:-

- Earn enticing profits on current assets.

- Redeem/retrieve funds in less than half an hour, 24 hours a day, seven days a week.

- Receive a free ATM+Debit card for withdrawing cash.

- There are no account fees.

- There is no minimum balance.

- Original investment: Rs. 1000, with further investments starting at Rs. 500.

- SIP with Insurance:-

- Participate in mutual fund schemes via reputable asset management companies.

- Based on the amount and length of the SIP, you can receive up to 1.5 crores in an additional life insurance policy.

- Signing up is simple, digitalized, and hassle-free.

- Insurance coverage continues even after the SIP is terminated.

- Corporate Fixed Deposits:-

- Put the money in corporate fixed deposits from well-known corporations.

- The research group rigorously verifies each corporate fixed deposit on offers.

- By dealing in 'Select' corporate fixed deposits, you may reap the perks of safety and excellent profits.

- You have the freedom to pick your capital investment, term, interest rate, and maturity value.

- National Pension System:-

- Invest regularly in a minimal combination of equities, corporate bonds, and budget deficits.

- Set your investment strategy to meet your needs, or allow it to be determined regularly.

- Pick your favorite PFRDA-approved Pension Financial Adviser based on their record of success and your specific requirements.

- In addition to your NPS expenses under section 80C, you can benefit from additional tax benefits of up to Rs.50,000 as per section 80CCD.

How FundsIndia Works

FundsIndia is a web-based tool that assists you in managing your financial investments. FundsIndia's operation consists of various aspects:-

- A platform for internet investing

- A list of the best-performing mutual fund's

- Professional financial advisors

- Trading and investing in stock

Platforms:-

- FundsIndia App

This FundsIndia phone app has quickly gained user trust, owing to its regular update frequency cycle. Among the main components of such a mobile app are:-

- Through the phone app, you may invest in mutual funds, SIPs, and stocks.

- There is a robo-adviser function accessible, similar to the ARQ service provided by Angel Broking.

- Essential functions such as a market watch list, alerts and notifications, and so on have been implemented.

- The app includes financial news and advice.

- FundsIndia Web

FundsIndia provides an internet surfing investing program and an investment opportunity. There is no need to download or install anything; simply navigate to the login page, enter your information, and begin managing your assets from there.

- List of Best Mutual Funds

FundsIndia provides most of the best 50 mutual funds (fund kind of) depending on the risk tolerance.

For example, under equity funds, it recommends Axis Bluechip fund for investors with slightly higher risk and Birla Sun life SL Investment fund for those with increased risk.

FundsIndia recommends long-term loans, hybrid funds, and tax-saving funds for low-risk, moderate-risk, and high-risk investors.

However, it is ultimately up to you to determine which mutual fund suits your investing strategy and goal.

- Expert Advisory

FundsIndia provides high-value consulting services. The portal provides access to their in-house personal advisers and their Robo advisors.

FundsIndia's advice service can help you choose an appropriate mutual fund plan and develop a portfolio.

- Equity Investment and Trading

FundsIndia brokerage charges is a full brokerage that uses a commission-based brokerage model. The activity, however, is confined to stock investment and intraday trading. F&O, commodities, and currencies cannot be invested in or traded-in.

Survey of FundsIndia

Although FundsIndia charges reasonable fees, it offers analysis and advice on various financial products, including mutual funds and long-term equity investments.

The investing platform includes a small but capable in-house research staff that regularly publishes weekly reports. These studies provide a comprehensive overview of the financial realms and deep fundamental analysis.

Here are some introductory notes about this investing firm's study methodology:-

- On a broad scale, advisors monitor the economy's momentum and the performance of mutual funds.

- The Mutual Fund Research Desk examines the portfolio regularly to ensure that it produces at a constant level, particularly following Indian economic growth.

Simultaneously, if any problems or corrective action must be done, it sends an email to users suggesting rebalances.

