Want to know all about ICICI Direct Review? Then, you have landed on the right article!

ICICI Securities is part of the ICICI Group, India's leading banking agency. The ICICI group provides a range of financial services to its customers and has been in operation for 65 years.

It has established a prevalence in the market. ICICI Direct is one of the group’s popular investment services that many Indians are taking advantage of.

ICICI Direct is among India's top retail stock traders. It has approximately 50 lakh users globally. ICICI Securities creates a forum for investing in the stock exchange markets. It also involves the other cash equals.

ICICI Securities ensures timely pay-in and pay-out settlements. Hence, it has become a preferred stockbroker. It also aids other specialized services to ensure smooth operation.

Some of its special services include IPO, successive public rights, and convertible offerings. These are among the other equity capital market instruments.

It also provides amazing facilities to both unlisted and listed firms. A few of them are eligible foreign corporate investments and non-convertible debt securities. They also include buybacks, delisting, and open and worldwide offerings.

ICICI Direct Review: Know Everything (2022 Updated)

ICICI Direct Brokerage Plans and Charges

There are plenty of brokerage plans and icici demat account charges offered by ICICI Direct. These plans are flexible and helpful for all classes in society.

Being a retail stockbroker, ICICI Direct provides online investments and trading services. These include:

- Trading currency at MCX, NSE, and BSE.

- Equity and commodity trading

- Fixed deposits

- Mutual funds

- IPOs

- NCD

- Bonds

- Loan against some security

- Home loans

The 3-in-1 account service for trading is one of the most famous plans of ICICI Direct. It comprises an ICICI Bank account, a Demat account, and an ICICI Trading account.

It is ICICI Direct's most profitable venture. Furthermore, it effectively improves productivity and keeps your finances tracked and organized.

Some other plans include

ICICI Neo Plan:

The ICICI Neo Plan is a brokerage plan with a fixed price. It allows you to trade stock futures. It is done without having to pay a commission. There is a charge for stock intraday and derivatives trade.

It costs a flat payment of Rs 20 per every processed transaction. For equity delivery, it is 0.55 %.

This plan includes investment suggestions and analysis—a 30-minute payment when raising capital and low-profit margins credit. ICICI Direct offers a diverse array of items and services.

It includes One-Click Equities and Margin Trading Funding (MTF). Also, Smart Trading tools and the flexibility of buying stock are involved. All these functions through the Systematic Equity Plan, among many others.

ICICI Direct Prime Plan:

The ICICI Direct Prime plan is meant to cut brokerage fees. It helps in raising capital. It also ensures that funds are received immediately in their account balance.

Members of this plan also have access to special research. Clients can choose from four core plans. The first plan is Rs 299 followed by Rs 1,999. The third plan is for Rs 2,999.

Each of these plans gives an upfront brokerage discount. The discounts are throughout all stock and alternative markets. All plans are available for the entire year.

I-Secure Plan (Flat brokerage Plan):

In ICICI's I-Secure Plan, you can benefit from flat brokerage charges (in %) regardless of your cash flow. Trades/investors who want to be guaranteed and fixed brokerage can benefit from this plan.

The I-Secure Plan from ICICI Bank is helpful. It is meant for regular traders. It offers Flat Brokerage in percentage regardless of profit margin worth.

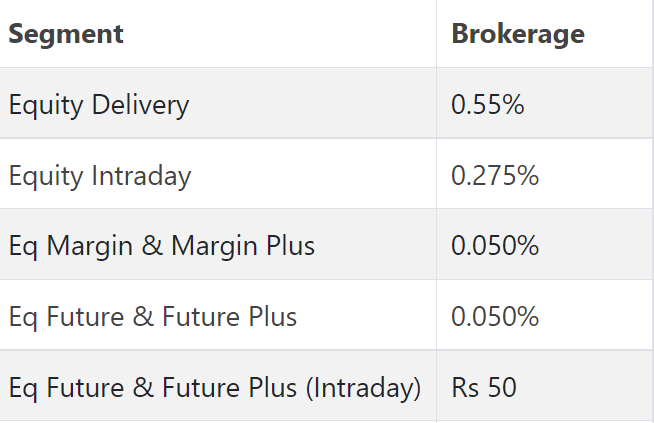

Here are some of the brokerage charges:

Let’s take the Futures Market for example. For trading in this market, ICICIdirect has three products: 'Future,' 'Future Plus,' and 'Future Plus Stop Loss.'

Futures is a product developed for traders who want to purchase or sell futures contracts for a specific number of days or until the contract expires.

FuturePLUS is a solution designed for intraday traders who want to purchase and sell future contracts on a daily basis.

