Want to know how to pay tax online? Well you have landed on the right article.

Want to avoid those long queues and the paperwork while income tax payment? If yes, then we have good news!

Paying income tax is now fast and easy with a completely paperless, online procedure called e-tax payment system. Like other banking services, you can now make your tax payment while lounging in your home.

Earlier, in the offline procedure, you were asked to submit several documents and bank statements, but now the e-tax system launched by the Income Tax Department has made everything online and smooth.

All you need to do is to carefully go through the step-by-step process with the necessary documents at hand. To guide you on the correct procedure and uncover other crucial facts about online income tax payment, we are here with this read.

So, let's get started!

How to Pay Income Tax Online?

Simple, easy, and quick, if you have all your documents ready with a good internet connection. To make the income tax online payment, you need to follow these few simple steps-

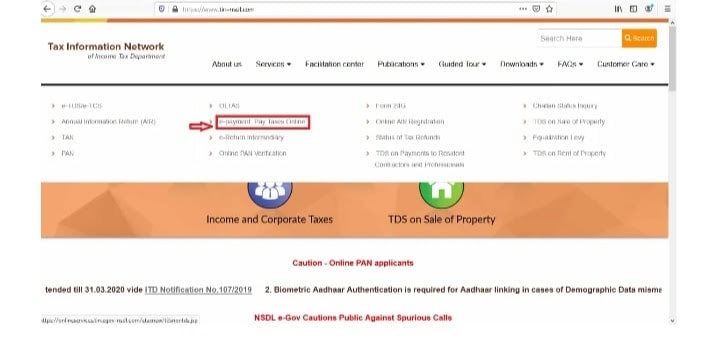

Step 1. Firstly, you need to visit the official e-tax website tin-nsdl.com and then click on the ‘e-payment: Pay Taxes Online’ option.

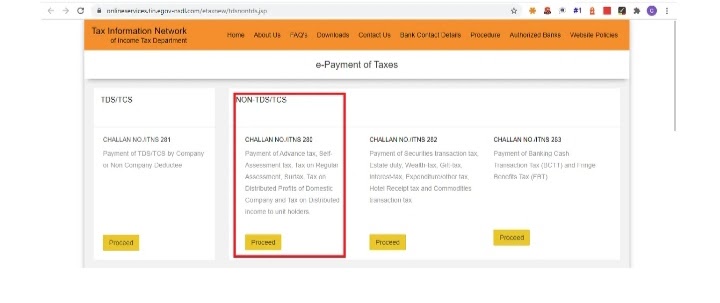

Step 2. This will redirect you to a different page where you have to click on the ‘Proceed’ option under ‘Challan No./ITNS 280’ of the ‘Non-TDS/TCS’ tab. Check the screenshot below-

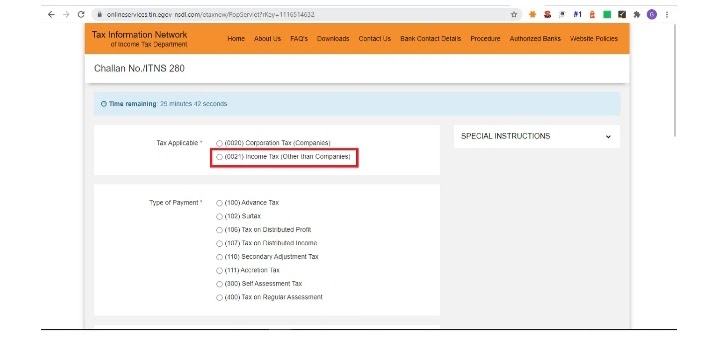

Step 3. Again, this tab will redirect to the next page, where you have to select the ‘(0021) Income Tax(‘Other than Companies’)’ under the Tax Applicable tab. Now, input the correct details asked to proceed further.

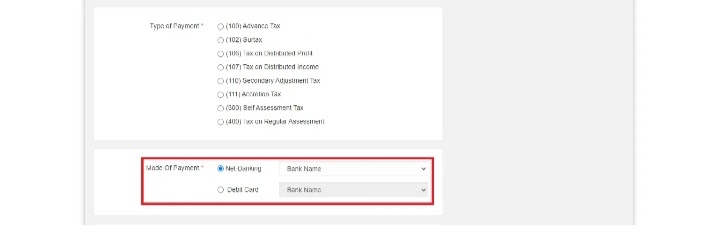

Step 4. After successfully filling the required documents, select the mode of payment you want to use to complete the transaction.

