Looking for a sbi ppf calculator?

Great! You have reached the right place; we are here to help you.

One of the preferred methods of saving for retirement, especially among the working class in India, is the Public Provident Fund (PPF). A PPF account provides for a tax break on investment amounts, making it appealing to most people.

Ever wondered how to go about opening your PPF account at a bank? In this article, we'll go over how you could open a PPF account with SBI, and what you need to know about using it.

Public Provident Fund

The Public Provident Fund is one of the most popular long-term savings and investment option schemes, mainly due to its combination of safety, returns, and tax savings. The PPF was first offered to the public in the year 1968 by the GOI.

Since then, it has emerged as a powerful tool to create long-term wealth, especially for investors who like to put aside money for periods that can be as long as 15 years! With its attractive interest rates and tax benefits, the PPF is a big favorite among individuals who like to save small amounts over time.

How can the SBI PPF Calculator help you?

The SBI PPF Account Calculator will aid you to reach your investment goals. To use the tool, simply enter an amount and period to get a detailed report of what you can earn from your SBI Fixed Deposit or a Certificate of Deposit (CD), or investments in your Public Provident Fund (PPF).

The calculator will also let you know exactly how much interest is earned on the savings over time.

SBI PPF Calculator provides different PPF calculation modes, which are:

Fixed yearly amount: It tells you how much return you should earn if you invest x amount every year for the next 15 years.

Fixed monthly amount: It shows how much return you should earn if you invest x amount of money every month for the next 15 years.

Variable yearly amount: If you want to calculate the future value as of a given date, you should select this option, and enter either how much you plan on investing every year, or how much it will be worth at a later point in time.

Variable monthly amount: In this, you can estimate your return maturity amount by providing your month-wise investment.

How to open a PPF account in SBI?

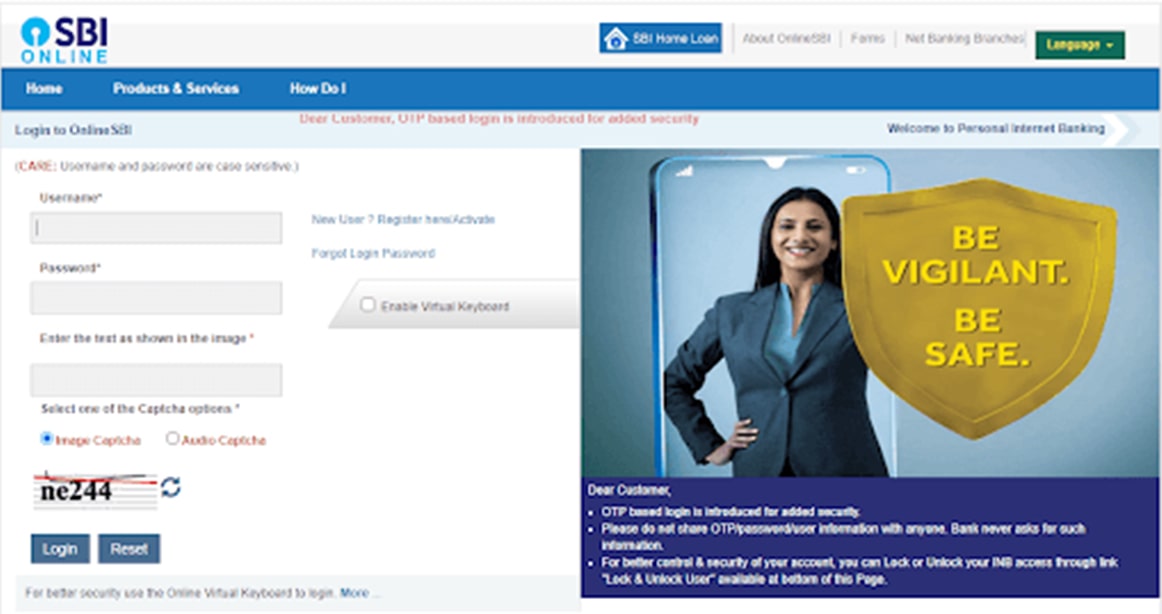

Step 1: Visit the SBI website at www.onlinesbi.com and log in with the details.

