Want to know how to check pf balance? Well you have landed on the right article!

Employees at the time of retiring receive many benefits, and the Provident Fund (PF) is one of them. To take advantage of the retirement benefits, both the employee and the employer must contribute a minimum of 12% of the employee’s basic income.

The money raised in this way will be invested in some safe assets. The employee’s account is also credited with an interest rate of 8.50 percent (current year interest rate). As a result, when an employee retires, he receives a lump sum payment.

The credit balance in a provident fund account of an employee comprises the employee’s contribution, interest on the employee’s contribution, employer’s contribution, interest on the employer’s contribution.

One may feel static with provident fund contributions, as people will only see the benefit after getting retired. But did you know?

As a taxpayer, you are eligible to avail of deduction on these contributions towards the PF account. Every year, taxpayers who fall under the realm of prescribed income limits to pay the tax with their applicable slab rate can claim deductions as per the Income Tax Act, 1961 under the head of 80C.

This reduces the burden of the taxpayer and encourages every citizen to pay tax promptly. Other benefits of a Provident Fund include pension schemes, loan schemes, partial withdrawal, and insurance policies.

And with interest accumulated into the PF accounts, the employees who start with small savings will have a pack of wealth in the long run. In times of emergencies, the members can withdraw their PF account money partially even before retiring

Although this option can only be availed if the employee meets the eligibility criteria and satisfies the prescribed reasons. A loan can also be taken against the PF funds. Checking PF balance has become easy with technology, eliminating a lot of paperwork.

Now, you can check your balance in various ways—you can check epf online, via SMS from your registered mobile number, by giving a single missed call, and through the UMANG or the EPFO app. By using any of the aforementioned methods, a retired employee can check their EPF balance.

Different Methods on epf balance check:

As mentioned above, we have discussed the four methods that can be followed simply by all the members of the Employee Provident Fund Organization (EPFO) who want to access their PF accounts.

Step-By-Step Process of Four Methods on how to check pf balance online:

1. Check Your PF Balance Using EPFO Portal

EPFO portal is easily accessible by any employee. The EPFO portal provides services such as checking the status of their claims in the PF account, accessing their PF accounts, requesting withdrawals, and viewing or downloading passbooks.

With the registered UAN (Universal Account Number is a 12 digit unique number), employees can have all the details of their PF account at their fingertips.

UAN remains unchanged until the employee retires (Even if the employee switches the job, he or she can open a new PF account with the old number of UAN). This unique number is essential to process any service in the EPFO portal.

PF balance check with uan number :

Once the employer has activated the UAN number, employees can follow the below steps to arrive at the EPFO portal. Make sure that your device is connected to a strong network while navigating through the portal.

