The UTI PAN Card is one of the essential documents that all individuals and corporations must own for income tax purposes and other related tasks.

A UTIISL PAN card is also mandatory for purchasing properties, assets and opening bank accounts in any government or private bank. These days you can easily apply, reprint, or update PAN card details online through the UTIITSL website.

Established in 1993, the UTI Infrastructure Technology And Services Limited (UTIITSL), earlier known as the UTI Technology Services Limited (UTITSL), provides technical services support to financial institutions and other governmental sectors of India.

Services Offered by UTIITSL for PAN Card

- Application for new PAN Card

- Tracking PAN Card

- PSA Login

- UTI PSA Login for Admin

- AO Code Details

- Bulk Verification of PAN Card

- PAN Card Application Centers

Application for PAN Card and Other Details

Steps for UTI PAN Card Application for Indian citizens

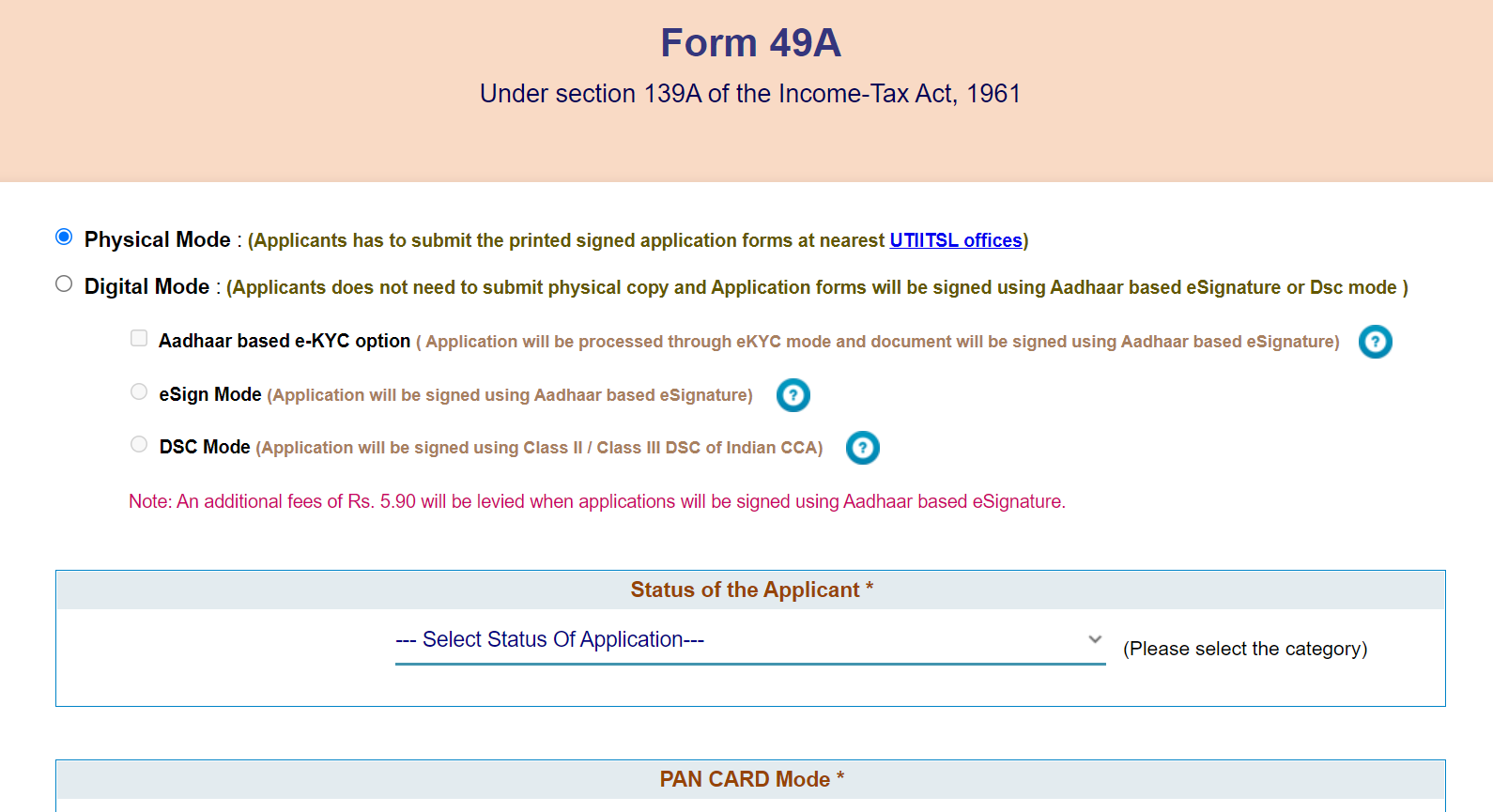

There are two ways in which Indian citizens can apply for a new PAN Card; either by submitting a physical copy of form 49A or using your digital signature to apply one online.

|If you opt to use your regular signature, you have to make the payment online, print and form, and submit it to your nearest UTIITSL center.

