Having an updated PAN card is important, not only while performing key transactions but while filing ITRs too. You must file your income tax returns on time, no matter if you're a business owner or a freelancer offering services to an organization.

While applying for a new PAN card, you must correctly fill in the AO code. But, what is ao code in pan card and what is the importance of ao code for pan?

Let's find out.

What Is AO Code In Pan Card

Appointed the Income Tax department to assess income tax returns filed by taxpayers, AO is short for Assessing Officer. The AO can, in some cases, summon the taxpayer for discrepancies in the information provided and seek clarification

Issued by the Assessing Officer, the AO code is essential while applying for your PAN card online.

What is area code in pan card?

The AO code is an important detail to fill in your PAN card application. Also known as the 'Assessing Officer's code', it contains details about the area of jurisdiction under which a person's tax returns fall.

Made of different components, it helps ascertain which tax law applies to an individual. You can get to know your AO code by visiting the Income Tax office in your city.

Components of an AO Code

So, what exactly does the AO code consist of? What are some key elements included in it?

If these are some questions that come to your mind talking about AO codes, we've got you covered.

Given below is a detailed description of the four major components of an AO code:

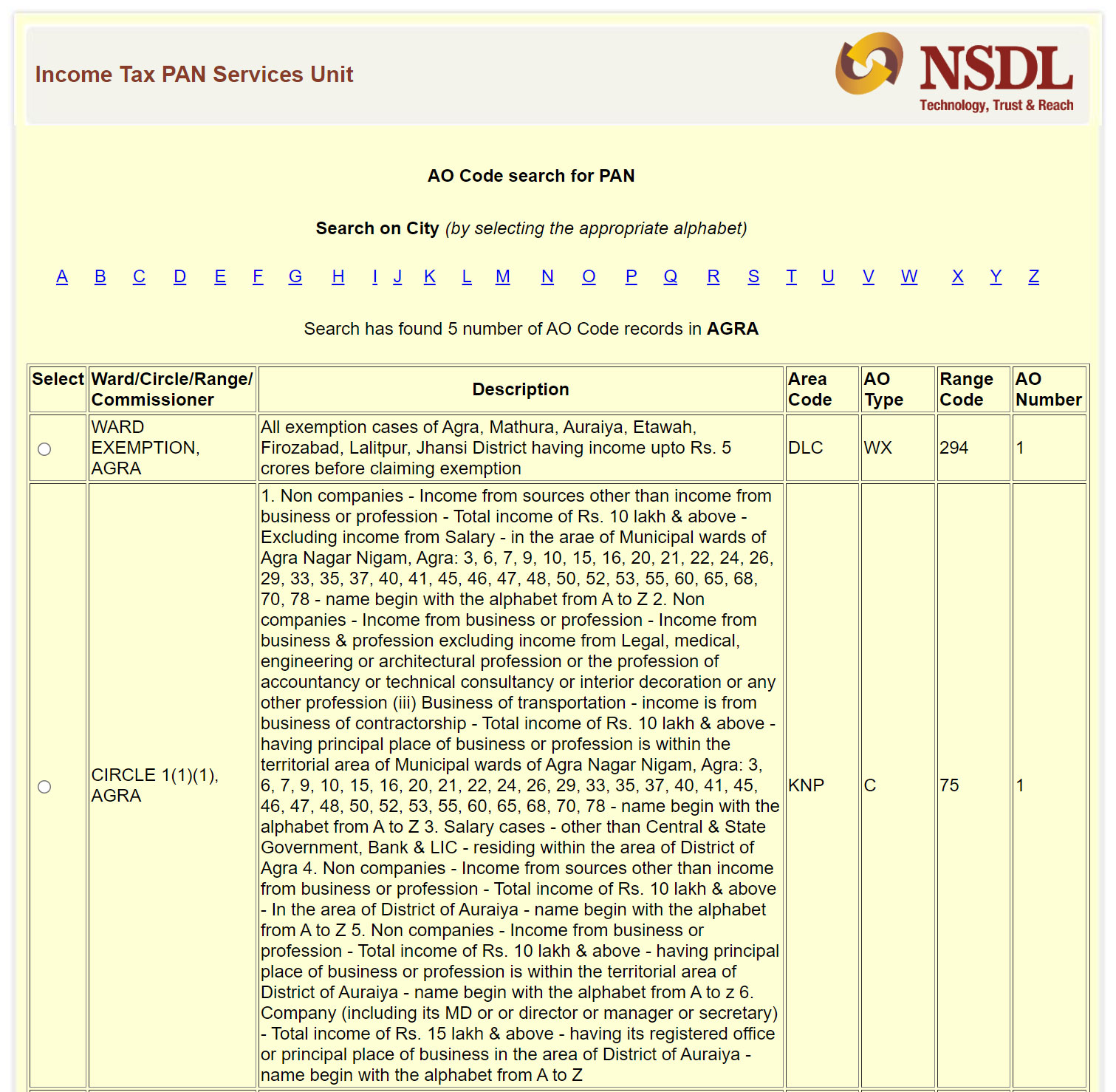

- What is Area Code: The area code for pan card defines the region or geographical area under the Assessing Officer.

- What is AO type in pan card: Primarily used for identifying the type of Assessing Officer (Ward, Circle, Range or Commissioner), this component helps identify the category a PAN cardholder, company or individual belongs to.

- What is Range Type: PAN cardholders are assigned a range type/code to identify the ward or circle they live in.

- AO number: This is the number assigned to an Assessing Officer. Published on the NSDL website, this is the last component of your AO code.

How to Know the Jurisdictional AO?

Available for taxpayers who are also PAN cardholders, the ‘Know Your AO’ service can help you know more about the Assessing Officer under whose jurisdiction your ITR falls. One must have a valid PAN & phone number to do so.

To know your jurisdictional AO, follow these steps:

