Want to know How To Cancel A Cheque? Well you have landed on the right article

If you ever need to validate your banking details, a cancelled cheque is the most crucial instrument you can use. Though internet banking and phone banking have taken over most banking activities, using cheques has its benefits.

When it comes to cancelled cheques, you can use them as proof whenever you opt for an insurance policy or PF withdrawal. Just like a normal cheque, a cancelled cheque has your banking details such as bank name, branch address, account number, and so on.

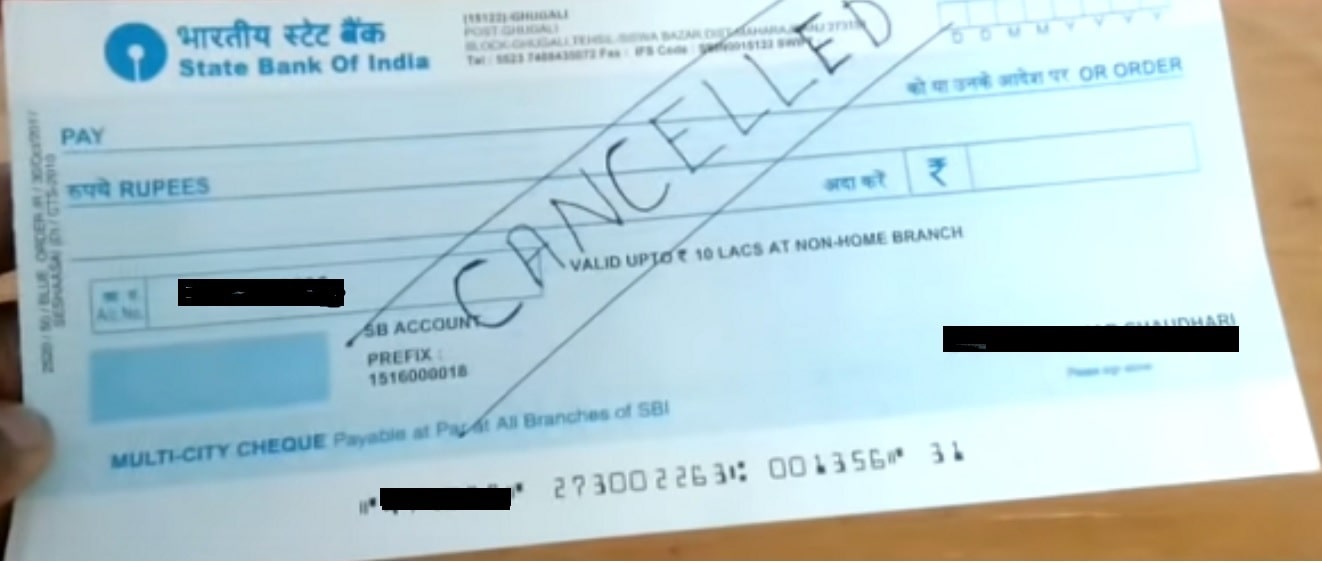

But, how to write a cancelled cheque? You can write a cancelled cheque by making two parallel lines (across the cheque) and writing the word ‘cancelled’. Let us learn more about how to make cancelled cheque and where you can use it.

A cancelled cheque can not be used by anyone. It is only meant for validation purposes.

- Account number

- IFSC Code

- Name of the bank

- Branch name and location

- MICR Code

- Cheque number

How to make a cancelled cheque

Methods to cancel a cheque

Apart from validating bank details, you can cancel a cheque if your cheque is stolen or lost. Cancelling a cheque also safeguards you even if it falls into the wrong hands.

If your cheque is stolen, you need to make sure that no one can cash that cheque. Firstly inform your bank that your cheque has been stolen.

If you have already given a cheque and for any reason you need to stop it from cashing, you can use a tool called stop payment. You can stop payment of cheque by

- Raising online requests: In online mode, you need to log in to your internet banking by using your user ID and password. Select the ‘stop payment of cheque’ option.

- Then select the account number and enter the cheque details, such as the cheque number and a reason to stop payment. Once you enter these details, press 'confirm' and verify.

- Personally visiting a branch: If you decide to visit the bank personally, you need to submit a request to stop payment of the cheque.

- Mention details in your request such as recipient’s name, date of issuing the cheque, amount to be debited, cheque number, and account holder’s details.

- Customer care helpdesk: You can also stop payment of the cheque by calling your bank’s customer care helpline numbers.

- A customer care executive will help with the process of cancelling the cheque.

How To Cancel A Cheque?

Cancelling a cheque is no rocket science. Here is your step-by-step guide to cancel a cheque.

Step 1. Take out a new cheque from your chequebook. Use perforation marks for easy tearing.

Step 2. If you want to cancel a cheque, draw two parallel lines across the cheque and write the word ‘cancelled’ between those two parallel lines.

