Want to know how to use paytm? Well you have landed on the right article

Demonetization was one of the most crucial steps taken by Prime Minister Narendra Modi that changed the landscape of Indian digital payments and mobile wallets.

When the government banned Rs. 500 and Rs.1000 notes in 2016, many people were clueless about making payments in the absence of physical cash. Paytm, India’s most popular mobile wallet startup, saw this as a golden opportunity to solve the problem of making payments without cash.

Paytm stands for “Pay through mobile.” During the times of demonetization, digital wallets like Paytm pioneered to serve millions of people with their daily transaction needs without the need for physical currency.

Within a year, Paytm gained over 150 million users and became one of the biggest platforms for digital payments. But, if you are unfamiliar with how Paytm works, this paytm user guide will tell you everything you need to know about Paytm.

How to Use Paytm (2022 Updated)

How Can I Use Paytm

The first question arise before you use paytm is "how to create paytm account" well to use your Paytm wallet, you need to create a Paytm account with the help of your email ID and mobile number. You can also change the Paytm app’s default language from English to Hindi.

Ways to Use Paytm

You can use Paytm to transfer money and make payments by:

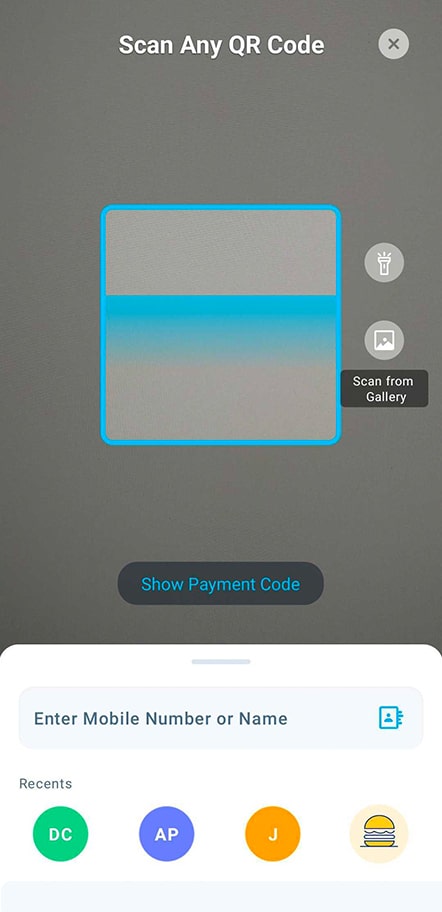

- Scanning QR code: To use this payment method, you have to just open the Paytm app and choose the option of scanning the QR code. Once you scan the QR code of the vendor, you can enter the amount and proceed with the payment.

- Paying by using a mobile number: You can simply pay money by entering a mobile number. Open your Paytm app and select the option of mobile number. Enter the mobile number and enter the amount. It is an easy way to simply send money to anyone with their ten-digit mobile number.

Use of Paytm App

Paytm has been a life-saver when it comes to making online payments and even transferring money. While Paytm is primarily used for online payments, there are many more ways in which you can use this mobile wallet, such as:

- Mobile bills: You pay postpaid mobile bills and prepaid mobile recharge by using the Paytm app. You can select from the list of network operators and suitable recharge plans.

- Household bills: With Paytm, you can also make bill payments for DTH, electricity, gas cylinder, broadband, water, and landline bills. Paytm also sets a reminder for monthly payments to save you from missing the next payment due.

- Loans and credit score: You can use Paytm to check your credit score and even avail instant loans by using Paytm postpaid.

- Travel bookings: Paytm is used for making travel and hotel bookings. From domestic travel to within the city commute, you can use Paytm to book tickets for your flights, train, bus, metro. You can also book international flight tickets on Paytm.

- Events: You can book tickets for events and movies within your cities.

- Investment: Paytm offers an investment option under which you can easily invest money in mutual funds and Paytm stocks. You can also make fixed deposits (FDs) using the Paytm app.

- Digital gold: You can buy digital gold with the Paytm app. With real-time pricing, you can buy gold with great flexibility. You can purchase gold even worth Rs.1. If you wish, you can turn this digital gold into a physical asset and get doorstep delivery.

- Insurance: You can purchase an insurance policy with the help of Paytm.

- Paytm Mall: Paytm Mall is a unique marketplace where you can shop for many products such as fashion accessories, lifestyle products, household products, and electronic gadgets at discounted rates.

- School fees: Paytm has tied up with some schools to make school fee collection easy. You can pay school fees by using Paytm.

- e-Challans: Paytm started with an e-Challan facility, with which you can track your Challans and make online e-Challan payments.

- Gaming: Paytm offers gaming options for gaming enthusiasts. You can play Paytm First games and win rewards that can be used as a wallet balance.

- Donations: You can use Paytm to make donations. Many reputed NGOs are listed on Paytm. You can choose any of them to donate to a good cause.

- Rentals: With Paytm, you can pay your apartment rent, society maintenance, shop rent, furniture rent, and much more.

- In-store payments: While shopping in a retail store or dining in a restaurant or cafe, you can make payment by scanning a QR code with the in-store payment facility provided by Paytm.

