Want to know What Is Cred? Then, you have landed on the right article!, make sure to read the article carefully to know is cred safe?

Are you facing difficulties in making timely credit card payments? Keeping track of the billing cycle due dates can be hassling using multiple credit cards. Missing a single credit card payment deadline can negatively affect a person's credit score.

Have you heard of the app called CRED, the first of its kind in India that helps you clear your credit card payments on time and earn rewards?

CRED also offers many other exciting benefits apart from credit card bill payments. Let us discuss the CRED app in detail and its pros and cons.

The finance domain has undergone major changes during the last few years, with fintech companies coming up with scores of innovations. One such new entrant to the realm of fintech is the Bangalore based company CRED.

It was founded by Kunal Shah in 2018 and has created a buzz in the Indian financial market since its inception. CRED is an app that helps its members manage multiple credit card payments promptly and earn rewards in the process.

How CRED Works

What Is Cred: Know Everything (2022 Updated)

CRED is strictly a member-only platform. To maintain its trustworthiness, CRED is very specific about the admission of members. CRED allows only individuals with a credit score of at least 750 to become its member.

Credit score verification is carried out through third party credit rating agencies like Experian, CIBIL, CRIF, etc.

Following are the steps involved in using the CRED app:

The first step is to start using CRED is to download it on your phone and sign up using your valid phone number. The CRED app can be downloaded on Android and Apple phones from the app store.

CRED shall verify your mobile number using an OTP when it is downloaded. Enter the OTP received on your phone to proceed with the sign-up. Ensure that the mobile number used to log in to CRED is linked to the credit cards you are willing to link.

After the OTP is verified, CRED shall look up your credit score and verify it to make sure you are eligible for membership. If your credit card falls below the required score, you will be out on the waiting list.

Once your membership is accepted, the app will add all your credit cards linked to your phone number. The app will initially list up to 10 credit cards, which can be expanded if the member wishes to enlist more cards. The credit cards will have to be verified by adding the masked numbers.

Once credit cards are added, CRED will deposit Re 1 to each credit card through online payment to verify them.

After successfully signing up, you can start using the CRED app to manage your credit card payments and earn rewards seamlessly.

Major benefits of CRED App

There are several benefits that the CRED app provides its members.

Timely credit card payments: The primary function of CRED is to give a platform to integrate all your credit card payments. This means that it is no longer required to check each credit card statement individually to find outstanding payments, minimum due, etc.

You can add all of your credit cards in one app and conveniently make payments on time using CRED, and for individuals using more than one credit card, making credit card payments on time will no longer be a hassle.

- Payment of rent and education fees: This feature was added later on to the app. CRED now also helps pay rent and educational fees apart from credit card bills.

In return for a small service charge, CRED offers the assistance of payment of rent or educational EMI on a 24/7 basis.

There are a lot of offers and cashback associated with each payment. Using the automated command, you can also ensure that your rent and educational fees are being cleared on time without requiring you to initiate payment each time.

- Protection and safeguard: CRED app is equipped with an AI-backed system that keeps account of each credit card payment record and maintains a record of billing cycles, due dates, spending patterns, card statistics, suspicious activities on your cards, etc.

CRED also provides timely repayment reminders so that the credit card holder does not miss a payment deadline. Another important benefit of the CRED app is exposing hidden charges associated with credit cards.

- Cashback on transactions: CRED offers a bounty of cashback offers with their bill payments. Cashback is earned in scratch cards using the kill the bill feature after making a payment. The minimum amount of payment to earn a cashback is Rs. 1000.

For example, if a user pays rent on CRED using Axis bank credit cards for two consecutive months, they earn a flat Rs. 250 cashback per month. However, there are maximum limits on how much cashback one can earn in a month.

