Looking for ways on how to close hdfc credit card? Great! You have reached the right place; we are here to help you.

Are you tired of the credit loop? Or lost your card somewhere? There's no need to worry. You can get your HDFC credit card closed or cancelled in a matter of seconds.

There are several ways of doing so. If you have lost a card, you must immediately cancel your card as some unauthorised transactions might take place for which you can be held accountable. HDFC provides exceptional services for credit cards.

You can quickly get your card closed or cancelled if you lose it somewhere or if your card gets stolen. The best part about getting your card closed is that there are multiple ways to be done. You can choose to go in a way that sounds easier or is more convenient to you.

For cancelling or deactivating a credit card, HDFC has a mechanism in place. The bank takes 7-10 business days to close a credit card after the cardholder submits a request.

How to Close HDFC Credit Card?

If you are not using your card anymore, you can get it deactivated and save yourself from paying the yearly charges. You can cancel your card by opting in for any of the following steps:

- You can cancel your cards at your convenience by placing a call on the toll-free number 61606161/6160616, which is available 24 hours a day, 7 days a week. You must add your area code before the stated number to reach your city's customer care.

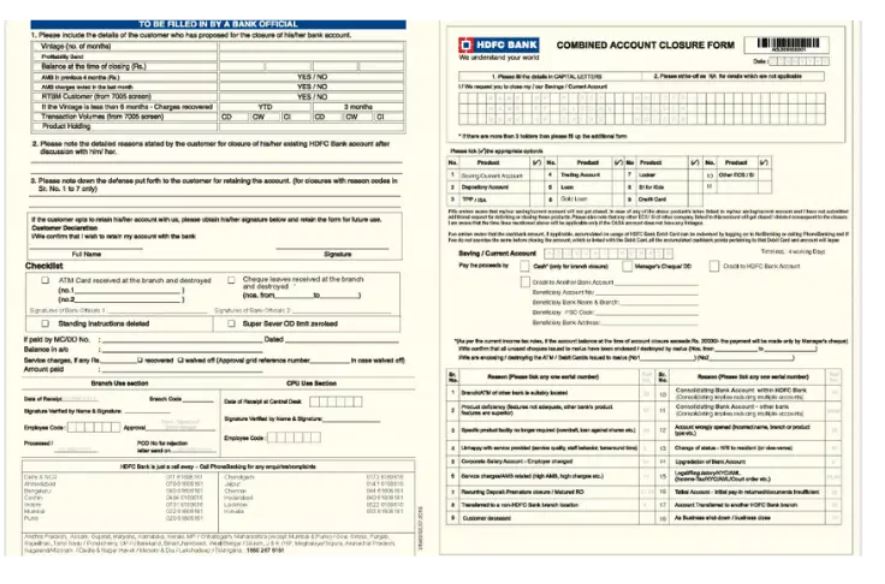

- Owners of credit cards can complete the Credit Card Closure Form. You can fill the form at www.hdfcbank.com. They can mail it to the Manager, HDFC Bank Credit Cards, PO Box 8654, Thiruvanmiyur, Chennai-600041 after filling it out.

- They can also write a letter or send a letter to the corporate office's manager, who is located at the same address. You must submit information such as your name, phone number, basic details of the card, etc.

You should not, however, divulge vital information like the card's CVV or the ATM PIN. - As soon as the cancellation process begins, you should cut the credit card half diagonally. You should know that if you cancel your main credit card, all the other add-ons to that particular credit card will be cancelled.

You must keep in mind certain things before closing or cancelling your HDFC credit card. Some of these considerations are listed below:

- It's preferable if you pay off all of the debts associated with the card you want to cancel. Before you cancel the card, be sure that all of the EMI transactions have been completed. If you don't do so, your credit score may suffer, and you may have problems acquiring a loan in the future.

- You must redeem all of your unredeemed points before requesting a cancellation of your card. You can get exciting products from the HDFC catalogue in exchange for your reward points.

HDFC Credit Card Cancellation by Calling Customer Care

Here is one of the most popular ways of how to close hdfc credit card. You can cancel credit card by contacting HDFC customer care. You can call the customer care of HDFC bank and let them know that you want to get your card cancelled. A customer care executive will immediately raise a request and look into the matter.

Once the request gets submitted, an HDFC customer care executive will again reach out to you to confirm the card's details. They will also try to understand why you are getting your card cancelled.

The cardholder should cut the credit card in half diagonally after the cancellation process has commenced. They should also be warned that if they cancel or close their primary credit card, their add-on credit cards will be cancelled as well.

HDFC Credit Card Cancellation by Submitting a Written Request

Alternatively, you can also reach out to the branch manager of HDFC bank and ask him to get your card cancelled. You can do this by sending a credit card closure letter to the bank manager so that he can proceed to look into your request.

The letter must mandatorily contain your credit card number, full name and other relevant contact details. You can go to the bank and submit the letter in person.

Alternatively, you can also mail the letter to the Manager, HDFC Bank Credit Cards, PO Box 8654, Thiruvanmiyur, Chennai-600041 via post or a telegram. You must make sure that you mention all the relevant details related to the card that you want to get deactivated.

HDFC Credit Card Cancellation by Writing an Email

There are several ways of getting your HDFC credit card cancelled or deactivated. You can write an email to your HDFC branch to get your card cancelled. You can reach out to the branch on their email ID and drop them a mail with all the essential details about your card and yourself.

This will help the team understand the situation and trace back the relevant card that needs to be cancelled.

The personal information must be included in your full name, contact number and date of birth. Additionally, you can also mention your email address in the email body.

Important points to know when Closing HDFC Bank Credit Card.

It is pretty usual for a cardholder to raise a request to get their credit card deactivated or cancelled at any time. However, the cardholders must remember some things that must be checked before proceeding with the cancellation.

Before commencing the HDFC credit card cancellation process with the HDFC bank, the cardholder must go through the following checklist:

- Payment of the balance: You must be sure all outstanding balances or EMIs have been paid in full before cancelling a credit card. The bank notifies them by phone or email at the phone number or email address they provided if the cancellation process gets initiated without the clearance of all kinds of dues.

- Reward Points Redemption: Prior to asking for a credit card to be cancelled, cardholders should check the balance of reward points that have yet to be redeemed.

These points can be exchanged for fun and useful items from the bank's rewards catalogue. These points can also be redeemed for significant discounts on a variety of products. - It's best not to use your credit card right before you cancel: The bank will not proceed with the cancellation process if you use the credit card shortly before cancelling it.

The process is terminated when there are new dues on cards set to be cancelled. Only after the new debts are paid off will the bank proceed with the process. - Review for fraudulent use on the most recent statement: Before cancelling your HDFC credit card, double-check your most recent credit card statement to confirm there have been no fraudulent activities.

This is true if you cancel your card because you've misplaced it or if someone has stolen your HDFC credit card. You must destroy the card once the bank has terminated it owing to your request. - Deactivate automatic bill payment: There might be a possibility that you have an automatic payment option for your credit card. If the bank isn't aware of your cancellation request or you have a different bank for all your debit transactions, the payment might be made, and the deduction of funds might happen.

In this case, you might have to pay an additional amount from your pocket. Therefore, make sure that you disable the auto payment option for your credit card. - Get a written confirmation: You need to take in writing from the HDFC bank that your card has been deactivated. In many cases, there might be a possibility that the request was raised, but the cancellation was discontinued due to a lack of a piece of information or pending payment.

Therefore, you must ensure that you get it in writing over an email or an SMS that the card has been deactivated.

Does a Cancelled or Closed Credit Card Affect the Cardholder’s CIBIL Score?

If you have multiple credit cards and use them all, having one of them cancelled or closed will only hurt your CIBIL score. In this case, it would result in a lower credit limit and a higher credit utilisation percentage. Your CIBIL score may suffer as a result.

However, because credit cards play a primary role in establishing credit from the ground up, cancelling one may not be the greatest option if you have numerous cards and utilise them all.