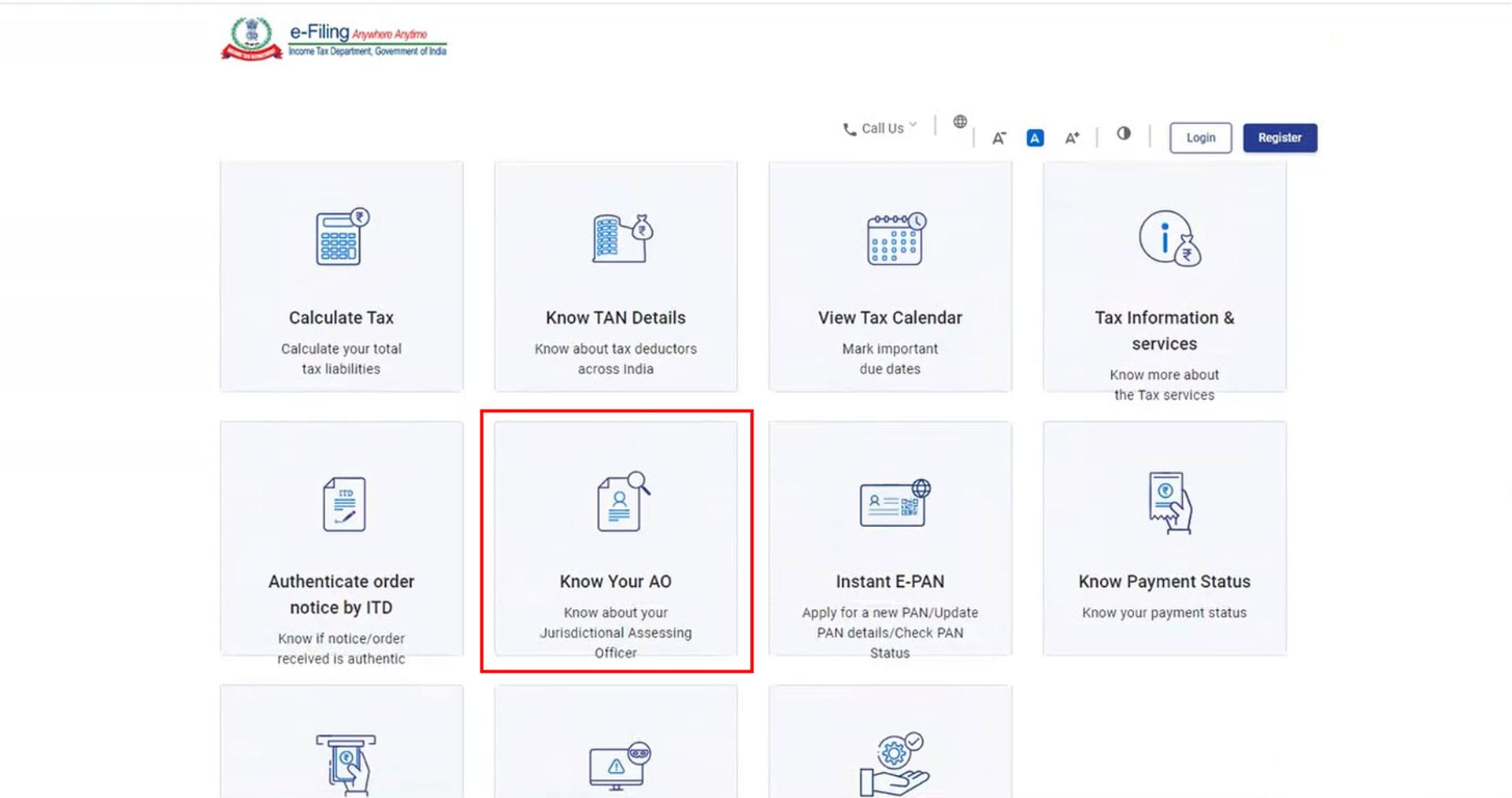

- Open the e-filing portal & click on the ‘Know Your AO’ option.

