Want to know how to earn 1000 rs per day from share market? Well you have landed on the right article

Every individual who becomes a part of the stock market looks up to making money through it. Though there were reservations against it a few years ago, things have now changed for the better.

Today, it stands as one of the most lucrative mediums to make money and gives you a return better than any other financial avenue.

But is it possible to make money from the platform on a daily basis? Yes. Is the amount earned from the share market up to 1000 rupees? Also yes.

Stock trading can be called a strategic art involving patience, practice, and hard work. One must constantly monitor the market's changes and make strategic and quick yet planned decisions accordingly.

Once you have mastered this, earning from a share market is no longer difficult. It is important to note that this will not happen overnight and requires immense patience and practice.

One needs to make investments, study the patterns of the market and try for about six months or a year and then can things seem to be smoothly running.

Different approaches can be used to reach this destination of earning daily. Here are some of the various routes you can take and earn through investing in the share market.

In this article, we have covered the best methods of how to earn 1000 rs per day without investment online from stock market.

how to earn 1000 rs per day from share market

Different Ways of how to earn daily in share market

1. Intraday Stock Trading:

Like we use social media to find out what's trending now, similarly, in this trading technique, one spends time finding out the 'trending' shares. These stocks are likely subjected to significant changes, and their values can go up and down.

To stay updated with what is happening in the share market, you can follow the news, websites, social media pages, and several other sources and find out stocks that are currently in the news for new earnings releases, new business acquisitions, and announcements.

Remember, any recent change done by the listed companies can influence the share market. For example, when Zomato, one of the leading food delivery applications in the country, announced that it would be issuing IPOs, the share market saw some different patterns.

Similarly, when Glenmark Pharma announced that they have medicine for COVID, they became trending shares in just a day.

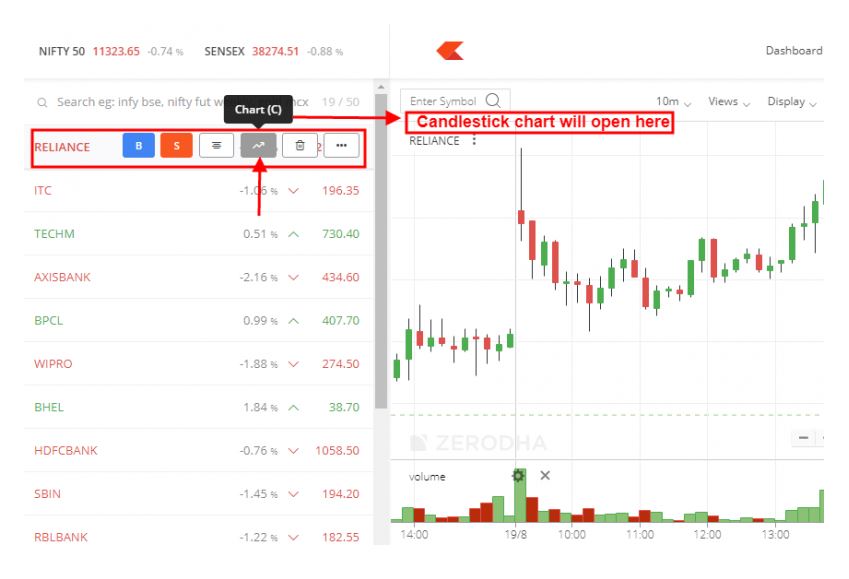

To further study the stocks, you can use the candlestick price chart, which can be found on the trading account app of your broker.

This chart shows you the price difference in a given period, and the bars or candles are in two colours, green signifying that the closing price recorded at the end of the chosen period is higher than the opening price.

The red bar stands for the situation where the closing price for the period was lower than the opening price. The lower end of the candle stands for the opening price, and the upper end is the closing price.

For example, if you open a 10-min candlestick chart of stock at 11:00 am, when the price is Rs. 250, and the price goes up to be Rs.255 at 11:10 am, then the candle, in this case, would be a green one.

This chart helps get a clearer picture and make crucial decisions for investments. Depending on the chart, you must note that it becomes your duty to decide when to buy or sell stocks.