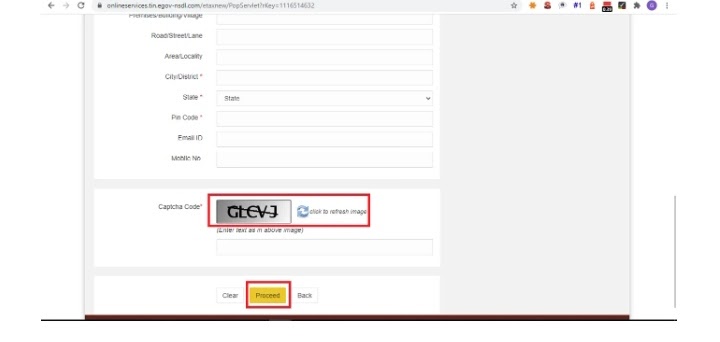

Step 5. Now, enter the captcha code shown to verify human identity and then click on the ‘Proceed’ button.

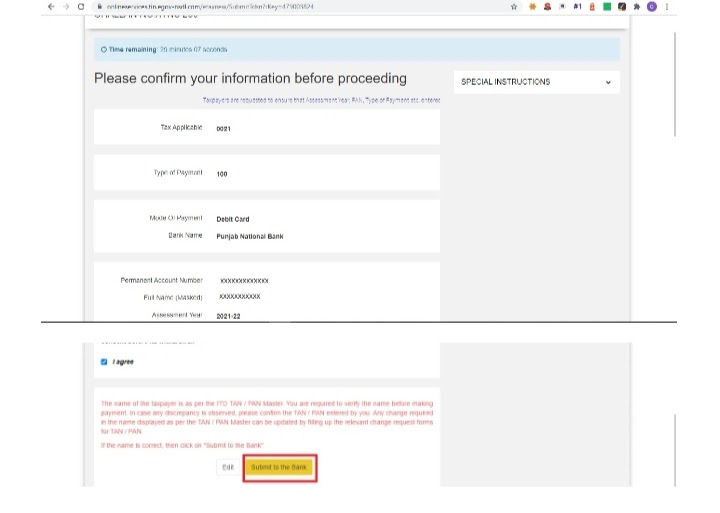

Step 6. This will ask for confirmation about the authenticity of the information provided and can proceed further. To confirm this, just click on the ‘Submit to the bank’ button.

Step 7. You will now be able to see your bank website asking for your card details or net banking details to complete the payment.

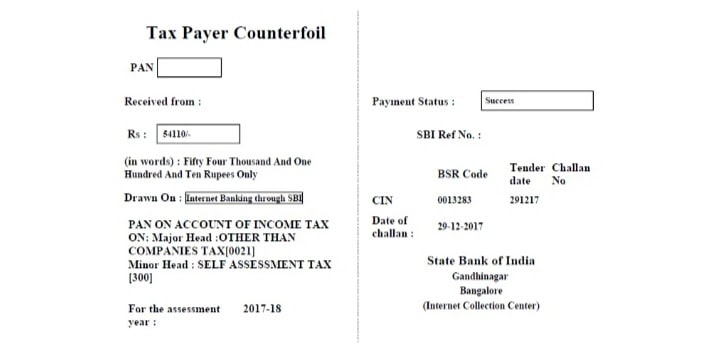

Step 8. After completing the payment, you will receive a payment receipt with essential details like tax amount, BSR code, date of challan, challan serial number, etc.

Eligibility to pay tax online

If you are now thinking that there has to be a separate set of eligibility criteria to pay tax online, then you are right. To pay your income tax online, make sure you meet the eligibility criteria as per the Income Tax Act:

- You must be a citizen of India, with a minimum annual income of Rs.2.5 lakh.

- The minimum annual income rises to 3 lakh if you are above 60 years, and to 5 lakhs if you are over 80 years in age.

- You may have a firm that follows the guidelines of Section 44AB, or a co-operative society, BOI, local authority (ITR 5), AOP, or an artificial juridical person.

- You could be a resident of India who has signing authority of an account held outside India or you have a financial interest in an entity or property.

- You have to confirm whether or not you claim tax relief under Sections 90A and 90 or, according to Section 91, have claimed deductions.

- Under Section 139 (4B) (ITR 7), if you are an assessee who is responsible for producing returns.

Working of Online Tax Payment

How does it all work? Does any factor affect the workflow?

Yes, the work differs on many factors when it comes to making your tax payment online. Here are some of them:

- PAN: The PAN (Permanent Account Number) is the most important document in banking, a PAN card issued in your name is mandatory for online tax payment.