Easy Steps to Create Your Paytm Account

Creating a Paytm account is easy. Just follow these easy steps and start using Paytm.

Step 1: Download the Paytm app from your Play Store or App Store. You can also use Paytm’s website to sign up.

Step 2: Set up your Paytm account with the help of your email ID and mobile number.

Step 3: Use net banking or debit/credit card to add money into your Paytm wallet.

Step 4: Start using your wallet money for online payments or transactions.

Step 5: You can either send money by scanning a barcode or directly using a mobile number.Steps to Use Paytm in Hindi

You can modify the language settings in the Paytm app to use it in a different language. Go to your profile settings and click on the ‘Change Language’ option. Select Hindi or the language of your choice.

What Is a Paytm Wallet?

A Paytm wallet is a digital wallet that you can use to make payments. You can add money from your bank account to your Paytm wallet and even withdraw money from your Paytm wallet as you need. It is a digital payment platform used for making online payments.

The digital wallet is seamlessly connected with your bank account, and you can add money using numerous methods such as debit or credit card, net banking, etc.

How to Use Paytm Wallet/How To Activate Paytm Wallet?

Once you download the app and create a Paytm account, your account will be verified with a one-time password, also known as OTP. To make Paytm a safe and secure platform, every time you make a payment, you will be asked to enter an OTP.

Enter the correct OTP received on your mobile to complete your transaction. You can save your credit or debit card details for faster money transfer.

Being an RBI governed digital wallet, it is mandatory to complete the KYC to use all the services of the Paytm wallet. You can complete your KYC with the help of an Aadhar card, passport, or voter ID card.

How Paytm Works for Offline Payments?

Do you know that you can use Paytm wallet for making offline payments? That's right.

Even if your phone does not have an internet connection, you can seamlessly make payments using the Paytm wallet. Use the QR code to make payments that align with OTP verification.

To make a payment using Paytm, all you have to do is to open the Paytm app and choose the ‘Send or Pay’ option. Then scan a QR code or barcode and authenticate the transaction with the help of a One-time Password (OTP).

This option is useful to complete a transaction even when you have low or no internet connectivity.

Is Paytm Wallet Safe?

Yes. It is natural to have security concerns when it comes to online payments.

Paytm is a 100% safe platform that enables you to make online payments instantly.

Every payment is carried out using 128-bit encryption with SSL security. It is done using a secret key that does not disclose the password or even its length.

On top of that, Paytm is an RBI-approved digital wallet, which makes it even safer to use. Millions of people trust Paytm and that makes it the largest and first online payment wallet. For additional safety reasons, Paytm does not store your card’s CVV details.

Step-by-step Guide to Using the Paytm App

Step 1: To use the Paytm app, first download Paytm from the App Store or Play Store and set up your account. Sign up with the help of your email ID.

Step 2: After successful registration and verification process, you can start using your Paytm wallet for sending or receiving money.

Step 3: To add money to your Paytm wallet, go to the home screen of the app. Click on ‘Add money' to proceed further.

Step 4: You can use any of the payment methods such as internet banking, credit or debit card, and UPI to transfer funds from your bank account to your Paytm mobile wallet.

Step 5: Once you select the desired payment method and enter necessary details such as card number, CVV, etc., choose the ‘Pay Now’ option to complete the transaction.

Step 6: Now, you can use money in your Paytm wallet to make online payments.

You can also save your card details for faster transactions next time.

You can also accept money by following these simple steps:

Step 1: Open the Paytm app on your mobile and choose the ‘Passbook’ option on your app’s home screen.

Step 2: To transfer money from your wallet to your bank account, select ‘Send Money To Bank.’

Step 3: Click on ‘Transfer’ to proceed with the ongoing transaction.

Step 4: Enter bank details and the amount you wish to transfer to your bank account.

Step 5: Choose the ‘Send’ option to complete the transfer of money from your wallet to the bank.

You can make payment using the Paytm app in 2 ways. Here are easy steps to make payment using the Paytm app:

Using Mobile Number:

Step 1: Open the Paytm app on your mobile.

Step 2: Select the ‘Pay or Send’ option on your app’s home screen.

Step 3: Choose the ‘Mobile Number’ option and select the mobile number you wish to make payment to.

Step 4: Enter the amount you wish to send and select the ‘Send Money’ option to complete the transaction. You will get a message after a successful transfer of the money.

Using QR Code:

Step 1: To send or pay using a QR code, open the Paytm app on your mobile screen.

Step 2: Go to the app’s home screen and select the ‘Pay or Send’ option.

Step 3: Scan the desired QR code to which you wish to send money.

Step 4: Enter the amount you wish to pay and select the ‘Pay’ option to complete the transaction.

You can check the balance and the transaction history by choosing the ‘Passbook’ option on Paytm's home screen. It displays the transaction summary of all payments made or received using Paytm.

Paytm also offers rewards to its users in the form of Paytm cashback points. You can use Paytm’s cashback points for shopping, travel, or entertainment. Paytm also allows you to use it as a Paytm balance.

