Want to know sbi simply click card review? Well you have landed on the right article -

There are 67.6 million credit cards in use as per the data collected till November 2021. SBI is India's second-largest credit card issuer, with 13 million cards in use.

The State Bank of India (SBI) is the largest nationalized bank in India and among the first to start lending to consumers via credit cards. It has various kinds of credit cards to suit the lifestyles of customers. The SBI SimplyCLICK Credit Card is one of its best seller products.

The first thing which meets the eyes when we look at any product is its visual appeal. Unlike most credit cards that are black, the SBI SimplyCLICK Credit Card has a bottle green background. In addition, with a symmetrical print, it looks quite elegant.

As the name suggests, this card is specifically designed for people who love to shop online. Before applying for this card, you must know that this is not a free credit card. It offers many benefits; however, you need to shop online using the card to reap those benefits constantly.

The card is also highly beneficial for those who are always on the go. It is accepted across multiple countries in many outlets and allows you to withdraw cash from ATMs abroad.

Depending on your choice, you can either apply for Visa Platinum or MasterCard Titanium SBI SimplyCLICK Credit Card.

SBI Simply Click Card Review

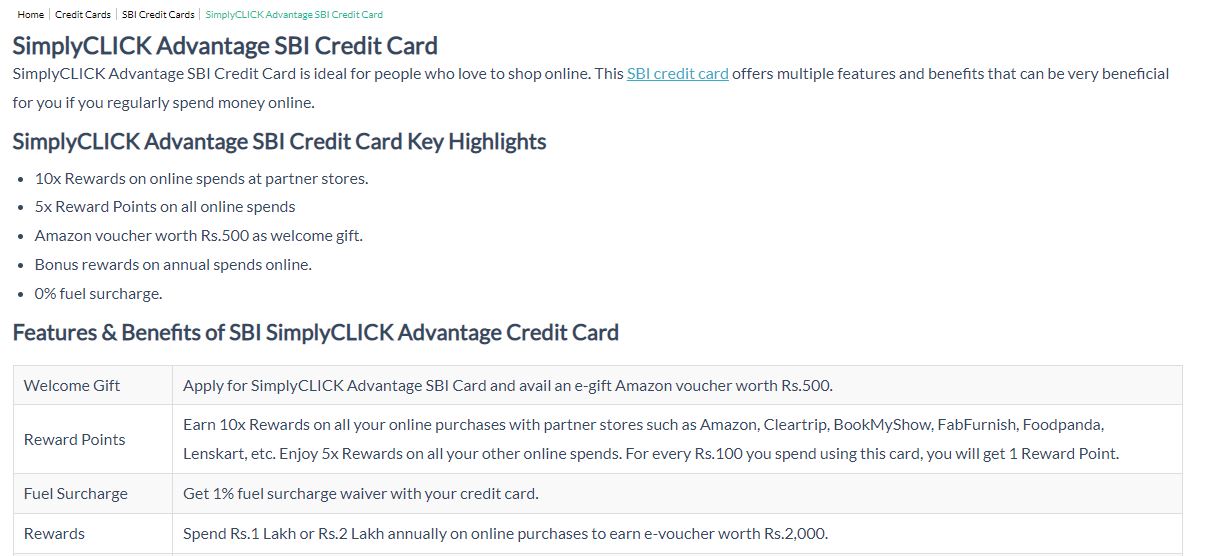

Key Highlights Of SBI SimplyCLICK Credit Card

The following are the key highlights of the SBI SimplyCLICK Credit Card:-

- You can earn 10x Rewards on online spending at partner stores such as Amazon, BookMyShow, Cleartrip, FabFurnish, Ola, Zoomcar, Lenskart, Netmeds, etc.

Hence, it makes sense to do a good amount of online shopping from the online partner portals or offline brick-and-mortar stores. For every INR 100 you spend using the SBI SimplyCLICK Credit Card; you get 1 Reward Point.

So, you will earn rewards at a 2.50% rate which is better than most other cards available in the market. - You can earn 5x Reward Points on all online spending. This card is beneficial for shopping from the online partner portals and offline retail stores, but it also gives points on every transaction five times more than any regular card.

- SBI offers an Amazon voucher worth INR 500 as a welcome gift. So this covers your joining fees of INR 499.

As mentioned earlier, the SBI SimplyCLICK Credit Card is beneficial for users who do a lot of online shopping. The bank awards bonus rewards on annual spending online. - This card offers a 1% fuel surcharge waiver on transactions between INR 500 and INR 3,000. The maximum waiver, though, is capped at INR 100. It will help you save some money during these high inflation times of petrol and diesel prices.