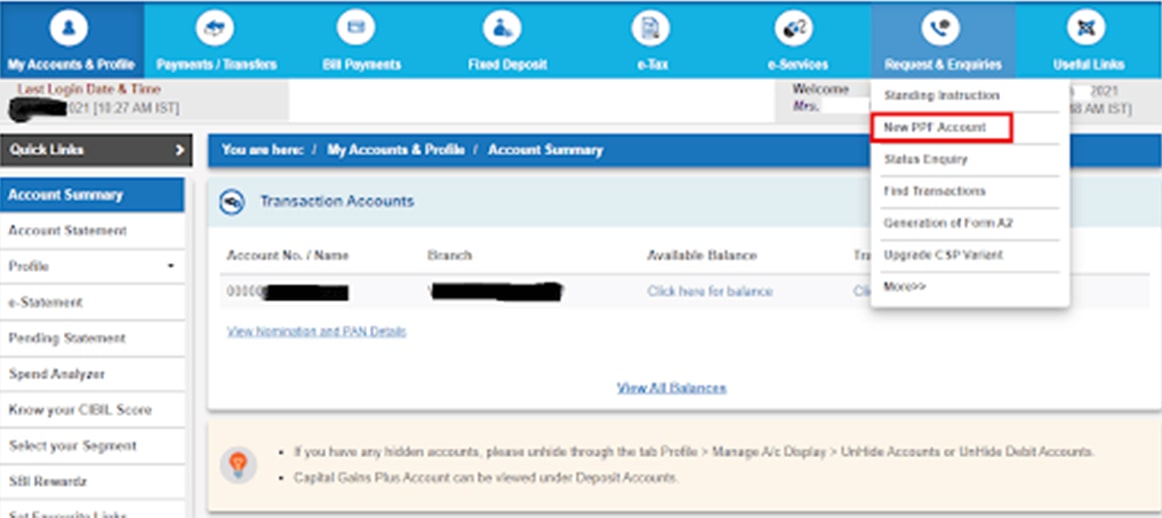

- Step 2: Click on the request & inquiries section as shown in the image below and select “New PPF Accounts”.

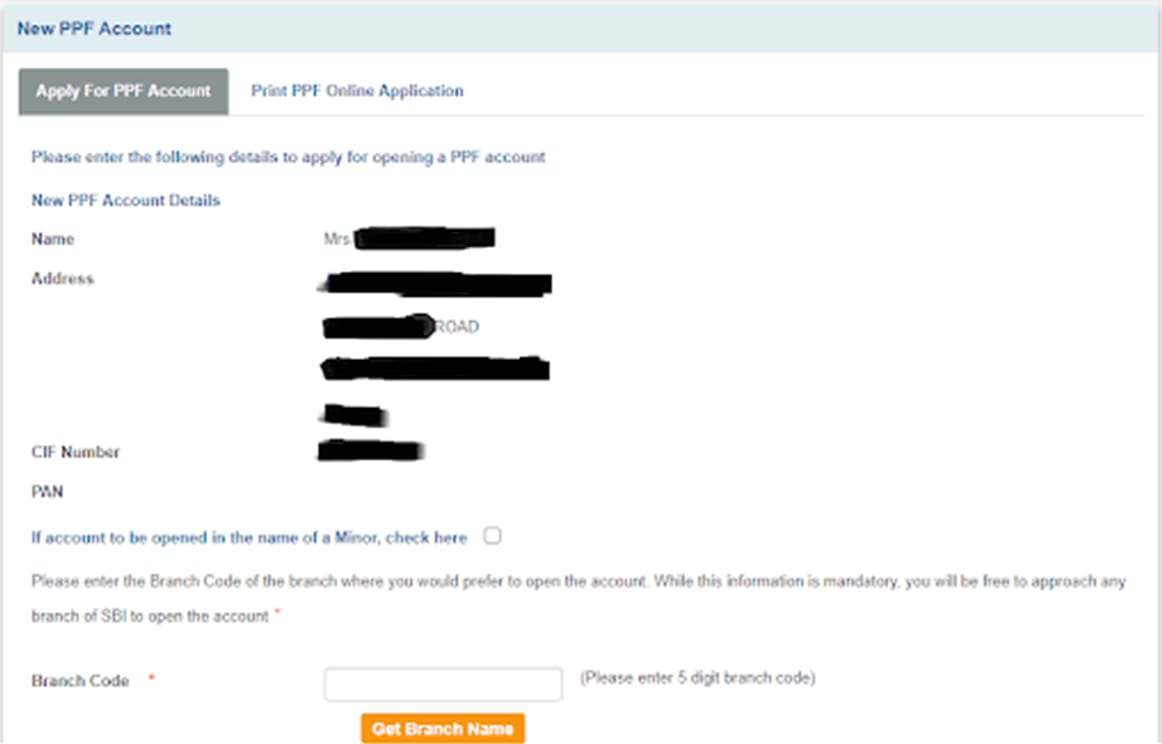

- Step 3: A new page will appear and your name, address, and CIF number will be displayed on the screen.

