Want to know how to create paypal account? Well, you have landed on the right article!

PayPal has been in existence for over two decades now. Its immensely streamlined and user-friendly system is the major reason why people around the world prefer its services over traditional cash and cheque transactions.

Millions of people and thousands of businesses in numerous countries have been using the online financial services of PayPal for quite some time now. But most of us don’t exactly know what a PayPal account is and how to make a paypal account?

Before moving further, let’s glance at the history of the trailblazer of online transaction services.

A quick peek into the history of PayPal

Despite being in cutting-edge competition with other online payment giants, PayPal maintained its prominence due to robust security and extensive features. With the help of this globally renowned online platform, you can send a payment anywhere in the world.

You can buy things from any remote country and pay them via PayPal. It comprehensively supports online purchases from Amazon, eBay, and other popular retail stores. In fact, basic money transactions from one PayPal account to another or a supported back account are simpler than you think.

How PayPal works in India?

PayPal is one of the safest online platforms for regular money transfer and online shopping. It has an unswerving buyer protection program with proper data encryption. It delivers the same scale of security that you can get in a credit card service.

Although, you can’t expect the same level of customer satisfaction and support from a usual credit card company as PayPal.

Simply put, people all over the world rely on PayPal for crucial personal or business-related transactions. As a buyer, you will get to experience a plethora of features of this online money transfer platform. On the flip side, things can be slightly different for sellers who receive payment from overseas buyers.

The seller protection program and policies of the money transaction company are not as elaborate as the buyers’ program. It means that the company will support the buyer rather than the seller in case of a dispute.

Those who wish to open a business account on PayPal must know that the platform is not FDIC-insured. Thus, businesses in India can’t expect the regulations of an official bank from their PayPal accounts. What you can do with your PayPal account in India doesn’t fall in an eclectic zone.

As a user with a personal account, you can shop from famous brands around the world. To do this, you will have to link either a credit card or a debit card with the account to complete the purchase with the seller. On the contrary, PayPal lets you accept payments from your international buyers in 200 countries.

The doors are open for domestic buyers, but that would cost sellers more than an actual India-based payment gateway system. In short, businesses in India should think about opening a PayPal account only if they have overseas customers. Otherwise, it would be just another source of expense!

There are plenty of benefits of registering on PayPal as a business account. Not only can you receive payments from various countries, but you can also transfer the money to vendors, suppliers, and your remotely working employees.

However, you can’t throw caution to the wind while making payments through PayPal, as it may lead to extra charges in terms of 4.4% + applied currency fee. That’s right! The world’s most preferred payment gateway has a fixed exchange rate.

What might surprise you is that PayPal’s exchange rate system is significantly different from actual banks. It can also be described as the mid-market exchange rate.

Whatever payment gateway businesses choose, it should be somewhere around this rate to keep up with the currency-switching dynamics. Another fascinating thing about the PayPal business account in India is that your balance goes straight to your local bank account on a daily basis.

What do you need to open a PayPal account?

In comparison with other common money transfer platforms, PayPal is the one that exhibits the quality of a user-friendly digital gateway. You don’t need much to get started.

An active phone number and a valid email address will get you on your magnificent journey of online payments. In addition to these basic details, you will need a registered business and a PAN number to begin your business account on PayPal.

Even for a personal account, you are required to add a debit card or a credit card to your PayPal account to start making the purchase. It doesn’t always have to be a card, and you can simply link your bank account to it. Though, your bank account must access global money transfer for the same.

The procedure of creating a business account on PayPal reflects the scale of convenience and security it provides for its users worldwide. For a business account on PayPal India, you need to have correct PAN card details and a business bank account with the same PAN card.

Other than these staples, you may also need to provide certain business-related documents alongside some industry-specific information.

PayPal is free for users but until when?

You don’t need to spend a single penny while creating a personal or business PayPal account in India or elsewhere. However, usage fee applies to your practical use of the platform.

As we have discussed earlier, it charges for global transactions that include the exchange rate imposed by the platform itself. This fee is applied to both personal and business accounts. Businesses have to bear an additional fee as per the applied domestic and global transfers. Here’s how it works:

The domestic transaction fee of PayPal India is 3% + ₹3. If you use a debit card from RuPay or make the purchase using BHIM-UPI, the fee will be 2.5%. This fee elevates up to 4.4% along with a fixed currency exchange fee on every international transaction.

