The Kotak Mahindra Bank, one of the most prestigious banks, offers a wide range of fixed deposits. It helps investors achieve their financial goals through investment in FD.

The entire process of opening an FD account is quite simple. The bank offers a wide range of fixed deposits, from letting investors achieve their financial goals through Investment in FD.

Kotak’s fixed deposit investment is ideal if you want to increase your savings and have peace of mind. The detailed features of kotak fd calculator is written below

Features of Kotak FD Calculator

- Kotak Bank FD provides lucrative rate of interest on FD that help increase the overall value of your money. A secured ROI makes FD investment a better option than others.

- One can easily invest in Kotak Bank FD with a minimum amount worth Rs 5,000. Moreover, there is no restriction on the maximum amount of investment one can make.

- The flexibility in tenure of Kotak Bank FD varies from 7 days to 10 years.

- The investors can choose to withdraw the interest amount periodically or can withdraw the same at the time of maturity. The flexibility makes Kotak Bank FD a better investment alternative.

- One can easily invest through internet banking or mobile banking. There is no need to fill out a form and visit the branch. However, you can visit the nearest branch if you want to open an FD offline.

- You must add a nominee for your Kotak Bank FD at the time of investment, but it can be changed later.

- Kotak Mahindra Bank offers liquidity through a sweep-in FD facility.

- The overdraft facility against your fixed deposit investment is also possible.

How can Kotak FD calculator help you?

Investors planning to invest in a fixed deposit offered by Kotak Mahindra Bank can refer to the FD calculator offered by the bank to get a better idea about the investment and the earnings from the account.

With the help of an FD calculator, investors can save much of their time while checking the accurate details of their investments.

How to calculate Kotak FD Interest Rates?

The interest on a fixed deposit investment is calculated after considering many factors. The key factors playing an important role include the total amount of investment, time, and interest rate.

One can easily calculate the interest amount using various ways mentioned below:

- Simple Interest on Fixed Deposit

Simple interest is the interest earned on the principal amount at a predetermined interest rate for a fixed investment period.

- Formula used for calculating the interest

Simple Interest = (P * R * T)/ 100 P- Principal amount invested, R- Rate of interest (%), T- Tenure

- Example

Mr. Mohan invested Rs 10,000 for a period of 60 months at an annual interest rate 10%.

Simple Interest = (Rs 10,000 * 10 * 5 years)/ 100 = Rs 5,000

The Principal amount invested (P) = Rs 10,000, Rate of interest (%) = 10% per annum, Tenure = 5 years

Maturity Value = Principal amount of Investment + Simple Interest earned during the tenure

Maturity Value = Rs 10,000 + Rs 5,000

Maturity Value = Rs 15,000

- Compound Interest on Fixed Deposit

Compound interest is the interest earned on the principal amount of investment and the interest earned on such type of investment.

In this way, the interest rate is increased to the number of periods (years) for which the interest will be compounded and multiplied by the principal amount invested.

- Formula used for calculation

A = P (1+r/n) ^ (n * t)

A = Maturity Amount, P = Principal amount of investment, r = Rate of Interest, n = number of compounding in a year, t = total years

- