Want to know How to use atm card? Well you have landed on the right article

The ATM card has become a critical component of today's financial business. All current and savings account holders receive an ATM card from the financial institution after starting an account at the bank.

The card allows them to access their account anytime and from wherever they want. When an active customer's ATM card expires, a new ATM card is provided to them.

An ATM card is the one that you use to complete specific transactions at an ATM. This machine allows you to withdraw cash, check your balance, and do other financial activities without the assistance of a bank employee.

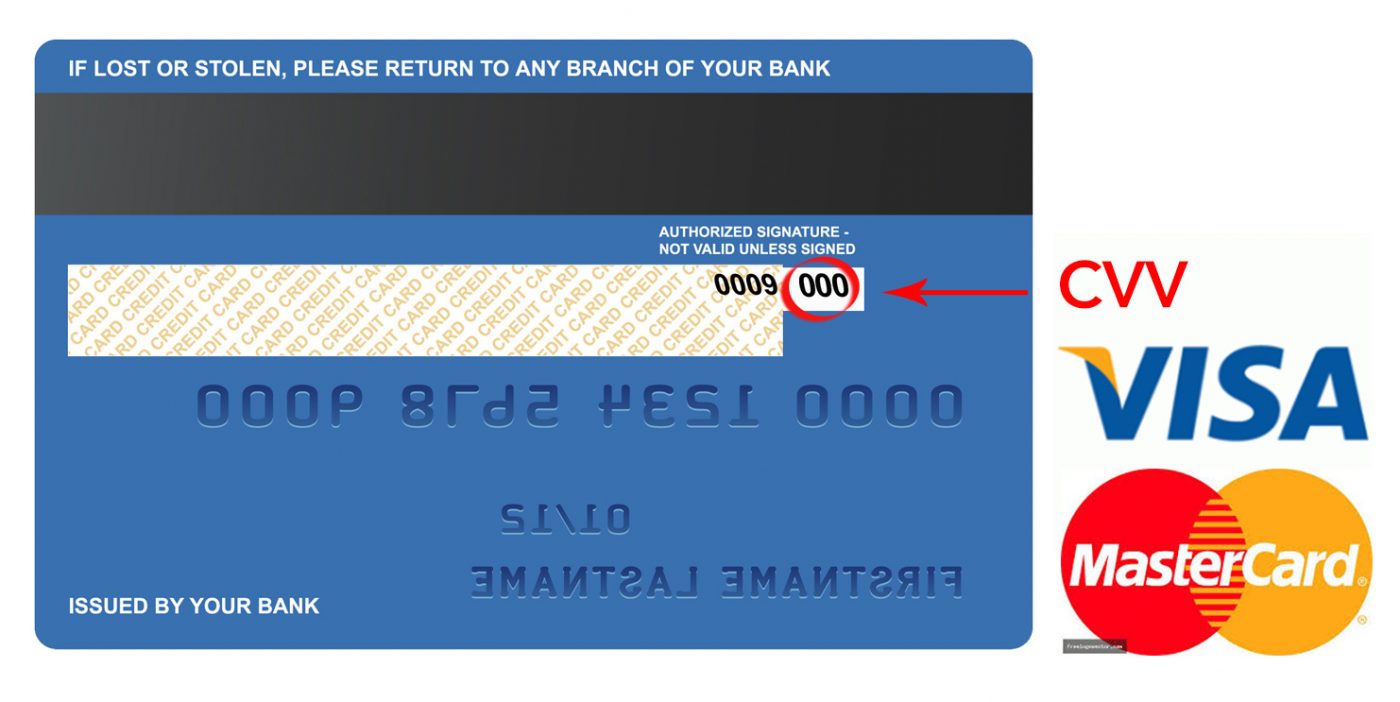

An ATM or debit card number is a sixteen-digit identifier that is used to identify the card. It includes the owner's name of the account,

The card's expiration date, and a three-digit credit verification value (CVV) that is printed on the back of every ATM card for safety purposes.

If you provide CVV, it implies you have the actual card. There is an EMV stripe on either side that stores all the account owner's information. This information is automatically read when you put an ATM Card into an ATM.

Even if you don't how use card, this article includes detailed guide that will teach you how to use atm card first time in a right manner.

How to use ATM card?

- Regardless of the bank, visit the closest Automated Teller Machine (ATM). You can make transactions at a bank ATM of your choice, even if your account is not with that bank.

- In the ATM, place the card in the slot provided. Whenever it's prepared to take the card, it normally blinks, and an arrow appears.

- If you don't know how to insert atm card, Ensure the front end of the card is facing the top and that it is placed clockwise. If it is not correctly inserted and the machine is unable to identify the details, a message appears on the screen.

- The account owner's information is stored on the magnetic stripe that is usually on the backside, which is instantly identified by the ATM server, allowing you to complete the transaction.

- The screen shows the procedures to complete a transaction and can be used as a reference. You may also change the language whenever you like.

- In most ATMs, a speaker provides auditory feedback and guides you during the procedure.

- Type in your four-digit ATM PIN on the keypad. Never give out your ATM pin to anyone. While entering the PIN, make sure no one is looking at you.