This fixed fee varies as per the type of country you select for the transfer. It is 0.30 USD for the USA, 0.20 GBP for the UK, and 0.30 AUD for Australia. Business owners are strictly advised to carefully assess the applicable fee aside from the mid-market rate and exchange fee before finalizing any payment on PayPal.

How to Create Paypal Account?

Setting up an account on PayPal is the easiest thing on the internet, given that you already have an active mobile number and an email ID that you use quite often. Read on to know how to make paypal account:

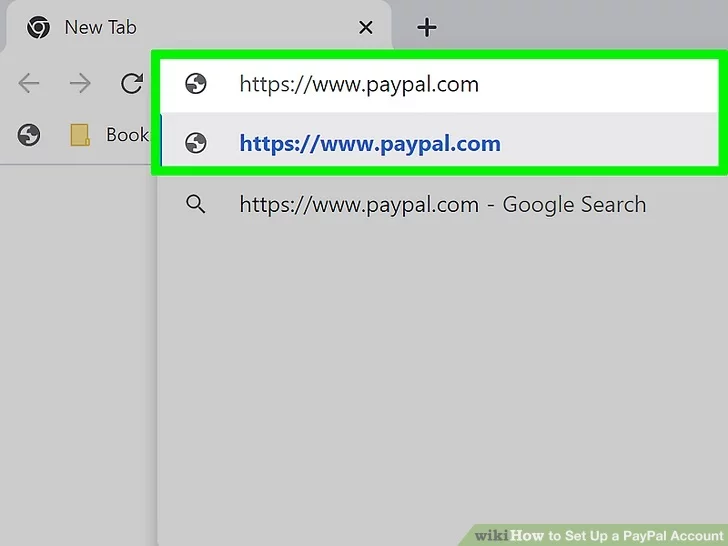

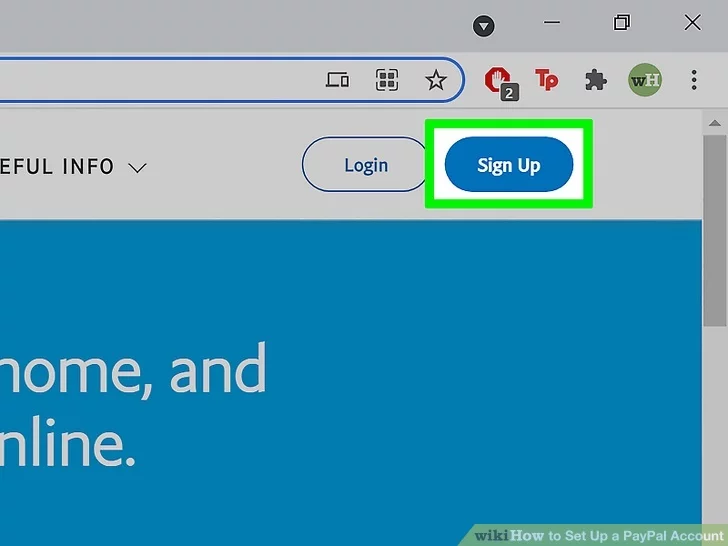

- 1Go to the official website of PayPal and go to the top-right section of the page. There you will see the ‘Sign Up’ button. You probably know what you need to do next!

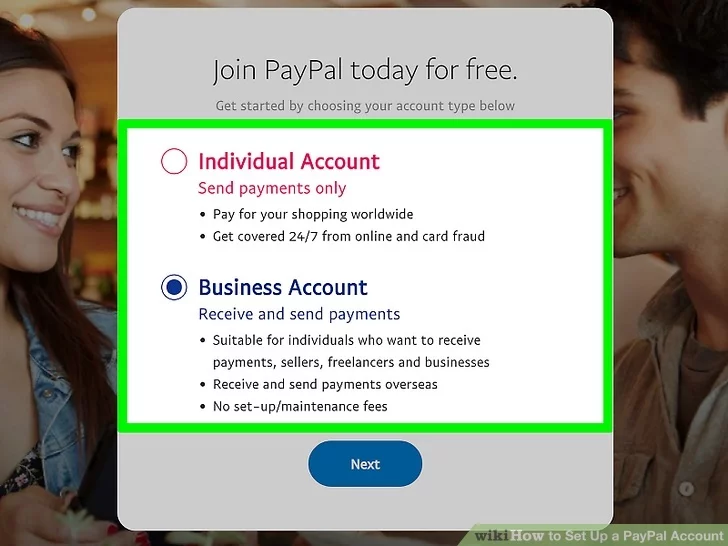

- 2After clicking on ‘Sign Up,’ you will be asked to choose your preferred account type between a personal account and a business account. Make your selection and click on ‘Next.