Here we will explore in detail the steps for both types of application processes:

PAN Card Application for Indian Citizens Using Regular Signature Process

In the absence of a digital signature, you will need to make the payment, download form 49A, fill it, and submit the form along with all the necessary and signed recent photographs to a UTIITSL center.

How To Fill Form 49A?

You can download form 49A from the UTIITSL website. In the form, you have to write the following details:

- Applicant’s full name

- Desired name on the card

- Applicant’s Gender

- Applicant’s date of birth

- Details of applicant’s parents

- Applicant’s residential address

- Applicant’s official address

- Applicant’s telephone/mobile number

- Applicant’s email address

- Applicant’s Aadhar number if allotted

- Applicant’s income source

- Applicant’s representative Assess details

- Marking the documents provided by the applicant as proof of identity, address, and date of birth.

- Declaration by the applicant that the details provided is true to the best of their knowledge.

Payment and Download of Filled Form 49A

Once you’ve filled up form 49A, make sure you click on the “submit” just once. The filled-in form will appear on the screen for you to check and verify all the details before proceeding to the next step.

Once you have ensured that all information is in order, it is time to make the payment of Rs. 107 using the payment options and gateways supported by UTIITSL. You can process the payment using the gateways provided by PayU India and BillDesk.

- Here are the payment modes offered to the applicant:

- Credit Card (Accepted cards: Visa and Mastercard)

- Debit Card ( Accepted cards: Visa and Mastercard)

- Netbanking

- Cashcard

- Any other payment option displayed by the payment gateways mentioned above

Once the payment goes through, the applicant will be able to save and download the application. Do not forget to save the application number. However, if the payment fails, you can always cancel the transaction and start afresh.

You can also regenerate the application using the “Regenerate Online PAN Application” option. All you have to do is enter the 10-digit application number and submit it.

Pre-Submission Procedure for Form 49A

The downloaded application will have a “payment confirmation” endorsement. Fix two photos of 3.5cmx2.5cm size on the form. Following that, the applicant has to sign at three following places:

- Sign across the photo on the left-hand box of the application

- Sign in the space provided below the photo in the right-hand corner

- Sign in the space provided at the bottom of the right-hand corner on Page 2

Once signed, attach copies of documents the applicant is submitting as proof of address, identity, and date of birth. Submit the completed application to your nearest UTIITSL office.

PAN Card Application for Indian Citizens Using Digital Signature Process

If you have a digital signature, you can utilize that to apply for a new UTI PAN card. Just submitted scanned copies of POI documents along with your photo and signature on the UTIITSL website.

How to Fill Form 49A Online?

While filling form 49A, you have to provide the following information as and when it appears on the screen.

- Applicant’s full name

- Desired name on the card

- Applicant’s Gender

- Applicant’s date of birth

- Details of applicant’s parents

- Applicant’s residential address

- Applicant’s official address

- Applicant’s telephone/mobile number

- Applicant’s email address

- Applicant’s Aadhar number if allotted

- Applicant’s income source

- Applicant’s representative Assess details

- Digital copies of documents the applicant wishes to submit as proof of address, identity, and date of birth. You can access your Digilocker account to get the necessary documents if you have one.

- A color photo in 300 dpi sized 213x213 px. Ensure that the photo file does not exceed 30kb

- A scanned copy of your digital signature in black and format, 600 dpi. The size of the photo must not be more than 60kb.

- Declaration by the applicant that the details provided is true to the best of their knowledge.

Payment and Submission Form 49A Using Digital Signature

This process is the same as the one where the applicant uses their regular signature. The only difference is that once the payment gets through, the form is automatically submitted in the portal, and the applicant need not do it separately in UTIITSL centers.

Once you have filled in all the details in the form, you will be redirected to the payment portal. Using the payment gateways provided by PayU and BillDesk India, make a payment of Rs. 107. You can pay using the following methods:

- Credit Card (Accepted cards: Visa and Mastercard)

- Debit Card ( Accepted cards: Visa and Mastercard)

- Netbanking

- Cashcard

- Any other payment option displayed by the payment gateways mentioned above

Once the payment is successful, the form will be automatically submitted. In case of payment failure, you can try again by canceling the current transaction.

UTI PAN Card Application for Foreign Citizens

Like Indian citizens, foreign citizens can also apply for new PAN cards on the UTIITSL website. Both international organizations and foreign individuals can avail of this service. Foreign individuals of Indian origin, overseas citizens, and people holding foreign citizenship can apply for an Indian PAN card.

International private and government organizations, financial establishments, non-government and charitable institutions can also apply for a PAN card in India. In this case, the applicant, individual or organization, has to fill out form 49A and submit it to a UTIITSL center.

