Searching ways for pan card verification, then you have come to the right place.

The PAN Card is an essential identification document for financial transactions. If you have bought a property valued above INR ten-lakhs or part of the burgeoning start-up ecosystem in India, you must have furnished PAN details for the processing.

PAN is also required during big-ticket investments, opening a bank account or DEMAT, ITR filing, and several other financial activities. Having said that, we need to verify the Permanent Account Number and ensure the authenticity of the PAN card for hassle-free financial transactions.

The Income Tax Department has allowed and authorized NSDL e-Governance Infrastructure Limited (Rebranded as Protean eGov Technologies Limited in December 2021) for PAN verification services. Any Indian citizen can avail of the services and confirm PAN details

PAN Card Verification

Types of PAN Verification Methods

We explained the significance of PAN and why you should verify it for hassle-free financial activities. Now, we will explain Three ways to substantiate the PAN details.

File-based Verification

Generally, government organizations confirm bulk PAN details through a file-based method. They can substantiate up to a thousand cards at once with this process. The applicant or the person who manages the process must submit details in the exact format specific to avoid rejections.

Steps to Confirm PAN

Step 1: Log in to your account on the e-filing website of the Income Tax Department of India. If it is your first time, register first and then log in to proceed.

Step 2: Follow the instructions and upload up to 1000 files. Check and recheck all details before moving to the next stage.

Step 3: Once the filled details have been verified, click on ‘Submit’.

Step 4: The system will review your submission and generate PAN details of files. Their turnaround time is within 24 hours. NSDL mentioned guidelines to upload documents and submit other required information. You should strictly follow the given instructions to avoid rejection.

Screen-Based Verification : NSDL Pan Verification

Applicants can confirm up to five PAN cards at once with a screen-based verification method. An individual can verify someone else’s PAN with all the required details intact.

Steps to Verify

Step 1: Visit ‘e-filing’ at www.incometaxefiling.gov.inwww.incometaxefiling.gov.in and log in to apply for pan

card verification online.

Step 2: On the next page, submit details of up to Five PAN cards. Enter the number in the specified section.

Step 3: Check all the data, confirm and select ‘Submit’.

Step 4: The system will check and display PAN details on the screen.

*Always follow NSDL guidelines to submit the details to

avoid rejections.

Application Programming Interface (API) or Software based Verification

You can use API-based confirmation processes for faster and reliable output. You can use software to check PAN status in quick & easy steps.

Steps to Verify

Step 1: The software provides an inquiry form link. Go to the link and fill it properly.

Step 2: Next, integrate with the PAN confirmation API.

Step 3: Submit PAN number.

Step 4: Extract all the information you require.

Responses of PAN Verification Application

1) Valid PAN

PAN status, PAN Cardholder’s Name, Information about Previous PAN Update,

*Name on the PAN card

*Aadhaar Linked Status

2) Valid PAN with situations/events like Mergers & Acquisitions etc.

PAN Verification Status along with the Occasion, Full name of the PAN Cardholder, Details of the Last PAN Card update,

*Name on the PAN card

3) Deleted or Deactivated

The website will display the status as “Deleted” or “Marked as Deactivated.” There will be no other details on the screen.

4) Fake PAN

Protean eGov portal will show status as “Marked as Fake.” There will be no other details on the screen.

5) PAN not found in the Income Tax Department Database

- The portal will show the message “Not present in the ITD Database.”

- You need to provide proof of the PAN Card (PAN Allotment Letter or Photocopy of the PAN) applied for the confirmation.

- If unable to do so, Protean eGov will forward your file to the Income Tax Department for investigation.

6) Inoperative PAN

You will get PAN verification status, the full name of the PAN Cardholder, details of the last PAN Card update.

*Name on the PAN card, as per ITD database

Verify PAN Card by PAN Number

The Income Tax Department of India also offers the facility to verify PAN cards with Permanent Account Number only.

