Want to know coindcx vs wazirx "Which is better ?" Well, you have landed on the right article! How do we describe the money we can’t touch? We might say it's our debit card, visa card or credit card right!

Now, what if we had money that we couldn't touch, that isn’t controlled by anyone, and that could be worth whatever we decide? No idea? Well, the answer is cryptocurrencies. So, what is a cryptocurrency? Well, it is neither a credit card or a debit card or even cash.

There is no power or finance to back it up. So, what exactly is it? Cryptocurrencies are digital currencies that are decentralised. This means, as previously stated, that they are not guaranteed by any bank or government agency.

They do, however, follow a set of guidelines. It can exist outside of the traditional financial system; it instead exists within a computer network.

So, we have given below a comparison between CoinDCX vs WazirX with respect to factors such as trading costs, security, trading platform, and support.

You can download Wazirx from the link below and earn cashbacks on your first trade

You can download Coindcx from the link below and earn rewards on your first trade

Also Read :

A Detailed Comparison of wazirx vs coindcx

In India, cryptocurrency is in its infancy but is witnessing strong growth in a short duration. Users are searching for simple ways to trade and invest in cryptocurrencies, which is why new cryptocurrency exchanges are popping up everywhere.

Among them, two cryptocurrency exchanges stand out from the rest: WazirX and CoinDCX. Both these exchanges were founded in the year 2018 and are now two of the most well-known, trustworthy and user-friendly cryptocurrency exchanges in India.

Both these platforms allow the users to purchase cryptocurrencies and sell them directly in INR. Although they have many similarities, one should take note of the several distinctions between them before beginning their trading journey.

Overview Of WazirX

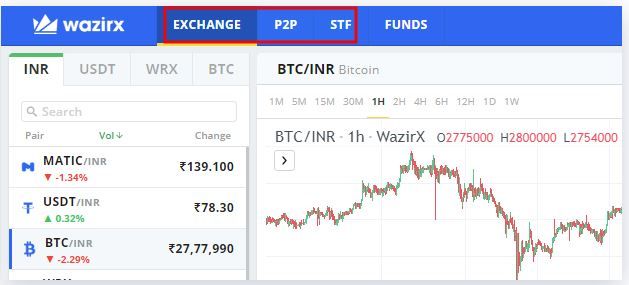

WazirX is a cryptocurrency exchange based in Mumbai, India, and has the biggest daily crypto trading volume of over $104 million. It was acquired by Binance, the world's largest cryptocurrency exchange, on November 21, 2019.

WazirX has many perks and features to offer for its users. WazirX P2P boasts of the world's first auto-matching P2P engine that offers a unique solution to bridge the gap between the world currently run by fiat currency and the ever-evolving cryptocurrency.

The WazirX token, often known as WRX coins, is the company's native crypto asset. It was created to suitably compensate the WazirX community for their efforts in bringing it up.

WazirX was initially only available to Indian crypto investors, but on March 27, 2019, they expanded their reach to include crypto traders worldwide. WazirX’s online interface can be accessed through PCs and smartphone apps.

WazirX offers a diverse selection of cryptocurrencies. When writing this article, it supported over 90 coins, including ETH, BTC, USDT, DOGE, COTI, ETC, LUNA, and DENT.

These coins can be traded against INR, eliminating the need to convert them into USDT or USD at the time of liquidity.

WazirX also supports crypto-WRX, crypto-USDT, and crypto-BTC contracts in addition to crypto-INR contracts. It has a 24-hour spot trading volume of about USD 43 million, thus, ranking it 30th among crypto exchanges worldwide.

Wazirx also has a referral program through which you can earn 50% of your friend's trading , you can check the full details here :

Wazirx Referral Code

Overview Of CoinDCX

CoinDCX is currently among the top 50 crypto exchanges in the world, according to Coinmarketcap (a global website that records cryptocurrency prices and statistics).

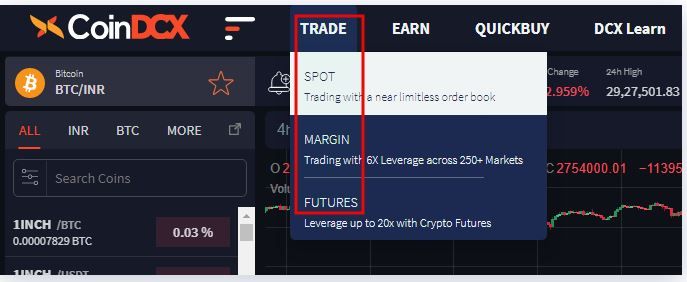

It supports over 40 cryptocurrencies, including well-known coins like BTC and ETH to lesser-known coins like AAVE, CHR, and BAT. It provides three trading options:

- Spot Trading: This option supports the trading of crypto assets against BTC, INR, ETH, USDT, BNB, USDC, BUSD, XRP, TUSD, TRX, and DAI.