You can choose to discontinue using a specific card. In this situation, though, you will be responsible for the card's yearly fees. You can call HDFC bank's customer service to find out the appropriate course of action in these scenarios. They may suggest that you close all of your cards.

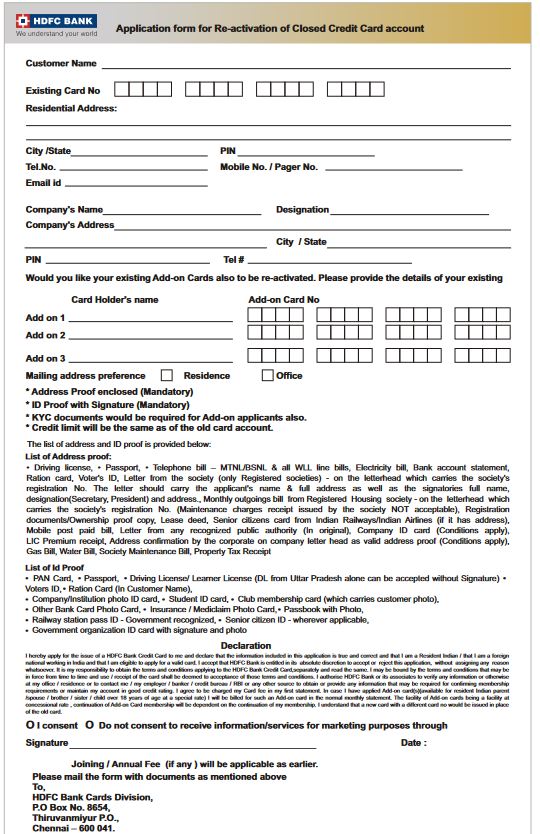

How to Reactivate a Closed or Cancelled HDFC Credit Card?

Yes! You can reactivate your HDFC credit card even if you get it closed. You need to fill the reactivation form for the HDFC credit card. The reactivation application form can be downloaded from www.hdfcbank.com.

You can also mail it to HDFC Bank Cards Division, PO Box 8654, Thiruvanmiyur, Chennai-600041, about the reactivation. They will raise a request and process it any further. The bank will revive the cancelled card once all applicable documentation and verification have been completed.

Frequently Asked Questions

1. Is there any way to cancel my HDFC credit card?

There are about four to five different cancellations of your HDFC credit card. You can either reach out to the customer care of the HDFC bank or write to their manager posted at the head office in Chennai.

Alternatively, you can also drop in a mail at the HDFC"s official email ID highlighting the issue and providing them with the necessary card and personal details.

2. Will closing a credit card come with additional charges?

There will be no additional charges involved if you decide to close or deactivate your HDFC credit card. However, if you have any residual dues attached to the card, you need to pay them off before closing your card. If you fail to do so, the card cancellation process will halt.

3. How to cancel HDFC credit card online?

You can write an email to your HDFC bank branch manager requesting him to close your HDFC credit card. It would be best to mention why you want to close your HDFC credit card.

Apart from that, you will also have to provide the basic details related to the card like the card number, Expiration date, etc. Do not give out information such as your CVV or your pin over the email. You will also have to disclose your personal information like your full name, date of birth, etc.

4.How can the HDFC credit card be deactivated?

There are several ways of deactivating a credit card. The easiest way is to reach out to the customer care of your respective bank and ask them to close the card for you. Provide them with the basic information, and they will process the card closing request.

5. What happens when a credit card is closed?

If you decide to close your credit card, you will no longer make any transactions using that particular card. It is suggested that once you get a confirmation that your card is closed, you should diagonally cut your card and dispose of it safely.

6. How can a credit card be closed without hurting credit?

If you have multiple credit cards and they are all in use, closing them will only hurt your credit score. Credit card cancellation in this situation can badly impact your credit score because it raises your credit limit and your credit utilisation score.

It's advisable to cancel the one you just obtained or maybe the card with the lowest credit limit first if you want to shut your credit card. It's advisable to pay off all of your debts before requesting to close your credit card, as only then can your request be completed.