Financial stability is an essential aspect of our lives. There are times when we might not have the resources to buy things to fulfil our needs. In this case, credit cards come into the picture.

Credit cards help you pay for stuff if you do not have the immediate funds to purchase them. They allow you to take short term credits using which you can pay for the products and services you need.

Credit cards are beneficial as they come with a monetary limit, and you can spend the amount up to the limit given. Getting a short-term loan from banks is a hassle. Therefore, you can use a credit card to make these small payments and then pay off the bill the next month with your monthly income.

How To Get Credit Card

Here are certain steps to know how to get credit card:

- Credit History: Your credit history plays a significant role in getting a new credit card. If you have taken any loans in the past, the bank will check your payment schedule.

It is recommended that you make timely payments for all of your loans. Even if you miss a single repayment of your loan, that will impact your credit score, and hence, your creditworthiness.

If it is your first credit card, a background check of your credit history might be conducted. If you have had loans in the past and missed an instalment, it might create some difficulties in getting you a credit card. However, if you have had healthy credits in the past, getting a credit card will be easy. - Repayment capacity: The credit limit assigned to you is more often than not based on your income, which defines your repayment capacity. Most companies follow the rule of giving a limit by just doubling the buyer's monthly income who wants the card

For instance, if Mr A earns Rs. 25,000 a month, there are high chances that the credit limit allotted to him is Rs. 50,000. However, this might change depending on your monthly expenditure.

You might have a greater limit if you tend to spend a significant portion of your family income. It is one of the most important aspects of getting a credit card.

There are several other parameters a bank will look into before issuing a credit card. Some of these parameters are:

- You should be a citizen of India.

- You should have a credit score of at least 700 and a history of regular payments for about six months. This condition is not applicable when you are getting your first credit card.

- Your minimum income must be at least Rs.20,000 per month.

- In the case of credit utilisation, the issuance of the credit card will also depend on the current income and your behaviour.

How to Qualify for a Credit Card

You need to qualify for a credit card before getting one. You must fulfil certain conditions to become eligible for a credit card. These situations are discussed in detail below:

- Age

Before applying for a credit card, you must ensure that you are old enough to get one. The legal age for getting a credit card in India is 18 years. However, even if you become 18, you need to have a regular source of income to be eligible to get a credit card.

Alternatively, if you don’t have a regular source of income, someone can apply for a joint credit card with you. You don't need to work full time in an organisation for having an income. You can also apply for a credit card if you have a part-time job that fetches you a steady and almost fixed income. - Income

Having your income source is vital before applying for your credit card. If you don't have your income, you must have access to household income. This kind of reasonable access can also include joint fixed deposits or a regular joint account with a person who has a fixed source of income.

This is important as regular payments have to be made to credit cards if you spend some money using the card. However, you cannot show your parents income and get a credit card for yourself.

If you want to get a credit card linked to your parent's income, you will have to apply for a joint credit card to assure that someone will pay for that card. - Credit History

You must have a positive credit history if you want to apply for a credit card. Credit history will determine your credit score based on which the decision of issuing you a new credit card will be decided.

Some banks will only issue you a credit card if you have a spotless credit history. It's always good to have a good credit score, as the better your credit score will be, the higher the chances of getting a credit card will become.

If you have a negative credit history, that might impact your chances of getting a credit card from the same issuer. However, you can try your luck with a different bank that might let go of one slip and issue a credit card to you. - Co-singer

Some credit cards require you to have a co-signer with you to back up your debts. The bank does this to safeguard itself from any bad debt that might arise from your card. If you don't have enough income, you will require a co-signer.

In this case, the co-signer also has to maintain all the prerequisites of getting a credit card and only then a new credit card will be issued to you. If you pay your balances on time, that will be great. Otherwise, the co-signer will have to pay the remaining amount.