- Margin Trading: This option allows a 6x margin to trade cryptocurrencies.

- Futures Trading: This trading allows OE and BM BTC futures with USDT and USD settlements up to 20x.

CoinDCX has the 52nd-highest 24-hour spot trading volume of about USD 19 million. Coindcx's referral program allows you to earn rewards from the first trade made by your friend , for more details click here -> Coindcx Referral Code

CoinDCX vs WazirX

Here are some of the aspects on which both crypto exchanges differ.

1. Profile of Founders

CoinDCX was founded by Sumit Gupta and is owned by Primestack Pte Limited. They've teamed up with DCX, a Singapore-based startup that specialises in crypto-enabled financial services. CoinDCX is a cryptocurrency exchange based in Mumbai, India, that trades about $40 million worth of cryptocurrency every day.

WazirX was founded by Nischal Shetty, who is a computer science graduate and the founder of several other firms, including Twi5 and Crowdfire. In 2014, he was listed among Forbes India's ‘30 Under 30’ entrepreneurs.

Conclusion: Both founders are experienced entrepreneurs with a wealth of knowledge in their respective domains.

2. Security Features

When you open a CoinDCX account, you must go through a KYC and bank verification to use its features. You can access your trading account with 2FA (Two-Factor Authentication) for added security.

CoinDCX keeps 95 percent of its cryptocurrency in cold wallets, i.e., currency is offline and not on the internet, and 5 percent in hot wallets.

This protects your cryptos against hacking. Furthermore, all cryptos traded on CoinDCX are insured by BitGo (a digital asset insurance company).

WazirX, on the other hand, conducts KYC and bank verification during the account opening process. To access your trading account and receive email or SMS alerts, you must go through the 2FA. WazirX keeps almost all of your money in offline cold storage, making it impenetrable to hackers.

Conclusion: CoinDCX’s security features have an advantage over WazirX as its customers’ funds are protected under the insurance policy of Bitgo.

3. Partners & Associates

The list of investors for CoinDCX includes Coinbase, Bain Capital Ventures, Bitmex, and Poly Chain.

WazirX was acquired by Binance, the world's largest cryptocurrency exchange.

Conclusion: WazirX has the advantage here because of its integration with Binance. If the government institutes a crypto ban, WazirX’s customers can immediately move their assets to Binance to protect them from loss.

4. Founders & Media Channels Access

CoinDCX media channels can be found on social media platforms such as Telegram, Twitter, YouTube, and Instagram.

WazirX’s presence can be found on Telegram, Facebook, and LinkedIn. WazirX also has a few other social media avenues through which their customers can contact them.

Conclusion: Wazirx or Coindcx both are backed by international corporations, are professionally managed, and have adequate security mechanisms in place to protect your funds. In general, the exchanges appear to be trustworthy.

5. Money Deposit & Withdrawal Ease

Both WazirX and CoinDCX allow for direct INR deposits and withdrawals. The exchanges have bank accounts in Indian banks where your funds are deposited and stored. Also, you can buy cryptos with the funds in your account.

Here is a table comparing the coindcx charges and wazirx charges :

Particulars | WazirX | CoinDCX |

Channels | UPI, IMPS, NEFT & RTGS | NEFT & RTGS, IMPS, UPI |

Apps | Mobikwik | Mobikwik |

Deposit Fees | IMPS, NEFT, RTGS: Rs. 5.90 per transfer From UPI: Rs 4 per transfer | Rs 0 |

Time | Maximum time – 72 hrs | Maximum time - 72 hrs |

Minimum amount | Rs 100 | Rs 100 |

Maximum amount | No maximum limit | Up to Rs 5 lakhs depending on KYC status |

WazirX does not allow withdrawals till the KYC and bank verification processes are finished. On the other hand, you can deposit and withdraw up to Rs 10,000 on CoinDCX while your KYC is pending. The versatility of CoinDCX may appeal to new cryptocurrency investors and traders.

Conclusion: WazirX is better positioned to help you get started with cryptocurrencies and develop your portfolio. The platform caters to both expert and new bitcoin traders.

6. Account Opening & Account Limits

WazirX and CoinDCX do not have a mandated KYC requirement, although both exchanges place restrictions on unverified individuals.

CoinDCX does not have account specifications that must be met, non-KYC users can only withdraw up to Rs 10,000 in a day, while verified users can withdraw up to Rs 5,00,000. CoinDCX's KYC verification process takes 24 to 48 hours, similar to WazirX.

WazirX has a simple account registration process. It enables you to open an account even without completing a KYC process. However, a non-verified account can only be used to trade and deposit funds. You must validate your account to use the P2P capability or withdraw funds.

WazirX's KYC procedure takes 24 to 48 hours for completion, similar to WazirX, following which all of the platform's features can be used.