Step 3. Make sure you write the word ‘cancelled’ in upper case.

Step 4. Remember, the parallel lines should not cover any kind of important information details mentioned on the cheque, such as account number, account holder’s name, IFSC code, branch name.

Which coloured pen should be used to cancel a cheque?

As you know, the cheque is a legal instrument that allows the cheque holder to access your funds. That’s why it is crucial to be careful about allotting a cheque.

Use a black or blue coloured pen to fill in the details on a cheque. If you fill your cheque with colours such as red or green, it may not be considered acceptable by your bank.

Black ink is the most recommended to be used to cancel a cheque. Avoid using red and green coloured ink.

How much fee is charged for stop payments?

When you use the stop payment option for requesting to cancel the payment of the cheque, you have to inform your bank.

For stop payment of cheque, the bank usually charges Rs. 100 to Rs. 200. However, the stop payment fee may vary across the banks.

Staying alert

If your cheques frequently get lost or stolen by someone, you must keep an eye on your credit. Stopping payment is a good way to save your money from the reach of scammers and fraudsters.

Regularly monitor your credit to avoid losing your money. You can check if your bank provides credit monitoring-related services.

What does a cancelled cheque indicate?

A cancelled cheque acts as proof that you have an account with a certain bank. It also serves as a way to confirm your banking details.

When would you need a cancelled cheque?

Apart from restricting payment, a cancelled cheque is used on many occasions. Listed here are some of the uses of a cancelled cheque:

- Loans and EMI-related processes: Whenever you plan to take a personal loan or buy a car, electronics, or any other things on EMI, your bank may ask you to submit a cancelled cheque to validate your banking details.

- It is a standard process that requires you to submit a cancelled cheque.

- To open a Demat account: If you want to trade shares and mutual funds, you must hold a Demat account.

- Stockbrokers may ask for a cancelled cheque among all other documents while opening a new Demat account

- Know Your Customer (KYC) completion process: KYC documentation is important when it comes to trading mutual funds.

- You need to submit a cancelled cheque while processing your KYC documents. A cancelled cheque acts as proof to verify your bank details.

- For purchasing an insurance policy: While purchasing an insurance policy, some insurance companies ask you to submit a cancelled cheque as a part of the procedure.

- At the time of withdrawing money from the employee provident fund (EPF): To confirm your bank details while withdrawing money from your employee provident fund account (EPF), you need to submit a cancelled cheque.

- For opening a savings or current account: Some banks ask their new customers to submit a cancelled cheque of the existing bank for opening a new savings or current account

- For using Electronic Clearance Service (ECS) to transfer funds: To use electronic clearance service (ECS) while moving funds from one bank to another, you need to submit a cancelled cheque for the verification of your bank account details.

Conclusion

In a nutshell, a cancelled cheque is a critical instrument that is used for the validation of your banking details across many financial services.

Even if people use internet banking for most of their banking activities, a cancelled cheque has its importance.

I hope you liked our article on how to cancel cheque, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

1. How to cancel a cheque?

To cancel a cheque, you need to take a fresh cheque from your chequebook and draw two parallel lines across the cheque. While drawing the lines, ensure the visibility of important details such as account number, cheque number, branch name.

Write the word ‘CANCELLED’ in an uppercase between those two parallel lines. Once you cancel a cheque, it can not be used for withdrawing money or accessing your funds.

2. When do you require a cancelled cheque?

A cancelled cheque is used on multiple occasions such as while opening new savings or current account, for KYC completion, for transfer of funds via Electronic Clearance service (ECS), for withdrawing money from your Employee Provident Fund (EPF), For processing loans, and EMI, for purchase of insurance policies, and for opening a Demat account.

3. Can I request my bank to cancel a cheque on my behalf?

Yes. Every bank provides a cheque cancellation or the stop payment option at a nominal fee of Rs. 100 to Rs. 200. You can inform your bank regarding the same via internet banking, personally visiting n the branch, or by just calling a customer care helpline number.

Stop Payment fee may vary from bank to bank.

4. Do I need to sign a cancelled cheque?

No. You should not sign on a cancelled cheque. A cancelled cheque is only meant for identifying your banking details with the respective bank. Signing a cancelled cheque is only needed in the case of normal cheques. Also, signed cancelled cheques may not be acceptable to your bank.

5. Are there any risks involved in cancelling a cheque?

Cancelling a cheque is not risky at all. However, you need to be vigilant to avoid fraudsters misusing your cancelled cheque for their benefit. In some cases, when people lose their chequebooks or get stolen by fraudsters, there may be a possibility of misuse.

However, you can immediately inform your bank to avoid any financial losses due to identity theft.

6. Can I use pencil or red ink to write a cancelled cheque?

No. You must use only black or blue ink to write a cheque. Use of a pencil may put you at risk of fraudsters using your cheque for unauthorized activities. The use of red ink may come across as something fishy or scammy.