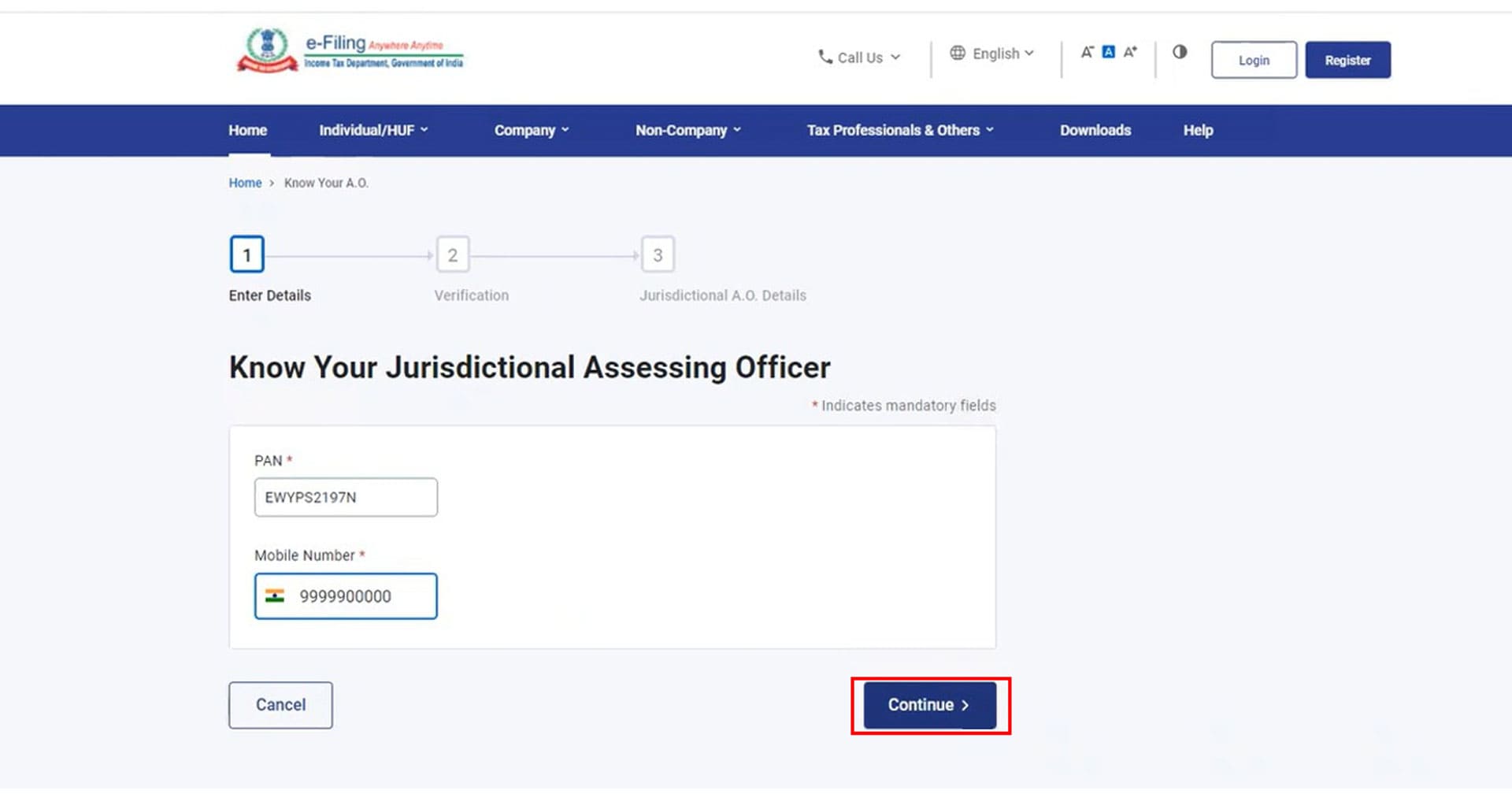

2. On the 'Know Your Jurisdictional Assessing Officer' page, you can enter your PAN and mobile number before clicking 'Continue'.