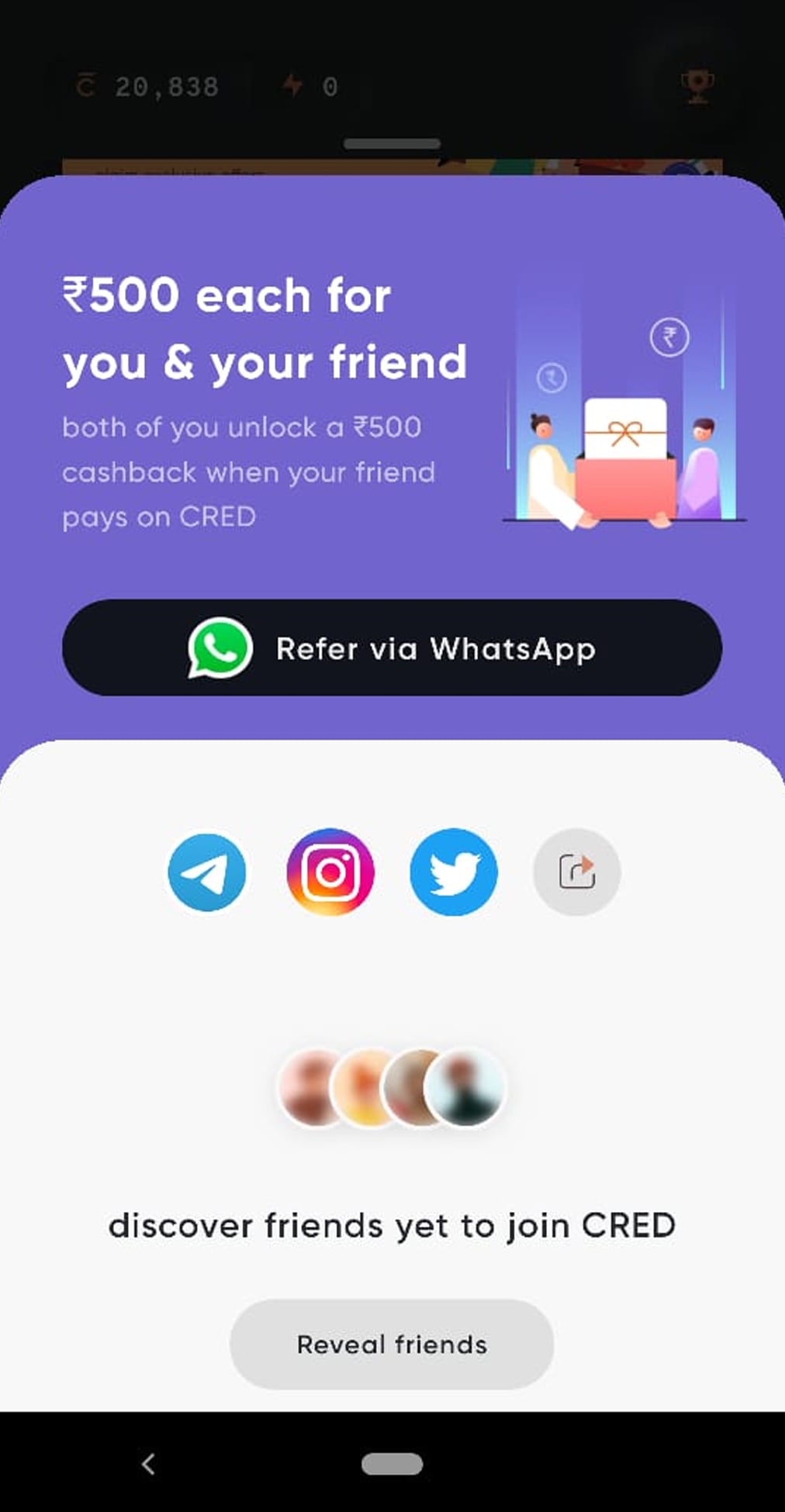

- Cashback on referrals: CRED also offers cashback of up to Rs. 500 when a friend referred by its member makes their first payment. The referral link can be sent using mobile apps like WhatsApp, Telegram, Instagram, Facebook, etc.