Conclusion: It is a tie in this aspect as the features in both exchanges appeal to investors depending on their needs.

7. Trading fees and charges

In both WazirX and CoinDCX exchanges, the spot exchange (markets where buyers and sellers swap cryptos instantly) is the only common marketplace.

Particulars | WazirX | CoinDCX |

Maker Fees | 0.2% | 0.11% to 0.001% based on the 45-day cumulative trading volume. |

Taker Fees | 0.2% | 0.11% to 0.001% based on the 45-day cumulative trading volume. |

Coindcx fees are calculated based on your 45-day trading volume. For a rookie crypto trader, calculating this can be difficult.

WazirX charges a set 0.2 percent fee, which is more than CoinDCX. WazirX, on the other hand, has a referral scheme via which you can earn WRX tokens.

If you pay your fees with WRX tokens, you will receive a 50 percent discount. In comparison to CoinDCX, this means you only have to pay 0.1 percent, which is a minimal fee for new traders.

8. Account funding methods

Both WazirX and CoinDCX accept INR as a fiat currency deposit. IMPS, UPI, NEFT, and RTGS, as well as Mobikwik deposits, are all supported by WazirX and CoinDCX.

WazirX charges INR 5.90 for IMPS, NEFT, and RTGS payments and INR 4 for UPI transfers. CoinDCX does not charge any deposit fees. Deposit requests can take up to 72 hours to be processed on both exchanges, with a minimum deposit amount of Rs. 100.

Both exchanges include a withdrawal fee that is specific to the currency being withdrawn. For BTC withdrawals, WazirX charges a fee of 0.0005 BTC, whereas CoinDCX charges in India amounts to 0.001 BTC.

wazirx or coindcx :Overview of Marketplace, Listed Crypto Pairs, and Trading Ease

1. Marketplace

Spot exchange allows for one-to-one purchase and sale of cryptocurrencies. WazirX acts as a custodian and allows you to purchase and sell USDT directly from other traders using INR.

Smart Token Fund (STF) allows experienced crypto traders to assist newcomers to expand their portfolios in exchange for a portion of the profits achieved.

This contrasts sharply with CoinDCX's spot, margins, and futures markets. Users can purchase and sell cryptocurrencies directly on the CoinDCX spot exchange.

Margin trading is similar to stock margin trading. Trading can be done here with a 6X leverage. Futures and options trading are similar to each other. They allow you to trade crypto futures with up to 20X leverage.

Conclusion: Except for the spot exchange, the other markets are different and unrelated.

2. Access to Defi applications

DeFi applications are Ethereum blockchain-based smart protocols. You can lend, borrow, or stake your cryptos, allowing you to profit from the cryptos in your wallet.

WazirX has no DeFi applications, but lending and staking DeFi applications are available on the CoinDCX market.

Conclusion: Once again, there is no way to compare the two exchanges. CoinDCX's DeFi program is designed for seasoned cryptocurrency investors.

3. Crypto trading pairs

In WazirX, there are only four basic trading pairings with which other cryptos are matched on WazirX. The four basic pairs are:

- INR/Crypto pair

- BTC/crypto pair

- USDT/ crypto pair

- WRX / Crypto pair

WazirX has a total of 70 cryptos linked with INR. You can buy them right now with the rupees in your account.

CoinDCX offers 11 different trading pairs hence offering you more options. The most common trading pairs are:

- INR / Crypto pair

- BTC / Crypto pair

- USDT / Crypto pair

- BNB / Crypto pair

- DAI / Crypto pair

- USDC / Crypto pair

- ETH / Crypto pair

- TRX / Crypto pair

- BUSD / Crypto pair

- TUSD / Crypto pair

- XRP / Crypto pair

However, in CoinDCX, you only have 32 cryptos connected with INR. This means that if you want to buy the remainder of the cryptos on CoinDCX, you must first acquire USDT and then use it to buy the cryptocurrencies you want.

Conclusion: Without any hesitation, the winner in this round is WazirX as it gives more crypto options that can be purchased directly.

4. Ease of trading

On App Design: CoinDCX has the appearance and feel of an FX trading platform, making it more suitable for seasoned traders. The dark mode of the app gives a pleasant viewing experience.

WazirX has a simple and clear design with only the most essential functionality, making it easy to learn and use even for inexperienced traders.