You must place a Stop Loss order in your intraday Futures trade when using Future Plus Stop Loss.

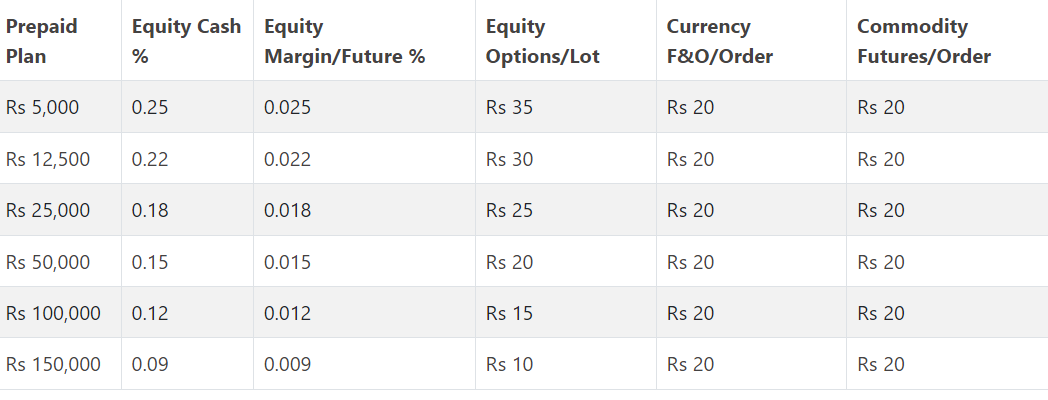

ICICI Direct Prepaid Brokerage Plan: This plan has been designed for a specific purpose which is to save you money on brokerage fees and transaction costs. The brokerage savings are 18 to 84 percent. The Lifetime Prepaid Brokerage Plan gives you the option of choosing from six distinct services. These are:

It is a fantastic alternative to paying brokerage fees in installments. In this plan, you pay a one-time brokerage fee that is good for 15 years.

You have 15 years to use the money, and you have the option of getting the money back if you don't use it.

In general practice, one pays a brokerage fee after every transaction, which can be problematic for some people.

ICICI Direct Customer Ratings and Review

Experience | 8.8/10 |

Product and services | 8.4/10 |

Brokerage charges | 7.9/10 |

Trading platform | 8.5/10 |

Research | 8.6/10 |

Overall ratings | 8.5/10 |

Star ratings | ★★★★☆ |

Customer reviews | 4000 |

ICICI Direct Brokerage Charges

ICICI Direct.com is among India's leading financial gateways. It offers a 3-in-1 account for retail stock market investors in India. It includes an ICICI Bank Account, an ICICI Demat Account, and an ICICI Trading Account.

It's a simple and effective approach to trade in a wide range of monetary assets. Users can get in-person support on investment instruments.

Reach out to any ICICI Bank branch or ICICI Direct office. Here is the detailed information on ICICI Direct brokerage rates.

Equity Delivery | 0.55% |

Equity Intraday | Rs. 20 / order |

Equity Futures | No cost, free |

Equity Options | Rs. 20 / order |

Commodity | Rs. 20 / order |

Currency Futures | Rs. 20 / order |

Currency Options | Rs. 20 / order |

Minimum Brokerage | Rs. 20 / trade |

Margin Money | 75% Margin |

Trading AMC Charges | Zero |

Demat AMC Charges | Rs 300 / annum from the second year |

The ICICI Direct Prime Brokerage Plan offers a number of benefits. It helps customers save money on service fees. It provides an eATM and an equity ATM.

For instance, you get limits ranging from Rs 2 lakhs to Rs 1 crore. ICICI Premium Brokerage Plan also provides exceptional MTF rates for interest per LPC. It ranges from 0.04 percent to 0.024 percent every day.

The ICICI Direct Prepaid Brokerage Plan offers lower trading costs and better service charges. The Direct Prepaid Plan does not include an eATM.

It is not like the Prime Brokerage Plan. But it provides six different plans ranging from Rs 5,000 to Rs 1,50,000. It offers a fixed charge of Rs 20 for each order under the 6 sub-plans.

How To Open Demat Account In ICICI Direct

ICICI Direct is a great choice for you as a beginner. It is the most reputable replete stock-broker company in the country. It has been in operation for over two decades now.

All you need to do now is register for three accounts with ICICI Direct. It helps to execute digital trading activities.

To open a Demat account in ICICI Direct, follow the steps mentioned below:

- Hit the green icon that says 'Open Demat Account' under the column.

- You will get a new page on the display of your screen.

- Read it attentively as the form appears. Go through it word by word.

- After that, make sure that you fill in all the needed details.