Step 4: If you are opening the account in the name of a minor, then click on the checkbox.

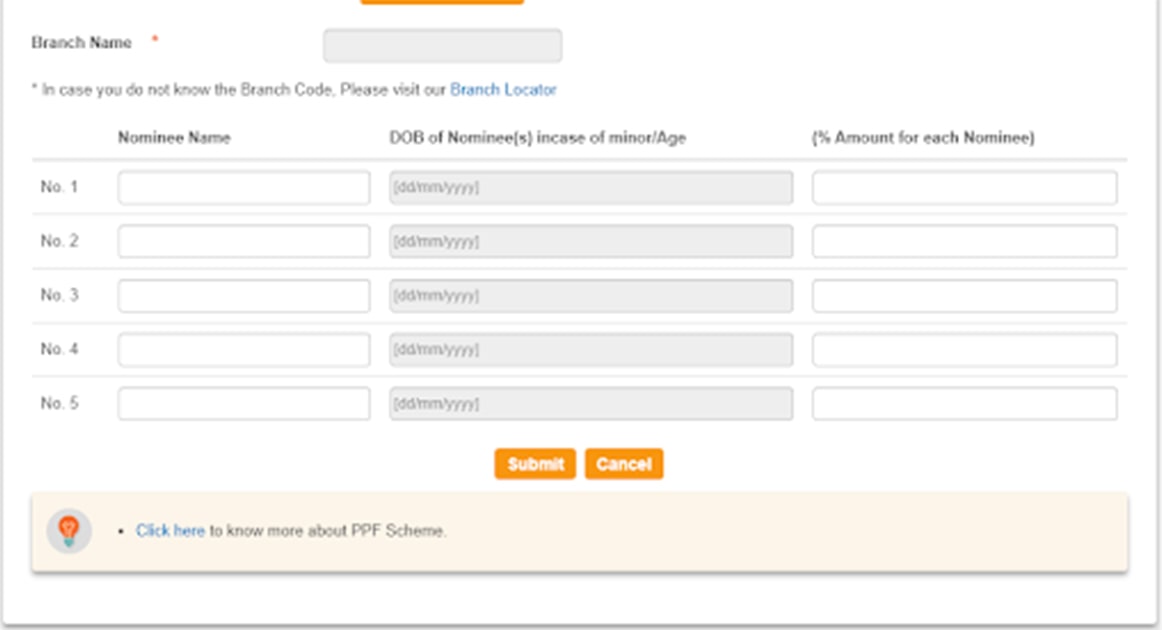

- Step 5: Enter the bank details of your home branch. Furthermore, you can enter up to five nominee details based on your choice and click the submit button.

Step 6: After verifying all the details, click on “Proceed”.

- Step 7: Your PPF account will be created, and a new screen will pop up where your PPF account number will be mentioned.

- Step 8: Print the account opening form by clicking on the “Print PPF Online Application” tab. Visit your home branch with the form along with KYC documents within 30 days to complete the process.

Advantages of using the PPF Account Calculator

The PPF Account Calculator is a tool that helps you to estimate your interest earned, maturity value, and investment period. To get an idea of how much interest you can earn on a particular sum and for how long, you need the help of a SBI PPF calculator.

All you have to do is visit the SBI site, enter the amount to be invested, and choose the period of investment from several options available on the website.

You will then get all the necessary information about your fund. Today it's critical to know the maturity date (or date of maturity) because it can help define the best strategy when looking at alternatives to a Certificate of Deposit.

There are many advantages of using an online PPF account calculator:

It will indicate how much interest you can earn given the amount of principal you have in hand.

It helps an investor to decide how long she/he should hold the investment to achieve their goal.

An online PPF maturity calculator also helps in revealing how much yearly amount is to be invested by showing the schedule of investment in advance. It also helps in understanding how much loan can be availed and how much amount can be withdrawn.

How to withdraw money from PPF?

A PPF account is an account for the long term. Typically, it will mature in 15 years, but there is a provision to extend its maturity after the first 15-year period, in a five-year block at a time.

