Want to know how to open NPS account? Well you have landed on the right article

The National Pension Scheme (NPS) is a voluntary, defined-contribution pension system that offers long-term retirement income at fair, market-based returns. The NPS is open to all Indian nationals.

Each NPS subscriber receives a PRAN (Permanent Retirement Account Number). In the case of a physical account opening, the individual can go to the nearest POP-SP and submit the PRAN application along with the required KYC documentation.

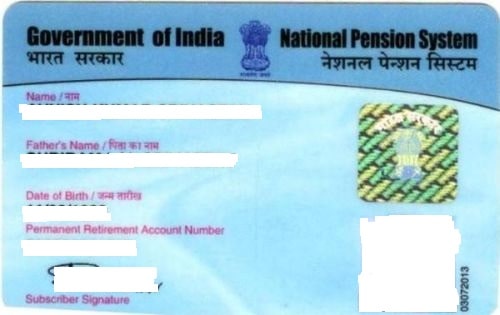

When a PRAN is issued, a PRAN card is mailed to the correspondence address.

Now let's dive in the article to know nps account opening process in detail.

Definition

The National Pension Scheme is a Central Government initiative to create a federal retirement program for its inhabitants. Except for members of India's military forces, this benefit program is available to workers in the general, private, and, unexpectedly, unorganised sectors.

Individuals can contribute to an individual benefits account at regular intervals while working under the plan. Individuals can withdraw a guaranteed sum when they retire.

When you resign as an NPS account holder, you will receive the balance sum as a monthly annuity.

NPS Account Types

Tier 1

Membership in NPS begins with the creation of a Tier I account, which includes a PRAN (Permanent Retirement Account Number). A singular interest rate is fixed in the NPS Tier I account until age 60.

You can make restricted withdrawals for particular purposes before the age of 60, or you can make a premature withdrawal. Under NPS Tier I, you can save and contribute to ensuring the expense deductions available under the Income Tax adaptation categories.

Tier 2

You can open an NPS Tier-II account alongside an NPS Tier I account. Tier II accounts serve a specific purpose and have simple withdrawal and exit rules.

Although it functions similarly to your NPS Tier I account, there are a few differences. First, a Tier II NPS subscription provides no tax benefits you can't guarantee derivations, and the corpus is taxed on leave.

There is no lock-in period for speculative assets in a Tier II account, unlike the Tier I account. You can withdraw from the Tier II account at any time.

In this sense, Tier I and Tier II are similar in functional methodology, as are the resources the board costs, also known as the choice of speculation.

Essentials Of Enrollment Through Aadhaar

Method: How to open NPS Account Online Using Aadhaar And Establishing eKYC For The eNPS Stage

By following the procedure mentioned below you can easily learn how to apply for nps online.