3. Users receive a 6-digit OTP, which they must enter before clicking the ‘Validate’ button.

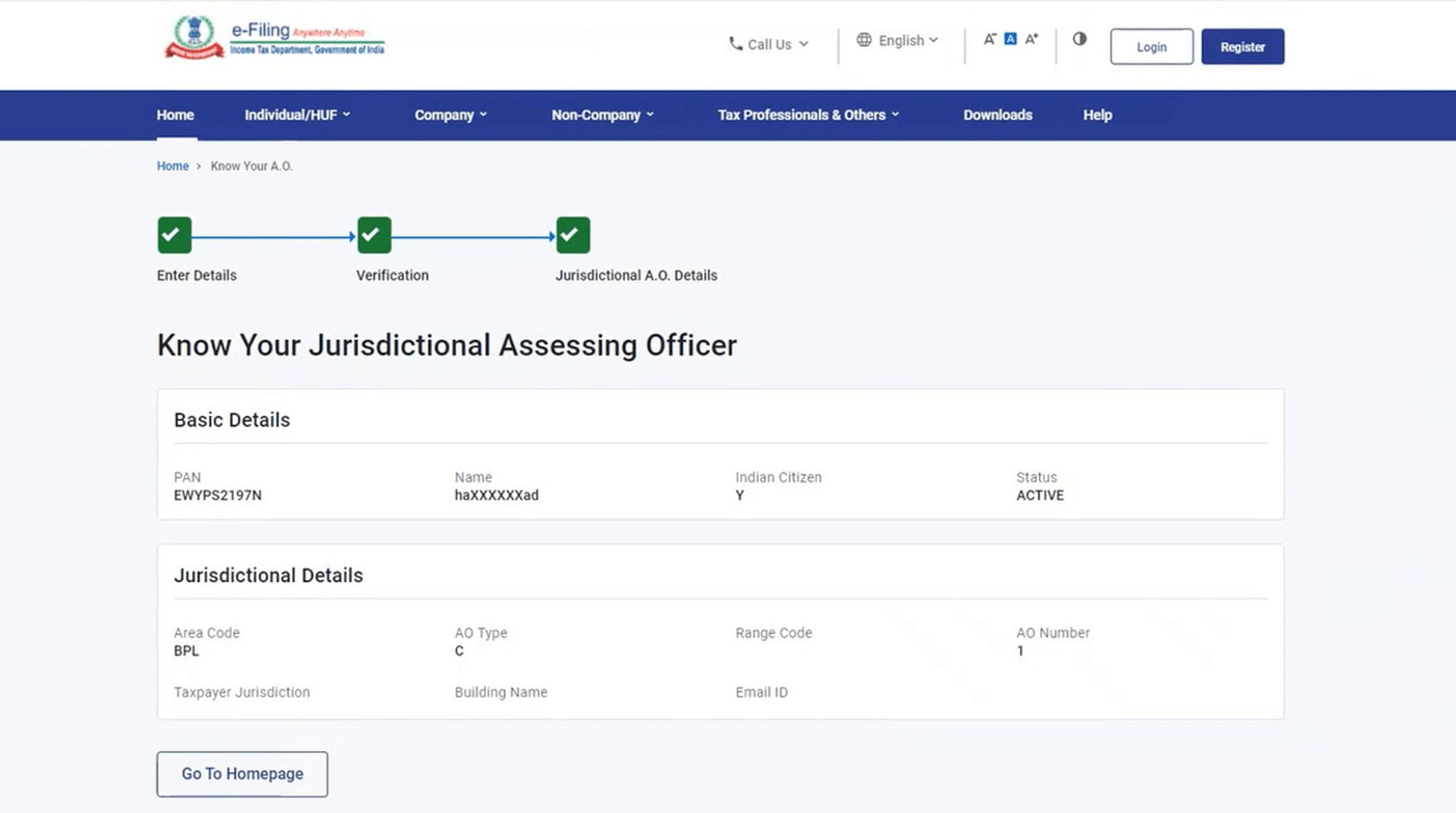

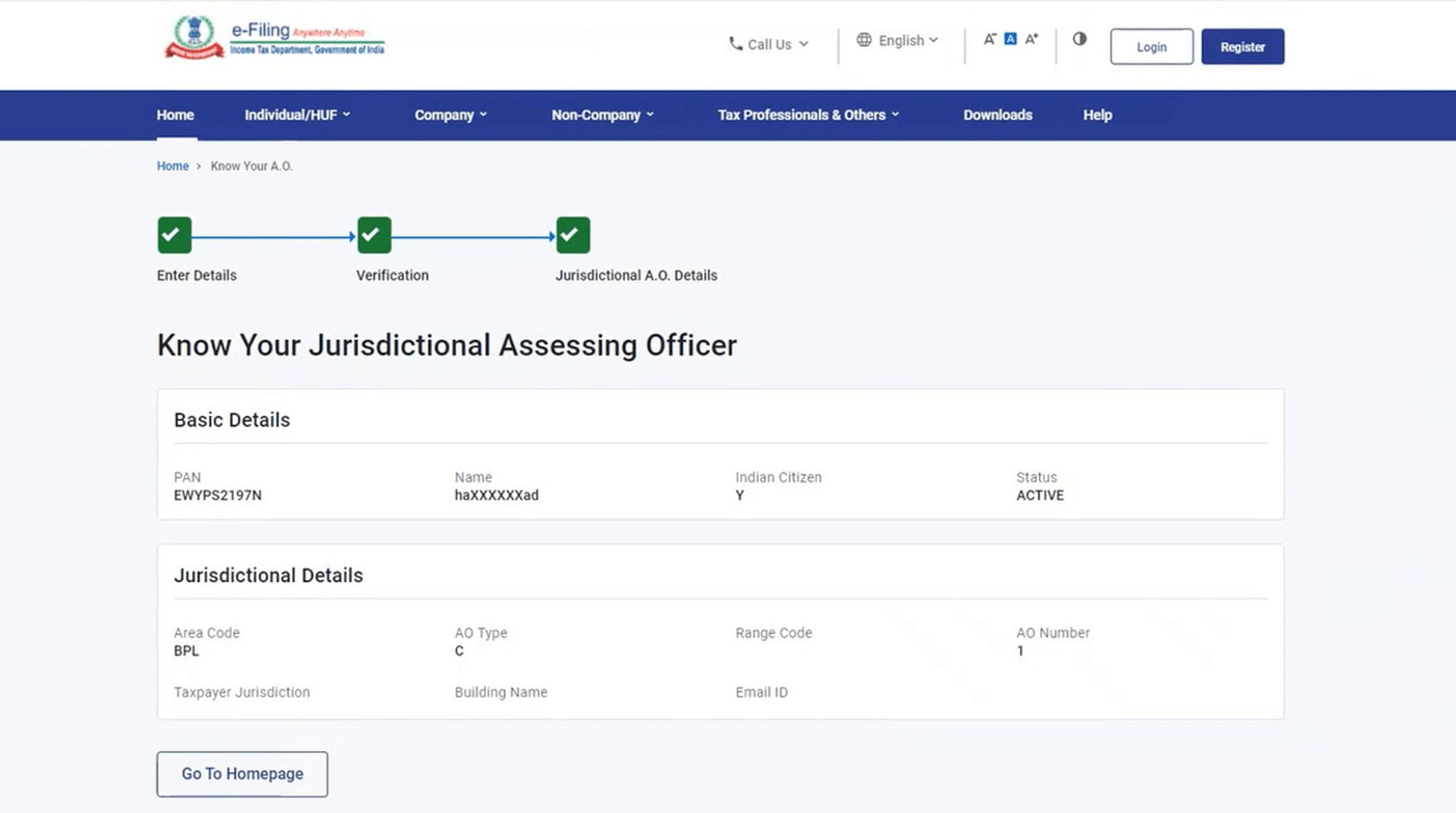

4. Once validated, you’ll be able to see the AO's details alongside your PAN status.

How to Find Your AO Code for PAN/Online

Knowing your AO code is essential if you want to know which tax laws apply to you as a taxpayer. If you want to understand how to find ao code for pan card online, follow the below steps:

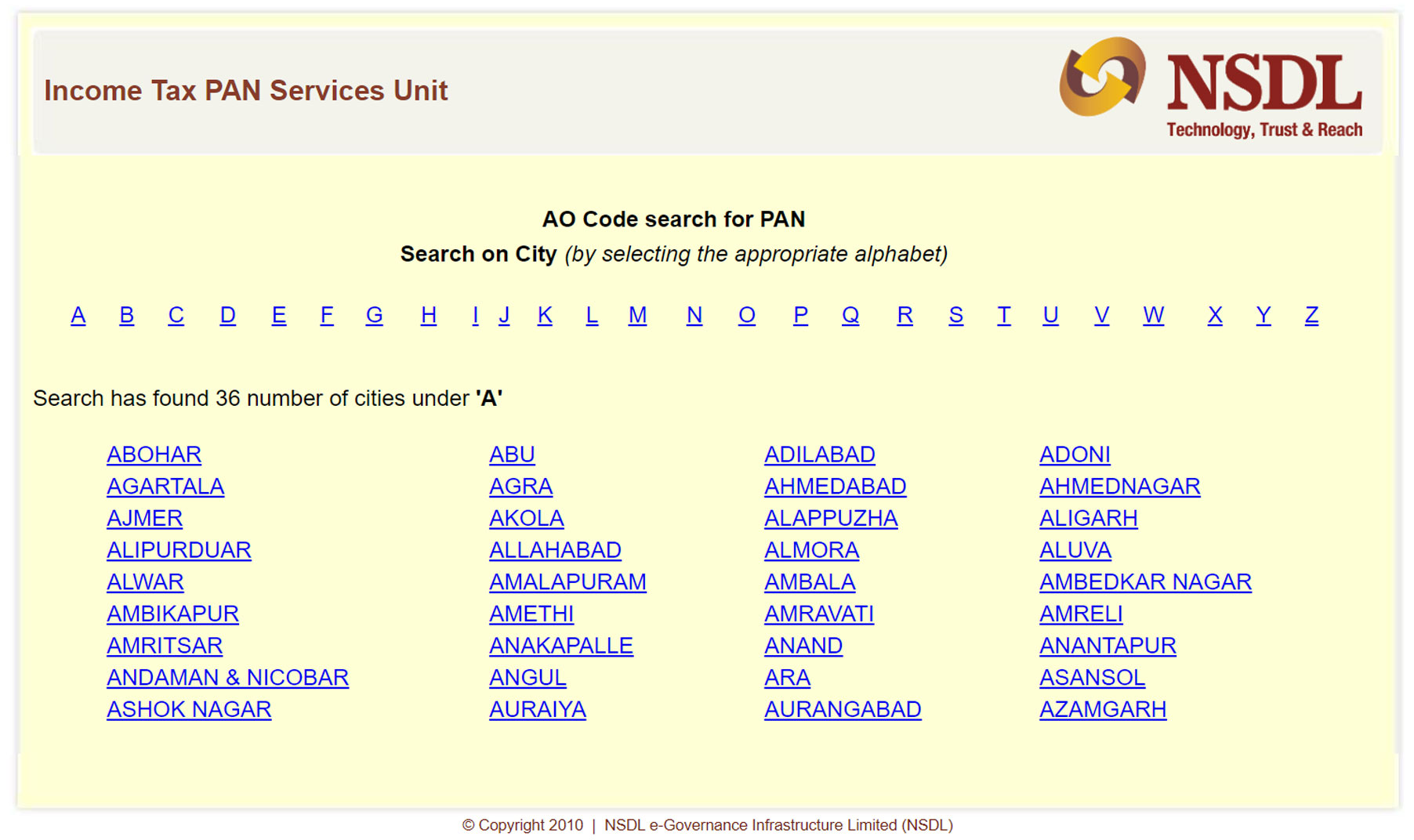

1- Visit the NSDL website ( https://tin.tin.nsdl.com/pan/servlet/AOSearch?alpha=A) & search for the AO code. Before doing so, you must also identify if you qualify as a salaried/non-salaried individual or a business organization.

