Do you want to make some corrections to your PAN card? Well, you must know how to make corrections to some of the important ID cards or financial activities cards. Read on to know more about how to make corrections to UTIITSL/NSDL PAN cards.

UTIITSL is a government-owned organization responsible for providing financial services. Various financial sectors of India are provided with technology by UTIITSL.

Incorporated in 1993, UTIITSL is responsible for offering PAN cards to those who are involved in any financial activity in India.

A PAN (Permanent Account Number) is an official card that keeps track of your financial activity and enables you to make transactions.

On the other hand, NSDL (National Securities Depository Limited) is also responsible for making PAN cards.

It has been working under the Income Tax Department of India since 1996. From applying for a new PAN card to making corrections to an existing PAN card, NSDL offers many services.

UTIITSL PAN correction

A PAN card is required to make a financial transaction of more than INR 50,000 from your bank. Since a PAN card also works as an ID card, it is important to keep your details updated. If there are any mistakes or updates in your details, you can apply for UTIITSL PAN card correction.

Correction form for PAN card by UTIITSL or NSDL

You may require the PAN card correction facility for several reasons. Some of the reasons that may compel you to search for a PAN card correction form are as follows:

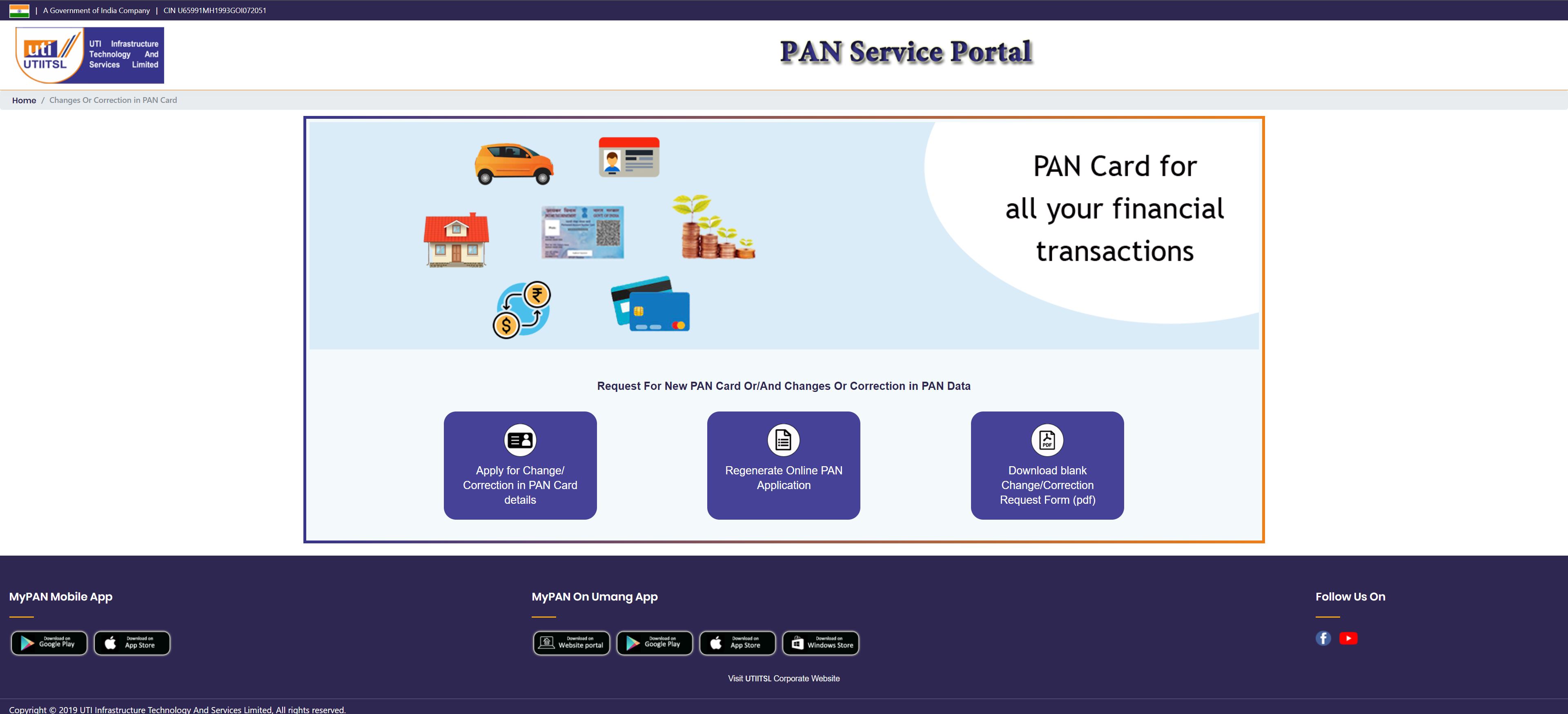

UTIITSL and NSDL offer PAN card correction forms on their official websites that enable users to change their PAN card details. Make sure you use the official website of UTIITSL or NSDL to make corrections to the PAN card.

Many unreliable websites may access your sensitive information in the name of PAN card correction. The official websites of UTIITSL and NSDL are both equally authorized for making PAN card corrections and you can use either of them.

PAN card correction via the UTIITSL and NSDL website

The PAN card correction steps can change for the NSDL and UTIITSL websites. You can choose any one of them as both works under the Indian government and are responsible for PAN card services.

Let us first see the steps for PAN card correction via the UTIITSL website:

The steps for PAN card correction via the NSDL website are as follows:

What are the supporting documents for PAN card corrections?

Supporting documents for PAN card correction can change according to the PAN card details being modified. Some common documents required for PAN card corrections are as follows:

Frequently Asked Questions

1. Which is better, NSDL or UTIITSL?

Both organizations are equally efficient when it comes to PAN card corrections. NSDL and UTIITSL both work under the Indian government and provide PAN card services to Indians and foreigners.

Since the processing duration of NSDL and UTIITSL are the same for PAN card corrections, you can choose either of them. However, NSDL has more branches across the country, so some people choose it for posting the PAN correction form.

2. How can I change my mobile number in PAN card UTIITSL?

You can change your mobile number in the PAN card by the PAN correction form. You just have to visit the official website of UTIITSL and submit your updated details.

Make sure you enter all other details accurately and submit the PAN correction form. You will have to enter the OTP received on your updated mobile number for authentication.

3. Is there a difference between the PAN card rectification form and the PAN card form?

UTIITSL offers a separate CSF form for making corrections to your PAN card (PAN Form CSF (utiitsl.com)).

However, NSDL offers the same form for a PAN card application or for making corrections in an existing PAN card (Request-for-New-PAN-Card-or-and-Changes-or-Correction-in-PAN-Data-Form.pdf (tin-nsdl.com)).

You can use any of the forms for making changes to your registered PAN card. However, the fees for a PAN card application and correction will change.

4. How to apply for a new PAN card online without changing any personal information?

You can apply for a new PAN card online via the official website of NSDL or UTIITSL. You can feed your personal information and apply for a new PAN card. The steps are simple. Make sure that you don’t own a PAN card already.

Any Indian, foreigner, or company cannot hold more than one PAN card. You don’t have to change any of your personal information while applying for a new PAN card. In fact, you have to enter accurate personal details while applying for a new PAN card.