- Thereby, you will be required to upload a few documents. It is to complete the KYC verification process.

- You will need an Aadhaar number and a PAN card in this process. It is to validate your identity and address proof. Also, a photo to validate your facial identity.

- Complete all the required stages and check the details twice.

- Now, ICICI Direct will contact you on your behalf. They will handle the final few confirmation checks.

- You must have carefully done all of the processes listed above. Hopefully, the username and password are in your email.

- Enjoy complete and hassle-free access to your new account. The service is rapid and smooth.

Pros And Cons of ICICI Direct

Here is a list of pros and cons for your reference.

Pros

- Your banking, brokerage, and Demat accounts are no more separate. They are all linked together in a tri-account. So, you don’t require any human intervention. This is perfect in an e-trading arena.

- E-trading is available for BSE and NSE-listed firms.

- You can manage your own Demat and bank accounts through ICICIdirect.com

- Low bandwidth websites are accessible. It is for those with a sluggish broadband connection. Clients trading from their mobile devices also gets the benefit.

Cons

- It is an expensive service.

- The minimum trading charge is Rs. 35 approximately. It is quite expensive for beginners.

- Commodity trading is not available through ICICI Direct.

- It charges a fixed fee of 0.05 per share on equity prices. It counts up to ten rupees. It tends to make cheap stock trading extremely difficult.

- Only the first twenty unlimited calls in a month are free. There is a charge of Rs 25 per call for a talk and deal after that.

ICICI Direct Trading Platforms

ICICI Direct allows its traders to cherish and get the most out of the power of automation. The trade of stocks is now made with unparalleled convenience. Let's start by looking at some of ICICI Direct's most popular trading platforms.

ICICI Direct Trade Racer: Trade Racer is a trading app based on terminals. It must be installed on a system as a file format. The app is created to help users with a solution for a complete stock exchange.

Features:

- All current scripts are on a unified page or dashboard for a quick view.

- Clients can work better with equities heading up or down using the live scanning tool.

- Without needing to spend time and energy observing any info, this app's ‘Heatmap’ feature helps find stocks going up or down the price chart.

- Color patterns and trade graphs can be tailored.

ICICI Direct Trade Racer Web: It's essentially a web-based version of Trade Racer. You can access this platform for trading using any website. There is no more requirement to set up any software for this purpose.

Features:

- Estimates happen on demand. That too, in real-time.

- You can drag and drop any widgets.

- You can have a maximum of five watch lists.

- You can take advantage of notifications and reminders.

- Watch lists with live broadcasting quotes available.

ICICI Direct Mobile app: The name conveys it all. This trading application is made so that it helps clients wisely trade and invest in stocks even if they are not knowledgeable about the field enough.

It is a quick and easy process to get daily info on the stock market.

Features:

- The most recent prices, scroll fragments, and money flow can all be checked.

- Market fluctuations and equity analysis can be seen.

- Availability of stock updates and live research sessions

Products And Services Offered By ICICI Direct

ICICI Direct has plenty of products and services available for you. These products are distinct and helpful for you. Take a look at the variety of financial and commercial options available for you.

- Equity

- Derivative trading

- Mutual funds

- IPO

- Fixed deposits

- Bonds

- Non-convertible debentures (NCDs)

- Currency trading

- ETFs

- Insurance

- ICICI PMS

- Loans

- eLocker

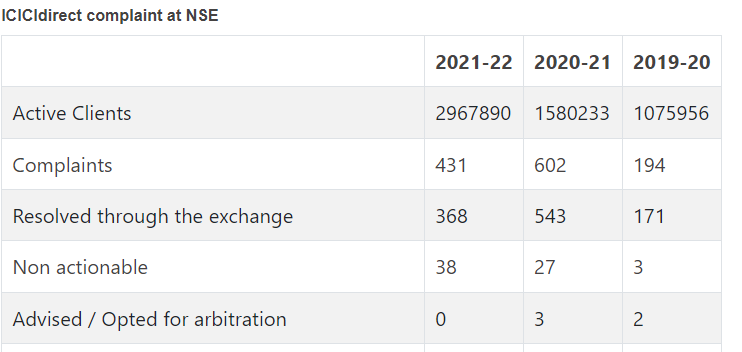

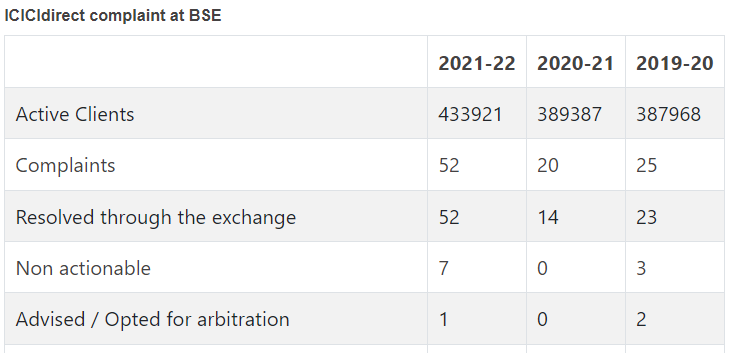

ICICI Direct Complaints

These are significant concerns about ICICI Direct broker that neither the broker nor the customer was able to resolve. For these, the consumer contacted the stock exchanges and filed legal complaints.