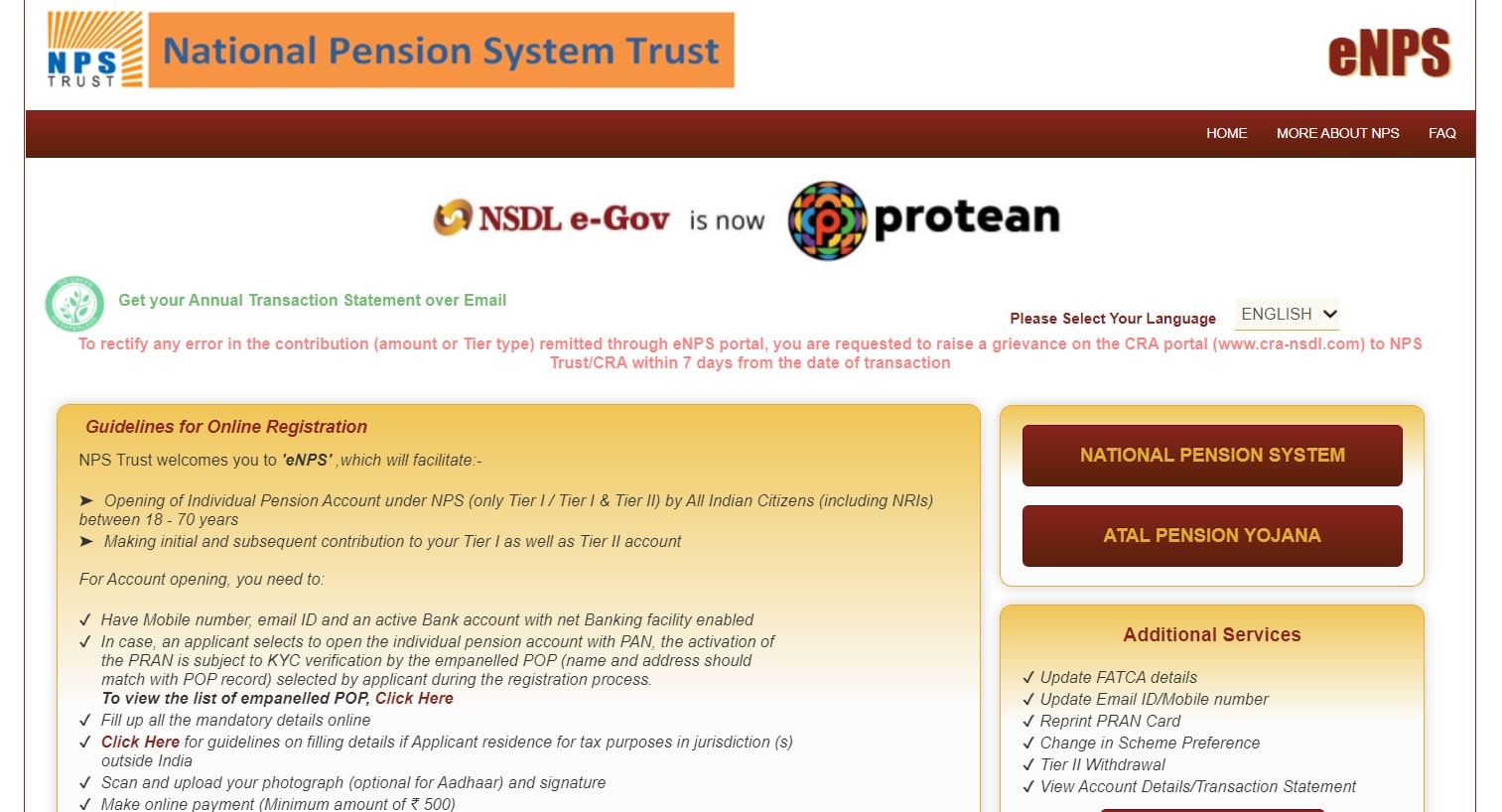

- 1Members must visit the e-NPS portal to register an NPS account online using Aadhaar.

