Want to know how to download form 16 Online & Offline? Well you have landed on the right article.

Firms utilize Form 16 to provide tax deduction information to their employees. Form 16 serves as documentation that your employer has filed your income tax returns with the authorities.

The employer must deduct TDS from your salary and remit it to the government if your income exceeds the tax exemption threshold, for example.

If your pay income falls below the tax exemption limit, the company will not deduct any TDS.

If your employer gives you a Form 16, it signifies that they have already submitted your tax returns for the year in question. The form can also be used as a TDS certificate for your salary.

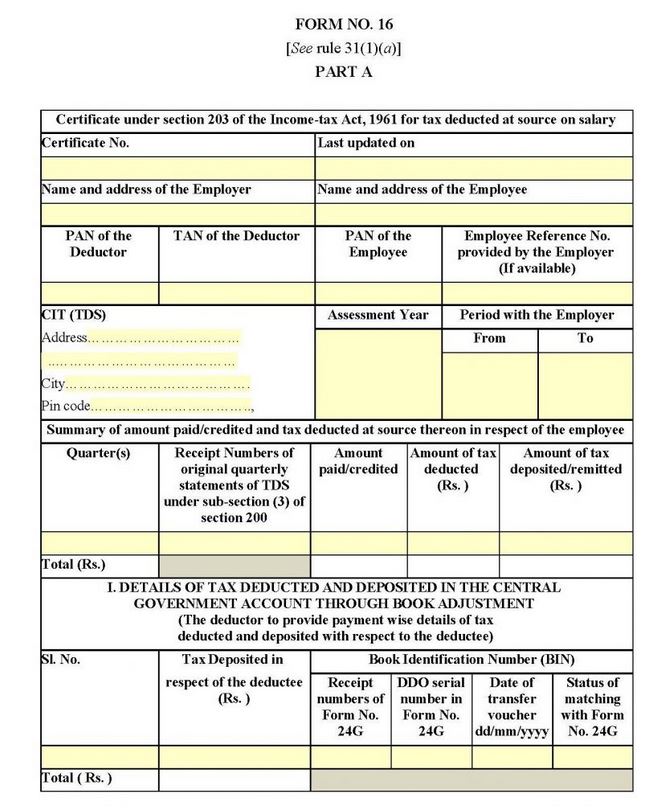

According to Form 16, an employee's total earnings for the year and TDS amount deducted are documented. You must fill out both parts A and B to fill out the form.

The PAN, TAN, name, address, TDS deducted, and other details of the employee and employer are contained in section A. Part B includes information on other sources of income, deductions, taxes due, and wages received. Every year, on or before June 15th, the employer normally issues the form.

In this article, we have covered detailed guide on how to get form 16 online.

how to download form 16

Important Components of Form 16

Part A of Form 16:

The employer's PAN and TAN numbers, quarterly TDS deposit and deduction details, and other information are listed in Part A of Form 16.

If you change jobs within the same fiscal year, you should be aware that each employer will issue a separate Form 16 Part A for the time you worked there. Part A includes the following elements:

- Details about the employer, such as name and address

- The employer's TAN and PAN,

- The employee's personal identification number (PAN)

- The employer's certification of the amount (summary) of taxes withheld and deposited each quarter.

