Want to know all about zerodha vs 5paisa? Then, you have landed on the right article!, make sure to read the article carefully to know everything about 5paisa vs zerodha.

Are you worried about inflation and the increasing cost of living? Do you want to invest in the share market but are concerned about the risks?

We are here to educate you about two of India’s leading stock broking firms and everything else you need to know before becoming an informed trader.

5paisa.com is a leading online stockbroker that was incorporated in 1996. It offers discount brokerage services in the equity, commodity, insurance facility, and currency at BSE, NSE, and MCX platforms to retail investors in India.

As per the last recorded data, they have more than 2 million customers, out of whom about 1.5 million are active. 5paisa Capital Ltd is a publicly-traded company registered with SEBI, CDSL, BSE, NSE, MCX and NCDEX.

5paisa.com is professionally managed and promoted by IIFL founders, and most of its customer base is younger than 35 years of age. They prefer to do equity trading via the app.

Prakarsh Gagdani is the Director and CEO of 5paisa.com, and his vision is to add three lakh new customers every month to the company’s ever-expanding customer base.

Zerodha is India’s No. 1 stockbroker that was incorporated in 2010. They offer online flat fee discount brokerage services to their customers to invest in equity, commodity, currency, IPO, and direct mutual funds markets.

They have a customer base of more than 7.5 million, which is phenomenal considering that they came into existence much later than many other stock broking firms in India. This company was founded by Nithin Kamath and Nikhil Kamath.

Zerodha vs 5paisa: Know Eve rything (2022 Updated)

Pros And Cons Of Zerodha Vs 5 Paisa

Let’s make a comparison of both stockbroking firms first before we reach a conclusion, read this section carefully, in this section you'll also get to know 5paisa vs zerodha charges:

- 5paisa.com offers trading at NSE and BSE. Zerodha has a bigger platform available to its customers, and they offer trading at NSE, BSE, MCX, and NCDEX.

- 5paisa.com has spent more on the infrastructure of their 900 offices across India. Zerodha, despite having five times the customer base of 5paisa, prefers to run their business on their online platform. They have only 22 offices across India.

- 5Paisa.com is a flat-rate discount stockbroker. It charges a flat INR 20 brokerage fee irrespective of the size of the trade, segment, or exchange.

Even with Zerodha, the customer has to pay a maximum brokerage fee of INR 20 for any transaction for an order of any size, amount, or segment. - Trading account opening charges for 5paisa.com are free, whereas Zerodha charges INR 200 for opening an account.

- Trading account annual maintenance contract charges for both platforms are zero.

- Demat account opening charges for both platforms are zero.

- Demat account AMC charge for 5paisa is INR 540 and for Zerodha is INR 300. So here, the trader can save some money.

- 5paisa charges INR 20 per executed order for equity delivery, whereas Zerodha offers this facility free of cost to its customers.

- For equity intraday, 5paisa charges INR 20 for each executed order for the standard plan users. For power investor packs and ultra-trader packs, 5Paisa charges only INR 10 for equity intraday.

- Zerodha charges INR 20 per executed order or 0.03%, whichever is lower.

- For equity futures, commodity futures, and currency futures, 5paisa charges INR 20 for each executed order for the standard plan users.

For power investor packs and ultra-trader packs, 5Paisa charges only INR 10 for equity futures, commodity futures, and currency futures. Zerodha charges INR 20 per executed order or 0.03%, whichever is lower. - Or equity options, currency options, and commodity options, 5paisa charges INR 20 for each executed order for the standard plan users.

For power investor packs and ultra-trader packs, 5Paisa charges only INR 10 for equity options, currency options, and commodity options. Zerodha charges INR 20 per executed order or 0.03%, whichever is lower. - 5paisa mutual funds offer both regular as well as direct mutual funds. 5paisa charges a flat fee of INR 10 for each executed order for online mutual funds investment.

An investor can invest in a lump sum or through SIP for mutual funds. However, Zerodha does not charge any brokerage fees for mutual fund investments. - 5Paisa has an above-average customer service team. Since their parent company IIFL was known for its customer service, some of the benefits are passed on to the 5Paisa team too.

