The Public Provident Fund (PPF) is a great savings fund option for the working class individuals of the country. It is a long-term investment with attractive return rates and interest rates that are not taxable under Income Tax.

Hence, this scheme has gained massive popularity in India. When you open a PPF account, the money deposited during one year can be claimed under the 80C deductions.

It is an excellent option for people who do not want to take risks because it is not linked to the market. The individuals belonging to the working class can protect their investment needs without fearing market fluctuations.

You can go to the Post Office or any national bank to open your account. You will need some documents like KYC documents, residential address proof, and passport size photographs when opening an account.

These days, almost every bank offers PPFs. However, it is better to open your account at trustworthy banks. One bank you can consider is the State Bank of India (SBI).

This article will discuss the various features, important aspects, and the procedure for how to open ppf account in SBI.

Features of PPF

- A PPF is a long-term investment plan, meaning you can only withdraw the money on maturity. It has a lock-in period of fifteen years, which you can extend by five years toward the ending of maturity.

- Withdrawal is allowed only in case of crises, and partial withdrawals are available from the seventh financial year.

- The government determines the interest rate on the PPF. Every month, the interest rate calculation is done on the lowest PPF amount that is available in your account after the fifth of the month.

- So, you should deposit money to your PPF account before the fifth of each month.

- PPF accounts have a minimum and a maximum investment limit for each year. Annually, you can make investments of more than Rs. 500 and less than Rs. 1.5 lakhs.

- You can take loans against your PPF account between the third and sixth year from the opening of the account.

- The amount is also limited to 25% of the PPF balance at the end of the second year.

Important aspects of SBI PPF Account

Investment limitations for the account

The lowest investment per year is Rs. 500, and the max is Rs. 1.5 lakhs. You can deposit this amount in your SBI PPF account at once, or it can be deposited in twelve installments.

Scheme duration

The PPF account matures in 15 years. You can prolong this term by five years by submitting the investment term extension paper.

Nomination

While opening the PPF account, there is an option of adding a nominee. You can even add a nominee or more than one nominee after the account is opened.

Transfer of your SBI PPF account

After opening your PPF account, there is an option to transfer it from one branch of the bank to any other branch. You can also move your account from the SBI bank to another bank of your preference or the Post Office.

Tax advantages

One of the significant reasons PPF has gained popularity among the working class is its appealing tax reduction schemes. You can get a tax reduction of about 1.5 lakhs under section 80c.

The money you receive from the bank as interest and at the time of maturity is free from tax.

Loans and withdrawals of funds

You can take loans against the PPF amount. You can do it between the third and sixth year after opening your account. You can withdraw money after the seventh year.

Any loans and withdrawals depend on the age of your PPF account and the balance on specific dates.

Interest rate

The government controls the interest rates of these accounts, which guarantees security and makes the scheme appealing. They announce the rate quarterly.

Currently, the interest rates, under the government, for the SBI PPF accounts stand at 7.1%.

Premature Closure

The maturity time for PPF accounts is 15 years. But you can apply for premature closure if your account meets certain conditions.

How to open PPF account online in SBI : Process

You can open your PPF account through the online method. Here are the steps for it:

- You can only use this method if you have a net banking account at SBI. If you do, log into your account using your account username and password.

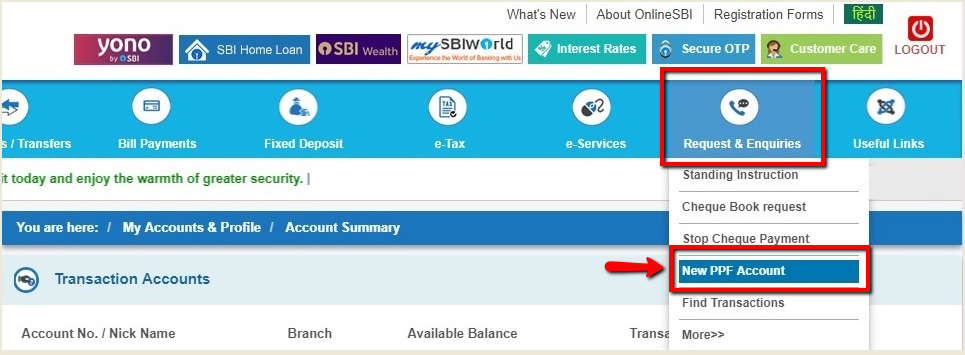

- On the drop-down menu, select the ‘Request & Queries’ tab.

- Here you will see the ‘New PPF Account’ option.

- On selecting this option, you will be redirected to a page where you must fill up your name, PAN card details, Customer Information File number, address, and email address.

- Provide the bank account details from which you will make deposits for the account. You will have to write the branch code as well. On entering the code, you will see the name of the branch.

- Submit the form, and you will get a reference number and download link for your application.

