Want to know how to check if my aadhaar and pan are linked? Well you have landed on the right article, make sure to know how to check aadhar linked to pan.

The Government of India has made it mandatory to link the Aadhaar card and PAN card. If you file ITR or apply for a government scheme to get subsidized LPG Cylinder (Domestic), pension, scholarship, etc., you know how important it is to link both verification documents.

It helps in faster processing, hassle-free direct benefit transfers, and easier financial transactions. Let us look at the ways to link the PAN and Aadhaar, the laws concerning this, and the limitations.

How To Check If My Aadhaar And PAN Are Linked (2022 Updated)

Income Tax Act And New Deadline

According to Section 139AA under the Income Tax Act, every citizen of India needs to attach their PAN with the Aadhaar number. Anyone with a permanent account number (PAN) as of 1st July 2017 comes under the purview of this guideline.

Every Indian who fulfils the criteria for obtaining an Aadhaar number on or after 1st July 2017 should mention the Aadhaar number when filing income tax returns (ITR) and application for a new PAN.

New Deadline: The Income Tax Department has announced a deadline extension from 30th September 2021 to 31st March 2022. The decision was taken in view of the pandemic. It is highly advisable to check and link both documents for multiple benefits discussed in the following sections of the article.

How To Check Aadhar Linked With Pan Are Linked Or Not

To check "how to check pan linked with aadhar", There are two ways to.