How to Fill Form 49AA?

The form foreign nationals need to fill in Form 49AA and can be found on the UTIITSL website. The applicants need to provide the following information on the form:

- Applicant’s full name

- Desired name on the card

- Applicant’s Gender

- Applicant’s date of birth

- Details of applicant’s parents

- Applicant’s residential address

- Applicant’s official address

- Applicant’s telephone/mobile number

- Applicant’s email address

- Applicant’s country of citizenship and ISD code

- Applicant’s source of income

- Details of applicant’s agent or representative in India

- The documents the foreign application will provide as proof of address and identity

If the applicant is a foreign institution or investor, they need to fill out additional details in the “KYC Details” section. Below is a detailed explanation of the same:

- If the applicant is a foreign individual investor, they need to declare their marital status as well as occupational details in the form.

- If the investor is an international institution that intends on investing in India, the corporate must declare the category under which their establishment falls.

- Declare the total annual income.

- If the establishment falls under the public domain, they must declare if they fall under any stock exchange. If yes, then under which stock exchange.

- The corporation must declare if any family member or members hold ownership stake or beneficial control in the company.

- If the applicant is a foreign corporation, they must declare if the institution is involved in any money-changing service, foreign exchange, Lottery/Gaming/Gambling services, pawning, or money lending services.

- The applicant must declare if they are engaged in politics or related to someone who is.

Form 49AA Submission and Payment

Once the form is submitted, the filled-in form will appear on-screen for the applicant to check and verify if all the information provided is correct and true. Then, they can go ahead and pay a sum of INR 989 to apply successfully. The applicant can process the payment by using any of the following payment options supported by UTIITSL.

- Credit Card (Accepted cards: Visa and Mastercard)

- Debit Card ( Accepted cards: Visa and Mastercard)

- Netbanking

- Cashcard

- Any other payment option displayed by the payment gateways mentioned above

If the payment is successful, the applicant will be able to save and download the application. They can also regenerate the form using the “Regenerate Online PAN Application” in case they lose the original one. All they have to do is to enter the 10-digit application number.

So, it is important to note down the application number somewhere safe and accessible.

Pre-Submission Procedure for Form 49AA

- The pre-filled printed form will have a “Payment Confirmation” mark on it. The applicant will now have to fix two photographs of 3.5cmx2.5cm in size and sign in three places.

- The first sign should be done across the photo fixed on the left-hand side box. The second sign should be in the right-hand side box and the third sign needs to be done at the bottom right corner of the second page.

- Provide all the copies of documents that are needed as proof of address, identity, and date of birth.

- The complete form can be submitted in any of the UTIITSL centers located in Kolkata, Mumbai, Chennai, and Delhi.

- The PAN card will be couriered to the address provided for communication by the applicant. A fee inclusive of the charge required to dispatch the card to a foreign address will be charged from the applicant.

Application for Change or Correction in PAN Card on UTIITSL Website

If you need to make any changes or corrections in the information on your PAN card, you can easily do so through the UTIITSL website online from the comfort of your home. All you need to do is to fill out the CSF form.

How to Fill Out the CSF Form?

You can fill out the CSF form using your digital signature or following the regular process. You will have to indicate the change or correction you want to make to your existing PAN card in both forms.

All you have to do is tick a red-bordered box to indicate the change or correction you want to implement. Apart from that, you will also need to provide the following details in the CSF form.

- Applicant’s PAN card number

- Applicant’s full name

- The name they want on the card

- Applicant’s gender

- Applicant’s date of birth

- Details of applicant’s parents

- Indication for signature or photo mismatch (if the change if required)

- Applicant’s communication address (Office or Residential)

In case there is an address change, upon indication, an additional sheet will be provided to update the address.

- Applicant’s AADHAR number

- The PAN numbers allotted to the applicant

Upon verification of the details entered by the applicant, they will need to select the documents they wish to submit as proof of identity and address. Apart from that, they will also need to submit the following as PAN proof:

- Copy of current PAN card

- Copy of FIR

- Copy of PAN allotment number

CSF form with Digital Signature

- Upload the digital copies of all the documents you wish to submit as proof of identity and address.

- Upload a color photo sized 213x213 px, 300 dpi on the website. Ensure that the file is within 30kb.

- Upload a scan of your digital signature in the black and white format in 600 dpi within the 60kb limit.

CSF Form Submission and Payment

Given that this is a request to make changes and corrections to the existing information on a PAN card, no charge was levied by UTIITSL.

CSF Form Submission for Regular Signature Process

- Print the form with the “Payment Confirmation” endorsement on it and fix two photographs on it, both sized 3.5cmx2.5cm in size.

- Put your signature across the photo on the left-hand side, below the photo on the right-hand side, and in the bottom right-hand box on page 2.