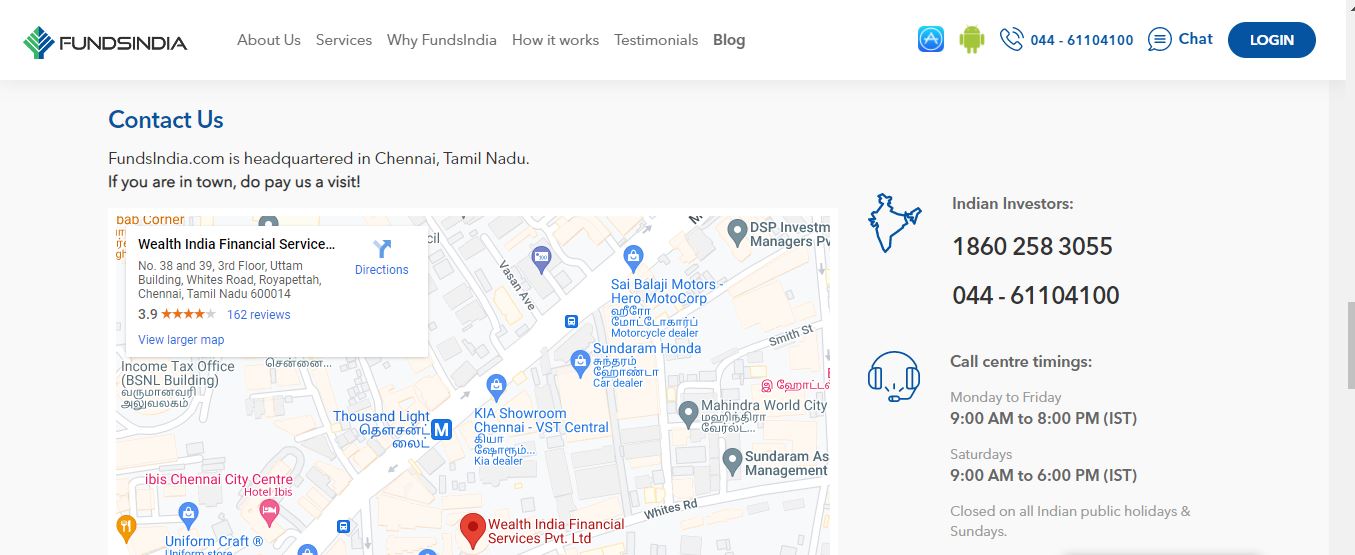

Customer Service at FundsIndia

Service is one of the most critical components, especially for consumers who watch their assets daily and are willing to switch and relocate their investments.

FundsIndia offers its clients the following communication options for support:-

- Webchat

- Phone assistance in India

- Phone help for NRIs

- EmailSkype

The choice of communication methods is rather varied, and customers may reach out to this investment platform via the majority of web platforms.

However, suppose you are searching for local support or help through a branch or sub-broker office. In that case, you will be disappointed because there is no physical presence outside the corporate headquarters.

Nonetheless, those who rely on communication methods receive enough assistance and service, as mentioned earlier. The only criticism that FundsIndia can give is about its turnaround time.

FundsIndia charges

This investment business has kept its price at a level accessible to small investors. This is explained by the fact that the investing website does not impose any commission for equities turnovers of less than one lakh rupees.

Fees for Opening a FundsIndia Account

Fundsindia demat account review: You do not have to spend anything to register an account with FundsIndia.

Furthermore, AMC (Annual maintenance charges) are assessed for your trading account, although these charges are only relevant after the second year.

- Rs. 0 Fees for Opening a Trading Account

- Demat Account Opening Fees Rs. 0

- Trading Account Annual Maintenance Fees Rs.200

- Annual Maintenance Fees for Demat Accounts Rs. 0

FundsIndia Brokerage

Whenever it comes to trading costs, FundsIndia operates similarly to a traditional discount stock broker, charging a fixed rate for a brokerage from across financial categories (Equity, Derivatives) that it offers.

Investing, on the other hand, is free.For further details, use the FundsIndia Brokerage Calculator.

Delivery of Equity | Rs. 20 per completed order |

Intraday equity | Rs. 20 per executed order |

Equity Futures | 20 per completed order |

Options on Equity | Rs. 20 per completed order |

FundsIndia Transaction Charges

Here are some other charges that you need to consider unless you want to get surprised later in your trades:-