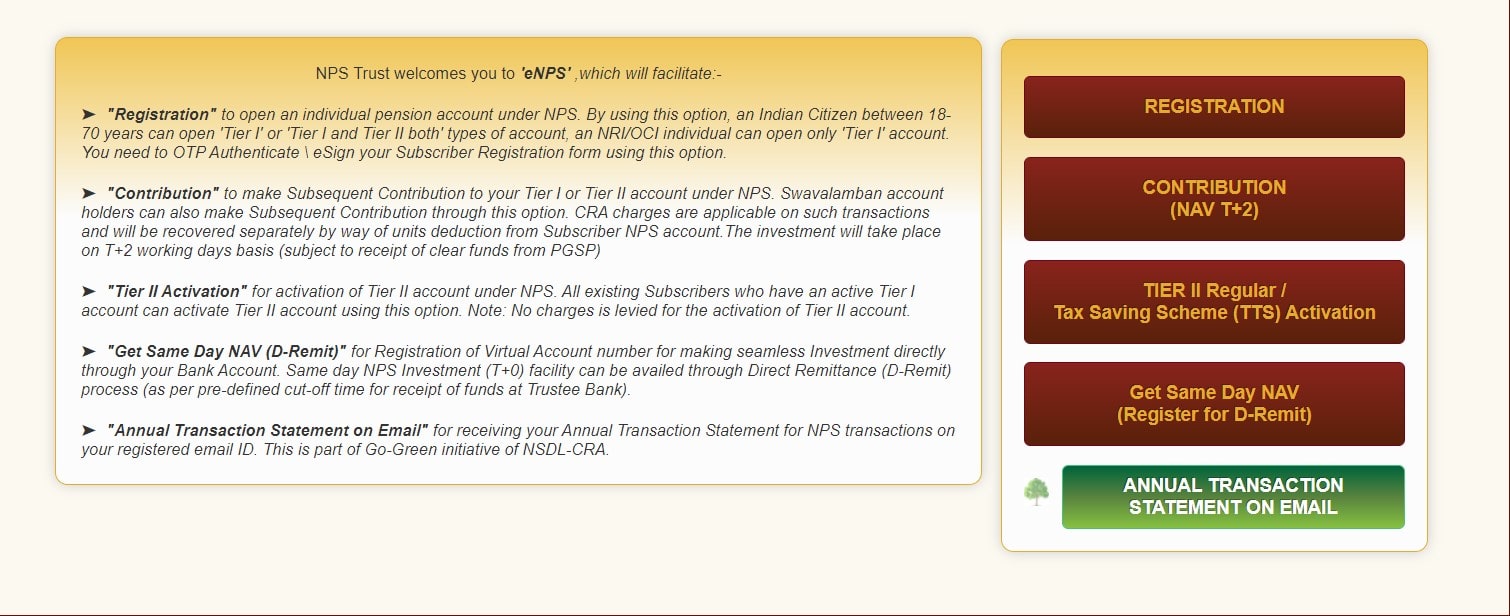

- 2Members must first select "National Pension System" and then "Registration".

- 3Members are next asked to select an account opening category - either "Individual Member" or "Corporate member". The applicant's status must then be selected from "Indian Citizen," "Non-Resident Indian (NRI)", or "Overseas Citizen of India (OCI)".