1. Online Method to Check if my PAN and Aadhaar Card are Linked or Not

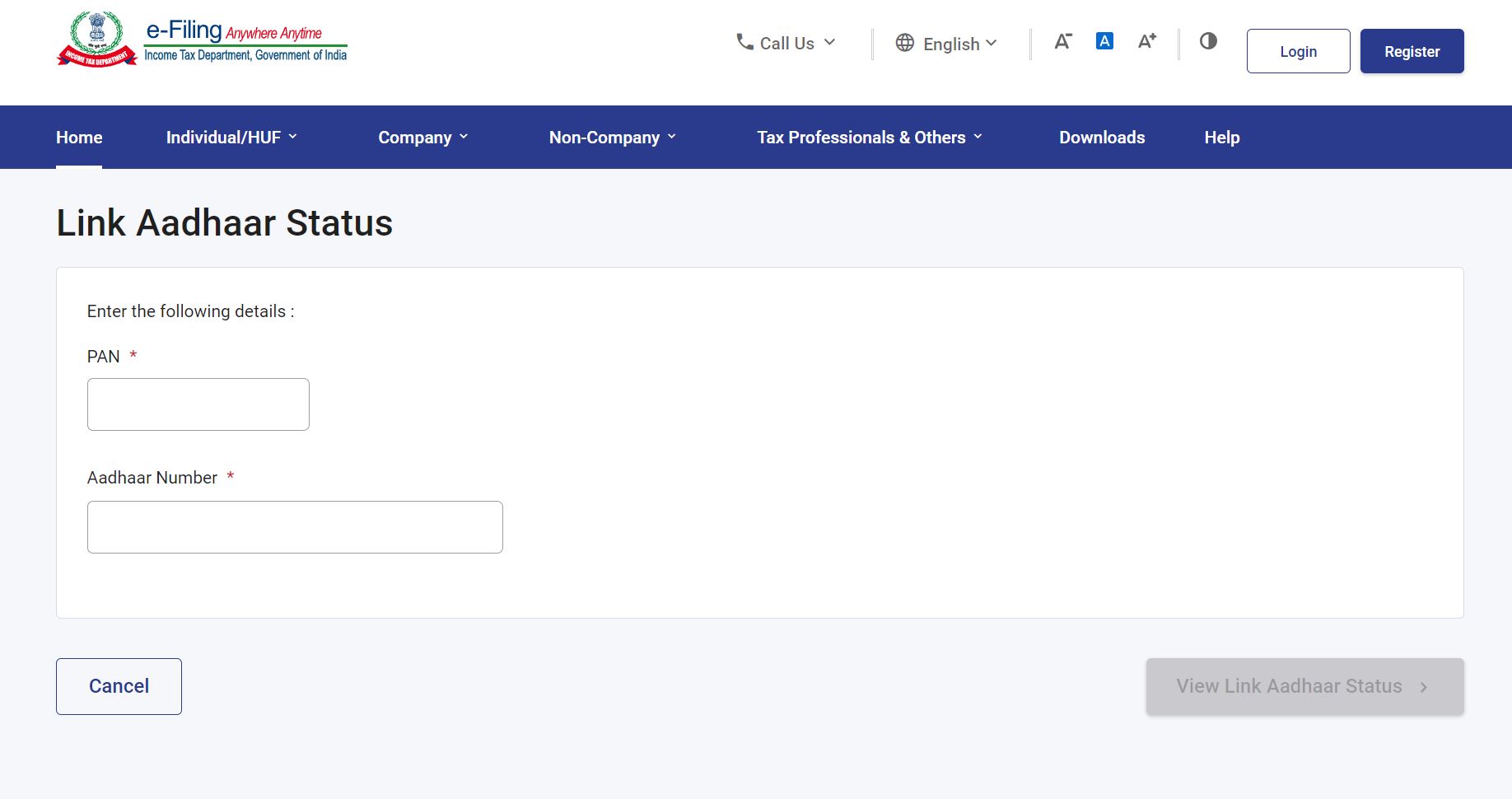

You can check the pan aadhaar link status through four simple steps.