A PAN number is a 10-digit alphanumeric number printer on the front face of the card. Moreover, to log in to the ITR portal, a PAN number is required. - TAN: It stands for Tax Deduction and Collection Account Number and is second only to the PAN number. The TAN number is essential to pay your income tax successfully.

The Income Tax Act, 1961 says that the payer has to pay the Tax Deduction at Source (TDS) before the payment is made to the beneficiary. After successful payment, TDS is submitted to the IT department.

It is mandatory to have TAN for all organizations and individuals who are involved in such payments types.

- E-payment: You can use various online portals to pay your tax if you hold a valid PAN and TAN.

- ERACS: It stands for Electronic Return Acceptance and Consolidation System. It's a type of interface and works between the taxpayer and a web-based utility.

It allows you to upload your Tax Collection at Source (TCS), Annual Information Return (AIR), and TDS on the Tax Information Network (TIN) central system. - OLTAS: It stands for Online Tax Accounting System and is a type of database. This database helps the Income Tax Department keep tax records and manage the collection of tax stored.

Benefits of income tax payment Online

Paying tax online in a seamless, hassle-free way is in itself a benefit, but apart from this, there are many benefits too that you must know as a taxpayer. These are-

- Transferring a tax amount from your account becomes easy and super fast.

- The net banking option allows you to pay your tax from anywhere across the globe 24 x 7.

- As tax payment proof, the Transaction ID will reflect on your bank account statement, making it easy to store and retrieve information.

- Your e-challan details will be directly sent to the Income Tax department for verification.

- Checking your tax payment is even easier; you can check your payment status on the Tax Information Network website to see whether your payment was received or not.

Documents required to pay income tax online

Having the right documents at hand will save you time while making the tax payment online. The list of documents you need to successfully pay your income tax includes-

Form 16

Form 26AS

Form 16A, Form 16B, or Form 16C

Deductions under Section 80D to Section 80U

Interest certificates issued by bank or post office

Salary slips and bank statement

Tax saving investment proof

Capital gain on selling property and/or mutual funds

Aadhaar Card

PAN Card

Home loan statement from bank or NBFC

List of authorized banks for online income tax payment

Unfortunately, not every bank accepts Online Tax Payments, but a lot do. Here's the complete list of banks who accept Online Tax Payment 24X7-

Allahabad Bank

Andhra Bank

Axis Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

HDFC Bank

ICICI Bank

IDBI Bank

Indian Bank

Indian Overseas Bank

Jammu and Kashmir Bank

Oriental Bank of Commerce

Punjab National Bank

Punjab and Sind Bank

Syndicate Bank

Vijaya Bank

State Bank of India

UCO Bank

Union Bank of India

United Bank of India

Found your bank? Great!

But, what to do when the online tax payment is on hold? Don't worry! Here's a brief overview of what you can do in such situations-

Method to Pay your Tax Offline

- First, visit the nearest branch of your bank and ask for an applicable challan form. In case you’re in doubt about which one, that would be Challan 280.

- Now, fill out the challan form with all the correct details.

- After filling the challan successfully, move to the payment counter and submit the form with the total tax amount payable. You can pay the tax amount either in cash or by cheque.

- In case you are paying the tax amount through cheque, make sure that it is in favour of the ‘Income Tax Department’.

- Your bank will retain the required portion of the challan form, affix a stamp on the left and give it back to you as payment proof. Keep this proof for future reference.

I hope you liked our article on how to pay tax online, if you have any comments or suggestions do share them in the comments below.

Note- Offline income tax payment can take up to 10 days to reflect on Form 26AS.

Frequently Asked Question

Q1. How can I pay my income tax online?

To pay your income tax online, visit the official E-Tax website, tin-nsdl.com. Select the Services option and proceed to ‘e-payment: Pay Taxes Online.’ Follow the steps in each subsequent screen to pay income ta online.

Q2. Can one pay income tax online?

Yes, one of the ways for tax payment happens to be an online mode wherein users can pay their taxes anytime as desired, provided they meet some criteria. To know about the requirements and the necessary steps, please read the information given above.

Q3. What is challan 280 income tax?

Challan 280 is a form one can see on the authorised site of the Income Tax department. This challan can be utilised to complete the online payment of income tax. The challan can be documented online or delivered offline to pay the applicable tax.

Q4. How can I pay my income tax online with my debit card?

Using a debit card to pay your taxes is another way of paying taxes. The process for paying the tax online through a debit card is almost the same as mentioned above. However, the processing fee for debit cards would differ from other modes.