Zerodha has an excellent customer service team rated the best by the traders. - The traders found the online trading tools of Zerodha more powerful and robust than that of 5Paisa.

- Zerodha has a very lucrative referral program for its customers, attracting many new customers to the portal every month. 5Paisa has not launched any such referral programs yet.

- 5Paisa offers free technical, derivative, and fundamental research and advice to its customers, and Zerodha, too, sends free newsletters with the findings of their research to their customers.

- 5paisa is a depository participant (DP) of the Central Depository Services (India) Limited (CDSL), one of the two central depositories in India. The 5paisa DP ID is 12082500.

- Zerodha is also a DP of CDSL. Zerodha’s DP ID is 12081600.

- 5Paisa has a trading platform on the Web, mobile app, and EXE. Zerodha has a trading platform on Kite, Pi, and NEST.

- With a Zerodha trading account, you can trade only in Indian stock markets like NSE and BSE. You need to open a separate account as Vested within 5Paisa to invest in shares in foreign markets.

- The Reserve Bank of India allows an Indian citizen to invest up to $250,000 per year in overseas markets. They have a dedicated team to help the investors with their queries.

They can send an e-mail at vestedsupport@5paisa.com and get all the responses to their queries.

Features of 5paisa and Zerodha

We have compared the pros and cons of 5Paisa and Zerodha and presented all the points for customers to be aware of before trading. Now let’s compare some of the distinct features which will help customers in making further decisions:

- 5Paisa has three plans for its traders: basic plan, power investor pack, and ultra-trader pack. Zerodha has only one standard plan for all investors.

- 5Paisa charges a monthly fee of INR 449 to their customers who have opted for the power investor pack and a monthly fee of INR 899 to their customers who have opted for ultra-trader packs.

For the standard plan users, there is no monthly fee. Zerodha does not have separate plans, and they do not charge any monthly fees either. - 5Paisa gives its investors the benefit of margin trading by offering the facility of buying stocks at a marginal price. The rest of the cost is borne by the stockbroker 5Paisa.

The margin later can be settled when the investor squares off their position in the market. For all the three plans, basic plan, power investor pack, and ultra-trader pack, the margin trading is 0.5% only.

Zerodha does not offer any such benefits to their customers, and they have to pay the full price while trading. - The call and trade charge for 5paisa is very high at INR 100 per call; however, they compensate by allowing the trader to place as many trades as they want in that one call. Zerodha charges INR 50 per executed order for the call and trade facility.

- 5Paisa offers a bot (automated) advisory platform to build a fully customized mutual fund investment portfolio, which has been appreciated by the traders of this platform. Zerodha has a good brokerage and margin calculator, and the traders find it very useful while making their investments.

- Zerodha offers up to 20x leverage on intraday trading. 5Paisa does not offer such a feature.

Which is right for the user? 5Paisa or Zerodha?

5Paisa and Zerodha both are very good and reliable platforms for traders, and they can choose the one based on their requirements.

If you are new to the world of trading, it is better to open an account with Zerodha as there offer a flat brokerage plan. Their charges per trade are higher than that of 5Paisa; however, their equity delivery fees are zero.

They have only an account opening charge and annual maintenance charge. However, 5Paisa is more suited for veteran traders.

By paying a monthly charge of INR 499 for the power investor pack, they can save considerably on equity delivery charges, equity intraday charges, future equity charges, equity options charges, etc.

All these charges will be INR 10 instead of INR 20, which Zerodha charges. This facility is beneficial for anyone who does heavy trading.

For someone who spends INR 5000 in a month on a bunch of shares and leaves them in their portfolio till the share prices increase, there is no logic behind paying monthly fees.

With 5Paisa, a regular trader can spend INR 999 for the ultra-trader pack and save a considerable amount of money on the brokerage charges. However, again, it is beneficial only for heavy traders.

Zerodha’s portal is extremely user friendly, and everyone who has used multiple platforms vouches that Zerodha is the simplest of all.

Hence, for a rookie investor, it is the best platform to start with and then progress toward gaining more knowledge and risk appetite to invest more.

Frequently Asked Questions

1. Is Zerodha safe?

Zerodha is not under any debt, and the stocks of the traders are with CSDL, so stockbrokers cannot undertake fraudulent activities. Zerodha lends less than 5% of its own money to consumers, and hence there is no chance of credit risk.