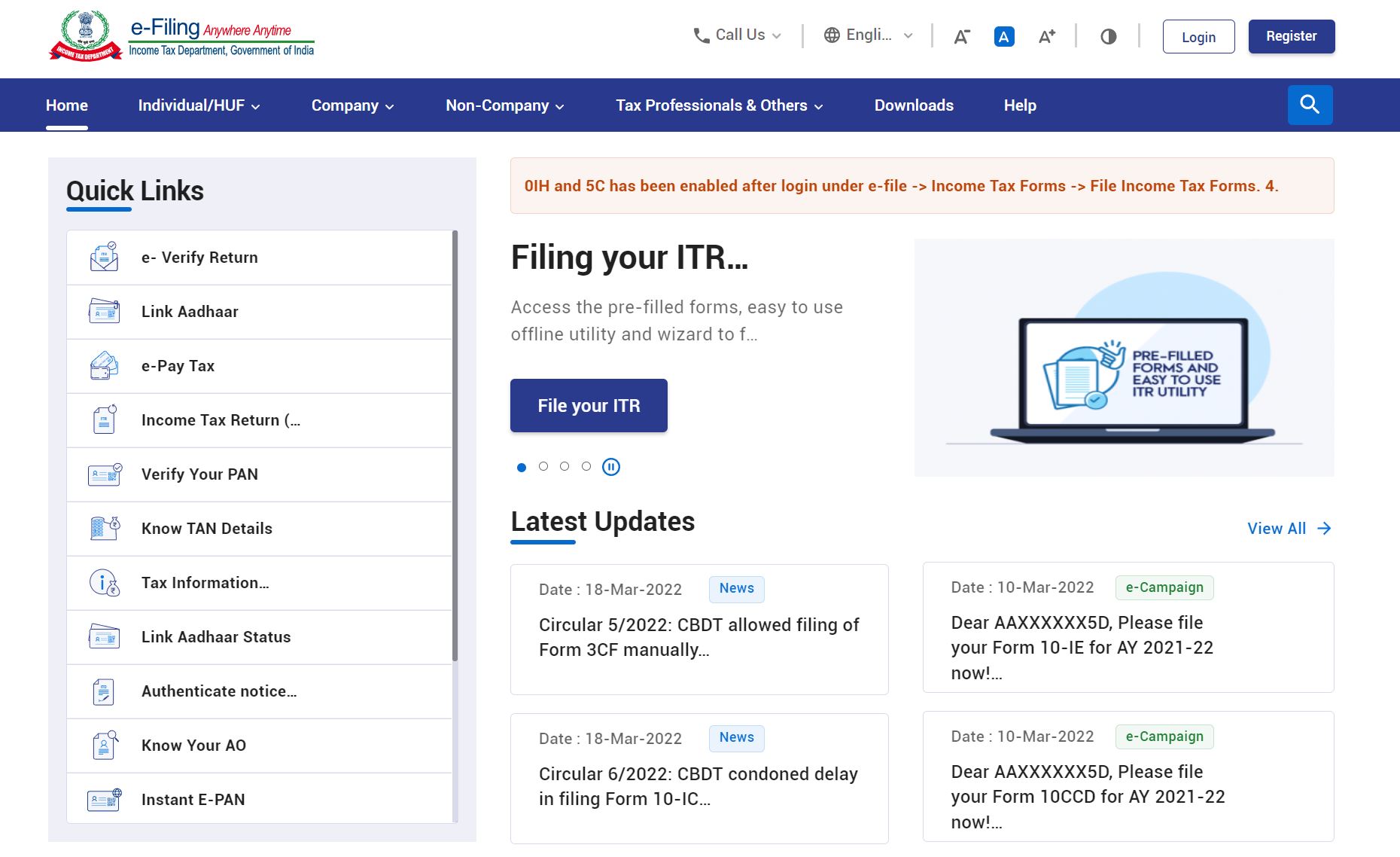

Step 1: Go to www.incometaxindiaefiling.gov.in/aadhaarstatus

Step 2: Write your Permanent Account Number

Step 3: Submit your 12-digit Aadhaar Number

Step 4: You will find the option 'View Link Aadhaar Status,' click there

That's all! The status will be displayed on the screen. You can check it on any digital device, including smartphones, personal computers, laptops, tablets.

Offline Method through Income Tax Department's SMS Number

If you want to know, how to check if my aadhaar and pan are linked or not through offline mode then, you have an SMS option. Let's go through the steps.

Step 1: Compose a message in the following format: UIDPAN< Aadhaar Number><PAN>

Step 2: Send the message to the Income Tax Department's provided numbers 56161 or 57678

Step 3: Next, you will receive a message about the status of your registered mobile number.

The standard format of the message if your PAN and Aadhaar cards are linked: “Aadhaar (followed by last four digits) is already attached with PAN (...) of the Income Tax Department database. Thank you for using our service.''

You can check if your Pan card is linked with an Aadhaar card or not through these online and offline methods. But if you have not attached PAN and Aadhaar yet, it is high time to do it. Let us explain what options we have to link these mandatory documents. We will explain step by step for your quick reference and use.

Methods to Link PAN card and Aadhaar Card

Link through Income Tax Department e-filing website

Step 1: Visit the website for the Income Tax Department, i.e., www.incometaxindiaefiling.gov.in. Keep your PAN card, Aadhaar card, and mobile phone with the registered number during enrollment.

Step 2: Next, log-in or register to proceed.

For new users: PAN numbers work as user ID. Submit PAN, date of birth, and create a password for registration.

For registered users: Log in with Permanent account number, password, and date of birth.

Step 3: Next, you will see a pop-up prompting you to link the Aadhaar with the PAN. You can also go to the menu, click 'Profile Settings,' and select 'Link Aadhaar.'

Step 4: Verify PAN details, including name, date of birth, gender, with Aadhaar card information.

Condition 1: If any mismatch between the Aadhaar card and PAN card details is found, you need to rectify and update first. Data should match on both documents to complete linkage.

Condition 2: If your data on PAN and Aadhaar matches, enter the twelve-digit Aadhaar number and select the 'click now' option

Step 5: Once verified information on both documents, the system will pop up a confirmation message for Aadhaar and PAN card linkage.

You can also link PAN and Aadhaar through www.egov-nsdl.co.in and www.utiitsl.com.

Link through SMS

You can repeat the same procedure of checking the linked status of PAN and Aadhaar afresh if you are not registered on the Income-tax department website. Send an SMS on 56161 or 57678 and follow up either on the website or SMS. We have mentioned the format above. Please refer.

Link through form filling at PAN service providers

You can also visit physical PAN service centers, fill the form, submit required documents to link PAN and Aadhaar manually.

Why is it Important to link pan and aadhaar?

It is time to explain the benefits of linking PAN and Aadhaar for individuals and the Government.

Comprehensive Control over Financial System

Aadhaar cards are nearing universal coverage across India. More than 700 government schemes are attached with Aadhaar, and it is a mandatory verification document for practically all transactions.

Linking the Aadhaar card with the PAN provides comprehensive control over financial transactions. Control and management of financial activities help in curbing the black money economy, discourage people from tax evasion.

Benefit for citizens

Restriction on tax evasion and money leaks causes more cash flow in the system. It helps the Government to spend more on welfare schemes and contingency expenditure.

Detection and Restriction of Multiple PAN Cards

Hindustan Times reported on 31st December 2021 that the anti-corruption department of the Odisha Government captured 5 PAN cards from a Tehsildar.

We have read and watched several such news reports in recent years. Multiple and fake PAN cards are favorite tools for financial fraud and tax evasion. Let us understand how they do it.