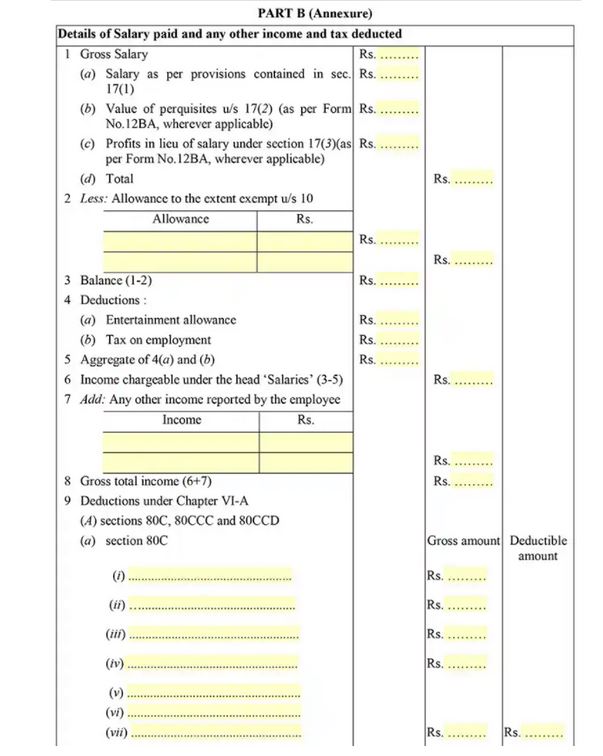

- Part B of Form 16:

An annexure to Part A of Form 16 is Part B. Part B, which the employer is responsible for preparing for its employees, comprises information on the salary and deductions permitted under Chapter VI-A.

Take Form 16 from both employers if you switch jobs during a fiscal year. In addition, part B has several new components that have been made public, including:

- A detailed breakdown of salary

- Exempted allowances under Section 10

- Deductions permitted by the IT ACT (under section VIA)

The following is the list of deductions:

- Section 80C of the IT ACT provides a deduction for life insurance premiums, contributions to the PPF, etc.

- Contributions to pension funds can be deducted under Section 80CCC.

- Section 80CCD(1) allows for a deduction for contributions made by employees to a pension plan.

- Section 80CCD(2) allows for a deduction for taxpayers' own contributions to a notified pension plan (1B).

- Section 80CCD (2) allows for a tax break for employers who make pension contributions on behalf of their employees.

- A deduction under Section 80D for health insurance premiums paid.

- Deduction on Interest paid on loan for higher study is under Section 80E.

- Donations under Section 80G are eligible for a tax deduction as charitable contributions.

- Under Section 80TTA, Interest earned on a savings account is subject to deduction.

- Tax benefit under section 89.

how to download form 16 using pan number

The following is a step-by-step guide on how to get a copy of Form 16 from the IRS's official website:

1st step: Log on to the IRS's TRACES website.

2nd step: To begin, you'll need to enter your User ID, Password, and Personal Identification Number (PAN).

3rd step: Select 'Form 16' from the 'Downloads' page after logging in.

4th step: Decide on the year you want to be assessed (assessment year).

5th step: Double-check the name and PAN information.

6th step: The TDS receipt number must be entered.

7th step: Add the total tax collected and deducted up to the TDS date.

8th step: Fill out and submit Form 16.

9th step: Click on the 'Downloads' tab and select the 'Requested Downloads' option.

10th step: Download the files in HTTP or PDF format when the Form 16 Part A and Part B status changes to 'Available.'

How to fill form 16

There are a few things to keep in mind when filling out the Form 16A, such as:

1st step: If you have a PIN for the deductor, make sure to include it when you enter their name and address.

2nd step: Fill out the Deductor's TAN (In this case, the first four digits are represented by letters, while the latter five are represented by numbers, with the last digit being represented by an alphabet).

3rd step: Fill in the Deductor's PAN, an alphanumeric number with the first four digits in alphabets, the following five digits in digits, and the final one in alphabets.

4rth step: Acknowledgement numbers 4 and 5 must be entered here.

5th step: The next thing is the type of payment, such as a contractual payment or a professional payment, for example.

6th step: Enter the relevant codes for each of the above-mentioned payments.

7th step: The deductee's name should be included.

8th step: The deductee's PAN number (whose TDS has been deducted) must be entered in the column PAN no. of the deductee.

9th step: The financial year will be entered in the Form's period field. For the sake of illustration, let's take the example of April 1st, 2020 - March 31st, 2021, for the current fiscal year.

