Want to know how to fill cheque? Well you have landed on the right article

We all know that the number of bank accounts is increasing daily. With the increase in awareness, many people have started to build a business and are depositing their money in their bank accounts.

Due to this transition, many people have started using cheques for transactions. So, let us understand why we need a cheque leaf and what it means.

A cheque is a document of order statement of money transferred from one account holder to another to either one individual or a company's name or whichever name the cheque is issued. Cheques are one of the safest ways to transfer money.

While dealing with cheques involves no hard money, there is no fear of money-losing in transit, theft, or being misplaced. A cheque is a negotiable instrument with many delivery options. Some essentials of cheque are as follows:-

- It is considered as an order without any condition.

- A cheque is drawn from a particular bank.

- The amount has to be paid on demand.

- The exact amount is paid on the cheque and how much is written on the cheque.

How To Fill Cheque (2022 Updated)

How To Write Cheque

- Depositing a cheque refers to crediting or adding the money or the amount into your bank account. A person may have to wait for 24 to 48 hours to get the change reflected in the bank account. The bank follows the process of approving a cheque when you deposit it.

- Cashing a cheque means getting the cash after the clearance of the cheque. You need to deposit your cheque that has the amount you want in cash. You will get the money in cash, and you can use it anywhere.

Validity of Cheque

The RBI has reduced the date of issue from 6 months to 3 months on cheques, Demand Drafts, Pay Orders and Banker's cheques.

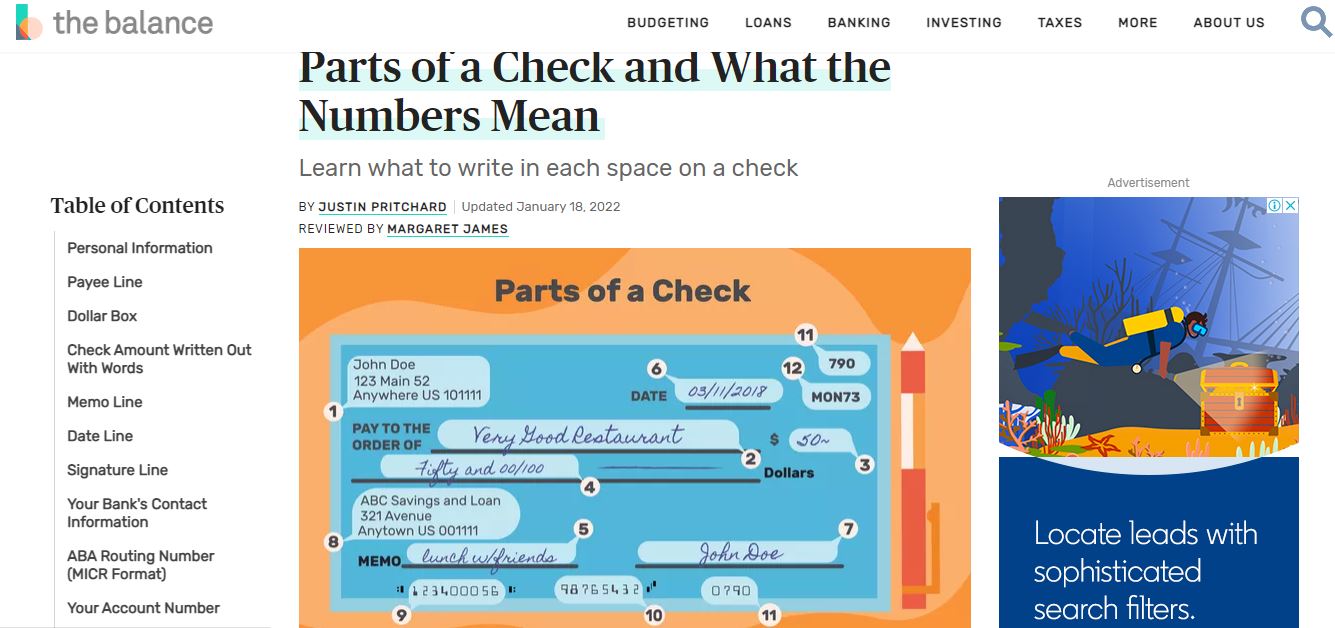

How to fill a Cheque

- Include the date: The date should be filled with the month and year. The column of date is there on the right-hand side corner where DD/MM/YYYY is written. It would help if you wrote DD in the date box, MM in the month box, YYYY in the year box. The cheque will be valid for three months after the date is written.

- Name the recipient: Instead of paying, you have to write the person's name to whom you need to present the cheque. If you need to give this cheque to the organisation, write the name of the organization. If you want it for yourself, then issue it for yourself.

- Fill in the amount with numerals: In the box of numerals, you need to add the amount in numbers. Whenever you write starting from the starting point and then end it with a slash so no one can add a number.

- Write out the amount in words: In the place of rupees, you can write the amount given you want the issue the cheque for. After writing the amount, you can draw a line for safety purposes.