One can choose to take out the money as well, but it's best if they continue putting more money into the account to benefit from the advantages of investing in a PPF account.

While partial withdrawals are made unconditionally after six years, you can continue to defer your deposits in PPF accounts. While complete withdrawals of money cannot be done before the 15th anniversary of the opening of your account, in case of premature withdrawals, you can follow the below steps:

Fill Form C.

Enter all the required details.

Submit the form along with your PPF passbook.

The bank will verify all the details mentioned in the form along with the eligibility of the account holder.

Upon completion of the process, the amount will be credited to the holder’s account.

How to take a loan on PPF?

PPF accounts allow people to take out personal loans against their available balance in the account. This is excellent for people who want to obtain a short-term loan but don't want to pledge any of their assets as collateral for the loan.

The most compelling benefit of a PPF account is that you have the right to take out a loan on this account if you so choose. However, keep in mind that it's most beneficial when used to attain short-term loans.

You need to keep all the following in mind while taking out a loan on PPF:

Eligibility

The loan can be availed during the third through the sixth financial year of a business plan. For example, if your account was opened in 2020–21, you could apply for this line of credit during 2022–23, if you qualify.

It will be a 36-month loan, which means timely monthly payments need to be made to avoid any penalties or fees.

Interest

The interest rate is as low as 1% annually if the loan is paid back within 36 months, but it rises to 6% a year after 36 months.

Amount of loan

The maximum amount of loan that you can avail of is up to 25% of the balance in the PPF account, as of March 31st. For example, if the account holder is applying for a loan on March 1st, then 25% of the PPF account as of March 31st shall be considered as the maximum loan amount.

Form

To apply for a loan against your PPF (Public Provident Fund) account, the applicant must fill out Form D and send it to their bank, stating the amount of money being applied for.

Please also include a letter explaining specifically what the funds will be used for, but even more importantly, please also provide a copy of your PPF Account Passbook with this form.

Frequently Asked Question

Q1. Can NRIs invest in the PPF scheme?

Foreign nationals are not permitted to make investments in PPF schemes, which is usually an investment option that most Indian citizens enjoy.

Since an NRI cannot make any new investments into a PPF account, they should be careful about how they handle the funds in their existing account at the time of settlement. They must also notify all changes or alterations to their financial contributions right as they happen.

Q2. Is the SBI PPF scheme ideal?

Yes, the SBI PPF service is safe and secured. Moreover, the scheme offers high benefits on the deposited amount. To summarise, some key features of the SBI PPF Account are as follows:

- It can be opened at virtually any bank branch or post office.

- The minimum amount to deposit is ₹500, with no maximum limit or cap.

- The investment can be made as a lump-sum amount or made in 12 installments over 12 months (1/12 per month).

Q3. How can I check my PPF account maturity on the SBI portal?

You can now find out your PPF account maturity date through the SBI Net Banking portal. Follow the procedure detailed below to determine when you will be able to withdraw the maturity value from your PPF account.