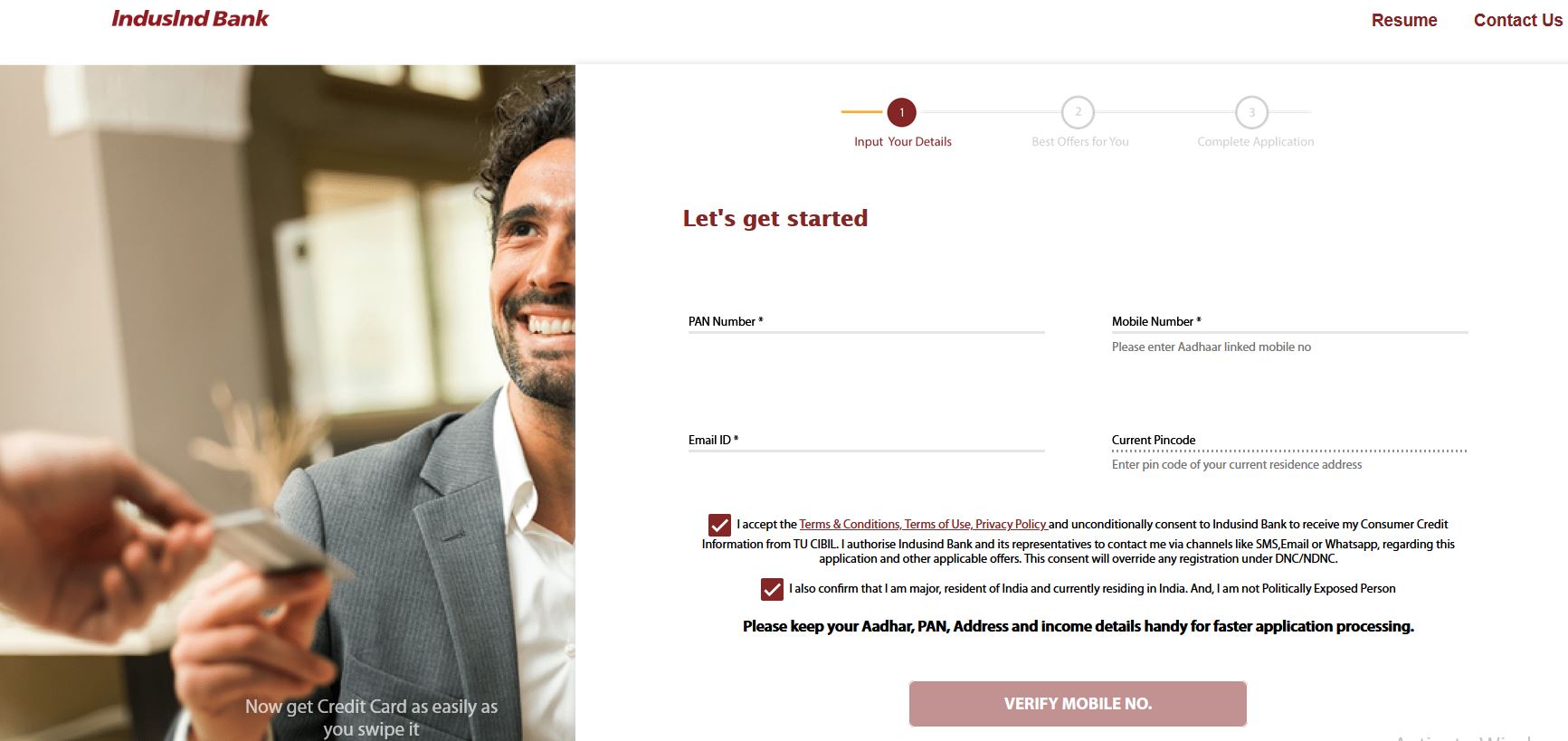

How to apply for credit card online

Here are the steps on how to get credit card:

Step 1: Compare all the different kinds of credit cards offered by different banks.

Step 2: Make a list of cards you think are suitable for you. You can also call this stage the card shortlisting stage.

Step 3: Check your eligibility by entering your details on the bank's platform. The platform will tell you if you are eligible for any of the credit cards or not.

Step 4: Your card will be approved online once you fill in the application form provided by the bank on their website.

Alternatively, you can also go forward with the following steps:

Step 1: Go to the bank’s website. You can take any bank of your choice.

Step 2:: Explore all the cards that the bank is offering to its customers.

Step 3: The website will have a comparison tool, using which you can compare two or more cards to come to a conclusion about which card to buy.

Step 4: Select the card after comparing all the cards and click on the 'Apply' button present on the website.

Step 5: Duly fill the application form present on the website. Once you fill in all the details, you will have to upload all the necessary documents required to get a credit card.

Step 6: Click on ‘Submit’

The bank will verify all the documents and issue you the credit card if everything goes smoothly.