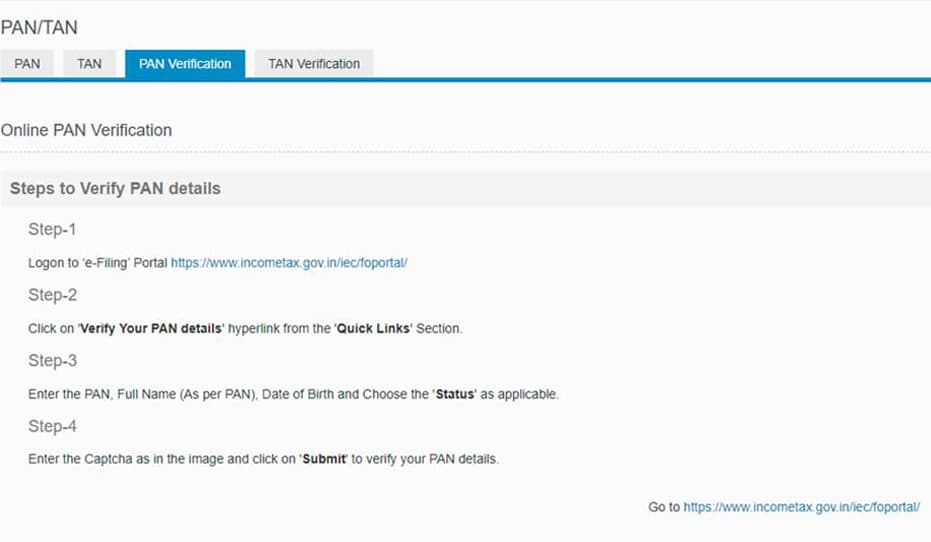

Steps to Confirm

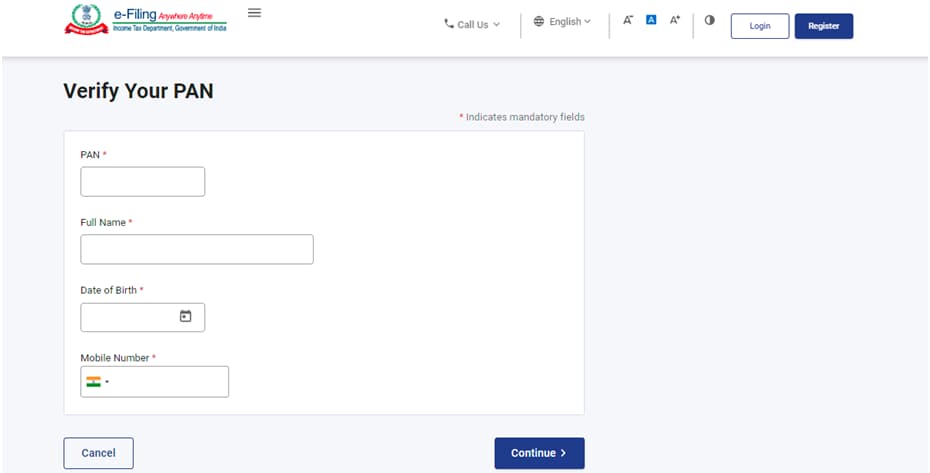

Step 1: Visit and Log-in at the NSDL website with valid credentials. Keep PAN card and personal information ready. You will need them to submit in the verification process.

Step 2: Next, enter demographic details: full name and date of birth with Permanent Account Number. Data should match with Aadhaar and Government documents.

Step 3: Enter the category of your PAN card such as Hindu Undivided Family, Individual, Corporate, etc.

Step 4: You will get a captcha verification code in the next step. Enter exact letters and digits and click submit. Captcha is case-sensitive. You need to understand and write carefully.

Step 5: The system will display the status of PAN after successful confirmation and data match.

Step 6: Applicants need to verify confirmation status within five days from receiving the acknowledgment.

PAN cardholders can also verify through UTI Infrastructure Technology and Services Limited. Indian citizens can visit the UTIITSL website and apply for PAN cards similar to Protean eGov Technologies Limited.