- You will have to print the form and sign the pages, which require attestation. You have to make sure that you go to your SBI branch during the 30 days that follow after filling the form. You will have to carry KYC documents, passport size photographs, and address and identity proof.

- On verification, you will have to deposit a minimum amount of Rs. 500 by cash or check.

How to open ppf account in SBI : By visiting the SBI branch

If you do not want to use the net banking facility, you can visit the nearest SBI branch to open a PPF account. Here is steps on how to open ppf account in SBI by visiting the branch:

- You have to make sure that you visit a branch that allows PPF account activation.

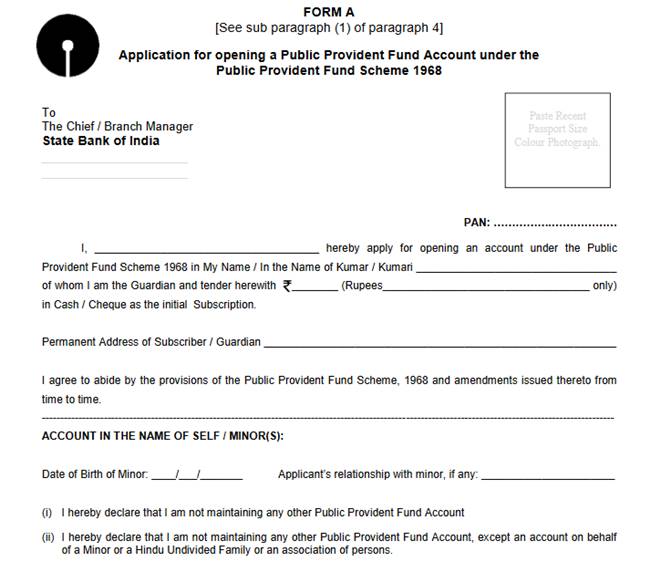

You will have to fill up and submit the PPF account commencement form, also called Form A. This form is obtainable at the bank, or you can install it through the SBI site as well. - You have to carry appropriate documents like the photocopy of your Aadhaar card or PAN card.

- When the bank verifies your account, you will have to deposit the minimum investment amount of Rs. 500 by check or cash.

How to transfer your SBI PPF account?

SBI bank allows its users to transfer their accounts from one branch to another or even to other banks. You can also move your account to the Post Office. Here is how you can do it:

- Go to the SBI bank branch where you have opened your PPF account.

- You will have to fill in your details in the PPF account transfer form. The form must contain basic information about your current PPF account, like the account number associated with your PPF account and branch. You have to give these details even if your account is with another bank or post office.

- The bank will also require your passbook along with the form.

- The bank officer will verify the PPF transfer form. Your current bank account or post office will dispatch these papers to the bank branch or post office where you want to transfer your account.

- You will have to take the KYC papers to the new branch for verification. Your account will be activated when the bank will sanction your account.

- Then your account is functional, you will get a fresh passbook from this branch. It will show you the particulars of the new PPF account, like balance and information on credit and debit.

Conclusion

There is a lot you need to learn about PPF accounts. So, it is always a good idea to look up as much information as possible before opening your account. There are certain minimum and maximum investment limits that you need to maintain.

If you do not want to take risks, this is the perfect option. But, you need to understand that the maturity period for the PPF account is 15 years. You can take loans and make withdrawals if your account meets certain conditions.

Frequently Asked Questions

1. How to transfer a PPF account?

You have to visit the branch where you have your PPF account and fill up the account transfer application. When the bank sanctions your request, it will send the appropriate papers to the branch you want to transfer your account to.

The new branch will give you a new passbook, and you can also change the nominees.

2. How do you link an SBI PPF account to the account online?

You do not need to link the two accounts. When opening your PPF account, it is opened under the present customer ID. Thus, your PPF account is already linked to your savings account. You can use the same details to access the two as well.

3. How to know your PPF account number?

You can check your account number and balance under the personal banking tab using net banking. You will see both your PPF account and savings account on the dashboard.

Furthermore, you will also get a passbook from the bank, which contains the account number associated with your PPF account and information on recent transactions and balances.

4. Is a PAN card necessary for PPF?

A PAN card is essential because it serves as identity proof. But if you are a minor, the KYC documents of your guardian are required.

5. Who is eligible for a PPF account?

Any Indian adult can open a PPF account. But in the case of minors or individuals with an unsound state of mind, a guardian can open an account for them.

6. How to withdraw money from a PPF account before maturity?

You have to check if you are eligible for premature withdrawal. If you are, you need to fill the form C and submit it to the bank. Submit other documents that the bank may require.

The bank will then process these documents and allow you to withdraw the money.

7. What are the documents required to open a PPF account in SBI?

The requisite documents are:

- The PPF account opening form.

- Passport size photographs.

- Address proof.

- Copy of the PAN card.

- Nomination form.

8. How many times can a PPF account be extended?

You can extend your PPF account any number of times.