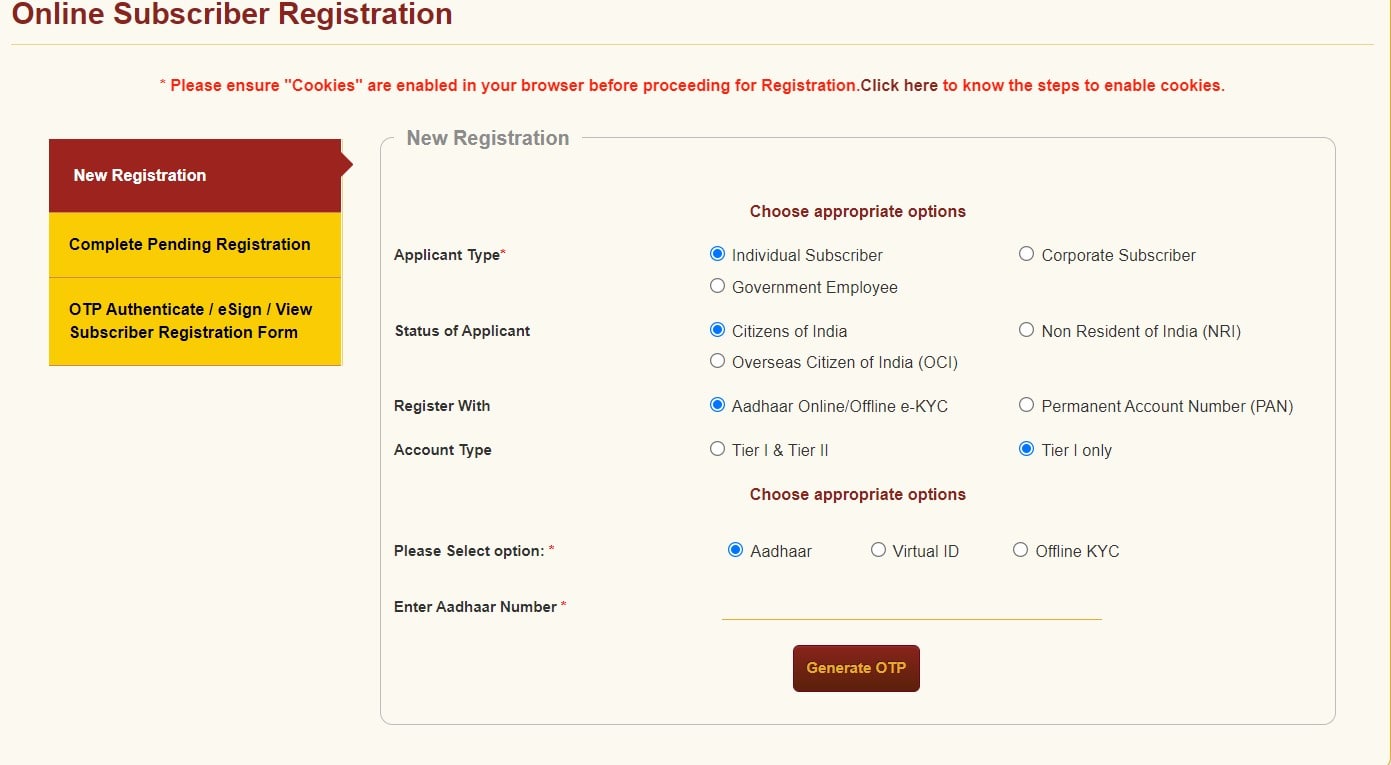

- 4While completing the nps online registration and selecting the "Tier kinds" for account opening, subscribers must pick the "Aadhaar Online/Offline KYC" option.

- 5To proceed with the "Aadhaar online" process, members must choose and enter either the "Aadhaar" (12-digit)" or "Virtual ID" (16-digit) number issued by UIDAI, and then click "Generate OTP". If a Virtual ID is not accessible, subscribers must create their own VID.

- 6To generate the One-Time Password (OTP), customers must select "Generate OTP" and enter the OTP obtained on the cellphone number associated with their Aadhaar.

- 7Following submission of the OTP and consent to utilise Aadhaar details, demographic information (name, gender, date of birth, address, photograph, and so on) will be retrieved from Aadhaar records.

The Indian government has designed a deliberate, purposeful, and responsible plan. This retirement system tries to address the different issues that Indian employees face after they retire. The National Pension System is addressed by the NPS.

Individuals' hold reserves are placed in a benefits store, which is then donated by saving bosses, who are aided by the PFRDA, into various game plans of bills, shares, government protections, and so on.

This would then create problems throughout the years, reliant upon the benefits made as an element of the theory. If people are utilising their PAN number as a form of identification, then they must provide their cell phone number, email address, and net money balance.

You can use the PAN number option in around 15 PFRDA-approved banks.

When reports are issued, KYC checks will be performed. Extra location confirmation records should be provided as well. KYC is charged at a rate of Rs 125 by banks.

As an interbank check may be required, this cycle may bring forth specific nuances.