They are supervised according to the Income Tax Department rules & regulations and authorised to issue and substantiate your Permanent Account Numbers.

Steps to Verify at UTIITSL

Step 1: Go to their website and log in with your PAN number.

Step 2: In the next screen, there will be options to choose for PAN verification. Select and submit required details.

Step 3: Your data will be verified and you will get results in the next screen.

PAN Verification by Name and Date of Birth

The Income Tax Department allows PAN verification with credentials including name and date of birth.

Steps to Confirm

Step 1: First, you need to sign-up at the e-governance website of the Protean Technologies Limited (Formerly NSDL e-Gov) for online services.

Step 2: Enter sign-in details along with your full name and date of birth. It will get you access to the PAN details and status of confirmation.

*You should maintain correct and same demographic details including date of birth and name on all Government documents for hassle-free PAN verification.

e-Verify Returns via

Aadhaar

The government has facilitated electronic verification returns through Aadhaar. It provides better integration between Aadhaar and PAN and helps faster PAN verification.

Steps to e-Verify Returns via Aadhaar

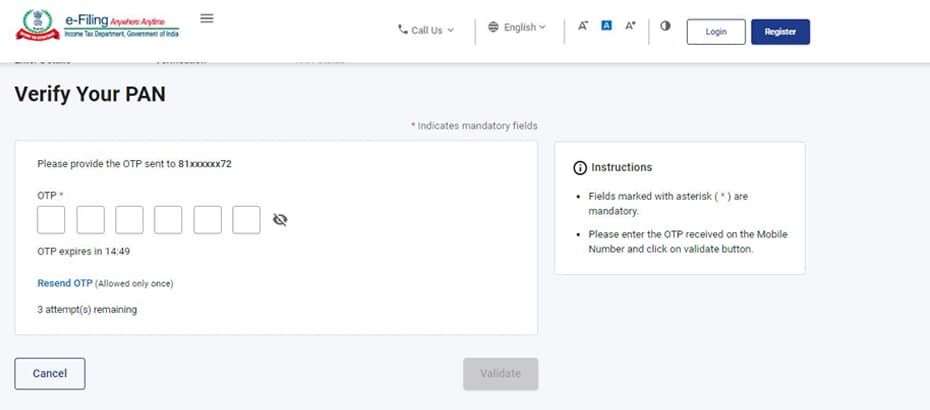

Step 1: Visit www.incometaxefiling.gov.in and log in with a ten-digit Permanent Account Number, password, and case-sensitive captcha verification code.

Step 2: Go to ‘My Account’ on the dashboard.

Step 3: Select the ‘e-verify return’ option.

Step 4: Find and click on ‘I would like to generate Aadhaar OTP to e-verify my return’ to proceed.

Step 5: You will receive a one-time password on the registered mobile number. You must maintain the same number for Aadhaar and PAN for successful PAN verification.

Step 6: Enter the password and complete the e-verify returns confirmations process.

Verification of Applicability under Section 194N

You can also check applicability under Section 194N. The section explains how much cash you can use without paying TDS (Tax Deducted at Source). Currently, you are liable to pay TDS on cash withdrawals of more than INR 20 lakhs (without ITR filing), and INR 1 crore (with ITR filing).in a financial year.

Steps to Verify

Step 1: Go to the Income Tax Department e-filing portal.

Step 2: Submit 10-digit Permanent Account Number and Registered Mobile Number.

Step 3: Next, there will be terms & conditions. These are standards T&C, ‘Agree’ and ‘Continue’.

Step 4: Follow the guidelines in the next screen about the confirmation of applicability under Section 194N.

Eligibility of PAN Verification

The List of Entities Eligible for PAN Verification

- Reserve Bank of India

- Central Vigilance Commission

- Stamp & Registration Department

- Income Tax Projects

- Payment Banks approved by RBI such as India Department of Posts, Fino PayTech Limited, Aditya Birla Nuvo Limited, etc.