10th step: To finish the form, you'll need to enter the TDS deduction information.

11th step: The amount of TDS that is stated verbally.

Ways to fill Form 16B

1st step: Gross Salary — Your total remuneration, including any benefits and allowances that you get, less any deductions.

2nd step: Rent allowance, travel allowance, and other perks provided by your work are examples of "allowances."

3rd step: Employer-provided deductions and allowances are not included in the total income that can be taxed.

4rth step: Total gross income – The ultimate pay amount on which taxes will be computed is derived by adding any other income provided by the employee.

5th step: All relevant deductions under Sections 80C, CCC, CCD, D, E, and G of Chapter VI-A

6th step:

Deduction Aggregation - All deductions are tallied, and the total amount to be deducted is determined.

7th step: Total Earnings - This is where the ultimate revenue is subtracted from all relevant tax deductions and exemptions.

8th step: As a result of the tax brackets and rates, the total amount of tax to be paid is determined.

9th step: Education An additional 3% educational tax surcharge has been applied to the Cess.

10th step: Tax Due - The sum of all taxes owed. Under Section 89, any reliefs that have been requested and provided can be adjusted here.

11th step: Tax Payable - Amount of final tax due by the employee, from which the employer deducts TDS.

12th step: You agree to the TDS and sign a verification form.

Types of Form 16

Three forms of Form 16 are available: Form 16, Form 16A, and Form 16B, which are all certificates of income tax withheld at the source of the income. Part A and Part B make up the second half of the Form 16 form. Form 16A and Form 16B are not the same as Form 16 Part A and B.

Explaining Different Parts of Form 16:

- Form 16 A:

TDS Certificates are also known as Form 16A. It is used for tax withheld at source on income that is not salary. Form 16 A has detailed information on how taxes are deducted from sources other than wages. In addition to the data on Form 16A, there is information on Form 26AS.

When a bank deducts tax from your interest on fixed deposits, insurance commission, or rent receipts, you'll receive a Form 16A. Form 26AS has the same information as Form 16A. Suppose no tax has been deducted at the point of sale? Does the employer still require form 16?

The employer does not need to issue Form 16 if no tax has been deducted. However, to complete your tax returns, you can still ask your employer to provide you with Part B of Form 16.

- Form 16 B:

Form 16B is typically a TDS certificate issued to a seller by a buyer, i.e., a deductor. Taxpayers can use it to confirm how much tax was deducted at the purchase of a property.

Taxes are deducted from paychecks and sent to the deductor, who deposits the money with the IRS. TDS deducted on the sale of a property is detailed in Form 16B, which is a certificate.

According to Section 194-IA of the ITA, TDS on immovable property is covered. But, on the other hand, TDS does not apply to agricultural and immovable properties that are sold for less than Rs.50 million.

To comply with Section 194 of the Income Tax Act, buyers must deduct a TDS of one percent from the amount they receive. In addition, the buyer must issue Form 16B income tax to the seller in question once the tax amount has been deposited with the IT Department.

Unlike Form 16, which is a TDS certificate for salary, and Form 16A, which is a TDS certificate for non-salary income, this form validates the TDS applicable to the sale profits of the property.

Difference between Form 16, Form 16A and Form 16B:

While preparing their Individual Tax Return (ITR), employees need to submit Form 16, Form 16A, and Form 16B. Although there are many differences across the forms, there are also many similarities. Specifically, we'll look at the following distinctions between Form 16 and its variants:

Form 16 | Form 16A | Form 16B |

A TDS certificate sent to employees to show how much money they've earned from their salaries. | For employees with income other than the salary of the company's president, this TDS certificate is required. | A tax deducted at source (TDS) certificate for property sale proceeds |

Only applicable to salaried income that is earned by salaried workers | Interest, dividends, commissions, mutual fund income, and so on all fall under this category. For salaried personnel, the frequent assumption is that Form 16A is required. | Income from the sale of a building or piece of land is covered by this rule (other than agricultural land) |