2- On the website, select the city where you currently reside.

3- Given in a table would be the list of AO codes for different cities.

4- Select your city before clicking the ‘Submit’ button.

Finding AO Codes for Top Cities

The table below contains information about the AO codes for some of India's top cities. Let’s take a look:

AO code for Chennai | |

AO code for Delhi | |

AO code for Bangalore | |

AO code for Kolkata | |

AO code for Patna | |

AO code for Gurgaon | |

AO code for Hyderabad | |

AO code for Mumbai | |

AO code for Ahmedabad |

How to Check your AO Code Online?

Many people want to know how they can check their AO code online. If this is a concern for you too, follow these steps:

Step 1: Go to the e-filing portal at https://incometaxindiaefiling.gov.in./home.

Step 2: Now click ‘Profile Settings’ followed by the ‘My Profile’ tab.

Step 3: Under the 'My Profile' section, click 'PAN Details', and the website will show you all the details in your AO code - AO type, range code and jurisdiction, among others.

Step 4: To avoid sharing incorrect information, you must double-check your PAN details for mistakes.

How Is Your AO Code Determined?

For those paying taxes for the first time, it’s imperative they would want to know the process behind determining the AO code in your PAN.

With that said, here’s how your AO code is usually determined:

For individual taxpayers getting their income either through salary or a combination of both salary & business, the AO code depends on their official address.

The code for individuals with other income streams and their salary is determined based on their residential address.

If you're a business organization (LLP, Partnership, Trust/Association) or a HUF, your AO code will depend on your office address.

For Defence Forces, the codes are as follows:

(A) Army Personnel

Description | ITO Ward 4 (3), GHQ, PNE |

|---|---|

AO type | W |

Area Code | PNE |

Range Type | 55 |

AO Number | 3 |

(B) Air force Personnel

Description | ITO Ward 42 (2) |

|---|---|

AO type | W |

Area Code | DEL |

Range Type | 72 |

AO Number | 2 |

AO Code Types

There are primarily four types of AO codes used to identify a company or individual. Here's what they are:

International Taxation: Applicable to people or organizations not based in India but who have applied for a PAN card.

Non-international Taxation (Outside Mumbai): AO codes applicable to people/companies based in India other than Mumbai.

Non-international Taxation (Mumbai): AO codes applicable to people/companies based in Mumbai.

Defence Personnel: AO codes for defence personnel associated with the Indian Army or the Indian Air Force.

Conclusion

This article has covered the various components of AO code comprehensively while diving deep into its various types and discussing the methods you can use to find your AO code online. While not mandatory, it is good to know the AO code on your PAN card.

Frequently Asked Questions

Q1. what is AO code in pan card for students?

An important aspect for identifying the Assessing Officer and the area of their jurisdiction; the AO code primarily consists of 4 major elements and is mentioned at the top of the PAN application form.

If a student is below 18, they don’t need an AO code.

Q2. Is AO code mandatory for PAN Card?

Used to check the jurisdiction under which an applicant is covered, the AO code is a crucial factor during taxation. It is primarily because of these AO codes that the Income-tax department can identify which tax laws apply to an individual.

It is mandatory to mention the AO code in your PAN application.

Q3. How do I find my income tax AO code?

It's quite easy to do so. All you need to do is visit the e-filing portal and open the Profile Settings option, followed by the ‘My Profile’ tab. Once here, you can easily click the ‘PAN details’ option and get to access information about your income tax AO code.

Q4. How can I change the AO code of my PAN card?

You can change the AO code on your PAN card if you’ve moved to a new location. To do so, you can either write a letter or go to the NSDL portal and modify the details along with other supporting documents.

After submitting the form and making the payment, you'll receive an acknowledgement that must be printed and sent to NSDL by post.

Your records will now be moved to a new Assessing Officer.

Q5. What is ao code for no income individuals?

Like students under 18, unemployed individuals don't have an AO code on their PAN cards. They can, however, choose a salary below a certain amount while filing their PAN card application online.

Q6. How can I find my area code for a PAN?

Very simple. We need to go to the e-filing portal of the Income Tax Department of India and access the 'Profile Settings' tab.

Once through, they must go to the 'My Profile' section of the portal and click on 'PAN Details' to find the area code.