The simplest logic to use here is if you are expecting the price of a particular stock to go up, you can buy the stock and then sell it off when the higher price is reached.

For example, if the cost of the stock stands at Rs.5 and you are projecting that it will go up to Rs.8, then in an ideal scenario, you can buy the stock, hold it till it reaches Rs.8 and then sell it.This way, you can make a profit through strategic planning and projection.

2. Futures & Options:

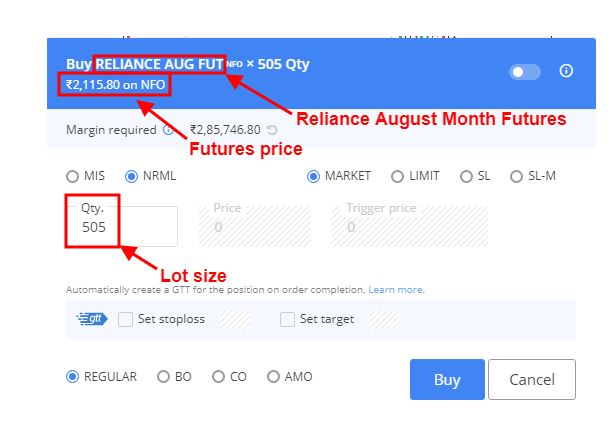

Certain stocks fall under the Futures & Options segment of the National Stock Exchange. The futures & options stocks fluctuations depend on the underlying share prices. For example, the cost of HDFC futures depends on the underlying price of the HDFC share price.

This segment is associated with the expiration date and a 'minimum lot' size. Meaning if you want HDFC futures, you will be given the option to buy HDFC Futures with different expiry months.

Now, assuming that HDFC Futures has a lot size of 500 shares, and one buys HDFC futures and the price goes up by Rs. 1, you will make Rs.500.

Now, let us assume that the prices in July are expected to go up by Rs. 20. In this scenario, you can buy HDFC shares for July expiry, and if the price goes up by Rs. 20, you will make 500*20= Rs. 10,000.

However, if the price does not increase as expected, you will have to exit the futures position by the last Thursday in July, as futures expire on the last Thursday of the chosen month.

The capital required for trading futures will be at least 2 Lakhs; trading of futures needs to be done carefully and with caution. Also, since there is a 'minimum lot' for every future, there is a possibility of massive loss if the projection fails.

In the case of options, you can behind trading options with as little as Rs.5000. Through options trading, you can earn considerable returns in a day with little investment.

There are two options in case of options trading - Calls, also called Bullish and Puts, also called Bearish. These options can be considered similar to bets.

For example, if HDFC is trading at Rs.300 on 3rd August and you expect the price to increase, you can buy a call option for HDFC for July expiry.

Like futures, there is a 'minimum lot' for options, and you will need to pay a price to buy options. If the option is trading at Rs.5, and the lot size is 1300, the amount to purchase the option becomes 1300*5= 6500.

3. Swing Trading:

The idea of swing trading is to enter the field of trading to hold the shares for just a few days. Though it may not give you Rs.1000 daily initially, once you have understood the strategy, reaching the targeted profit amounts will not be a task anymore.

For example, let us assume that the government announces privatisation of BSNL, and the bidding deadline is 31st August.

To gain profit, usually, people buy a certain amount of shares before the bidding date to see the price of the share increase and sell those shares when the price has reached the desired hike. It is possible to profit before the bidding date in swing trading.

In comparison to intraday trading, swing trading requires more capital since you will have to buy the shares and hold them or consider buying futures. However, for swing trading in the case of options, the capital requirement is much lower in comparison.

how to earn 1000 per day in share market?

Now that we have covered the different concepts and techniques associated with the share market let us discover which approach helps you make Rs.1000 daily in the share market.

If your aim to enter the share market is to make money every day, indulging in intraday trading will pave the path for earning quickly and daily. In this form of trading, you can buy stocks and sell them on the same day.

The stocks purchased are not seen as an investment but rather to earn profit by observing the fluctuations and harnessing them.

For example, if you follow the trending stocks every day and gather the correct sources like news platforms and websites, it will become easy to catch hold of the pattern of the share market.