Issued to a person by their employer as proof of legal TDS | It is issued by a financial institution or individual who deducts taxes from income other than salary. | TDS applicable on sale is verified with this document, which is provided to the seller by the deductor (the buyer of land or property). |

Published once a year (annually) | Published every three months (quarterly) or once a year. | Issued according to the volume of business |

Applicable for those who make more than 2.5 lakh per year | Those who earn more than a specific amount but do not receive a wage are eligible under this. | Each transaction that surpasses 50 lakh is eligible for this. |

Benefits of Form 16:

- Individuals can use an ITR to their advantage when applying for a car loan or any other type of financial assistance. All major banks can request tax returns.

Additionally, if your loan application is rejected or you do not receive as many loans as you desire, you can provide a copy of your ITR receipts. - Without filing your returns, you will be unable to use any of the year's capital losses to offset any following year's capital gains. The year in which a long-term capital loss is made can be carried forward for up to eight successive years.

Only the year's long-term capital gain or loss can be used to offset a long-term capital loss. However, a short-term loss of capital might be offset by a long-term gain in the capital. - To apply for a government tender, one must show their tax return receipts from the preceding five years. This is according to experts. This process is another way to verify your financial situation and determine whether or not you can meet your payment responsibilities.

- Form 16 is not given to businessmen, consultants, or partners of companies. As a result, if their annual income exceeds Rs 2.50 Lakh, ITR receipts become even more crucial. To prove their income and tax payments, self-employed individuals simply need their ITR receipts

Where is Form 16 Used For?

Form 16 aids in filing an Individual Tax Return (ITR) since it contains information about an individual's pay and tax exemptions that can be quickly accessed. Part A And Part B make up the TDS certificate. Remember that the TRACES logo should appear on both parts.

Is Form 16 mandatory?

When a company deducts TDS from an employee's salary, they must provide the employee with a Form 16.

Form 16 is a tax document that shows all the revenue earned and TDS withheld for the financial year. Using Form 16 makes it easier for salaried employees who don't have any other sources of income to file an ITR or income tax return.

Conclusion

So, is Form 16 essential? Form 16 is a proof of income or a "statement of income from salary" provided to various government agencies upon request. As a means of submitting an ITR (Income Tax Return)

proving one's income, and verifying one's tax liability, this document can also serve as a means of verifying tax-saving investments, assessing and approving loans, issuing visas,

as well as aiding an employer in determining their tax liabilities and what deductions their previous employer has made when changing jobs. As a result, any working professionals need to submit their Form 16 to bring several benefits.

I hope you liked our article on how to download form 16 for salaried employees, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

1. When are the due dates for the issuance of the Form 16 and Form 16A certificates?

According to a news statement issued by the Ministry of Finance, the deadline for filing Form 16 was extended to July 31, 2021, from the prior deadline of July 15, 2021. As a result, employees will be unable to complete their tax computations until after receiving their Form 16.

Because most taxpayers can only finalize their income tax returns and ITRs once they receive their Form 16, this would give them precisely two months to file. This year's ITR filing date is September 30, 2021, for the FY2020-21 fiscal year.

2. Can I get a duplicate Form 16 certificate if I misplace the original one?

Please request a copy of your Form 16 from your employer if you lose it. The employer has the authority to issue a duplicate Form 16 on plain paper with the word "Duplicate" prominently placed on the form if you've misplaced it.

3. Can I download my Form 16 certificate without enrolling myself in the TRACES website?

To download your Form 16 and Form 16A, you must be a registered user on the TRACES website.

4. How is the Form 16 generated?

Enter your User ID and Password, as well as the Taxpayer Identification Number (TAN) of the deductor and login to the TRACES website. You can automate the process of importing data from

TRACES into Form 16 Part A and then automatically creating and merging that data into Form 16 Part B before sending it to the employee or deductee.