Features And Benefits Of SBI SimplyCLICK Credit Card

The following are the features and benefits of the SBI SimplyCLICK Credit Card:-

- You can apply for the SimplyCLICK SBI add-on cards and give them to your family members like parents, spouse, children, or siblings above 18. They will not have to depend on you for online and offline shopping.

- You can use your SimplyCLICK SBI Credit Card in over 24 million outlets worldwide, including 3,25,000 outlets in India.

- The card's contactless feature will allow you to wave your card on the go and make purchases. This feature is especially helpful when buying metro and other local train tickets.

It is also perfect for buying movie tickets, fast food, drive-in restaurants, petrol pumps, etc. Even if the card is waved multiple times, the unique security key feature of Visa payWave will ensure that only one transaction goes through.

That way, your card will not leave your hand, and the chances of anyone duplicating it and counterfeiting it later are reduced. During the pandemic.

This feature was highly useful as you need not punch in the PIN on the POS machine, which has been touched by other customers and employees of the seller. - INR 5000 is the maximum amount permitted to be used through contactless mode. You cannot set individual limits, and INR 5000 is fixed for this feature. However, if the card is lost or stolen, the fraudster can use it for up to INR 5000 even though they would not know the PIN.

- There is no way to make a purchase unknowingly if you walk past a contactless card reader holding your credit card in your hand or your purse. Your card has to be waved within 4 centimetres of the card reader for more than half a second.

And the retailer has to enter the amount of the transaction. Terminals can only process one payment transaction at a time, and hence you can use the contactless feature without any worries. - You can avail of INR 100 instant cashback on your first movie ticket booking on the BookMyShow Mobile App. This benefit is meant only for first-time BookMyShow users.

- If all the cards collectively linked to your account (including the add-on cards) spend INR 1 lakh annually on online purchases, you will earn an e-voucher worth INR 2,000.

This is known as the milestone benefit. If you use your SBI SimplyCLICK Credit Card for INR 2 lakhs, you will get an e-voucher of a larger amount. - SBI will waive your yearly fees of INR 499 if you spend INR 1 lakh on your SBI SimplyCLICK Credit Card in one year.

- You can use this SBI SimplyCLICK credit card to withdraw cash easily. It can be used at more than a million Visa/MasterCard ATMs.

- If you accumulate the reward points, you can redeem them to get more vouchers from Amazon, Cleartrip, or other partners of SBI. You will realize that the more shopping you do use this card, the more you save through the reward points.

- The income eligibility for this card is extremely relaxed. It is INR 20,000 per month for salaried professionals, and for self-employed individuals, it is INR 30,000 per month.

This criterion makes this credit card so popular, as most of the other credit cards offering these kinds of benefits have more stringent eligibility criteria. - Flexipay: You can convert purchases of over INR 2,500 into EMIs, and it will take off the burden for you to pay the entire amount in one shot or pay higher interest rates when you just pay the minimum amount due.

However, jewellery, gold bullions, and other exceptions apply as per RBI guidelines. You cannot convert them into EMIs. - You can put standing instructions for utility bill payments, making your life hassle-free.

- You can avail of the balance transfer facility from other banks. It will help you pay the balance of other credit cards in EMIs, and the interest rate is also lower.

- You will receive extra rewards if you spend INR 2 lakhs or more on your credit card in a year.

- People who are not eligible for premium SBI cards, like ELITE and PRIME, should opt for this card. The rate of approval of this card is very high. Unless you have a poor credit history, it is highly unlikely that your application will be rejected.

- Easy Money: Using this facility, SimplyCLICK SBI Credit Cardholders can get a cheque or draft against their cash limit delivered to their addresses. This facility is very useful during emergencies.

Joining Fees And Other Charges Of SBI SimplyCLICK Credit Card

As mentioned earlier, the SBI SimplyCLICK Credit Card is not free of charge.