Once the pattern has been spotted, you can easily refer to the candlestick chart and buy and sell your shares accordingly.

Remember, the candlestick chart is one of the easiest visual keys to understand how the market performs on the chosen day.Once you have mastered the pattern, you can easily make projections and predict the upcoming price fluctuations.

Whenever you expect the price of a share to increase, the most straightforward and logical step is to buy the share and then see the rise in price throughout the day and decide to sell it at a strategic moment when the price has peaked.

Though it may sound difficult to conduct, once you have learnt to make the right projections, making profits every day and earning up to Rs.1000 daily will not seem like an impossible occurrence anymore.

Thumb Rules to Trade Stocks Like a Pro

Like every science, art and practice have rules that are easy to follow and become crucial foundations behind decisions made. Similarly, there are specific thumb rules that one can implement to trade stock like a pro.

A. Take small profits and make multiple trades.

Since the primary aim is to regularly make quick profits every day, the trader should focus on making multiple trades with profits, even though small ones are attached.

While trading, you must remember that making 2-3% profit regularly in a single trade is close to impossible.

The best way to reach out for profits is to settle for a lower profit margin but increase the number of trades. Sacrifice the size of the victory, but make sure you have multiple victories to count on!

This strategy has been framed based on three ideas:

- If you are exposed to a diverse and dynamic market for a short time, it will reduce the chances of adverse events.

- Though it is difficult for a stock to make about 20-20 Rupees, making 2-3 Rupees a day is easy to witness.

- The chances of seeing a minor price movement are more likely than a significant price movement. Even if the market is range-bound, there are c=be several small events that the trader can exploit well.

Using this strategy, it is possible to make 1000 Rupees in the share market daily. It will ensure wins in the market with the slow yet gradual growth of profits.

Though this strategy is backed by its ideas and techniques, it does not intend to say that they should restrict themselves when the trader is confident.

B. Trade-in shares that have a high volume

One of the significant rules of intraday trading is to be on the constant lookout for shares with high volume or liquid shares. In this case, the term 'volume' is the number of shares passed from one hand to the other.

As the position of the stock is locked and closed before the trading hour comes to an end, the amount of profit depends on the volume. Whenever you decide to trade, ensure that it has logical thinking invested in it.

Though several other people and platforms might come up to give you advice on what decision you should take, the final decision you make should be yours.

The best way to begin is to make a list of shares that seem to be in the talks and trending recently. Refer to this list and do your share of research about them. Study their recent patterns, news about them, and expected projections.

Using this research and the pattern you noticed, make the crucial decisions.

C. Leave behind your greed and your fears.

The stock market as a place can get competitive and overwhelming at times. It may lead you to feel several emotions together, including greed and fear.

Emotions such as greed can lead you to make instant and impulsive decisions without using a strategy or logical thinking. You might start to bite more than what you can chew on seeing a constant profit.

It will lead to severe losses. On the other hand, the feeling of fear will restrict you from making important decisions in time. Ups and downs are a part of the trading process and are common to see.

No trader can make significant profits every day. Thus, it is important to keep your psychological and emotional sentiments aside when dealing in the share market.

As a proficient intraday trader, your duty should be to keep an eye on important things, stay within limits, stay away from fear, and remain confident.

D. Keep your entry and exit points fixed.

Now we know what to keep aside when indulging in intraday trading. Let us focus on the techniques that will help increase your chances of making a good profit.

The key to earning daily in the share market lies in keeping your entry and exit points fixed. Being a trader, you need to identify both carefully as they make for the two pillars of the share market.Once you have mastered this, making profits can be an easier process.

To begin with, before you place the buy order, make sure you determine the entry point and the price target of the stock you are dealing in.

Price target refers to the price at which the stock is fairly valued, considering the history and projected earnings.

When a stock is valued below the target price, it makes for a good time to invest in the stock as when the stock reaches the target price or exceeds it, you will profit

Setting and keeping an entry and exit point ensures that you do not sell your shares instantly on seeing a price increase.

Because of most traders' common habit and tendency to sell shares on seeing a minor increase, they lose out on the opportunity to make more significant profits whenever possible.