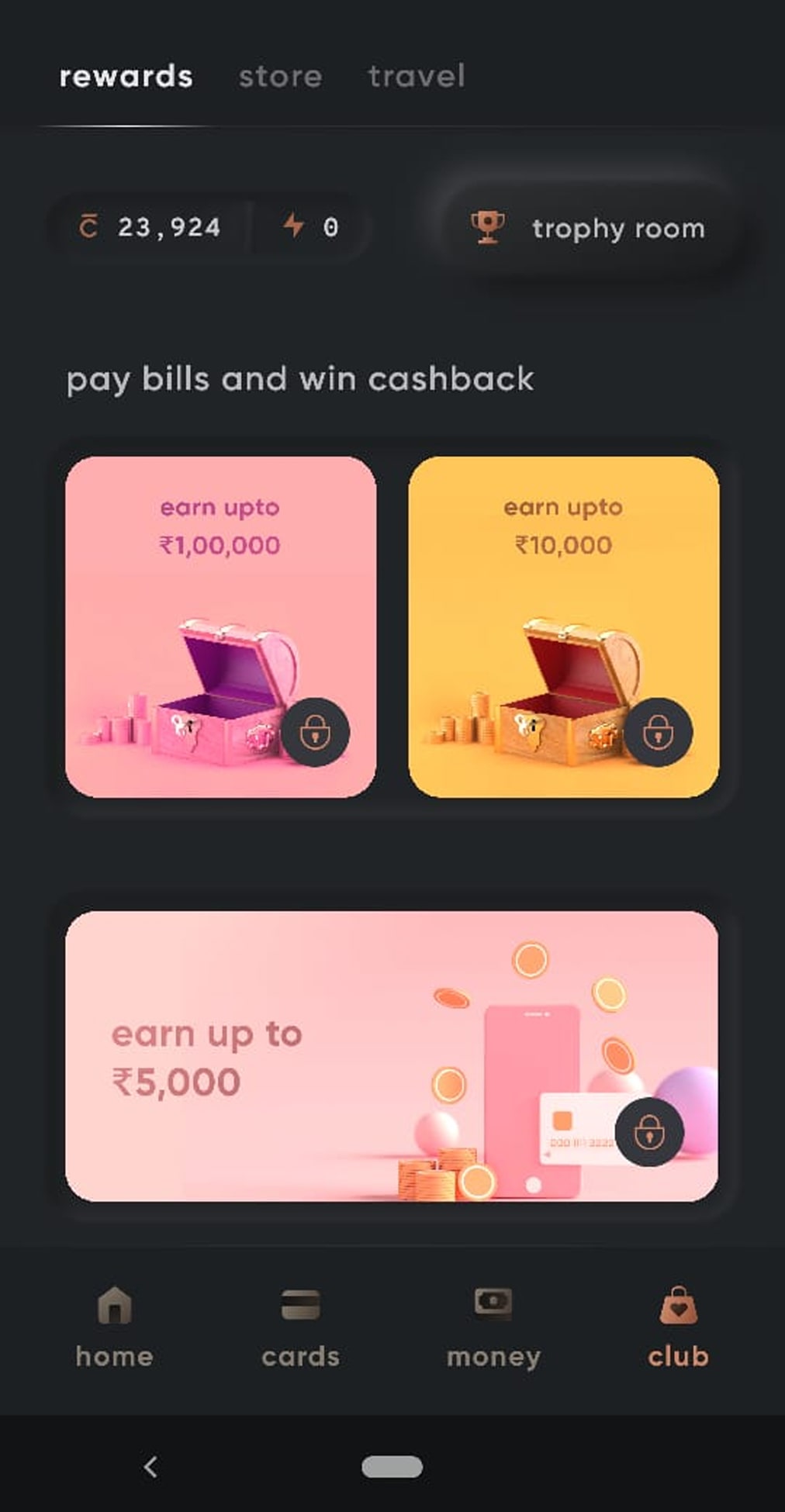

- CRED coin rewards: Payments through the CRED app entail earning CRED coins that help you claim exclusive rewards from a wide variety of brands. CRED coins earn you exciting awards and access to premier products and services.

