Want to know how to calculate interest on loan? Well you have landed on the right article.

Interest is the price that is paid when you borrow money from someone. Whenever a loan is given by a bank, organisation, or individual, an additional interest amount has to be paid to them.

This amount helps compensate them for the lending risk, that is, the possibility that the borrower may not repay the amount loaned. The loan interest also allows other uses of the same money.

Consider this situation. It is Ram's long-time dream to own a house of his own. He has some money in hand but needs ₹10 more lakhs to complete the purchase. Hence, to get this money immediately, he applies for a loan from a bank.

After settling into his new home, Ram does a quick calculation and knows that he has to pay back an amount of ₹10.5 lakhs in 5 years. The extra ₹50,000 is Ram's interest over 5 years to the bank that sanctioned his loan.

There are different types of loans and loan interest. Let us consider the major factors influencing the interest rate on a loan.

how to calculate interest on loan (Updated 2022)

Hence, it becomes beneficial for us to know about the different types of loans, the risk associated with them, and hands-on knowledge on how to calculate and interpret an interest rate on a loan.

Depending on the lender, different interest rates may be applicable, and they may often involve multiple calculations.

However, the concept of each interest rate is easy to understand, and each interest amount depends on the same set of factors - the interest rate, the amount borrowed, and the period of repayment.

We will be looking at two techniques that can be used to determine the type of interest - Simple Interest Loans and Amortising loans.

how to calculate loan interest Using Simple Interest

The simplest way a lender gives out money is using simple interest. This simply means that the borrower has to pay a fixed interest amount for a particular period.

To calculate simple interest, one has to know these 3 details:

- The amount borrowed (or commonly referred to as the Principal)

The interest rate charged by the lender (this is given as a percentage)

The time for which the money is being borrowed

Simple Interest is the product of all these parameters.

For example, if Ram borrowed ₹10 lakhs with a simple interest of 10% for 5 years, he has to pay an amount of ₹50,0000 as the interest for the duration.

Simple Interest = Principal X Interest Rate X No. of years

Simple Interest = ₹10,00,000 X 10/100 X 5

Simple Interest = ₹ 10,00,000 X 0.1 X 5

Simple Interest = ₹ 50,000

Amortizing loans

In amortizing loans, the lender receives a fixed amount of payment over a period inclusive of the principal and the interest amount. This type of loan is commonly found when the same amount of money is given in installments,

As in the case of EMI, and is common in mortgages, student loans, and auto loans. This type of loan involves paying a hefty amount for the interest in the first few installments, but they become smaller towards the end of the payment period.

The interest calculation in amortizing loans is simple but involves multiple iterative steps.