Along with this, keeping a fixed entry and exit point will reduce the fear quotient and greed possibility, as it will take away an amount of uncertainty or the case of an adverse situation.

E. Limit Your Loss by Using a Stop-Loss Order

One of the most strategic steps to take is to reduce losses to earn maximum profit. A stop-loss order solves this purpose by limiting an investor's loss.

By using this strategy regularly, you can reduce the chances of a loss and reach your profit target faster. It is a reliable strategy that intraday traders commonly use and trust.

The stop loss that you set should always be in proportion to your target. Setting the stop loss at 1% is a safe and wise decision if you are a beginner.

Stop-loss works so that when the price of a share falls below the limit set, the stocks get sold automatically. Let us understand this with an example.

You have bought 1500 shares of a company, and have kept your stop loss as 1%, which is Rs. 15. As soon as the price falls below 1485, you close the position and sell the shares.

This helps reduce the chances of a huge loss and assists in keeping a check on the falling price of shares. By following this strategy, the chances of loss every time a fall in the share price takes place reduces overall.

This way, every time this strategy rescues you from potential loss, it also takes you closer to the profit that you target achieving.

F. Follow the trend

To practice intraday trade, one of the most crucial habits to include in your daily life is the need to stay updated with what's happening. Being aware of changes in the market shapes the trade decisions made.

All the information must be at your fingertips, readily available whenever you need it.

Inculcating this habit makes this strategy one of the most trustworthy and safest strategies to use when indulging in intraday trading. If you aim to make Rs.1000 daily through the share market, here are a few guidelines for you.

1. Make a list of the chosen stocks you wish to target.

2. Track the changes taking place and impacting these stocks for about two weeks before you take any decision or action.

3. During these two weeks, analyse the stocks through different approaches such as oscillators, volume, and indicators.

4. Over time as you follow the trend, you will understand the pattern and then polish your accuracy with each passing day.

5. Based on the indicators you used during the analysis phase, you can fix your entry and exit points accordingly.

6. Lastly, before buying shares and investing, make sure you have fixed the stop loss and the target profit you wish to make.

Conclusion

The stock market is a rising platform to make profits. One needs to place their logical thinking, combine it with the right techniques, conduct thorough research, observe trends, and ultimately make timely and strategic decisions to begin their journey in the share market.

If you are a beginner and are planning to start buying shares, make sure you are aware of the terms and phrases used in the industry and have a deep understanding of how the market functions. Once you start investing and have mastered the art, making Rs.1000 daily will become a regular occurrence.

I hope you liked our article on how to earn 1000 rs per day from share market, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

1. Can I earn lakhs in the stock market?

Yes, you can. However, this will not be an immediate process if you are a beginner. Now that you have understood the tips and tricks for earning Rs. 1000 a day, by investing the time and gathering knowledge on the stock market

And implementing it by making small buyings initially followed by larger ones, you can get closer to your goals. You might need a bigger investment at times to earn a bigger amount.

You can also choose to begin by investing a small amount and gathering all the profits made over the months to reach your target of one lakh from the stock market.

2. Do I need to pay tax on shares?

As per the Income Tax Rules, the gain made on equity shares is taxable since equity shares are considered capital assets for the company. These are further segmented into two categories based on the time for which the trader holds them.

They are called short-term when you own a share for less than 12 months and are taxed differently. When you have a share for more than 12 months, it falls under the long-term category and is taxed accordingly.

3. Does Zerodha cut tax?

Yes, Zerodha cuts tax for the gains made on a short-term or long-term basis. Intraday trading falls under the income from the speculative business category and is charged accordingly.

4. Can stocks make you rich overnight?

The act of trading in the share market is a tricky art that takes time to be mastered. It cannot be learnt by reading books and is practical application-based learning gained only through actual execution.

Making earning and generating profits by trading shares takes time to understand. Though it is possible to observe, analyse, plan and project the right amount and take all the necessary steps to become rich overnight, it is not a common phenomenon.

To earn money in the share market, one needs to constantly polish their skills and learn the new trends and practices to remain active.