A PAN card is issued by the Income Tax Department and the UAN number is issued by the EPFO portal. A PAN card is an alphanumeric number and has 10 digits in it. The UAN is a 12 digits number issued by the Ministry of Labour and Employment.

In this article we are going to discuss in detail why it is important to link your PAN card with your UAN and how you can resolve the issue of any type of error shown in linking your UAN on EPFO portal with your PAN card.

It has been noticed that many users on the UAN portal are facing the problem of failed verification, when they are trying to link their Permanent Account Number or PAN card number with their Universal Account Number or UAN number.

You can check your KYC/ know your customer on the EPFO portal by clicking on the ‘MANAGE’ option and check for digitally approved KYC. In case your PAN card is not verified on the EPFO portal, it will be shown as Unverified.

If you are facing a similar problem, in this article we are going to guide you, to solve this problem. This problem is very common and can be resolved so you don’t have to panic at all.

The PAN card number is linked with the EPF UAN number to avail the benefit of tax deduction, when an individual with less than 5 years of service is claiming a Provident Fund amount of 50000 INR or more.

Reasons why your PAN verification is showing error:

If your name registered with the Income Tax Department of India, is different from your name on the Provident Fund portal, you will face the PAN verification error.

This problem can be solved by filling and submitting the PF joint declaration form, this form requires a user to fill both the correct and incorrect name. The employee should get this form attested by his/her employer. This form needs to be submitted within 30 days to the regional EPF office.

Use this https://www.nielit.gov.in/sites/default/files/PDF/FacilityManagement/name%20change%20correction%20form.pdf form to do the same. If the error is happening due to a mistake in the PAN card, then the employer has to make necessary changes in the PAN card.

The other reason for this problem can be improper integration of the official website of the Income Tax Department and the Provident Portal.

Sometimes, even if your names match on both the Provident Fund portal and the Income Tax database, an error may arise when linking the PAN number with the UAN number.

If your name on the PAN card and PF portal match, then you can resolve the PAN verification error problem by raising a grievance with the official PF portal.

In such a case, the officials will check your case personally and solve it.

How to raise a grievance to solve the PAN card and PF link verification failed process?

Here’s a step by step process of how you can raise a grievance to solve PAN verification error.

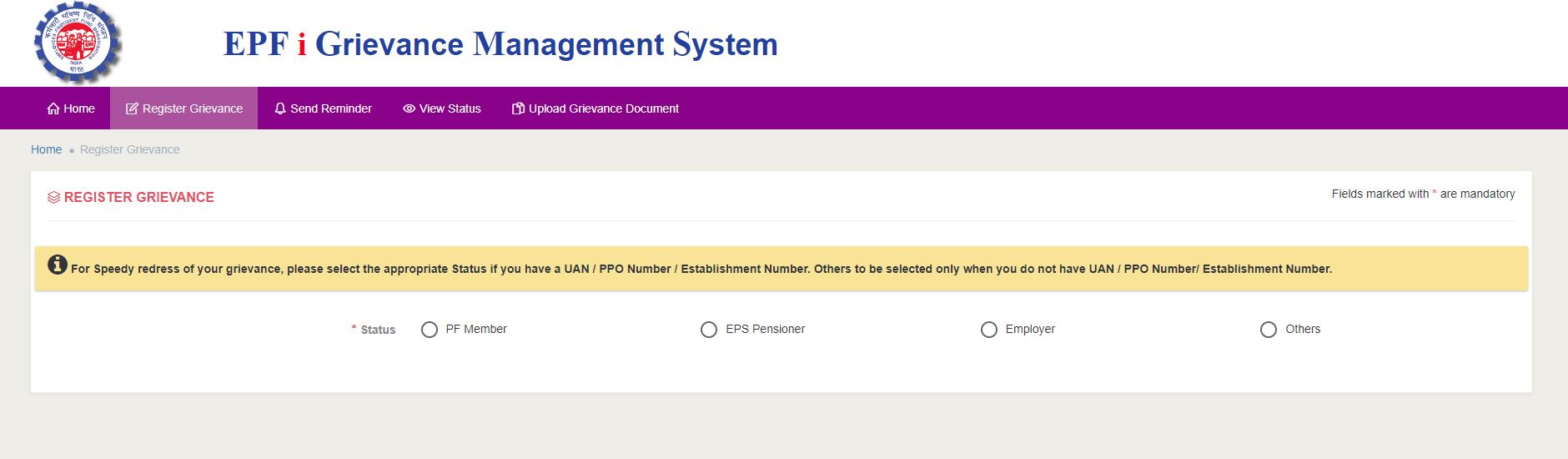

- Visit this page https://epfigms.gov.in/Grievance/GrievanceMaster on the official EPF portal.

Out of the four options on your screen, select ‘PF member’.

You will be asked, if you want to claim ID? Click the option NO.

Once you do that, enter your UAN number and security code in the respective boxes.

On your registered mobile number you will receive an OTP.

Enter this OTP correctly.

Next, you will have to enter your address, an alternative mobile number (though it is not mandatory to provide an alternate mobile number).

Also, enter your Provident Fund ID number.

In the grievance related to option, select the option PF office.

For the grievance category you will have to select the options KYC related issues.

In the grievance description option, describe the specific problem you are facing.

Click submit.

Within 24 to 48 hours you will receive a reply from the regional/local EPF branch addressing your grievance.

This step is additional, if even after raising a grievance your problem is not solved (the chances of this happening are very low) you can send a reminder of your application.

What to do if there is a mistake in your PAN card details?

It has been noticed that in some cases the gender on the PAN card is wrong. It is usually not easy to track this problem so make sure you verify your details registered with the Income Tax Department/your PAN card.

You can do this by visiting the official website of the Income Tax Department and logging in. Once you are logged in, click on PAN details. Check the details like Gender, Category, Address for any possible errors.

If you want to avail the services of UAN/EPFO it is mandatory to have your KYC verified. This includes your PAN card number and also your 15 digits Aadhaar card number.

Frequently Asked Questions

1. What happens if the PAN card number is not verified in the UAN portal?

EPFO requires PAN details to deduct tax. If your contribution to EPF is less than 5 years, EPFO will use your PAN details for taxation purposes.

2. What to do if the PAN is active but the details are not matching the PAN database?

Visit the official website of NSDL, and click on the PAN CORRECTION option. You will find the PAN CORRECTION option in the application type dropdown. Once you fill your details, and scan and upload your e-signature, click ‘Submit’. Also, enter the PAN card number in which you want to make corrections.

3. Can a PAN card number be verified online?

Yes, PAN card number can be verified online by authorised entities such as RBI approved authorised dealer Category II, Mutual Fund Advisor, banks and other such entities.

For full list of these authorised entities, you can visit this link https://www.tin-nsdl.com/services/online-pan-verification/pan-verification-overview.html

4. How do I know if my PAN is verified with my UAN number?

You can check the status of PAN verification by visiting EPFO’s portal. Login with your details. Check if the PAN verified status appears on the home page under the member profile option.