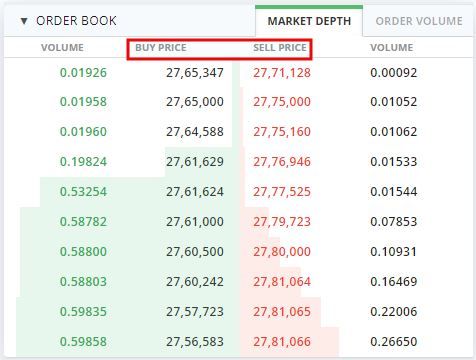

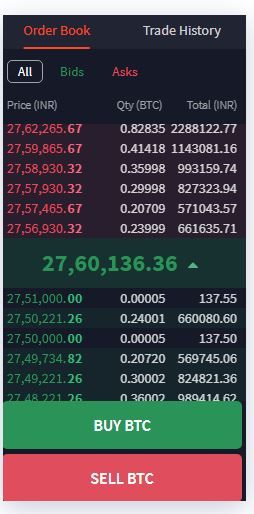

On Buy/Sell Orders Windows: The order window on CoinDCX is a little confusing because the bids and ask rates are shown one below the other. If you are inexperienced with the order book, it can be difficult to interpret the buy/sell orders arranged in this manner.

However, one advantage is that more orders can be reviewed. For example, if you click the bids or ask for an order book, you can obtain details on roughly 80+ orders in the book.

On WazirX, it's easier to understand as bids and ask orders are displayed side by side. The sole constraint is that only ten orders can be displayed at once.

On Cryptocurrency Shorting: Shortening - the act of selling a crypto asset at its high price in the hope of buying it back when it is low - is not an option on WazirX. On CoinDCX, you can short 50 coins at once using margins.

Conclusion: WazirX exchange tops CoinDCX in terms of ease of trading since it makes the user's experience simple, needing the least amount of effort to understand and buy/sell cryptos.

Its user-friendly design includes features that intermediate and advanced traders need. CoinDCX caters to more experienced cryptocurrency traders, as evidenced by its platform and product offerings.

5. WazirX & CoinDCX Customer Service Comparison

The bad news is that consumers can only use online inquiry forms and social media outlets for contacting both exchanges. WazirX and CoinDCX users have complained about INR deposits being delayed and trading difficulties during peak hours.

This could be owing to banks' refusal to work with the exchanges, as well as the crypto markets' recent significant price volatility. But, both exchanges have attempted to acknowledge these issues via their Twitter accounts.

CoinDCX and WazirX have said that they are beefing up their IT infrastructure and people to address the issues.

Conclusion: The customer service staff at both exchanges is average, and there is a lot of scope for improvement when it comes to customer service.

Why should you choose WazirX?

Make WazirX your go-to crypto exchange if you like a user interface that is straightforward, intuitive, and easy to use.

Other reasons to choose WazirX are:

- 0.1 percent fee of trading WRX coins

- INR is linked to over 70 different cryptocurrencies

- Money can be deposited in INR directly into your bank account via UPI rather than NEFT, RTGS, or IMPS.

Why should you choose CoinDCX?

CoinDCX is a fantastic platform for you if you want to have:

Trading charges on volume-wise fees

Lower rate among the upper class (up to 0.001 percent).

Cryptocurrency futures and margin trading

Short trading strategies

UPI for transactions other than regular RTGS and NEFT

DeFi applications to make money with your cryptocurrency

Gives instant buys and sells

Charges zero fees on your investment

Conclusion

WazirX and CoinDCX are both best platform for crypto trading in india. However, WazirX has an advantage in some areas.

WazirX has over 90 cryptocurrencies on its exchange and is constantly adding new ones. It is a superior choice if you want a variety of trading alternatives.

The most significant advantage of WazirX is its powerful trading algorithm. WazirX is a great option if you're an experienced trader seeking a trading platform of institutional grade. In comparison, CoinDCX is more appropriate for newcomers.

Overall, WazirX is a good choice if you value performance and client service. CoinDCX is a good place to start if you're new to cryptocurrency trading.

Frequently Asked Questions

1. Which app is better than Wazirx?

CoinDCX is the greatest cryptocurrency trading platform of all since it offers a simple user interface and a seamless user experience.

Over 300 cryptocurrencies, altcoins, and tokens such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and others are available to buy, sell, and trade on this app.

2. Can CoinDCX be trusted?

Yes, BitGO insures all funds, including users' cryptocurrencies housed in MultiSignature cold wallets, ensuring complete financial security.

3. Is CoinDCX legal in India?

Yes, trading in crypto is legal in India as there is no ban imposed by the government.

4. Is there any Coindcx withdrawal fee?

Yes, 0.1 percent taker’s fee and a 0.1 percent maker’s fee is charged by CoinDCX. The withdrawal fees are substantially lower, at 0.2 percent of the entire withdrawal or a fixed fee of Rs 10, whichever is higher.

5. Which is better wazirx or coindcx?

WazirX offers less liquidity than CoinDCX. Futures and margin trading are among the better goods and services offered by CoinDCX. WazirX has fewer cryptos listed than CoinDCX.

They also offer a crypto financing service with a reasonable interest rate.

Both platforms are good, but which one is better depends on your purpose for using these platforms.