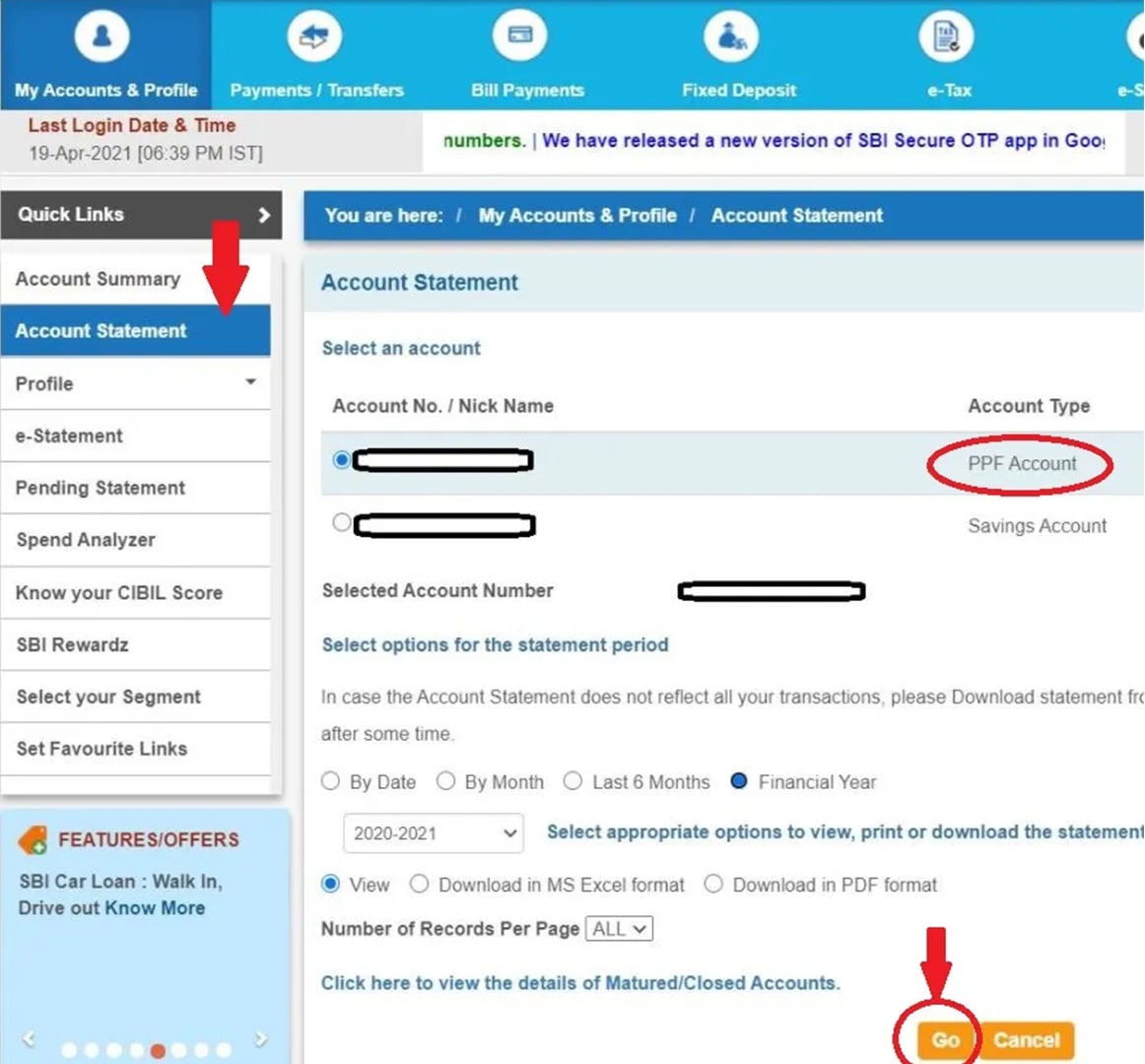

Log in to SBI Net Banking, and click on the “Account Statement” tab. You should be able to find this under the “Quick Links” menu on the left panel. Refer to the image below:

Q4. Can I have 2 PPF accounts?

As per the old rule, you are not allowed to open two PPF accounts. This means that if you know about a second account and do not report it to the Income Tax Department, this second account will be treated as irregular for tax purposes.

This happens because, legally, only one PPF account can be opened by one individual at any given time.

Q5. Can I pay towards the PPF monthly?

Yes, one can pay PPF monthly, and according to tax and investment experts, if invested smartly, one can become very wealthy after choosing a monthly investment mode that is PPF-account enabled.

Q6. How much to invest in the PPF?

The catch with this particular investment option is that one can only invest to the tune of ₹ 1,50,000 each year.

While this may sound like a limitation, experts have all agreed that this is a very safe fixed income product and beneficial for those who don’t want the hassle of making constant investments each month.

Q7. Should you invest in a PPF scheme?

Experts agree that even though the yearly investment amount is limited to only ₹ 1.5 lakh, the PPF is among the safest options for fixed-income investors.

For conservative investors, a PPF investment is an ideal option due to its risk-free rate of return and predictability in gains during the term of your investments. Investing in the PPF is recommended by financial experts as the maturity amount of your PPF will be tax-free when you cash out.

You’ll also receive interest earned during this time that can later be used to continue investing, or can be withdrawn.

Q8. Why should I invest in the PPF?

There are several benefits one gains while investing in the PPF, such as:

- Triple tax exemption status

- Beneficial floating rates when the interest rate is low

- The power of compounding works wonders in the long term.

- Even aggressive investors can diversify through the PPF.

- A must-have for investors in the highest income tax bracket

I hope you liked our article on sbi ppf interest calculator, and it must have solved your queries such as sbi ppf interest rate calculator, sbi ppf account calculator or ppf return calculator

if you have any comments or suggestions do share them in the comments below.