- GST Network (GSTN) handles the IT system of the GST portal. It is a non-governmental and nonprofit entity

- Central and State Government Agencies

- Central KYC Registry:

- A centralized repository of KYC documents of customers availing various services of the financial sector

- Commodity Exchanges/Stock Exchanges/Clearing Corporations

- Organizations that are needed to furnish Statement of Financial Transaction or Annual Information Return

- Businesses that are required to produce Annual Information Return or Statement of Financial Transaction

- Government-funded Educational Institutions(Central and State Governments)

- RBI approved Credit Information Agencies: CIBIL (Credit Information Bureau(India) Limited, CRIF High Mark Credit Information Services Private Limited, Equifax Credit Information Services Private Limited, and Experian Credit Information Company of India Private Limited

- Depository Participants: Mediators between the investors and depository. These are registered stockbrokers or agents of a depository

- Credit Card Institutions

Authorities who sanction DSC

- Mutual Funds

- National Pension System’s Central Recordkeeping Agency

- Credit Card Institutions

- Insurance Company and Repository

- Housing Finance Companies

- RBI approved NBFCs

- SEBI approved Invest Advisor

- RBI approved Prepaid Payment Instrument Issuers

Details Required to Register for the Online PAN Verification

List of Details and Documents a business needs to submit for Online PAN Card Authentication. We have shared documents in respective heads for better clarity.

Organization Details

- PAN (Permanent Account Number) and TAN (Tax Deductions and Collection Account Number) of the Firm/Business.

- PAN for Organisations is different from PAN for individuals. Personal PAN can be used only for Sole proprietorship firms.

- Name of the Firm/Business: A name that distinguishes a business from other firms. The fourth character of the Permanent Account Number symbolises the type of cardholder. For example: ‘C’ for Company, ‘P’ for Person, ‘F’ for firm, ‘H’ for Hindu Undivided Family and so on.

- Personal Information of the Entity: Keep the same personal information on all the company-related documents.

- Contact Details of the Business: Address, mobile number, email-id. Keep all of them active and ensure prompt responses.

- Category of the Firm/Business: Proprietorship, Partnership, etc.

Payment Details

Mode of Payment: Internet Banking, Card payment, etc.

- Payment Amount

- Number of Instrument

Signature Detail

- Serial Number of Digital Signature Certificate Digital signature certificates authenticate the identity of the applicant.

- Name of the Certifying Authority

- Class of Digital Signature Certificate

Documents for PAN Verification Online

- Organizations need to furnish the following documents for PAN verification.

- Terms and conditions typed on your firm/entity’s official letterhead.

- Companies need to provide an authorization letter on their letterhead.

- Declaration of Entities: Two copies need to be submitted with the signature of an authorized person.

- Incorporation Certificate: Legal certification for forming a company. Two copies need to be submitted with a signature of an authorized person.

- License or Certificate issued by a regulatory body. PAN verification requires two copies with the signature of an authorized person.

- Demand draft or cheque for the applicable charges. Entities and organizations are required to raise demand draft in favour of “NSDL-TN”.

Checking the Status of Online Registration

The Income Tax Department of India is the final authority for the PAN Card verification. The IT Department has been authorized by Protean eGov Technologies Limited (Formerly NSDL e-Governance Infrastructure Limited) for processing the PAN verification request.

NSDL e-Governance Infrastructure Limited checks format, documents, and details. The regulatory body forwards the verification request to the Income Tax Department if all details stand correct.

On successful PAN verification, the applicant gets an eight-digit User ID. You can use this to check the status of online registration.

An Individual, Government organisation and businesses can confirm their PAN verification status through acknowledgment number. It is a fifteen-digit code provided during applying for a PAN card through Protean, e-Mudra or UTI.

You can track the PAN status with the number. UTIITSL provides a nine-digit coupon number as an acknowledgment receipt.

Income Tax Department have all the authority to reject your request for new PAN or Verification on following grounds;

· Incomplete documents

· Wrong or mismatched information

You should check all the details while filling the application and submitting the documents. Once verified, use acknowledgment number and track progress of PAN Verification. You can check it from any digital device including smartphones, computers, tablets etc.