Enter the PIN carefully, as entering it incorrectly might result in the ATM card being blocked. - You'll notice numerous transaction options on the ATM screen, such as Transfer, Deposit, and Money Withdrawal, among others. You must choose the Withdrawal Option to make a cash withdrawal.

- Following your selection of the money withdrawal option, the screen will present various account types for you to choose from.

As a customer, you must select a savings account rather than a current account, as the latter is only used by corporations.

- Some ATMs provide you with the option of adding a line of credit to your account. This can assist a banker in an emergency if they require a large sum of money.

- Now, specify the amount you want to withdraw. Ensure you don't input a withdrawal amount that exceeds your account balance. Now hit the enter key.

- Now take the money from the machine's lowest slot.

- Once you collect the money, you will be given the choice of printing a transaction receipt. If you need a printed receipt, pick yes.

Types of ATMs

There are two types of ATMs: On-site ATMs are placed within a bank's premises, whilst off-site ATMs are the ones that are located elsewhere and do not have access to a bank branch.

Apart from these, some ATMs are classified according to their origin. These include: Yellow label ATM, White label ATM, Brown label ATM, Green label ATM, Pink label ATM and Orange label ATM.

How to activate a card?

You can activate a card in many ways.

- One way is by visiting the bank’s ATM with which the account owner has an account. You will need to insert the ATM card, enter the PIN or interim PIN, and follow the on-screen instructions.

When the account owner inputs the PIN, certain banks authorise the card automatically. - You can also call the bank's toll-free number. It is printed on the ATM card and on the bank's official website. For activating the card, you will be asked to supply all requested information, including account number,

address, recorded phone number, and ID proof. - You can also pick the ‘activate ATM card’ option after checking in to the net banking page and insert the security code supplied on the reverse of the card. Most banks also allow you to activate your ATM card using mobile apps.

- A few banks additionally allow customers to use their cards at their preferred stores, input their PIN to make purchases, and have their ATM cards activated automatically.

- In the event of a provisional ATM card PIN, the user must visit the bank's ATM and replace the PIN.

Difference Between an ATM card and a debit card

Debit cards are used for digital purchases or swiping at electronic machines, whilst ATM cards are used only at ATMs. Banks, on the other hand, often issue a single debit card that also serves as an ATM card.

Benefits of ATM card

The following are the benefits of an ATM card:

- You can get cash from any ATM without having to go to a subsidiary. It allows you to get money even if you are not in the vicinity of the branch of your bank.

- You can also get funds when travelling overseas. You may be required to pay an international charge, but it saves you from financial troubles in a different country.

- The account balance can be checked with a mini statement.

- You can pay taxes, insurance premiums, or bills if you are enrolled to receive these advantages.

- Checks and cash can be deposited even after the banking hours are over.

- ATMs now provide the ability to get Personal Loans as well as open and withdraw Fixed Deposits. This saves time.

- These advantages can be availed anywhere in the country, 24 hours a day, 365 days a year.