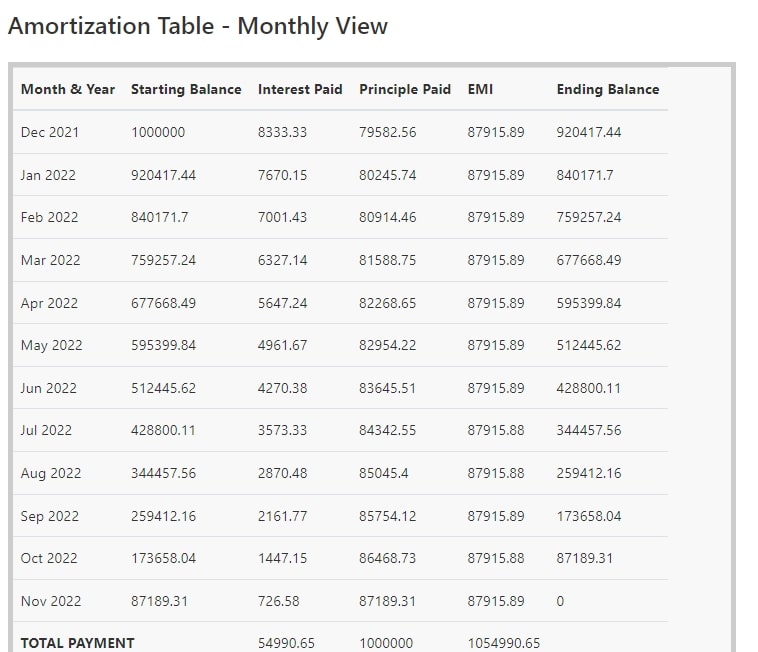

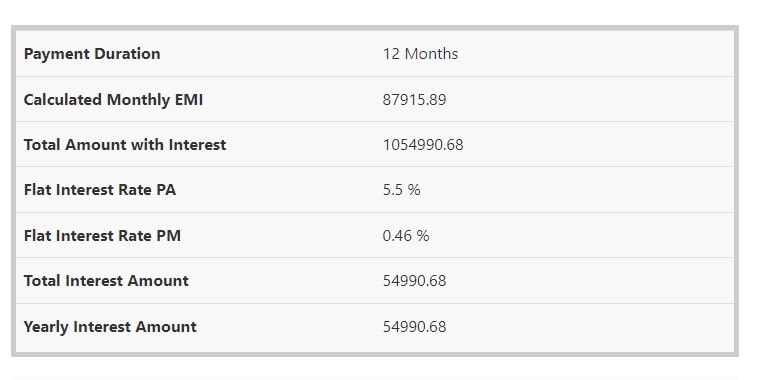

- The interest rate is divided by the number of times one wishes to make payments in a given period. For example, Ram borrowed ₹10,00,000, and his lender told him that he would pay ₹87,915 every month for 1 year to repay his full loan with interest.

If Ram plans to make the entire loan repayment by paying 12 times in a year, i.e., monthly payment over a year, then the interest rate of 10% or 0.10 is divided by 12 to get 0.0083.

Amortizing Interest Formula: Interest paid = (Interest Rate / No. of times payment is being made) X Remaining balance

- Multiply this number with the amount that was initially borrowed. For Ram, 0.0083 X 10,00,000 = ₹ 8,334 will be his interest amount for the first month.

- For the second month, subtract the interest and the principal Ram paid in the first month to get the interest amount.

- This process is continued until Ram has paid off his original principal amount. It can be noted that ₹54,990.65 is paid as a total interest to the lender along with the original principal amount.

An amortization schedule summarizing the key data can be presented as follows:

Factors that affect how much interest you pay

Though many internal and external factors may affect the amount of loan you pay, 5 significant factors effectively give an idea of how much a given loan will amount to in a specific duration of time.

Loan Amount or Principal

The interest paid is directly linked to the initial borrowed. By simple logic, the higher the loan amount, the higher the interest paid. To understand this better,

Let us take the example of Ram, who we discussed at the beginning borrowed ₹10 lakhs for buying a house. At the lender's interest rate of 10% per annum, Ram would be paying an interest amount of ₹10,000 every month,

Calculated using the simple interest formula. But if Ram borrowed ₹20 lakhs instead, he would have to pay an interest of ₹20,000 per month. Hence, we must determine the interest amount payable to the lender before borrowing any money.

Also, one should remember to take a loan only to the extent necessary, as higher loan borrowings may lead to very high-interest rates over time.

Key Point: The loan amount borrowed is directly linked to the interest charged. Hence, it is important to be prepared to estimate the payable interest and restrict the loan amount to the bare minimum.

how to find interest rate on loan

The next most significant factor affecting the interest payment is being aware of the lender's interest rate. In India, most banks charge an interest rate of 10% - 25% for personal loans.

However, this value may change according to the type of loan and other extrinsic factors. Interest rates may be charged annually, semi-annually, or quarterly. Hence, it is essential to note the amount of interest charged and its time period.

Let us take the example of Ram again, if Ram's lender charges him a 15% interest rate on an amortizing loan instead of the 10% interest rate, he will end up paying ₹83,099.75 versus ₹54,990.65.

In other words, he ends up paying ₹28,109 as interest for the same money borrowed. Moreover, interest rates can be fixed or variable over time, and the amount of interest charged to a person can depend on their credit score.

A lower credit score implies that a greater interest rate will be chargeable.

Key Point: The interest rate by the banks depends on an individual's credit score. The higher the interest rates, the higher will the interest amount payable at the end of the loan period.

Loan Term

This refers to the entire period for which a person borrows an amount of money. In this period, the total interest amount on the loan accrues and is payable to the lender as per the agreement.

For example, Ram takes a loan of ₹ 10 lakhs at 10% per annum for 5 years. This means that through 5 years, Ram will pay an interest of ₹50,000 and may pay it as ₹10,000 per year or ₹833.33 per month as per the loan agreement with the lender.

The loan term can be a short-term one as in the case of the purchase of electronic gadgets, or a long-term one as in the case of mortgages.

In short-term loans, a higher payment would be made over a short time, while in long-term loans, a seemingly small amount of money is being paid over a long time.

It is interesting to note that the total interest amount paid in a short-term loan is much lesser than in a long-term loan, though it may seem to be the opposite.

There have been cases when the interest amount exceeds the original borrowed amount. For example, if ₹100 has been borrowed at 10% per annum simple interest,

Then the interest payable will be ₹110 at the 11th year after the money has been borrowed.

Key Point: Loan term affects the total interest payable and needs to be taken into consideration by estimating one's loan repayment capacity or how much a person can afford to pay through a duration of time.

Repayment schedule or frequency of payment

This parameter tells us how often a person opts to pay the lender. The borrower may choose to make payments annually, quarterly, monthly, bi-weekly, or weekly as per the loan agreement.