ICICI Direct takes these complaints seriously and works to fix them. They do that with the help of a complaints report.

The number of complaints received by the stock exchanges from ICICI Direct customers is detailed in the ICICI Direct brokerage complaints report. This report examines data from the BSE and NSE's ICICI Direct online complaint system.

Here’s some data for you to understand in this report.

The ICICI Group has a risk analytics team that actively assumes these risks. They make required plans to save the firm from unnecessary legal issues.

ICICI Direct Customer Care

Need assistance with an ICICI Direct issue? Visit your nearest ICICI Direct branch, and you can opt for any customer service.

Here is a list of customer services available at ICICI Direct:

Expert agents for specific departments: You can seek guidance to be a part of ICICI Direct. Visit your nearest branch. You will get expert advice from their SME or other dedicated staff. It will further help you in the precise understanding of the process.

Homely behavior of the staff: Personnel at the ICICI group are very well-behaved. Most of the high service ratings are in the context of their hospitality.

Online trading: The brand understands your hectic schedule and so has made safe and secure online trading accessible for all.

You no longer need to contact stock exchanges and waste your precious time. All you need is an account of ICICI Direct registered on the website.

Net/Mobile banking facilities: Download the ICICI Direct mobile app to enjoy the perks. You can trade, see current quotes, track your portfolio and market movements, get live research calls, and much more with the iDirect trader app.

You can literally have the stock market and world of investment at your fingertips with this iDirect app.

Guidance for beginners: This feature makes ICICI services distinct from others. Even if you have zero knowledge of stock markets, the expert team will guide you in the process.

Email facility: You can connect to customer service by sending an email. The details are mentioned on the official website of the company.

Offices in wider areas: ICICI Direct has 226 branches in India. It is located in every vital corner of the country for your convenience. The services and facilities are the same for all branches.

Conclusion

The ICICI Direct is a retail stock trader that has many plans for you to benefit from. From old-school bonds to investing in mutual funds and stock exchanges – you can utilize it and manage your finances better.

The best part is that you can start investing right away. ICICI Direct can be handled through a fast and easy Demat account, and you can choose from several beneficial plans.

For instance, there is the ICICI Neo Plan. Then ICICI Direct Prime plan, I-Secure Plan (Flat brokerage Plan), and Direct Prepaid Brokerage Plan help cut your brokerage fees.

Now, you may have concerns. Fortunately for you, their customer service is top-notch, with email support and more than 200 branches for offline trading.

Have any questions? Check out some frequently asked questions or contact customer care.

I hope you liked our article on how to check jio number, and it must have solved your queries such as how to do www.icicidirect.com online trading login, what are icici direct intraday charges, what is icici direct account, icici direct reviews or what is brokerage from icici direct

if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

1. Is ICICI Direct safe for trading?

Yes, ICICI Direct is safe for trading. Their huge customer base and lack of major violations reported to date attest to this.

Additionally, it is a subsidiary of the ICICI Bank, an established bank in India, and the ICICI Securities, a company listed on the National Stock Exchange of India Limited.

You can check the feedback on the services from various available forums. This brand has been a part of many global awards and recognition for its robust services.

2. Can I invest in an IPO via ICICI Direct?

ICICI Direct allows you to apply for initial public offerings (IPOs). You can apply for an IPO online easily through your trade wallet. Go to ICICIDirect.com or download the ICICI Direct-based mobile app.

3. Does ICICI Direct provide research?

Yes, it does. In comparison with its fundamental research, ICICI Direct's research on short-term investments is average. Yet, it is good enough for anyone with basic knowledge of trading.

If your investments are hefty, you should conduct a high-level analysis at your end on the basis of these reports before deciding to invest in the share mDemat.

4. Is ICICI Direct good for beginners?

It is an amazing forum for beginners. It helps you seek assistance and provides a smooth investing environment. You can also experience the offline service from the nearest local branch.

The special customer care team is always available in every branch. Services like the three-in-one account for easy investments make trading much more efficient and easy. That too, even if you have zero knowledge of the stock market.