Top Credit Cards

Credit Card | Category |

FinBooster: YesBank | Reward Points |

IndusInd Platinum Card | Fee Waiver |

IndusInd Platinum Aura Edge Card | Lifestyle |

Citi Cashback Card | Cashback |

Citi Rewards Card | Rewards |

Indian Oil Citi Credit Card | Fuel |

HDFC Diners ClubMiles Card | Lounge Access |

HDFC Freedom Card | Reward Points |

Axis Bank Neo Credit Card | Shopping and Movies |

HSBC Platinum Credit Card | Travel and Dining |

Kotak PVR Gold Credit Card | Movies |

There are other credit cards, too, that are equally good. You can get in touch with your bank to know about all of these credit cards so that you can make an informed decision about choosing the right card.

Different Types of Credit Cards in India

There are several types of credit cards in India. Listed below are the ones which are popular among the cardholders:

- Shopping Credit Cards

- Travel Credit Cards

- Lifestyle Credit Cards

- Cashback Credit Cards

- Fuel Credit Cards

- Rewards Credit Cards

Features & Benefits of a Credit Card

There are several features as well as benefits of a credit card. Some of them are listed below:

- Welcome Gifts: When you get your new credit card, the issuer bank will likely provide you with a welcome gift. This gift could be anything from a gift voucher to a flat discount on purchases on a particular website. Some card issuers also credit some reward points to first time users.

- Rewards: There are several rewards attached to different credit cards. You should check with your bank to see what rewards they provide with their credit cards.

Generally, a rewards program is in place that encourages customers to spend more using the credit card to earn these rewards in exchange. - Fuel Surcharge Waiver: Fuel contributes to a very significant part of our income. Several banks provide a surcharge waiver if you spend a minimum amount of money on fuel every month, a great benefit for cardholders who own a two-wheeler or a four-wheeler.

- Cashbacks: Several banks offer cashback on different cards, where you get back a percentage of your spending on the card. These cashback rewards are associated with different cards.

You must be eligible to receive a cashback to claim this kind of reward. Here, a portion of the spending is credited back to the credit card. - Lifestyle benefits: There are several lifestyle benefits that you get with your credit card. You can get several offers on shopping, movie or concert tickets, health and wellness apps, etc.

- Travel Benefits: There are several travel benefits for which you might be eligible with your credit card. Some credit cards offer free lounge access at airports to cardholders. Some cardholders even earn air miles that they might redeem on their next flight booking.

- Global Acceptance: The majority of cards now issued in India are international credit cards. Therefore, you can use these cards anywhere in the world without any hassle, and the banks will take care of them.

- EMIs: The best part about credit cards is that you can change your transactions into instalments and pay a portion of those expenses monthly for a fixed term. EMI conversions of major transactions are among the best parts of credit cards.

How To Choose Your First Credit Card

You should know the most important terms and conditions before applying for your first credit card. You must consider several factors while you choose your first credit card. Some of these considerations are explained in detail below:

Fees And Charges: Fees And Charges: This becomes the most important consideration when choosing a credit card when it comes to charges. Different charges are attached to your card, and you must be aware of all of these charges. Some of these charges are:

- Joining Fee: As soon as you get your credit card, you will have to pay a one-time joining fee for your particular card. It can start from somewhere around Rs. 500 and can go up to thousands depending on the type of credit card you have gotten.

The more premium the card is, the more you will have to pay for your card. Some beginner cards have no joining charges associated with them. You can get in touch with your bank if you are looking for a free card.

Now, if your card comes at a cost, you will have to pay an annual fee every year for that card. There might be instances where your bank might run a promotional offer of a card with no joining fees. All of these details can be obtained from your credit card issuing bank.

- Annual Fee :Annual Fee is the price you pay for using a credit card for a year. While some cards may not have an annual fee attached, most cards come with an annual cost. You will be charged a fixed amount every year as the annual fee.

The amount to be paid as an annual fee is generally equivalent to the joining fee that you pay. Some banks might have offers wherein you spend a certain amount, and the annual charges are waived. Your bank will contact you with any such kind of offers or promotional discounts. - Finance Charges: If you cannot make your credit card payments on time, you will have to pay the finance charges associated with the credit card. Every card has a billing cycle and a duration during which the credit card bill must be paid.

A credit card provides you with easy credit, but it comes with a huge cost. The interest charges on credit cards are high. They may go up to 25% to 48% per annum, depending on your credit card type and your credit card issuing bank.

Therefore, you must choose a card that comes with a low-interest rate. Here, if you miss a payment, you might not have to pay finance charges if the interest rate associated with your card is low. - Late Payment Fee: If you miss out on a payment, you will have to pay the finance charges and a late fee that the bank levies. This late fee is usually fixed irrespective of the amount due on the card.