The more often the borrower decides to make the payments, the lesser the total interest amount payable on the entire loan amount.

By opting for regular payments through the loan term period, the borrower will be able to pay off the initial loan money faster, thereby decreasing the load of the interest rate on the remaining loan money.

A higher repayment schedule is more profitable for borrowers, especially when the lender lends his money on a compounding interest rate.

Hence, faster repayment implies that the borrower can avoid the multiplying effect caused by compounding interest.

Key Point: It is wise to lower the total interest payable by making loan repayments as frequently as possible, rather than opting for one bulk payment towards the end of the loan term.

Repayment amount

Repayment amount refers to the amount paid by the borrower each month to clear off the loan. Just as in the case of the repayment schedule,

One can end up saving a lot of money that might otherwise be paid as an interest just by opting for a large repayment amount.

Key Point: When a borrower makes larger payments quickly, the net interest amount payable reduces. Also, it is a good idea to ask the lender to waive off a portion of the principal amount every time a large repayment amount is paid.

How to get the best loan interest rates

There are a few ways by which a person can get the best interest rates on a competitive loan in the market.

- Improving your CIBIL/credit score

A person with a good CIBIL/credit score has the advantage of claiming competitive interest rates on loans. A CIBIL score is a PAN India standard that reflects one's trustworthiness as a borrower using financial tracking.

Hence, it is essential to maintain a CIBIL score of more than 750 is needed to claim a loan. A lower score may lead to the rejection of the loan. The CIBIL score depends on an individual's income, previous debt history,

Outstanding payments, defaults, credit repayments, among others. Hence, focussing on clearing any existing default and regularly updating one's financial status is key to increasing one's financial credibility.

- Opt for a shorter repayment timeline

The shortest-term loan often offers the best interest rate. Hence, while searching for a loan option, it is ideal to choose a loan based on a faster loan repayment schedule.

- Reduce your debt-to-income ratio

The Debt to Income Ratio (DTI) is a critical parameter that affects the eligibility of a person for a specific interest rate. The lower the DIT ratio, the better the person might get a competitive loan with a low-interest rate.

Hence, it is vital to clear off the existing debts or any other defaults.

Conclusion:

In conclusion, understanding and calculating interest rates may seem complicated. However, it all boils down to knowing a few critical parameters like the loan amount, interest rate, and the loan repayment schedule and amount.

Knowing these parameters makes it easy for a person to estimate the amount of interest payable. Moreover, note that the faster loan repayments are made, the better it is to lower the interest money.

Also, it is crucial to maintain an excellent financial report as reflected by credit score and DIT ratio to get competitive loans.

Hence, by knowing the type of interest, one can quickly determine the interest amount using online tools and get an edge over loan analysis.

I hope you liked our article on how to calculate interest on loan in India, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

1. What is the formula to calculate interest on a loan?

The interest amount payable on a loan depends upon the type of loan. It can be a simple interest loan, a loan with a compounding interest rate, or an amortizing loan.

Simple Interest = Principal X Interest Rate X No. of years

Compound Interest = Principal (1 + Interest rate)^No.of years

Amortization Interest = (Interest Rate / No. of years) X Remaining Principal

2. How do you calculate the interest rate examples?

If Ram takes a loan for ₹ 10 lakhs at 10% interest per annum and plans to repay the loan after 5 years, what will be the total amount of interest that he will be paying?

Simple Interest = ₹10,00,000 X 10/100 X 5

So Ram will be paying an amount of ₹50,000 at the end of 5 years as an interest.

3. What is the formula to calculate monthly interest?

If the interest rate is given annually (per annum), then the interest per month can be calculated by dividing this interest rate by 12 (no. of months in a year) and then multiplying with the principal amount to get the interest amount.

Interest = Principal X (Interest rate / 12)

4. How do you calculate the interest rate on a calculator?

The interest rate can be calculated easily using an online calculator. Depending upon the type of interest, the parameters can be plugged in to find the interest rate.

Simple interest can be easily calculated using a formula or a calculator:

https://www.calculatorsoup.com/calculators/financial/simple-interest-calculator.php

Compound Interest: You can use this formula to calculate compound interest:

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Interest in amortization:

https://www.calculator.net/interest-rate-calculator.html

5. How do I calculate a simple interest rate?

Simple interest can be easily calculated using a formula or a calculator.

Formula:

Simple Interest = Principal X Interest Rate X No. of years

Online calculator:

https://www.calculatorsoup.com/calculators/financial/simple-interest-calculator.php

6. How do you calculate APR from the monthly interest rate?

APR or the annual percentage rate is the interest rate along with fees and handling charges on loans calculated yearly. To calculate the APR,

We multiply the monthly interest rate by 12 (no. of months in a year) and add other expenses involved in procuring the loan, like convenience fees, as a percentage.