- Annual Fee: INR 499+ Taxes

- Welcome Gift: INR 500 Amazon Voucher

- Renewal fees: INR 499+ Taxes (waived off on INR 1 Lakh spend)

- Add-on Fee (per annum): Nil

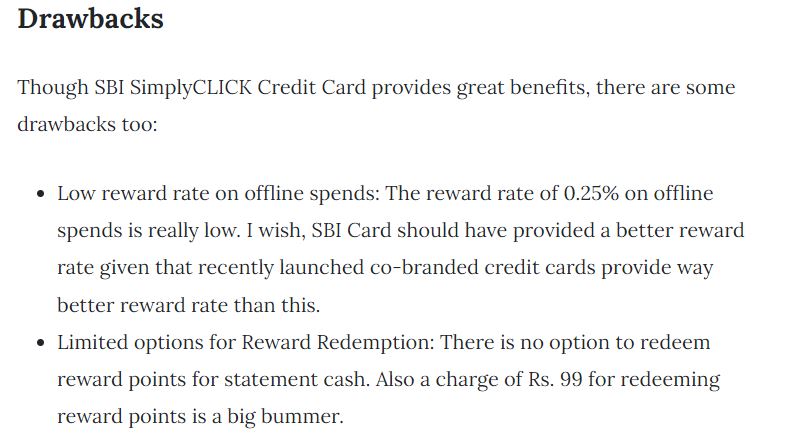

Drawbacks Of SBI SimplyCLICK Credit Card

Before you decide to click on the link to key in all your details and apply for the SBI SimplyCLICK Credit Card, you should know about its drawbacks too:-

- There is a joining fee and an annual fee for this card, as discussed earlier. Hence, if you do not shop much (online or offline), this card might not be for you. Even though you are compensated with the reward points.

If you use your credit card sparingly, you might feel that paying an annual fee is a waste of money. If you do not do online shopping for at least INR 1 lakh in a year, which is quite a large sum, you will have to pay the annual fees. - The contactless facility is fixed at INR 5000, a large sum. If someone wants to reduce it to INR 1000 or INR 2000, they cannot do it. This is an inconvenience and, therefore, many people hesitate to activate their contactless facility with SBI SimplyCLICK Credit Card.

- There are no special benefits available for travel, dining, or entertainment. So, if you eat out or travel frequently, you might be disappointed, as there are no special benefits for you. You might select other cards specifically designed for diners and travellers.

- Some users have complained that the options for reward redemption are limited.

Final Words

The SBI SimplyCLICK Card is one of the most popular credit cards in the market. Since SBI started the credit card business long back, and by 2002, they already had 1 million credit card subscribers, people trust them as their reliable financial partner.

SBI is one such name that even the older generation reckons with, and the elders in the family do not object if the youngsters go for SBI credit cards.

Credit cards have become a way of life in Indian families. It is necessary for large transactions and for paying huge hospital bills.

ICICI Amazon Pay Credit Card, HSBC Cashback Credit Card, HDFC MoneyBack Credit Card, RBL Monthly Treats Credit Card, Axis Bank Buzz Credit Card, HSBC Smart Value Credit Card, etc., are the other credit cards in competition with SBI SimplyCLICK.

Like the ICICI Amazon Pay Credit Card, some of them do not even have a joining fee or annual fees. And it gives good cashback options for shopping on Amazon and even other merchants.

I hope you liked our article on sbi simply click card review, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

1. How to get more details about SBI SimplyCLICK Credit Card?

Apart from going online and checking the information, you may post some specific questions on Quora. Normally, people who have used the product respond to it, and they provide more accurate answers from their personal experiences. Check the official SBI site for more details.

2. Is it possible to track the application status of my SBI credit card online?

Follow these steps to track the application status of your SBI credit card online:-

- Visit the SBI official website by clicking on

https://www.onlinesbi.com/.

- Now, click on the SBI Card under "Track your application", select "Check the status of your application", and enter your Application/Reference Number.

- Once you click on the "track", it will show the stage your application is in.

- If the officials check your credit history, earnings history, etc., it will show "In process", and if it is "approved", in the stage of card printing, the details will be mentioned there. If it is "rejected", that too will be mentioned.

The reason for rejection will not be mentioned; however, it is primarily due to a poor CIBIL score or discrepancy in the employment/self-employment status.

3. How to pay credit card bills?

You can pay your credit card bills via various means; some of them are mentioned as follows:-

- You may pay using the net banking facility of any other bank. It takes about two days to transfer the money from your bank account to any other bank.

- If you have an SBI savings account, you can set up auto-debit on your due date for the full amount due/minimum amount due to be debited from your savings account.

- You can send a cheque to the address mentioned on their website or look for an SBI cheque drop box nearby and drop the cheque there. Most of the SBI bank branches have a cheque dropbox for making payments for your SBI credit cards.

Ensure that you do not forget to mention your SBI credit card number at the back of the cheque.

4. How do I locate the nearest SBI Cheque DropBox?

You can drop your payment cheques to pay your SBI Card outstanding at any manual cheque drop-box location. Click on the link mentioned on this website in the first question, and it will open a PDF file. Then, you can search for the cheque on dropbox, which is most convenient for you.