Features of Paytm Wallet

It offers numerous features that are essential for seamless transactions. Here are some of the most enticing features of Paytm wallet you must know:

Step 1: Paytm is the RBI-approved wallet that is safe to use. Your money is safe in your Paytm wallet, and you can use it at any instance to make online payments.

Step 2: You can extend your wallet’s limit from Rs.10000 a month to Rs.1 Lakh with a simple KYC verification process. All you need is an Aadhaar card, passport, or voter ID to complete your KYC verification. With KYC, you can enjoy an increased usage limit.

Step 3: It is easy to add money to your Paytm wallet with the help of a debit or credit card, UPI, or net banking.

Step 4: Paytm provides an easy and convenient way for completing KYC verification with a video KYC verification process.

What are the benefits of a Paytm wallet?

Paytm provides many benefits to make your online payments smooth and secure.

Here’s a list of some of the benefits you get by using Paytm wallet:

- Being cashless and easy to use: Paytm is a cashless way to make online payments. It is a more convenient way than paying via your bank directly.

- Cashback and rewards: If you are a regular user of Paytm wallets, you get many attractive rewards and cashbacks for every transaction you make. You may also receive massive discounts on many merchant sites by using Paytm wallet.

- FASTag usage: Paytm has integrated with FASTag to make your travel at toll stations easy. You can link your Paytm wallet with FASTag and avoid making a stop at every toll station. It is beneficial for those who travel frequently.

- Paytm QR code acceptance: Due to its popularity and safety features, Paytm QR codes are accepted almost everywhere.

- Automatic money adding feature: With Paytm wallet, you can set up automatic money adding service that adds money from your bank to your Paytm wallet. You can set up an amount to be added.

- Set reminders: Paytm wallet is more than a payment platform. It also acts as a reminder to pay important bills. You can pay your electricity bill, recharge your mobile or even dish tv. It reminds you to pay bills as you approach the due date.

- Statements: Just like banks, you can get your monthly transaction statement to understand your spending pattern every month. You can manually choose a specific time frame for which you need statements.

- Fund transfer: Fund transfer is a key benefit of Paytm wallet. You can not just add and withdraw money from your Paytm wallet but also send money to another bank account. Paytm offers this service at a very nominal cost.

- Tracking your expenses: Paytm’s spending tracker allows you to keep a close eye on your spending and helps you define your budget. You can track all your expenses that are done via Paytm wallet.

- Paytm postpaid: You can enjoy the benefits of Paytm postpaid with Paytm wallet. The availability of this service depends on your credit score.

- Refunds: Whenever you make payments via Paytm, you receive refunds for canceled goods or services safely in your Paytm wallet.

- 24X7 help desk: Paytm has great customer care assistance. It offers a 24X7 help desk that aims at offering you the quickest solution to your problems related to Paytm payments.

Conclusion

Paytm is India’s largest virtual wallet that holds money and makes your online payments easy. As per 2018 data, Paytm has over 350 million active users. It is trusted by millions of Indians for their personal as well as business use.

Paytm allows you to do more than just online payments. It is an important tool to manage your online payments. It is a safe online payment platform that offers a secure way to make payments. With 128 bit encryption and SSL security, Paytm is the most trusted online payment app in India.

Apart from this, Paytm offers a 24X7 help desk to answer your queries or solve problems related to the payment. Even if you lose access to your Paytm app, you can get in touch with Paytm customer care on this 0120-4456-456 number or write to them at care@paytm.com.

I hope you liked our article on how to use paytm, and it must have solved your queries such as how to use paytm first time , how we use paytm, how to make paytm account

if you have any comments or suggestions do share them in the comments below.

Frequently Asked Question

Q. How can I pay by using Paytm?

Paytm wallet is easy to use. All you have to do is open the Paytm app on your mobile phone and click on the Send or Pay option. Then select a contact you want to send money to and enter the amount to be paid.

Use the OTP to complete your transaction. And that is how your payment will be carried out. You can pay bills and even book tickets with the help of Paytm.

Q. How can I use Paytm on my phone?

You can simply download the Paytm app from your App store. Set up your Paytm account with the help of your email ID and mobile number. As soon as it is verified, you can start using Paytm on your phone to make digital payments.

Q. Can I receive money in Paytm without a bank account?

Yes. You can receive money in a Paytm wallet without having a bank account. However, KYC and bank accounts are needed to withdraw money from your wallet.

Once you complete the KYC process, your Paytm wallet usage limit increases to Rs. 1Lakh.

Q. Can Paytm be used without an ATM or debit card?

Yes. You can use a Paytm wallet without an ATM card. Paytm supports various payment modes to add money to your Paytm wallet. You can use UPI, credit card, or net banking method to add money to your Paytm wallet without the need for a debit card or ATM.

Q. What is Paytm’s daily usage limit?

Without KYC, Paytm’s monthly usage limit was capped at Rs.10000. However, with KYC completion, you get Rs.1 Lakh usage limit at any given instance. You need an Aadhar card as proof to complete your KYC.

Paytm offers an at-home KYC process based on OTP, so you do not have to go to KYC Verification centers physically.