It might be as low as 500 and go up to thousands depending on your card and your credit card issuing bank's policy. A late payment does not only disrupt your financial stability but also affects your credit score.

Therefore, you must make sure that you do not miss any payment related to your credit card. - ATM Withdrawal Charges: Once you get a credit card, you can not only use it for making transactions using a card. You can also encash money equivalent to a certain limit that the bank decides.

However, if you decide on withdrawing cash using your credit card, you will have to bear a cost. This cost is known as cash advance charge. The fee will range anywhere between 2.5% to 3.5%, and this fee will be charged every time you decide to withdraw cash using your credit card.

You must ensure that you avail of this facility only in emergencies as it can become an expensive affair. New credit card users should avoid using this facility. - Over Limit Fee: Your card comes with a certain credit limit, and you should try to spend money within that limit. If you spend more than the limit that has been allotted to you, you will have to pay an over-limit fee to the bank. This fee ranges from anywhere between 2.5% to 3.5%.

- Foregin Markup: Every credit card comes with a mark-up for foreign currencies. This mark-up ranges from anywhere between 2% to 4%. This is the cost you pay for making an international transaction.

Every time you swap your card overseas or make an international purchase, this charge will be levied on all your transactions where the Indian Rupee is not the mode of purchase.

First-time credit card users must be aware of all of these charges as credit cards can have several financial consequences too, and you should try and be financially sound while making transactions using your new credit card.

Free Credit Period: The free credit period is when you can make all of your purchases using a credit card. You will have to pay later for all of these purchases. Generally, credit cards will have a free credit period of about 40-50 days.

In case your card generates the statement on the 1st of every month, you can make the payment against that statement in the next 15 days or so. These 15 days are given to you to arrange finances so that you can pay off the bill diligently and not be taken aback by any surprises.

Before you get your credit card, you should talk to your bank and determine your free credit period along with the date of payment.

Build Credit history: Credit history is a very important part of using credit cards. Your credit score is positively or negatively impacted with every transaction you make using a credit card.

Therefore, you should be careful while making all of your payment choices and try your best not to delay any kind of payment. If you make all of your payments on time, you will maintain a great credit score, and you will also come under the 'customer in good standing' category.

A good credit score will help you take any kind of loan from banks or other financial institutions in the future. You should also ensure that you don't exhaust your entire credit limit every month to have a fair credit use percentage that can help in improving your credit score.

Minimum Due and Rolling Over: There are two kinds of due amounts in the case of credit cards. The first is the total due amount, and the other is the minimum due amount.

You must pay the minimum due amount in the current billing cycle itself. You can pay the remaining amount, i.e. the total due amount minus the minimum amount in the next billing cycle if you are short on funds.

You should make sure that you use this rollover option in the rarest of cases or during an emergency as the amount will come to huge interest, and that cost will also have to be borne by you.

Along with interest, the bank might also charge a late payment fee on the payments that you make as you are just paying the minimum due and not the total due amount.

Convert card Balnace to Equated Monthly Instalments (EMIs): Credit cards have so many payment options that they can sometimes be a boon in disguise.

Several banks provide you with the option of converting the credit card bill into equated monthly instalments that you can pay in 6 months, 12 months or 18 months. You can choose the duration.

However, these instalments have interests typically lower than the finance charges. You should go on with the conversion only if the bill is too high and you do not have the balance to pay the bill.

As a new cardholder, you should try and make regular payments and avoid converting your monthly payments to EMI because you can get stuck in a credit loop that will keep you debt-laden and impact your credit score.

However, the best thing about this option is that you will get some extra time to pay your dues and get your finances in place. Some banks can convert single large transactions to EMIs instead of the entire bill. You can avail this feature if you are buying something like a car or a laptop.

Anitise Against Online Thfts: Precaution and prevention are the watchwords: You should always transact on reputable websites, terminals, or businesses; You must make sure the merchant swipes your card in your presence.

You should never reveal your PIN to anyone as it's highly confidential and can put you at great risk. You must also save the hotline support number for your credit card provider on your phone, so you can quickly block the card and file a dispute if the card is compromised in any way:

Lost or stolen. While your card is safeguarded against online theft and your interests are properly protected, you must be prepared to respond quickly and correctly.