A person or an organization can use one card for a limited financial activity and pay taxes for revenue from those activities, whereas at the same time applying for multiple PAN cards. They use one PAN card to pay taxes and conceal income from accounts.

This problem can be sorted out with PAN and Aadhaar linkage. Nobody can fake the biometrics and retina process of Aadhaar.

The Income Tax Department can match Aadhaar data with individuals. They will know the financial history of a particular PAN card. Therefore, it is next to impossible to keep several PAN cards. Government can close a significant loophole in the taxation system of India.

Tax Concessions And Subsidies

A clean and transparent system helps honest citizens. Government can increase tax collection, reduce tax evasion, and restrict black money with PAN and Aadhaar linkage. Data is the most precious thing currently, and it will help in making a corruption-free tax system.

That said, more tax collection means increased government reserves. It will help in getting tax concessions and subsidies for the individual honest taxpayers. It also supports Government welfare schemes and expenditure on infrastructure.

Automation and Less Paperwork

Aadhaar and PAN linkage can quicken the tax filing process. You do not have to do paperwork or wait for the IT department process. The data is automatically updated into the system, and taxpayers can file their taxes much faster.

Your registered mobile number on both documents should be the same for attachment and verification during tax filing.

Organized Structure to Pay Taxes and Monitor Transactions

Aadhaar and PAN card linkage will provide an organized structure for tracking payment history, filing over the years, and detailed analysis of financial transactions. Tracking can help regulatory bodies and individuals, both in their unique way.

Frequently Asked Questions

1. Do I need any additional documents to link Aadhaar and PAN on the e-filing website?

No, you don't need any other documents than a PAN Card and an Aadhaar card. You should have your smartphone with a registered mobile number for OTP verification.

To link PAN and Aadhaar, go to the Income Tax Department's e-filing website and select the Link Aadhaar Section. After that, submit Aadhaar and PAN numbers in the designated places. If information matches, PAN and Aadhaar will be linked. If the data does not match, you will require to rectify and update both documents. After updates, you can link them.

2. What should I do if the system shows an Identity Data Mismatch message while trying to link my Aadhaar and PAN?

Error in demographic data is one of the most common problems people experience with Aadhaar after UIDAI stopped partial authentication of demographics data. The regulatory body can check frauds, fake Aadhaar cards, and others.

In case of an error message, choose the biometric option to authenticate your Aadhaar. Visit the NSDL website to get the Aadhaar seeding request form. Visit the PAN center closest to you with this form so that you can complete the process offline.

You can look for the nearest PAN center on the NSDL or UTITSL with biometric tools on the website. You should also check and rectify demographic details: names and gender on both documents. After correction, repeat the steps to link again.

3. How can I make rectifications to the details on my PAN and Aadhaar?

You can make changes or update Aadhaar and PAN card details. The Government allows online and offline modes to apply for rectifications.

*You must ensure the registered mobile number for both verification documents should be the same. Keep it active while applying for any corrections or changes.

4. Changes or rectification for Aadhaar card

You can visit the UIDAI website or Aadhaar Sewa Kendra to make amendments to Aadhaar details. Citizens can update their name, residence address, vernacular, and gender online.

For People who like to do things traditionally, they can go to the Aadhaar enrollment center or Aadhaar Sewa Kendra to apply for changes.

Services that can only change offline or at enrollment centers are biometric details, registered mobile number, and email ID.

5. Changes or rectification for PAN card

You can apply for a new PAN, make corrections or update through a few quick steps. Visit www.tin-nsdl.com and follow the easy-to-follow steps mentioned.

6. What are the consequences if I do not link my PAN and Aadhaar?

Aadhaar and PAN card linking is mandatory for every Indian citizen. The Government introduced a new section 243H within Income Tax Act 1961 during the Budget 2021 announcement.

The section is about a fine of not more than INR 1,000, applicable to people who will link PAN and Aadhaar after the due date. The earlier deadline was 1st April 2021, extended to 30th September 2021, and now it is 31st March 2022.

People will not be able to do financial transactions and ITR filing. It will also impact subsidies and government scholarship payments.

I hope you liked our article on how to check aadhar linked with pan, and it must have solved your queries such as www incometax gov in aadhaar pan link, incometaxindiaefiling gov in link aadhar card, income tax pan aadhaar link, how to check aadhar link to pan or how to check if my pan is linked with aadhar.

if you have any comments or suggestions do share them in the comments below.