Transaction Charges | 0.0035% |

Stamp Duty | 0.01% of trade value |

Securities Transaction Tax (STT) | 0.1% |

Call and Trade | ₹20 |

Demat Statement Charges | ₹25 (first 2 statements are free) |

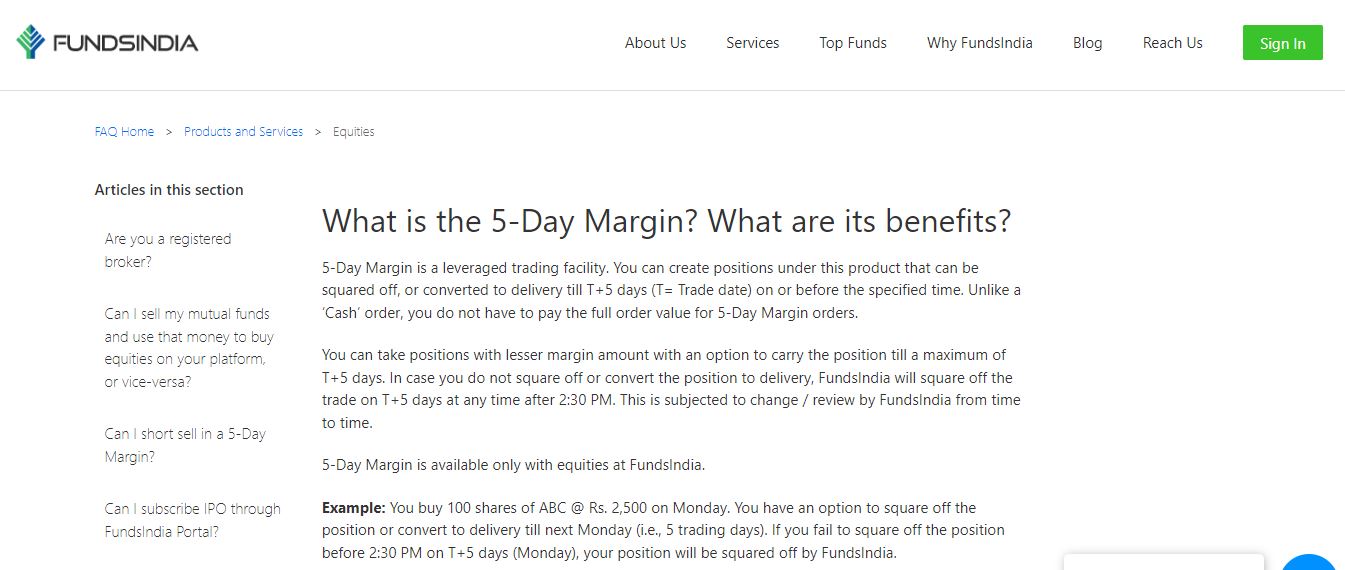

Margin FundsIndia

Although the interest rate as 5-day margins is as low as 12 percent (one of the lowest in the business), the broker offers limited exposure or leverage multipliers.

Here are the specifics:-

- Up to 5 times equity delivery

- Intraday equity up to 5 times

- Futures/Options on Stocks

- There is no leverage.

Where You Can Invest Through FundsIndia

- Investing in Mutual Funds:

FundsIndia presents a list of in-house specialists' top 50 mutual fund schemes chosen for investing. Bondholders' risk-taking ability categorizes funds into low, moderate, and high-risk categories. The selected mutual funds are classified according to their fund kind.

Aditya Birla SL Equity fund is for participants with a greater risk appetite, whereas Axis Bluechip fund is for moderate-risk investors. Axis long-term equity fund is suitable for moderate-risk investors.

Whereas Tata India Tax Savings fund is suitable for high-risk investors. For moderate-risk investors, choose the HDFC Hybrid Equity fund, while for high-risk investors, consider the ICICI Pru Balanced Advantage fund.

The following explains how mutual funds work at their most basic level:-

- An asset investment group (AMC)/fund house evaluates future earning opportunities in the market and analyses that investment's risks and possible benefits.

- The AMC investigates any related investment choices that may increase the value of - or assure the success of - the primary opportunity.

- The AMC's fund management selects various investments to balance risk and overall earning potential - matching the correct high-risk-high reward stocks with good safety consistent income securities.

- All fund data, including risk considerations, are carefully recorded and provided to the industry organization SEBI for regulatory clearance and the community for evaluation.

- The fund plan is accessible to the general public, who may then invest in it by purchasing fund units. The bigger the number of fund units acquired, the larger the investment and, as a result, the greater the amount of future revenue.

- The fund is either actively or professionally managed by a financial adviser, depending on the form of the fund.

- Declared payouts are paid proportionately among shareholders under the income approach. Dividend payments are reinvested for capital gain under the investment objectives.

- Capital gains are distributed to shareholders after the fund's duration.

- Equities

Using the FundsIndia website, you may invest in equities to construct a modest capital of Rs. 2 - 3 Lakh rupees. However, FundsIndia's equity offerings are confined to share investment and dealing (delivery & intraday). FundsIndia does not provide currencies or commodity markets trading.

Equity mutual funds are further classified based on:-

- Their investing strategy (value, dividend yield, or focused)

- Whether they are managed directly or indirectly (Active/Index)

- Their market capitalization (small-cap, mid-cap, or large-cap)

- If they are Sector or Thematic Funds (that only invests in a particular sector like pharmaceuticals or petroleum or a theme such as services, healthcare, etc.)

Stock funds are advised for people ready to wait at least five years for significant returns and don't mind the inherent risk of equity investments. These funds are riskier, but the potential payout is more prominent.

- Fixed Deposit for Businesses

Using the FundsIndia platform, you may invest in corporate fixed deposits (FD). Corporate fixed deposits from HDFC Fixed deposits, ICICI Dewan Housing finance FD, Sundaram Housing Finance FD, and others are available.

FundsIndia ensures that corporate FDs have evaluations from organizations such as CRISIL, CARE, and ICRA to guarantee that investors earn greater returns while maintaining adequate safety. You may also choose the FD amount of fund, duration, and maturity dates.