- Attach copies of all the documents you are submitting as proof of identity, address, and date of birth.

- Submit the filled-in CSF form in any of the UTIITSL offices located in New Delhi, Kolkata, Mumbai, and Chennai.

Offline Application of UTIITSL PAN Card Offline

Here, we explore the steps that will explain how to apply for a UTIITSL PAN card offline.

- Download the PAN card application form the UTIITSL website. You can also collect the same from UTIITSL agents. Carefully fill in the details mentioned on the form. These are the same as shown in the online application process.

- On completion, submit the form to the nearest UTIITSL office and pay the processing fee for the same. Upon successful submission of the form, UTIITSL will issue a new PAN card with 15 business days.

UTIITSL Offices in India for PAN Card Application

REGION | ADDRESS | PHONE NUMBER |

PAN PDC Incharge – Mumbai region | UTI Infrastructure Technology And Services Limited Plot No. 3, Sector 11, CBD Belapur NAVI MUMBAI – 400614 | (022)67931300 |

PAN PDC Incharge – Kolkata region | UTI Infrastructure Technology And Services Limited 29, N. S. Road, Ground Floor, Opp. Gilander House and Standard Chartered Bank, KOLKATA - 700001 | (033) 22108959 / 22424774 |

PAN PDC Incharge – Chennai region | UTI Infrastructure Technology And Services Limited STC Trade Centre, First Floor, A-29, Thiru- Vi- Ka Industrial Estate, Guindy CHENNAI - 600032 | (044) 22500426 |

PAN PDC Incharge - New Delhi region | UTI Infrastructure Technology And Services Limited Ground Floor, Jeevan Tara Building, Opp. Patel Chowk Metro Station, 5 Parliament Street NEW DELHI – 110001 | (011)23211273-74 |

Official Documents Required for Application of UTIITSL PAN Card

The documents asked by the UTIITSL during the PAN card application act as proof of the applicant’s date of birth, address, and identity. The following documents are accepted by the UTIITSL as address proof, identity proof, and date of birth proof.

Accepted Document Copies as Address Proof

The following documents must show the correct address of the applicant

- Valid voter ID card

- Electricity or telephone bill

- Ration card

- Passport

- Rental agreement

Accepted Document Copies as Address Proof

The following documents must have the applicant’s name against his/her photograph proving the individual’s identity.

- Voter ID card

- Passport

- Aadhar card

- Driving Licence

- Utility card

Accepted Document Copies as Date of Birth Proof

- Birth certificate of the applicant issued by the municipal authority

- Driving Licence

- Aadhar Card

- Voter ID card

- Passport

Different Kinds of PAN Cards Issued by UTIITSL

UTIITSL issues different kinds of PAN cards depending on the type of applicant.

UTIITSL PAN Cards for Organisations: These PAN cards bear the corporate name and the company’s registration date. Unlike PAN Cards issued to individuals, there will be no photographs on these.

UTIITSL PAN Cards for Individuals: As stated in the name, these PAN cards are issued to citizens of India for income tax purposes.

PAN Card Structure Issued by the UTIITSL

Here are the following details that will be mentioned on a PAN card allotted to an individual:

- Permanent account number

- Card holder’s full name

- Card holder’s father’s name

- Card holder’s date of birth

- Card holder’s signature

- Card holder’s photograph

Here are the details that will be printed on PAN cards issued to corporates

- Permanent account number

- Full name of the company

- Registration date of the company

How to check UTI PANCARD status ?

If you have filled your PAN card application online through the UTIITSL website, you can use the “Track PAN Card” service to get updates about the status. Follow the steps below to track the status of the card online:

- Open the UTIITSL PAN Card Status Tracking page

- Enter the “Application Coupon Number”

- Enter the security details and click on submit

- The current status of the application will appear on the screen

Frequently Asked Questions

1. How do I get a PAN ID for UTIITSL?

The process of generating a PAN ID from UTIITSL is fairly straightforward. All the applicant has to do is to attach a copy of his/her PAN card for PSA UTI registration. Along with that, the individual must also attach a copy of the Aadhar Card. Upload all the required documents for PSA UTI registration and submit the form.

2. Which is best for PAN cards UTIITSL or NSDL?

There is no significant difference between these two organisations as both falls under the Income Tax Department of India. Also, both are companies take the same amount of time when processing and issuing PAN applications and new cards.

3. How long does it take to get a PAN card from UTI?

It usually takes around 15 business days for an individual or company to get their PAN card from UTIITSL.

4. Is UTIITSL PAN card valid?

As the UTIITSL falls under the Income Tax Department of India, all PAN cards issued by the organization are valid.

5. What is the difference between NSDL and UTIITSL?

Both the organizations are major PAN card issuers in India, and both fall under the Income Tax Department of India. So, there is no significant difference between the two.