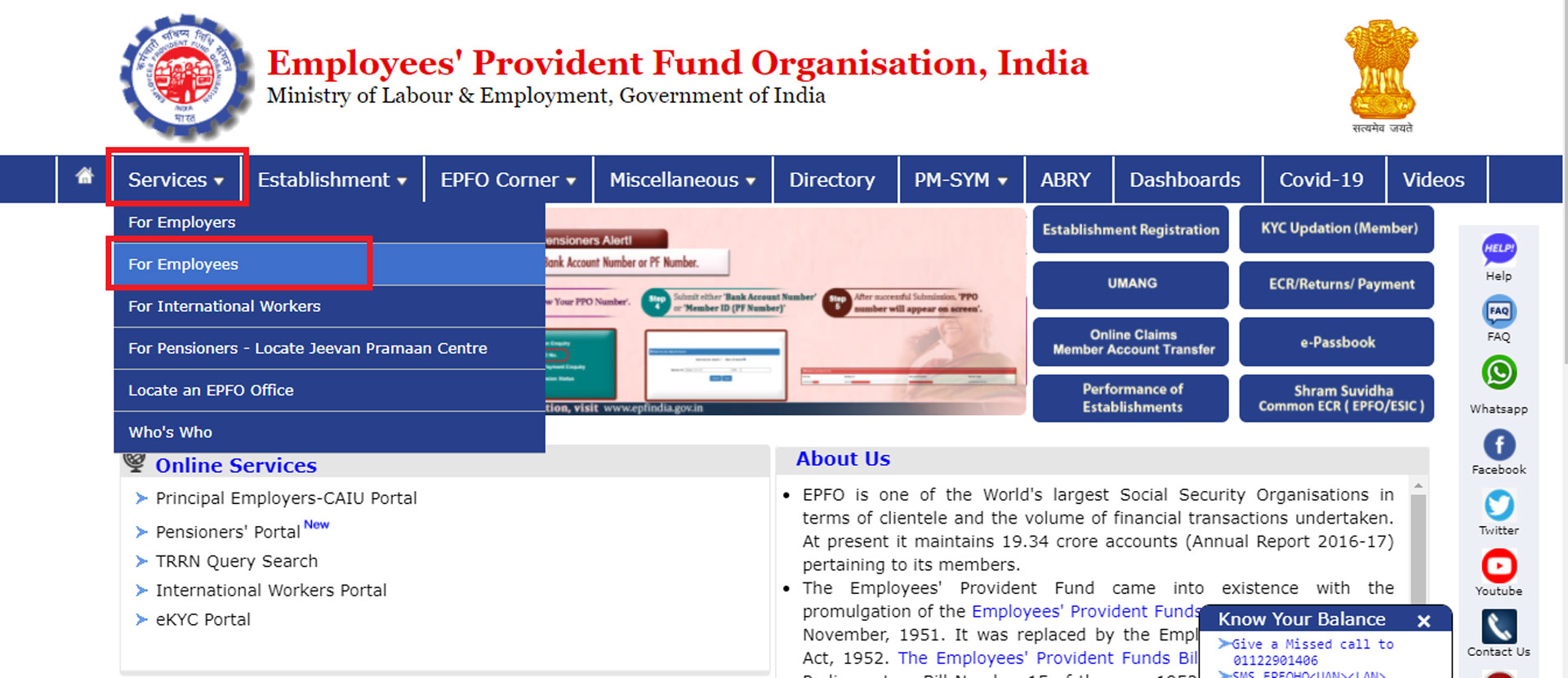

Step 1: Employees can visit the official website of the portal through the official link and they can find the Services Bar on the top panel.

Step 2: By clicking on the Services Bar, the employees will find the “For Employees” option in the drop-down menu and click on that.