- Super Saving Account

A Super Savings Account allows users to manage their spare cash by engaging in a liquid equity investment plan. The Super Savings Account has the same operating characteristics as regular savings account in a bank.

When you deposit in a liquid fund, you will receive a more significant return (4.7 percent to 6.7 percent) than a standard savings bank account, which only gives 3 percent to 3.5 percent interest.

With a minimum investment of Rs. 1000, you can start a super savings account. However, the maximum immediate withdrawals sum is Rs. 50,000 or 90% of the invested capital, whichever is less.

How To Invest Through FundsIndia in India

The simplest and most convenient way to invest in mutual funds:-

Step 1: Set up a free account on an online mutual fund platform like FundsIndia.com.

Step 2: Enter your credentials, such as name, DOB, address, bank account information, etc.

Step 3: Submit your KYC paperwork.

Step 4: Consult with a fund manager investing professional and a financial expert to assess your objectives and the level of risk you're ready to accept.

Step 5:

Invest your money to watch it grow!

It is just that simple to begin investing in mutual funds with FundsIndia.

To start investing in the stock market, simply follow these simple steps:-

Step 1: Visit www.fundsindia.com.

Step 2: Register for a free account and submit your KYC papers.

Step 3: Consult with a team of award-winning financial experts and investing specialists to choose which stocks to buy.

Step 4: Invest in your preferred shares and monitor your progress on the FundsIndia portal.

Step 5: Take a deep breath and watch your money rise.

Advantages of FundsIndia

Simultaneously, here are some benefits of choosing FundsIndia as your investing platform:-

- Account registration is free.

- Users can invest in mutual funds for free.

- LoW brokerage fees.

- Users get basic research as well as guidance with mutual funds.

- As part of the research, Robo advice eliminates any potential human mistakes in judgment.

- You can put a limit order, a market order, and a stop-loss order.

Disadvantages of FundsIndia

Here are some of the issues regarding utilizing FundsIndia's services:-

- There is no support in the currency or commodity markets.

- Intraday traders do not have access to research.

- Customer service response times can improve.

- Low exposure values are available.

- A limited number of investing platforms are available.

Conclusion

FundsIndia's online platform enables time-pressed individuals to buy shares, analyze, and administer financial assets from a unified platform.

You may also use the site for daily stock trading and access customized and Robo advising services for your equity investment needs.

If you enjoyed reading this article where we gave our Fundsindia Review, please share it with someone you care about!

Frequently Asked Questions

1. Is FundsIndia a legitimate company?

FundsIndia is a great place to invest in the stock market. It provides a wide range of instruments for investing. Excellent assistance from the FundsIndia team; you will be allocated a dedicated consultant who will be available to assist you.

KYC registration is swift from their end, and if there are any issues, they will offer immediate assistance to resolve them. The web registration is user-friendly.

2. Is FundsIndia good for a mutual fund?

A mutual fund plan is an investment vehicle that engages in certain firms and prospects. When the enterprises wherein the fund plan has invested perform well or when possibilities present themselves favorably.

The fund scheme receives a portion of the profits. The acquired share is subsequently distributed to all shareholders in proportion to their contribution.

FundsIndia is a fantastic place for developing your money. Their skilled research team chooses certain mutual funds so that investors may gain more significant profits over time.

It's as simple as sending an email at a convenient time, and they'll react with the most exemplary analysis and suggestions. Advisors do not infringe on consumers' time by constantly following up; instead, they let them invest at their speed.

3. Is FundsIndia direct or regular?

FundsIndia now only provides regular plans. A Direct plan is something you purchase directly from the mutual fund firm (usually from their website). On the other hand, a regular plan is something you are buying from an advisor, broker, or distributor (intermediary).

The mutual fund firm regularly pays a commission to the middleman, which is then recovered as a planned expenditure. A regular plan has a higher expense ratio in mutual fund parlance.

A regular plan is ideal for investors who do not have the market understanding or the time to maintain their portfolio. As a result, a regular strategy is significantly more convenient for investors unfamiliar with the market. They pay a negligible charge for expert counsel.

4. Is FundsIndia registered with SEBI?

Yes, FundsIndia is a registered stockbroker with the Bombay Stock Exchange (BSE). Their SEBI registration number is INB011468932. To sponsor a mutual fund (MF) in India.

An applicant must submit a request in Form A [first schedule of the SEBI (Mutual Funds) Regulations, 1996 (starting now referred to as the Regulations)] together with a non-refundable fee of INR 5 lakh.

SEBI-approved Asset Management Companies (AMCs) handle the money by investing in various stocks. The securities of the fund's different schemes are held in custody by a custodian who SEBI authorizes.

5. Fundsindia vs Zerodha which one is better?

Both the platforms have their own pros and cons but there is one basic point that Zerodha does not charge on your investment in shares.

I hope you liked our article on Fundsindia review, if you have any comments or suggestions do share them in the comments below.