Know more about CRED coins in the later section of the article.

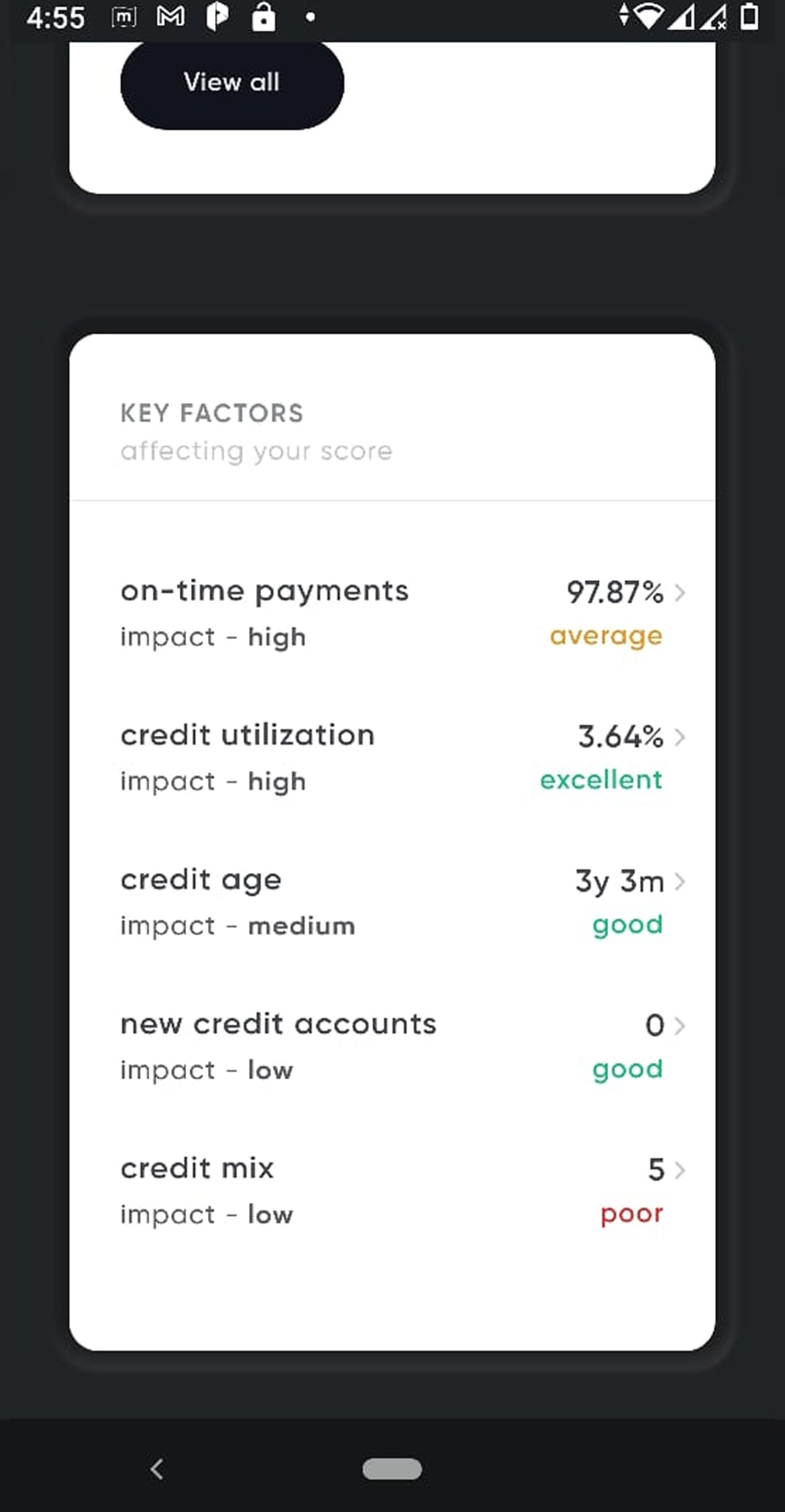

- Credit score and history: The credit card payment records and history are available for checking by the user for free 24/7. The CRED app allows you to view your credit score on Experian or CRIF completely free of cost for the first time.