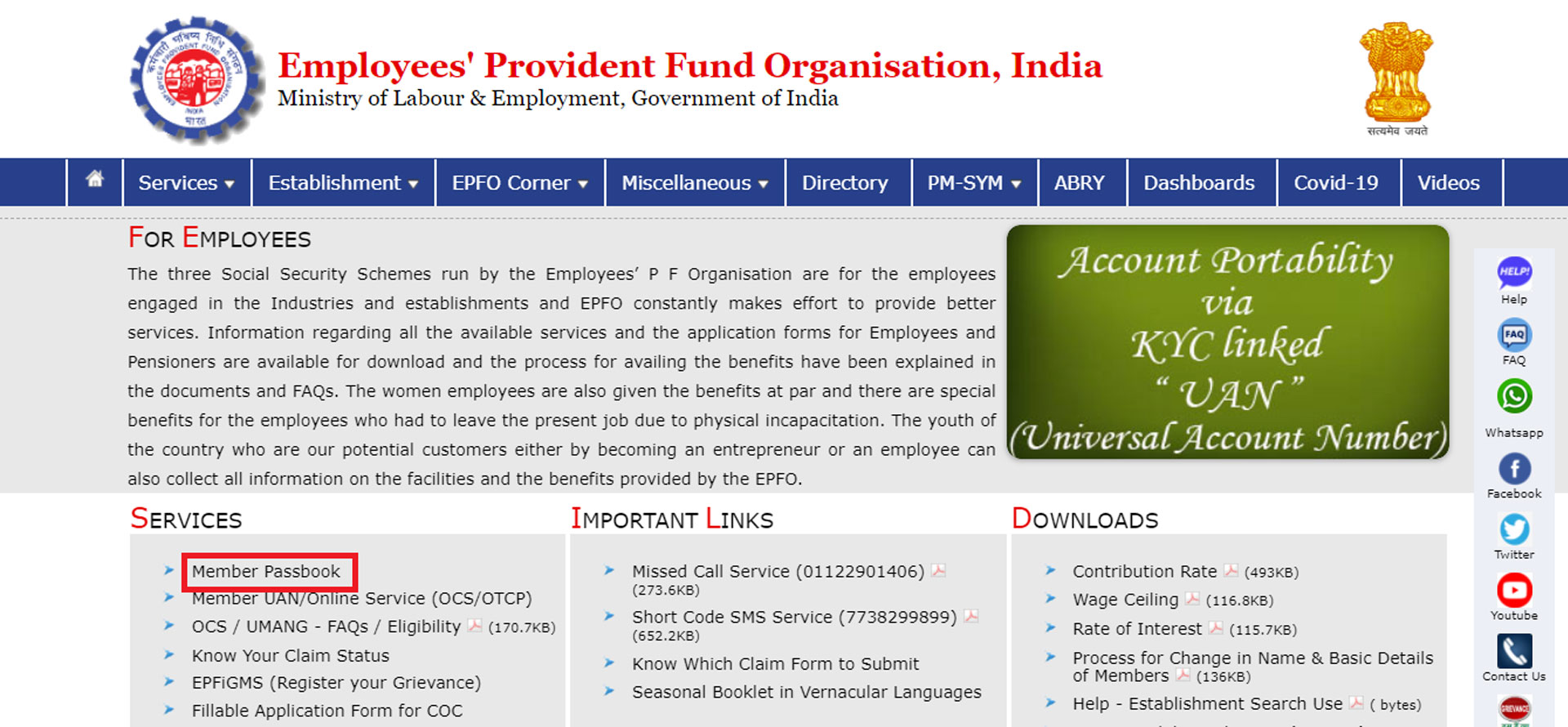

Step 3: Now, on the next page, employees can find the “Member Passbook” option under the column of “Services”. Click on that.