Credit Card Eligibility

To get your credit card, first, you must be eligible for it. The minimum eligibility criteria that you must fulfil to get a credit card is as follows:

Eligibility Criteria | Requirement |

Nationality | Indian |

Age | Minimum age of 18 years |

Employment Status | Self Employed or a Salaried employee |

Income Limit | Changes from bank to bank. A minimum of Rs. 20,000 for most banks |

Credit Score | >700 |

Documents Required to Apply for a Credit Card

You need several documents to apply for a credit card. All of these documents are listed below:

- A relevant ID Proof is required to apply for a credit card. The documents that can be accepted here are Passports, Aadhar Card, Voter's IDs, etc.

- You would also need proof of residence to get a credit card. An Aadhar card, electricity bill or telephone bill would serve the purpose.

- Proof of income is also required to get a credit card. An employment letter or your salary slips would work in this case.

You need several documents to apply for a credit card. All of these documents are listed below:

- A relevant ID Proof is required to apply for a credit card. The documents that can be accepted here are Passports, Aadhar Card, Voter's IDs, etc.

- You would also need proof of residence to get a credit card. An Aadhar card, electricity bill or telephone bill would serve the purpose.

- Proof of income is also required to get a credit card. An employment letter or your salary slips would work in this case.

Conclusion

Credit cards are necessary financial instruments. However, it would be best to use them with utmost caution as several other factors are attached to them. With every transaction you make, your credit history gets built.

This credit history is then converted into your credit score. You must make sure that you have a credit score above 700. Only if you have a good credit score can you apply for any kind of personal loan.

Not only that, but the issuance of your second credit card will also depend on your credit score. Therefore, make sure that you make regular payments to keep your credit score above 700.

Frequently Asked Questions

1. How can I cancel my HDFC credit card?

If you’re looking to cancel your HDFC credit card, it can be cancelled in four to five different ways. The most common way is to get in touch with a representative through HDFC bank's customer service helpline, or write to their manager at the head office in Chennai.

You may also send an email to HDFC's official email address (found on their website), providing details regarding your problems, and supplying the team with relevant card and personal information, to expedite the process.

You can also speak to a customer service executive at HDFC bank and the person will help you out with the entire procedure of closing your HDFC card.

2. Will there be additional charges involved in closing a card?

There will be no further fees if you choose to close or deactivate your HDFC credit card. However, if you have any outstanding balances on your card, you must pay them off before cancelling the credit card.

In the event you fail to make outstanding payments, the credit card cancellation process will come to a halt. There might be chances where you might be asked to pay a small cancellation charge if you have any kind of balance left on the credit card.

It is also advised to redeem all of your reward points before you decide to close your credit card.

3. How can I close my HDFC credit card online?

To close your HDFC credit card online, you have the option of sending an email to the relevant HDFC bank branch management. Your email should ideally highlight why you want your HDFC credit card to be closed.

It's preferable if you explain why you'd like to close your HDFC credit card. Apart from that, you will be required to enter basic card information such as the card number, expiration date, and so on. Do not send sensitive information by email, such as your CVV or pin.

You will also be required to provide personal information such as your complete name, date of birth, and so on.

4. How do I deactivate my credit card?

An HDFC credit card can be deactivated in several ways. The simplest and most common method is to contact the bank's customer service department and request that the credit card be closed for you.

Once you provide the customer service representative with the relevant details, they will help you out with the credit card closure process and initiate the request. Alternatively, you can write to your credit card branch with all the necessary information.

They will then start the process of deactivating your card. You can also write an email to your bank stating as to why you want to get the card cancelled.

5. What happens if I close my credit card?

If you choose to close your HDFC credit card, you will no longer be able to make purchases with it, or use the credit card to carry out transactions. After initiating the card closure process, you will receive a confirmation regarding the credit card’s closure.

Once you've received confirmation that your card is closed, it is recommended that you cut the credit card with a pair of scissors diagonally, and dispose of it safely. Any transaction made using a card that has been closed, will not be processed.

You can reach out to your bank in case you want to get your card reactivated. The customer care will assist you with all the steps.

6. How do I close a credit card without hurting my credit?

If you have multiple credit cards which are all in use, closing them can harm your overall credit score. The reason behind this is that the minute you close credit cards, the process tends to raise your credit limit and your credit utilisation score.

It is therefore advisable to cancel the credit card you have most recently obtained, and the one with the lowest credit limit first if you are looking to close your credit card.

It is also highly advisable to pay off all of your outstanding debts prior to requesting credit card closure with your bank. Failure to pay outstanding debts may lead to you being penalised.