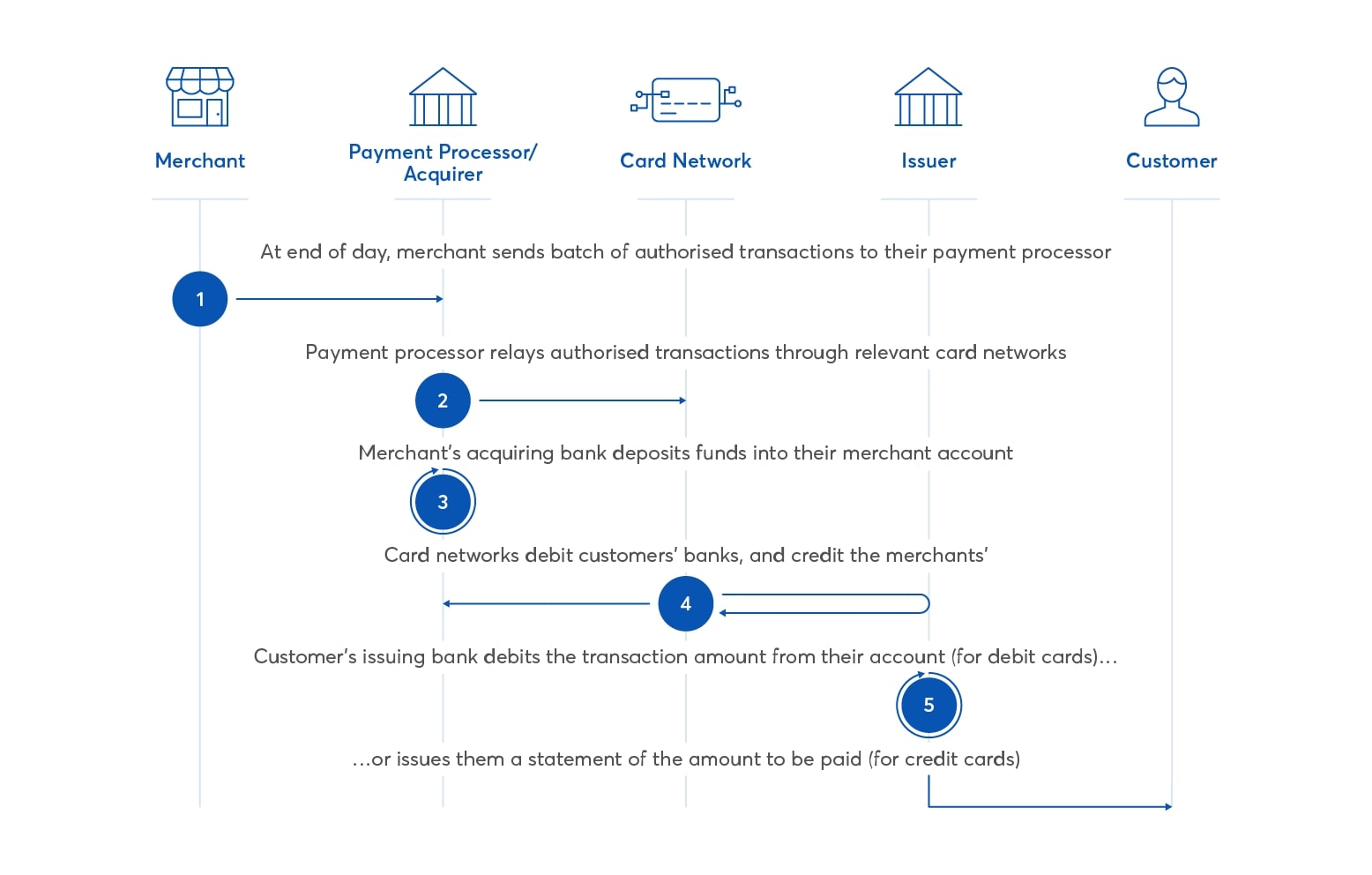

How to Use an ATM Card for Online Payment While Shopping

Follow these steps while using an ATM card for online shopping:

- Go to the merchant's webpage

- Choose your item and proceed to checkout

- Choose the Debit Card option on the payment page

- Input your ATM PIN and Debit Card information

- Select 'Pay Now’

- Input the OTP issued to you after you've been routed to the payment site

- The online activity with your ATM card will be executed when the OTP is authenticated

How to use an ATM Card at a PoS Terminal?

Use the following steps when using an ATM card at a PoS terminal:

- Put your card in the Point of Sale machine.

- Input the amount you wish to pay.

- Enter the PIN for your ATM card.

- The purchase will be completed after the PIN has been confirmed.

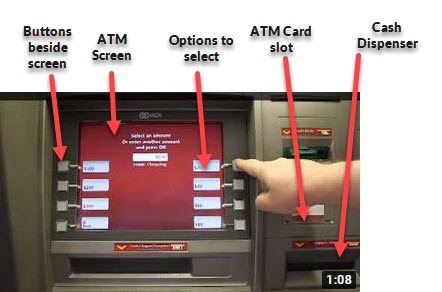

How to Use an ATM Card at an ATM Kiosk?

follow these steps to know how to withdraw money from atm at a kiosk:

- Place the card in the slot with the EMV chip face up.

- Please select your language.

- Insert the PIN for your card.

- Pick 'Cash Withdrawal' from the range of banking alternatives, like 'Balance Inquiry,' 'Money Transfer,' and so on.

- Select the type of account and then input the amount you wish to withdraw.

- Press 'Enter'.

- Collect the funds.

- If you need a transaction receipt, select Yes.

- If you wish to start a new transaction, select Yes.

- Then, take your ATM card out of the machine.

Words to the Wise

You should keep your bank balance in mind while making a transaction. You should understand your bank’s policies and monitor your spending to avoid overdraft charges.

Choose an ATM that is secured and be mindful of any intervention when making a transaction.

Conclusion:

ATMs have made it possible to carry out online transactions easily and even after banking hours. After understanding all the steps, you can say confidently I know how to use atm card. Don’t forget to count your money after using the ATM.

I hope you liked our article on how to check jio number, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

Q. Why is my ATM card blocked?

A card may get blocked if you enter incorrect information or the card is suddenly used in a different country, if you make a purchase of high value, or due to technical errors. Usually, when unusual activity is observed, the card can get blocked.

Q. Can I use my ATM card at any bank ATM?

A card can be used in any ATM for a few transactions. Once the limit of 5 transactions is reached, a fee is applied depending on the location, according to the instructions by the RBI.

Q. What is the difference between an ATM card and a debit card?

An ATM card can only be used at ATMs. However, a debit card may be used for a variety of purposes. They may be used to make purchases in a variety of venues, including stores, restaurants, and online, as well as at ATMs.

Q. How do you withdraw money from an ATM machine?

Enter the card and select language. Insert your pin and choose the service needed. Pick the account you need to use. Enter the amount. Get your cash and take the receipt.

Q. Can ATM cards be used online?

You can use your ATM card for making payments online by entering your card information. However, you should not save this information and make sure no one steals it.

Q How much does an ATM charge to withdraw?

Most banks don’t charge anything while using a card. However, some banks charge a maximum of 20 rupees per transaction once the limit of five free transactions is reached.