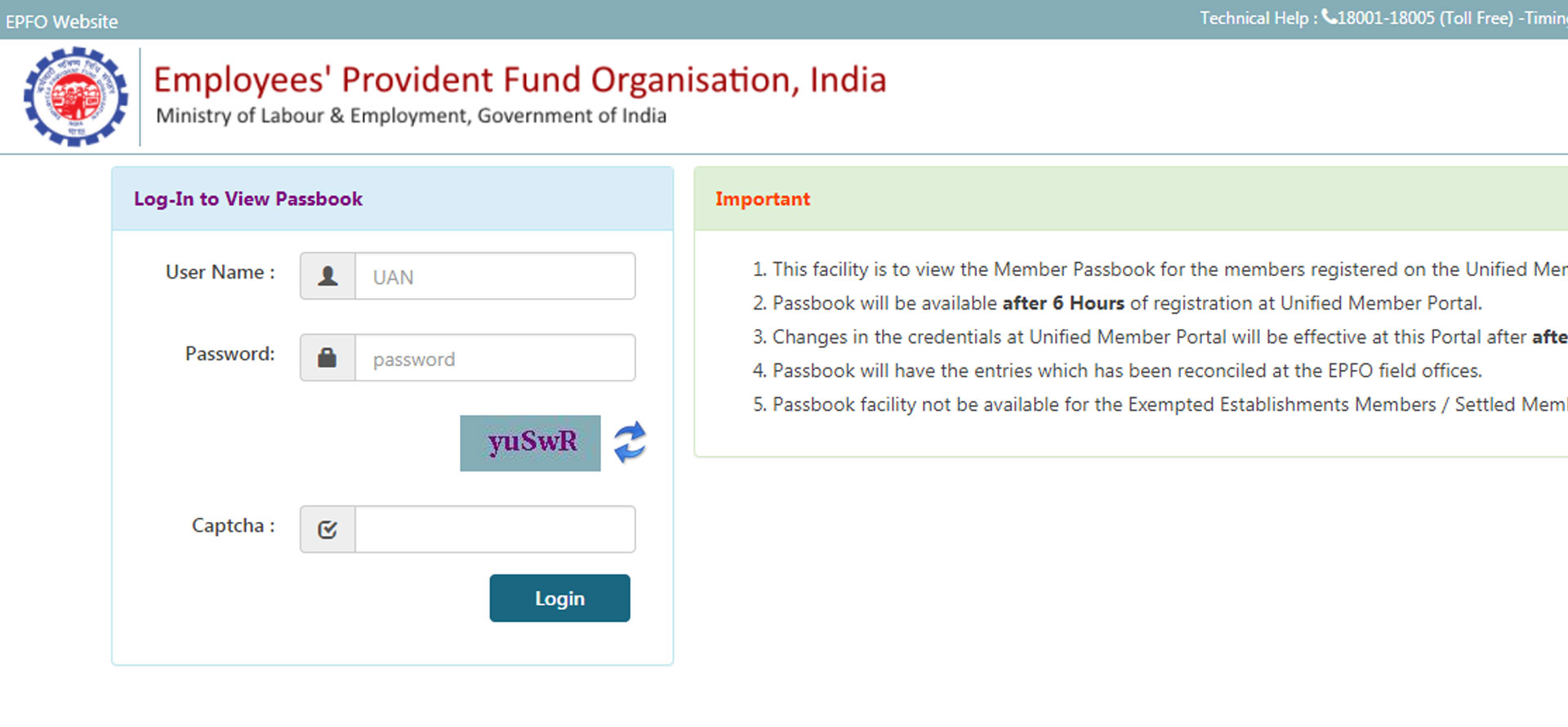

Step 4: Next, it will take you to a Login page, where employees have to enter their login details, i.e., UAN number, password, and captcha code.

Step 5: Once logged in to the facility, the employee can access their EPF account, view and download the statement with the respective membership ID.

2. Check Your PF Balance by Sending an SMS

Employees can check their PF balance with just one click through an SMS. The steps to send an SMS:

1: Type the message format: EPFOHO UAN ENG

2: Send the above message to 7738299899 from your registered mobile number.

You have a wide range of language preferences to select and send the SMS. Hindi, Telugu, Punjabi, Gujarati, Marathi, Malayalam, Tamil, Kannada, and Bengali are the additional languages available.

Only the first three characters of your choice language following UAN are to be entered into the SMS. If your preferred language is Telugu, type “EPFOHO UAN TEL”; if it is Hindi, type “EPFOHO UAN HIN” and respectively, to receive updates regarding PF balance in your language.

SMS facility is available 24/7. Employees can send an SMS at any time of the day. And Initial users are required to provide details by logging into the EPFO portal.

3. Check Your PF Balance By a Missed Call

The employees can check their PF balance just by calling the authorized number of EPFO from their registered phone number. Before calling, ensure the employer has integrated UAN with KYC details such as Permanent Account Number (PAN), Aadhaar, and Bank account number.

The call service can be availed upon linking them with your UAN. In case it is not linked, you can ask your employer to get this work done. Once an employee’s UAN has been linked, they can make a missed call from their registered mobile phone to 011-22901406.

Then the system, on the other hand, reads all your information and gathers every detail about your PF account. After that, the employee will be sent an SMS providing details of the PF balance immediately to their registered mobile number.

4. Check PF Balance Using UMANG/EPFO App

UMANG (Unified Mobile Application For New-age Governance) is available on the Google Play Store and as well as on the Apple Store.

This mobile application serves all the services such as checking PF balance, checking the status of other claims, tracking your account, general services, pension services, and all other services in one place.

Steps to check PF balance in the app:

1. After installing the app, click on the EPFO option.

2. Then select the “Employee Centric Services” option.

3. It will navigate you through another screen where you will find options such as view passbook and track claim. Click on the “View Passbook” option.

The employee will be asked to enter their UAN and registered mobile number along with the One-Time Password (OTP).

After verifying your details, the system will direct you to your dashboard to view your PF balance. You can view transactions, perform withdrawals, and deposit into the account.