However, if you want to check your credit score again subsequently, CRED charges a fee.

How to earn cashback from the Cred app?

There are two ways through which you can earn cashback from the CRED app:

Earning from Referrals: Like many other apps, CRED gives you the chance to earn when you invite more people to install and use the app. To earn from referrals, the user should select "Control" on the app. There you have to select the option "Invite your Friends".

You can send the invite link through WhatsApp, Facebook, Instagram, Telegram, etc. Once your friends receive the invite, they have to install the app on their mobiles using the same link.

When your friend makes the first payment on their credit card using CRED, both you and your friend will receive a reward of Rs. 500. The amount will be credited to your card.Cashback on every bill: With every credit card bill payment, CRED offers cashback for its users. These cashback offers keep changing. However, CRED makes sure that its users earn something on each transaction.

On the first payment, CRED offers a minimum cashback of Rs. 200. With subsequent transactions, the cashback amount changes with the size of payments. The offers can be availed from the scratch card you earn after each payment transaction.

This cashback can also be converted to real cash using the "Kill the bill" option, which will directly credit the amount in your credit card. The minimum amount of payment to earn cashback is Rs. 1000.

How to Use CRED Coins?

Cred coins are coins that you can accumulate in your Cred wallet. You earn one CRED coin for every one rupee paid through the CRED app. For example, if you make a credit card payment of Rs. 5,000 using CRED, you will earn 5,000 CRED coins.

However, CRED coins will be earned only when you pay your credit card bills timely.

The steps in earning CRED coins are as follows:

Step 1: Go to the CRED app and click to view all your credit cards.

Step 2: Select the credit card/s on which you want to make payment and select the option "Pay".

Step 3: Enter the amount you are willing to pay and proceed using online banking, UPI, etc.

Step 4: Once the payment is complete and processed, you will win an equivalent amount of

CRED coins. You can check your CRED coin balance at any time under the option "My CRED".

There are several ways through which you can utilise your CRED coins:

You can use CRED coins to avail the various products and services listed under the rewards catalogue on the CRED app. This catalogue gets updated every month. Currently, CRED has listed brands such as One Plus TV, Pepperfry and services like Swiggy, Uber, Yatra, Oyo, etc. Using CRED coins, you can book restaurants, hotels, resorts, etc.

You can also convert your CRED coins into cash using the "Kill the bill" option. The amount will be credited to your credit card. However, this option may not be much profitable as the actual converted value of CRED coins is very less.

For example, the converted value of 1000 CRED coins can be somewhere between Rs. 5-10.

Advantages of Using CRED

CRED has been of immense assistance to many in managing their credit card payments. Advantages can be listed as follows:

CRED helps keep track of credit card payments so that no due date is missed. When a person owns more than one credit card, it may be not easy to keep track of each due date every month without using a third-party app.

Missing deadlines repeatedly will negatively affect credit card scores and may lead to interest rate traps. CRED helps in effectively managing multiple credit cards under a single platform.It helps detect any suspicious activity, hidden cost, abnormal spending pattern, unexpected fees, etc., associated with your credit cards. For example, suppose you usually spend Rs. 40,000 monthly using 4-5 credit cards.

But last month, your total credit card bill went up to Rs. 2,00,000. This will immediately be alerted by the app to check out any payments you did not authorise.

It would be cumbersome to keep track of your spending every month by visiting individual credit card apps without using CRED.Members can earn attractive rewards and cash back with their credit card payments. More cashback can be earned by sending out referrals to people. CRED often offers premium and curated products and services handpicked for its members.

CRED offers an automated payment system to its members to pay rent and educational fees. Using this facility, members can give standing instructions for automated payment of rent and educational EMI every month so that no payment deadlines are missed.