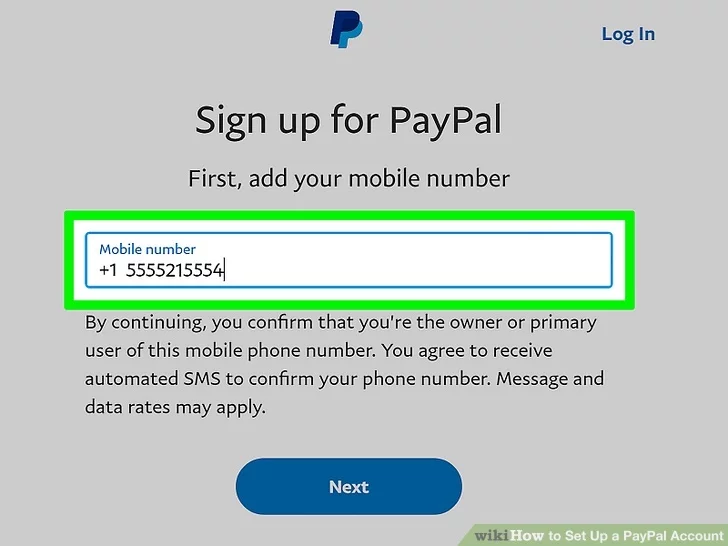

- 3In the following steps, you will need to provide a phone number (that’s where you will receive your transaction-related notifications). Now, start to fill the entire form by providing basic details such as your name, email address, etc.

- 4You may not need to create a new password as it can be accessed through your permanent Google account.

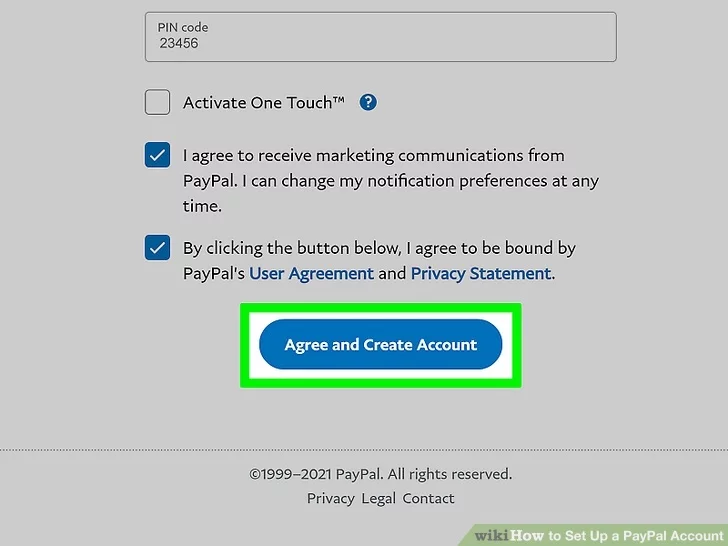

- 5Once you fill in all the details in the form, choose your nationality, give your address, and your account will be generated after the final tap on your system.

These steps mentioned above will help you learn how to open paypal account in India. To actually start the service, you will also need to provide your bank account and card details. Even if you don’t want to add any cards, linking a bank account is crucial to commence the transfer or acceptance of money.

How to verify an account?

After setting a PayPal account in India or anywhere else, the next big step is to verify an account. PayPal has a very exclusive yet streamlined system of verification that lets new users join the platform without compromising the safety of its existing users.

To keep using your PayPal account without any fear of a potential cyber-attack, you should verify your account by connecting your bank account with PayPal. To verify an account

- Visit the official website of PayPal and log in to your account using your credentials.

- Now, click on the option ‘Pay & Get Paid.’ You will be redirected to the wallet section, where you will have to choose ‘Bank & Cards.’ Select the option you prefer and provide the information accordingly.

- 3If you plan to link a debit or a credit card, don’t skip checking the basic PayPal charges on your credit/debit cards. Also, you should know that the verification process will be different for the bank account and the cards.