Enrolling For NPS offline

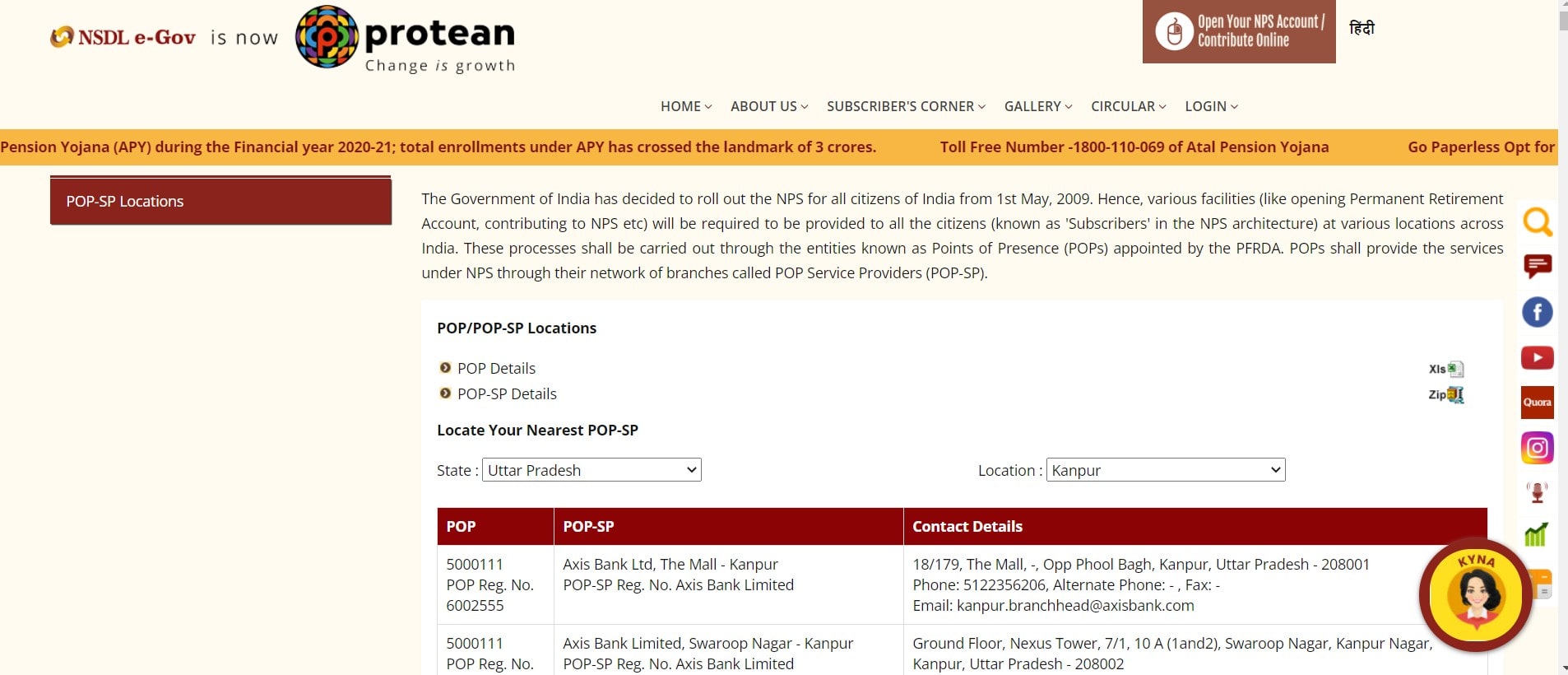

To know how to open nps account offline, you can go to any point of presence-service provider (POP-SP) office and present the enrollment structure in physical form together with KYC documents.

When you agree to KYC, you must provide proof of your character, date of birth, address proof, and a photograph. Whether you are an NRI or not, you must keep financial stability in India and furnish an Indian area.

If you are looking for how to start NPS account, then, you must have either an Aadhaar number or a PAN card. When selecting NPS, you should select one of the two central recordkeeping agencies to monitor your NPS account.

There are currently two central recordkeeping agencies (CRAs). The CRA restricts things like picking venues and subject matter specialists' movements. It will keep track of your records and assist you with all of your trades.

Various reports, such as school leaving confirmation, water charge, power charge, driving grant, copies of your storage facility account, PAN card, character card supplied by your administrator, rent receipt, monetary record.

And so on, are recognized for character and address confirmations. If you are unable to provide any of the records listed in the application structure

You can obtain a revelation of character and support of address embraced by a Member of Parliament, a Member of the Legislative Assembly, a Gazetted Officer, or even a Municipal Councillor as a last resort for character proof.

After you open the account, the CRA will send you a "Welcome Kit" containing the endorser's unique Permanent Retirement Account Number (PRAN) Card and the specifics specified in the Subscriber Registration structure at the time of selection.

You also receive a Telephone Password (TPIN) for your local area number record. You will also be given an Internet Password (IPIN) to allow you to view your data on the CRA website.

A Permanent Retirement Account Number (PRAN) is a unique 12-digit number apportioned to every endorser of the NPS scheme for a lifetime. This number is accessible from any part of India.

There are two sorts of records that can be held under PRAN:

What Are The Documents Needed For The Detached Application Of PRAN?

Individuals who intend to apply for a PRAN in the detached mode can go to their nearest Point of Presence-Service Provider (POP-SP). For such an application, the following reports will be required:

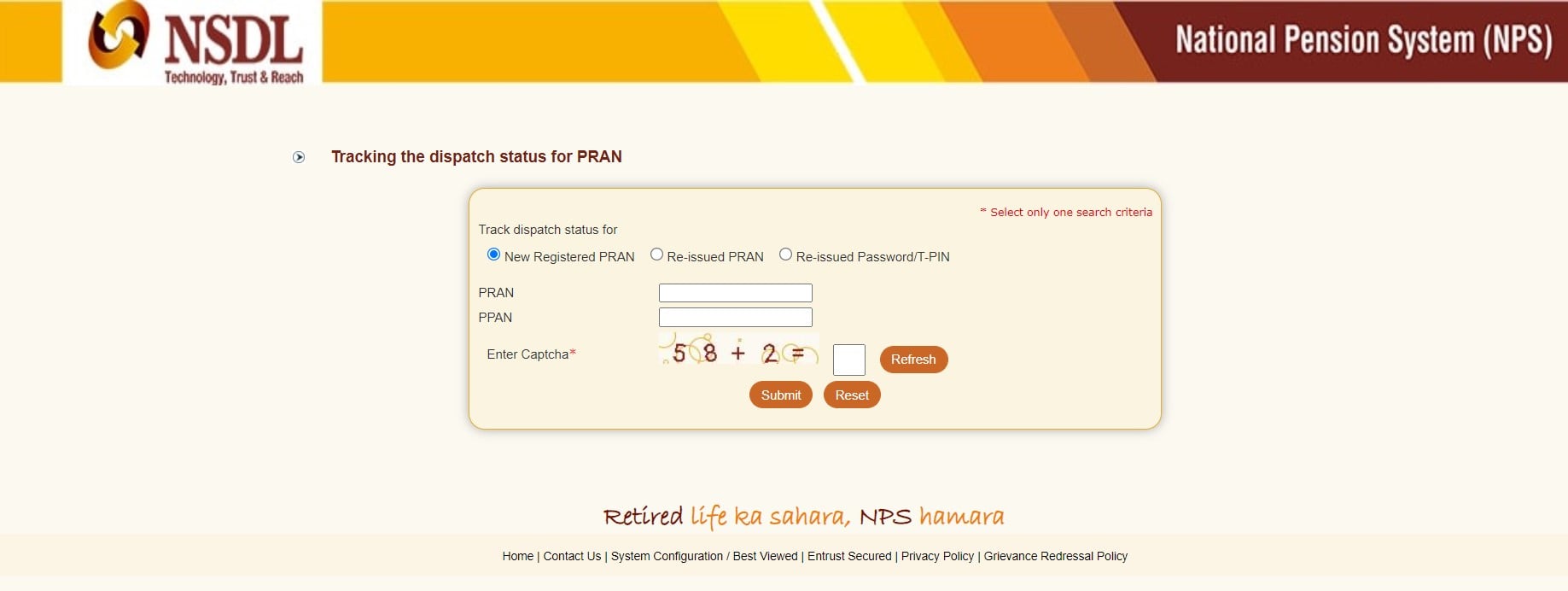

PRAN Online Application

Endorsers of the agreement may apply for a PRAN online using the NSDL portal. NSDL is the NPS's Central Record-keeping Agency (CRA), and it is tasked with the difficult duty of overseeing PRAN circulation uses.

NPS KYC Compliance will be completed online by transferring either an examined copy of the Aadhar Card or a checked copy of the endorser's PAN Card.

An inspected duplicate of the endorser's signature and the ally's photograph will be added to the entry shortly after.

Following the completion of all relevant details, the endorser will be directed to a portion of the submission.

Frequently Asked Questions

1. How to open nps account plot?

At the hour of conventional exit from NPS, the endorsers may use the gathered advantages bounty under the arrangement to purchase an everyday presence annuity from a PFRDA-impanelled catastrophe assurance association, isolated from taking out a piece of the accumulated annuity plenitude as a single sum, if they choose so. PFRDA is the nodal office for the implementation and oversight of NPS.

2. What measure of time will it take to open an NPS account?

The PRAN card is printed and dispatched within ten working days from the date of receipt of the appropriately filled-in enlistment structure at NSDL-CRA.

Investors who do not have their PAN and Aadhar connected to their bank accounts may miss out on the NPS this year. Because NSDL receives a high volume of NPS applications, nps account opening procedure can take up to 15-20 days.

Online: Online registration through the eNPS section is a great deal speedier and can be done in several minutes.

3. Which is better: NPS Tier 1 or Tier 2?

As you can see, each of the National Pension Scheme's account types serves a specific purpose. As a result, it is anticipated that it will help you in the long run.

While Tier 1 accounts assist you in accumulating your retirement corpus and lowering your tax outgo, Tier 2 accounts function similarly to savings accounts, allowing you to meet your investing needs.

4. Which bank is great for NPS?

There are two banks that are suitable for NPS A/c. SBI is ranked first, and ICICI is ranked second. If your branch provides good customer service, you can open an NPS account with SBI; otherwise, open an account with ICICI.

There isn't much of a difference, but if SBI offers customer service, you should go with it. The systems and procedures of government banks are clearly superior to those of private sector banks.