Members can also check their credit scores fast and reliably using the app. CRED app shows credit scores on Experian and CRIF both. One credit score check is free for first-time users.

What Needs to be Improved

Even though CRED has become very popular, there are certain issues on which there is scope for further improvement:

Product catalogue: Even though CRED boasts of an exclusive range of products and services, the catalogue offered has a huge scope for improvement.

The catalogue should be dynamic and include more trending brands. Many online shopping platforms offer a better deal and more collection than CRED.Email access: Another major demerit of the app is that it requires email-access permission for getting credit card statements. This is a major blow to the security and privacy concerns of members.

Market experts have suggested that if CRED can link with banks directly for credit card information, it will not require email access.Trust building: CRED is majorly dependent on how much trust people have in the app. To be more successful in the future, CRED has to go a long way in winning the trust and building relationships with potential customers.

CRED must focus on brand and value building to emerge as one of the most trusted brands in the country.

Safety & Privacy Concerns

There are several major concerns regarding safety and privacy while using the CRED app. Some of them have been highlighted as follows:

- Concerns with email privacy: As CRED requires access to your email to retrieve and update credit card statements, many potential users have raised concerns about allowing access to the app. Our emails may contain any sensitive information.

It is advisable to link such an email ID with credit cards, which may not be used for any other confidential or important purposes.

Another option is to deny access to email, in which case information regarding credit card payment due dates, etc., will not be available, but most of the other features can still be accessed. - Concern with credit card information: Many users may not be comfortable providing their entire credit card details, spending, payment history, etc. The fear of hackers gaining access to a credit card through third party apps is threatening for many.

However, the CRED app is quite safe, and it is almost impossible for hackers to access your credit card with CVV number, expiry date, etc. - Concerns with failed or delayed payments: Users have complained about failed payments or delayed payments while using the CRED app. It is always advisable to avoid waiting for credit card bill payment at the last moment to avoid such situations.

However, regarding refunds on failed payments, it may take some time, but the amount is usually refunded by CRED.

Verdict

There are numerous scary stories on credit card debts, interest traps, the relentless recovery procedure associated with credit cards. Yet it has become essential in today's world, with many opting for more than one credit card.

For such people, the CRED app can be a blessing that will help them in maintaining credit discipline. CRED has been recognised as a unicorn company in India, meaning it is one of India's privately held start-up companies that has managed to surpass $1 billion in valuation.

Within a short time, CRED has managed to gain the trust of users and investors alike.

The best thing about CRED is its cutting-edge design and smooth process flow. CRED gives the additional benefit of lots of cashback and other offers. However, the downside is certain issues with delayed or failed payments that certain users have suffered.

Moreover, the offers on products and services can be extended further to include more exciting avenues for the users. Currently, the offers cover a limited range of brands. This app will not be an ideal choice for those who are not comfortable revealing their financial details to a third-party app.

CRED must improve its servers and processes for seamless and faster payments and extend its range of offerings to attract a more customer base.

I hope you liked our article on What Is Cred, and it must have solved your queries such as is cred safe/is cred app safe, what is cred app, cred review, or is cred good If you have any comments or suggestions do share them in the comments below.

Frequently Asked Question

Q1. Is there a limit on the bill amount I can pay using CRED?

Ans: No, there is no limit on the bill amount you can pay using CRED. However, only in debit cards is there a limit of Rs. 2,000.

Q2. Does CRED charge a fee for card verification/bill payments through the app?

Ans: No, CRED does not charge any fee for card verification/bill payments through the app.

Q3. I have paid my bill through CRED but have not yet got a notification from my bank. Why is this?

Ans: At times, there may be a lag due to protocols. It may take up to 48 hours for a transaction to reflect in your bank account.

Q4. What type of flow is supported on CRED Pay?

Ans: CRED Pay supports two types of flows: collect and intent. Collect flow is the conventional technique where a push notification is sent to the customer's mobile, through which the transaction is processed. In the case of intent flow, the app allows the user to make payment directly on the CRED app on mobile.

Q5. What is the TAT to enable CRED Pay on my account?