Exempted Establishments or Private Trusts EPF Balance Check

In some cases, when employees try to check their PF balance through the Employees’ Provident Fund Organization Portal, they may witness errors displayed on their screen.

This kind of error shows that their Provident Fund money is with their employer or company and not with the Employees’ Provident Fund Organization (EPFO).

The companies who have permission from EPFO to manage their own money, those companies are known as “exempted establishments/private trusts”.

There are a few big companies, such as TCS, Infosys, WIPRO, HDFC, that don’t deposit PF money with Employees’ Provident Fund Organization. Instead, they manage it on their own under the supervision of EPFO.

EPFO allows big companies to manage the PF money on their own. The rules that apply to the normal PF shall also apply to the Provident Fund accounts with exempted establishments/private trusts.

The same rate of interest on funds applies but an employee cannot view their passbook online, i.e., at the EPFO portal, because the Employees’ Provident Fund Organization makes and manages the passbook.

Since passbooks are completely made and managed by the EPFO, the PF accounts with exempted establishments are not provided to view or perform any other activity via the EPFO portal.

Here, the employee cannot check his EPF balance through the EPFO portal, but the employee can check directly with his company.

Employees can simply have to contact their HR because here it is HR’s responsibility to give every other information about their PF account and at the time of withdrawal, the employees must approach HR to claim their accumulated amount along with interest.

Employees can check their PF balance in four simple ways, as mentioned below.

1. Check On The Payslip or PF Slip:

The companies (exempted establishments) that maintain PF money on their own give PF slip along with the salary slip. That slip has all the details of such employees’ contributions towards the provident fund account and can find their balance on the slip.

Some companies provide salary slips through emails where they can check their EPF contribution and EPF balance.

2. Check Through Company’s Employee Portal

Employee portals are built to bring all the employers and employees to one place and under one head. Various big companies have an employer portal.

If employees’ PF accounts are falling under exempted establishments, they can visit the employer portal of their company and visit the EPF section, which provides an pf online statement and information of their PF account balance.

3. Contact And Check With HR

You may approach your HR if you have failed to check your balance using the above two methods. HR maintains the PF balances. In this event, an employee can contact the HR department to provide details associated with the employee’s account.

4. Trace Back Your Contributions

Apart from tax deductions at the source (TDS), an employee contributes the prescribed percentage of the amount to the PF from his salary. Although tax is paid directly to the Government, employees may still be able to check their TDS details while filing tax.

But with PF contributions, the employee can calculate their balance by combining their contribution amount mentioned on the payslip along with the employer's contribution.

The combined amount is the balance in your PF account. It is that simple to compute the annual EPF balance by keeping track of your contributions.

In this way, the employees can track their monthly contributions towards PF accounts taken from their monthly salary amount and can calculate to find the balance without having to access the EPFO portal or ask their HR.

EPF Balance For Inoperative Accounts

PF accounts are dormant or inoperative for certain reasons, and the reasons are stated below.

- If the money is stagnant and kept in the PF account for over 3 years.

- When the claim of the PF account is unsettled or not filed before 35 months of the PF account holder's death.

- When the contribution has been nil from both employer and employee towards the PF account.

- The PF account money is not settled even after a claim is made by the employer to the employee.

- The PF amount is settled and processed the transaction, but the employee at the other end failed to receive or has not been able to claim the amount.

Source: EPF Guide

The PF accounts become inactive due to two prime reasons; one is employees ignoring the old PF accounts while switching jobs and considering opening new accounts.

The second is a communication gap between former and current employers while contributing a large amount to the account. All these consequences are because of the tiring process of EPF transfers.

Now comes the question of how to check the balance of such inoperative accounts. Many employees forget to claim their PF account amount and in that void, their accounts remain as inoperative.

If you fall under any of the above categories where your PF account has ended up as inoperative, you have a help desk provided by the Employees’ Provident Fund Organization that eradicates such circumstances among dormant PF account holders.

Although EPFO has stated that they don’t pay any interest on these inoperative accounts, from 2016, the inoperative accounts will continue to receive the interest amount accrued into the PF account.

EPFO had not paid interest from 2011 on such dormant accounts, but paying interest became effective after the Government had issued an official notification in November 2016.