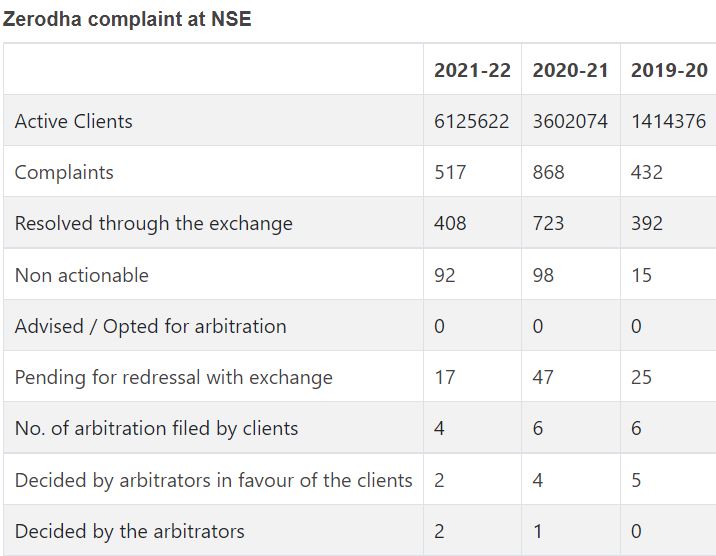

Zerodha offers exemplary and prompt customer service and addresses all customer queries and complaints immediately. Its ratio of complaints to active clients is among the least in the Securities and Exchange Board of India (SEBI).

2. Can we trust 5paisa?

Yes, trading with 5paisa is safe as the company is registered with SEBI, CDSL, BSE, NSE, and MCX. Since it has an experience of more than 25 years in the financial sector, it has a team of analysts who provide good research and analysis to its customers.

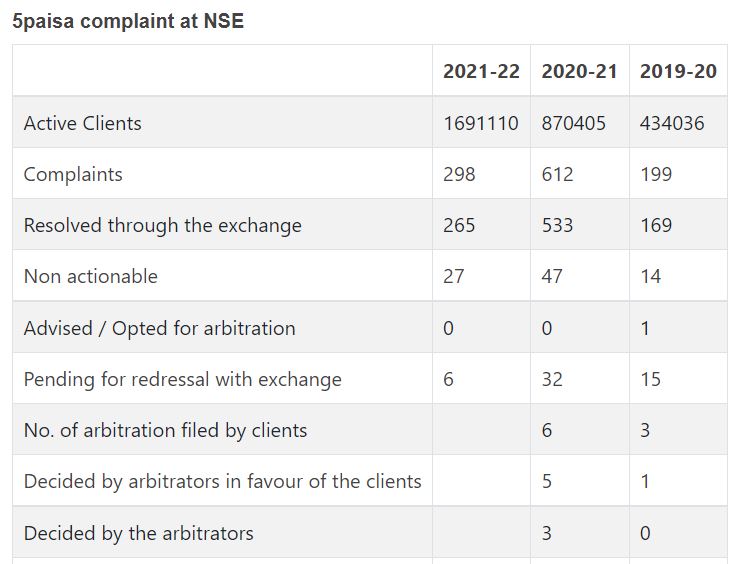

Customers have benefitted financially by following the guidance of their analysts. Its ratio of complaints to active clients is not very high in SEBI.

3. Can I transfer 5paisa to Zerodha?

As per SEBI guidelines, any investor can transfer their existing shares from one share broker’s account to another. Hence you can transfer your shares from your 5Paisa Demat account to your Zerodha Demat account without any hassles.

There are two types of transfers- inter-depository transfer and intra-depository transfer.. Since the central depository for both brokers is CDSL, it will be an intra-depository transfer, which is quite hassle-free.

4. Does 5paisa charge for cancelled orders?

5Paisa does not charge anything to traders for cancelled orders. The transitions on the 5Paisa platform are very fair and transparent, and if the client is unhappy with anything, they can raise a complaint with SEBI.

I hope you liked our article on zerodha vs 5paisa. If you have any comments or suggestions do share them in the comments below.