- 4For bank account verification, PayPal will send two small deposits to your account. These amounts can range between INR 1.01 and 1.50. You will see them in your bank details within 3-5 business days. After receiving these amounts, log in to your PayPal account, fill these exact amounts, and confirm.

- 5The process is slightly different in the case of card verification. You will need to add the required information in the ‘Banks & Cards’ section and wait for the 4-digit code. After receiving the code, fill it in the required area and confirm your submission.

And, you are done with the account verification procedure on PayPal India.

How to confirm a bank account in PayPal?

When it comes to confirming the bank account in PayPal India, you just need to follow the elementary steps to get the job done. While it’s not much of a hassle for personal accounts, businesses and larger enterprises must confirm their bank accounts on PayPal.

It is essential to sustain a verified identity on the platform and enjoy seamless global transactions.

Fortunately, confirming a business bank account on PayPal India isn’t as meticulous as one might consider. There are two different ways to do so. One of these methods can get you instant approval, while the other one will hardly take three or four days for completion.

The long-haul method is the one where you receive two small payments in the bank account and then confirm the same on the PayPal website. On the contrary, the simpler and quicker way involves instant confirmation. Here’s how to do that:

Go to the PayPal India website, log in to your business account, and click on the ‘Profile’ tab. Now, click on ‘Add or Edit Bank Account.’ You will be directed to the Bank Account page where you need to click on ‘Add Bank.’

Now you must choose the type of bank account while providing other related details in the following areas. You will also see a section for routing number, which is a 9-digit number you often see at the bottom of your cheque.

After filling all required fields, you can tap on ‘continue’ and select the ‘Confirm Instantly’ option. For this part, you will have to log in to your bank account page. In case you have any doubts, you can back off from this step and again select the option that says ‘Confirm in 2-3 Days.’

On the sidebar of the information page, you will see ‘Confirm Your Bank Account.’ Click on it, and you will receive the confirmation immediately.

Be extra careful with the little details you mention online, especially while providing your card details. In case of any confusion or missing information, you can consult with someone who already has a PayPal account or contact their support team.

I hope you liked our article on how to create paypal account, if you have any comments or suggestions do share them in the comments below.

FAQs

1. Do I need a bank account for PayPal?

The rules of PayPal can be different in various countries and for different types of accounts. As per the regulations, users don’t need to connect a bank account to their PayPal ID as long as they are only receiving the money in their account.

A bank account or debit and credit cards are needed only to transfer the money from the verified bank account.

If you are creating your PayPal ID for personal use, you wouldn’t have to worry about having a bank account linked to it.

On the other hand, those who own a business and often receive online payments via PayPal must connect their bank account to PayPal. It is an essential requirement for PayPal business account users in India and some other countries.

2. Is a PayPal account free?

Yes, a PayPal account is free. As an individual or a business account user, you will never have to think twice while building an account on PayPal. However, it’s the use of this platform along with country-wise money transfer that will cost the user a certain fee on each transaction.

The platform charges for currency exchange and fundamental transfer.

For example, the domestic transaction fee of PayPal India is 3% + ₹3. If you use a debit card from RuPay or make the purchase using BHIM-UPI, the fee will be 2.5%. This fee increases up to 4.4% with a fixed currency exchange fee on every international transaction.

3. How do I set up a PayPal account to receive money?

Setting up an account on PayPal for receiving money is easy. You can register for a personal account using your phone number and email ID. If you own a business and need to set up a PayPal account to accept payments from your overseas buyers regularly, you must create a business account.

It is vital to add your bank account details and link them with your PayPal account since the platform transfers the money directly to your bank account every 24 hours. You can also link your credit or debit card for the same. It is a benefit of the verified PayPal business account in India.

4. How do I accept money on PayPal?

It’s easy to receive payments on PayPal with a verified ID and confirmed bank account. You just have to log in to your account. You will see a request button on the right-hand side of the page. Enter the email address of the user you are expecting the money from.

It is one way of accepting money online on PayPal. If someone with a PayPal account pays you via the same platform, you will receive a notification on your email about the transaction. Plus, the amount will go straight to your PayPal balance.

5. Is there a monthly fee for PayPal?

There is no monthly fee for using PayPal, especially if you have to use the platform for buying things online from remote stores. On the flip side, money transfer can potentially lead to a notable cost depending on the type of country and currency.

Domestic transfers may not be that expensive, but international transactions include multiple fees such as the mid-market fee, currency exchange, etc.