The helpdesk by Employees Provident Fund Organization will assist such inoperative PF account holders in this situation. Employees can reach to EPFO help desk to check their PF balance.

To reach out to the EPFO help desk, just simply type out these keywords— "EPFO help desk" in the search bar of any search engine. It will redirect you to the official page of EPFO.

Recently EPFO has also rolled out the calling service. You can directly call their toll-free number 1800118005. By calling this number, you can inquire about your PF balance or resolve any issues. You can also write to them through their official email address displayed on the website.

Conclusion

The guide has briefed about the Employee Provident Fund or Provident fund; it is equally contributed by employer and employee towards a government scheme where this accumulated amount can be withdrawn at the time of retirement along with the interest amount.

We have seen four ways to check the balance of a PF account: via the EPFO (Employee Provident Fund Organization) website, via an SMS, by giving a missed call from the registered mobile number

And finally, through the UMANG app, which was developed by the ministry of electronics and information technology to provide new-age governance. Members can check, withdraw, and use other services through this app.

We have also seen how to check the EPF balance of exempted establishments in four simple ways, i.e., by checking the balance on the payslip or salary slip, checking through the company’s employee portal, by contacting the HR department

And also by tracking our contributions and calculating it by combining along with the employer’s contribution. Members of dormant accounts can also check their PF balance.

We have briefed that as well. With the new rolled out calling service, the employees of inoperative accounts can call the Employee's Provident Fund Organization official toll-free and get informed about their PF balance.

It is important to get acquainted with this crucial information so that we don’t get stuck at crossroads when we encounter one of the above situations in the future.

In the short term, the members of the PF account may not discover the benefits, but in the long run, the Employee Provident Fund scheme increases the purchasing power of the employee.

In the online mode, all paperwork has been eliminated, and the employees only need their time to check their balance. With this guide, the employees can forget about depending on firms that charge money, even for checking the PF balance.

They can also keep track of their contributions monthly during your course of employment and not wait until retirement age to get through all the procedures to lay hands-on the funds.

I hope you liked our article on epf balance check, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

Q1. Can an employee check his previous organization’s accumulated EPF balance?

Answer: Yes, an employee can check the EPF balance of their previous organization. The employee does not have to wait for their previous employer to issue the PF balance statement.

An employee with the details of their UAN number and password can log into the portal of EPFO and check the PF balance by verifying their previous organization’s Membership ID. The employee can find their previous organization’s Membership ID linked to the UAN on the EPFO portal itself.

Q2. Is it possible to check the PF balance using only the PAN card number?

Answer: No, you can’t check your PF balance with a PAN number. But it is essential to have your PAN number linked with UAN to have access to the EPFO portal, wherein you enter the details of UAN to log into the portal, and from there, you are directed to view your PF balance.

Q3. Can employees check their PF balance using only the Aadhaar number?

Answer: An employee can use the online pf check service by online EPFO portal or can give a missed call, or send an SMS, or use the UMANG app to check the EPF balance. However, the employee cannot check the EPF balance only with an Aadhaar number. The Aadhaar number must be linked to the UAN to avail of the services of the EPFO portal.

Q4. Can we check our PF balance via SMS even if that number is not linked with UAN?

Answer: Members willing to check their PF balance via sending an SMS have to mandatorily register a mobile number and get integrated with the UAN (Universal Account Number) with the help of their employers.

When an SMS in the prescribed format is sent by the member, the details revealing the balance of EPF will be sent back to the registered mobile number. To send the SMS, you must use the registered mobile number. So, it is not possible to receive SMS without linking the mobile number to the UAN.

Q5. Is it possible to check our EPF balance solely by using our PF number?

Answer: No, you cannot check your EPF balance solely by using your PF number. EPF members should have their UAN details to access their accounts and check their balances on the EPFO portal.

The PF number comprises 22 digits. The PF number is structured in such a way that it provides significant information about a PF account.

The first two letters represent the area code, the following three letters represent the office code, the next seven numbers represent the employer's PF registration code, the zeroes represent the establishment extension, and the final seven digits represent the employee's PF ID.