- Signature on the Cheque: The signature on the cheque is important. It shows the confirmation of the person on the cheque. You need to sign similar to what you have done while opening the bank account. Do the signature the same as the bank, or you need to pay a fine.

The various parts of the cheque

- Information of the bank:- Every cheque includes the name of the associated bank and its important details.

- IFSC code:- the IFSC code refers to the 11 digit code or unique cheque number for every bank account.

- Information of the payee:- A person who makes the cCheque should mention the payee's information correctly to avoid any confusion.

- Date:- The date should be inserted in the standard format of DD/MM/YYYY

- Account number:- It is the bank account number registered in your name. It is to be filled correctly.

- Signature of the person:- the cheque should contain the drawer's signature. Every cheque has a place where a person has to sign to confirm the transaction.

- The amount to be transferred:- A person needs to write the amount to be transferred very clearly on the cheque.

- A number of the cheque:- Every cheque has a unique number. It also contains the MICR code.

- Rupees:- It is a placeholder on the cheque that contains the amount to be transferred in words.

What are the different parties associated with a cheque?

Whenever a person makes a cheque, it is mainly for the third party. This third party can withdraw money from it through a bank. The name of the associated party is included in a cheque.

Given below is some important information about them:

- Drawer- The drawer is the holder of the bank account and the maker. It refers to a person who created the cheque.

- Drawee- It refers to the bank from where we draw the cheque.

- Payee- Payee refers to the person's name present on the cheque to get the payment. The payee and drawer can be the same person in the transfer case.

Things to Keep in Mind when Writing a Cheque

Common safety measures to write a cheque are:

- One can cancel the cheque by destroying or using it for a particular purpose of submission of ECS.

- Make sure you do not overwrite the drawee's name or date of the present or the amount of the cheque.

- Mention your account number, mobile number, debit/credit card number correctly on the backside of your cheque.

- Do not disfigure, tape or staple the cheque.

- Do not fold the cheque.

Depositing vs. Cashing a Cheque

- Depositing a cheque means that you are crediting money to your specific account. This may take some days in order to get the full amount.

- Cashing a cheque means you received a cheque from someone and submitted it to the bank. The bank will give you the specific money written in the Cheque.

Main types of cheques

- Bearer Cheque:- The bearer cheque is the cheque that is not crossed. You can go to the cheque counter and encash it. Whoever gets the cheque can withdraw the money. Hence, it is a powerful and risky cheque.

- Order Cheque: This cheque is only issued to the person whose name is given. You can strike the ‘bearer’ word in the Cheque to make it an order Cheque. It is also known as a transferable cheque. You can transfer the Cheque from one person to person.

- Crossed Cheque: This cheque is crossed by putting two lines in the left-hand corner. The advantage of the cheque is deposited only in her bank account. If you want to transfer to the bank account, you can use a crossed cheque. Both the cheques types of cheques will withdraw cash.

Conclusion

A cheque is a document of order statement of money transferred from one account holder to another to either one individual or a company's name or whichever name the cheque is issued.

Cheques are one of the safest ways to transfer money. The date holds a lot of significance in the cheque. It is a vital piece of information and thus cannot be taken lightly. The digital age of banking means that you may not need to use your Signature as often - but it's still important.

Your bank has a signature on file for your account. If you sign a check with an irregular signature, your bank may decline the payment, thinking it is fraudulent. You can avoid confusion by signing the same way each time for your cheque payments.

The above mentioned points will help you to filling the cheque with proper details.

I hope you liked our article on how to fill cheque, and it must have solved your queries such as how to write a cheque, how to fill a cheque leaf, how to fill cheque book

if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

1. What should I do if I make a mistake?

If you make a mistake, rewrite the cheque instead of cutting and overwriting it. Submitting a cheque that has mistakes can lead to dishonouring of the cheque. You may spill a drink on a cheque, rip the paper, or it can get worn out before using it.

If this happens, avoid using the cheque for a payment. Doing so may result in a dishonoured check because the bank teller cannot read the information on your cheque.

2. Is writing a check to myself allowed?

Yes, you can write a cheque to yourself in the name section. You can cut a cheque to the name of yourself.

3. How to fill a cheque for 40000?

Yes, you can write a check of 40,000 if you have a sufficient amount in the bank. If you have insufficient funds in your account to pay someone, don't write a cheque.

You may think of other funds to deposit money into your account before the payee cashes the cheque. Bouncing a cheque costs you even more in fees that you have to pay to the bank.

4. Can I deposit a 100000 cheque?

Yes, you can deposit 100000 cheques in the bank. There is no restriction on the money deposited in the bank. Only you need to fill in a few formalities to deposit such a large amount in the bank.

5. Can we write a cheque with a black pen?

Yes, according to the new rule of the SBI, you can write the cheque with a darker pen, which will be valid. Limit the words on a cheque to what is necessary.

Do not add notes and other irrelevant information. Too much writing makes it difficult for a bank teller to read your cheque, and may lead to a dishonoured cheque.