Want to know how to know pan card number? Well you have landed on the right article

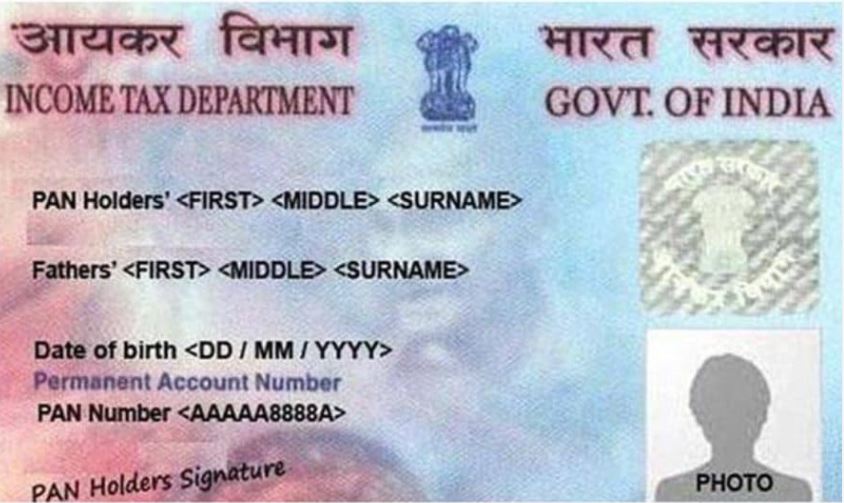

Whether you are a taxpayer or a non-taxpayer, a PAN card is an essential requirement. PAN or the permanent Account Number is a ten-digit ID usually in a combination of alphanumeric systems.

The PAN is identifiable with all judicial entities under the Income Tax Act of India formed in 1962. They are issued under section 139(A) under the supervision of the central board for Direct Taxes.

Know Your PAN Number

A PAN number can help you get through details in many ways:

- Through PAN number

- By the name

- By the date of birth

You can use the PAN for fetching details like how to know pan card number? The PAN card number is a valid document if you wish to fetch details through it. Start by logging into the tax department ITR filing website, register yourself by using your PAN number. Fill up the details in the registration form. However, the pan card issue date is not mandatory for any kind of verification.

Once you register, you will be sent a link to your given e-mail address. Activate the account by clicking on the link. Once your account is activated, open your account and click on my account on the dashboard.

The dashboard is the home page of your account. From the profile settings, click on PAN details. Your PAN details with other related information will be generated. Name, area code, jurisdiction, address and other information will be found.

Use name and date of birth for PAN card details:

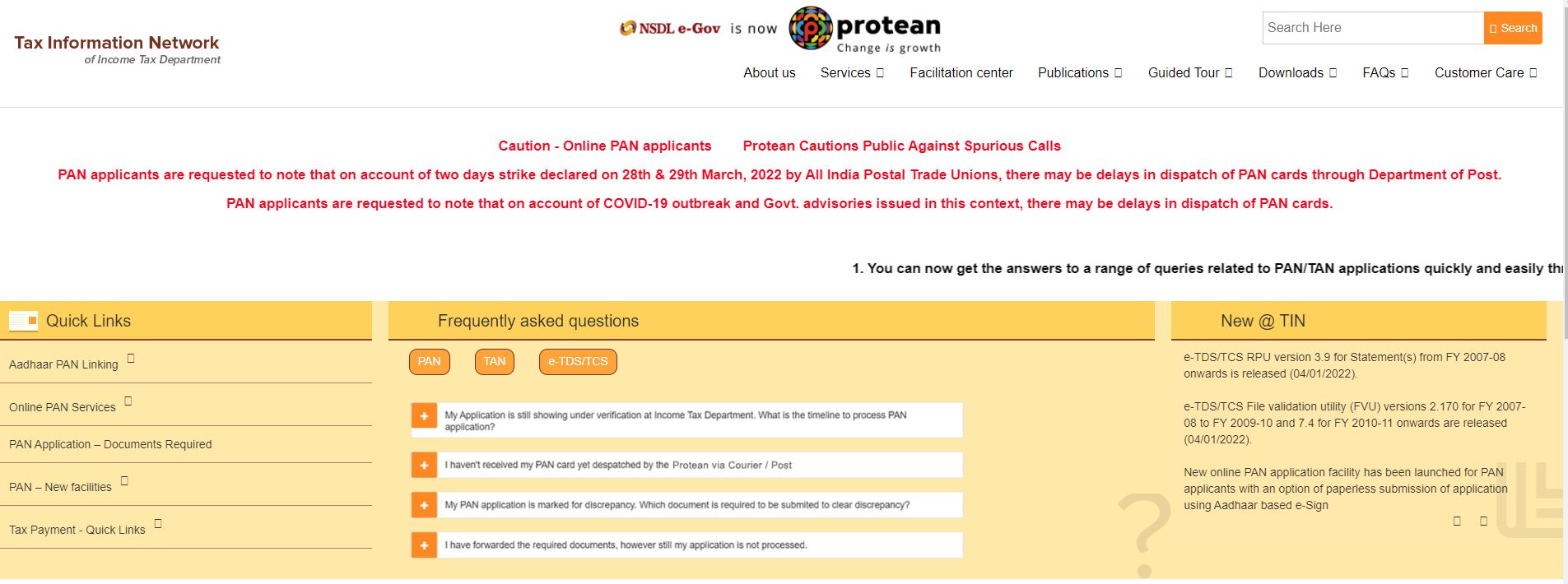

With the help of your name and date of birth, you can get PAN card details like if you have forgot pan number. An easy way to do this is to go on the NSDL website, click on “KNOW YOUR PAN”, enter the date of birth details with the surname first, then middle name and first name.

Enter with the correct captcha code and submit the form. You will receive the following details: PAN card number, first name, middle name, surname, area of jurisdiction and remarks stating your PAN card is active or inactive will be displayed.

The PAN is also linked to most of the other important documents such as the passport, Aadhaar card or gas distribution outlets.

And thus, you can also check your PAN card details by Aadhaar number.

Searching address details of your PAN card

From the e-filing website for tax filing, complete the registration and click on continue. Enter all the asked basic details such as name, date of birth and PAN card number. Fill up the form and a link will be sent to the email address.

Use the link to access your account. From your account, click on the My Account tab and fetch all the PAN details. It is this PAN number that holds all information about not only your income status but also your address details.

The PAN card can be given to all Indians and hence no two people will have the same number and address. You can recover the address details from this page on the tax filing website.

The Permanent Account Number is issued by the Income Tax Department of India. Although the PAN is a number, the physical PAN card has certain essential details such as your name, mothers name, date of birth and photograph.

Once you have been issued a PAN number irrespective of the address change, the PAN remains the same.

If you may require to update your PAN details

Start by visiting www.tin-nsdl.com. Select PAN services and apply under change or correction in PAN data. Submit all the details on the new redirected page by uploading your e -signature. Provide details of contact and address.

You will be asked to upload proof of residence, identity and PAN details. Payment has to be made through demand draft, net banking, credit or debit card. A nominal fee is charged for the corrections. Download the acknowledgement.

The documents to be sent to NSDL as hard copies include - the acknowledgement slip, two photographs and a cross sign. Once you send all the documents, your PAN will be delivered tentatively within 15-20 days with the amendments.

The toll-free number to know about your PAN

PAN services are available worldwide with accessibility through digital methods. The toll-free number is 18001801961. You can also access it through the NSDL number 1800222990.

Using the toll-free number, you can complain about any discrepancies related to your PAN card number, use it for status updates on your PAN card number, or in the cases of loss of your PAN card.

A PAN number serves not only as a valid document but also provides recognition of your status as a citizen of the country.

I hope you liked our article on how to know your pan number, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

Q1. Does the PAN card have a phone number?

Your PAN card does not carry a printed phone number. But the PAN card and your phone number are connected digitally. This means that the PAN is linked to your phone number to access details such as getting SMS, or for any financial transactions, etc.

Q2. Can a 17-year-old apply for a PAN card?

A PAN card can be issued in the name of a 17-year-old or less than 17 years. A guardian or representative, such as a parent, can apply for a PAN card. It is a hassle-free process and requires all the documents required for any adult.

For the photographs of the minor applicant, the photographs and important paperwork such as the Aadhaar card and address proof of parents will also be required.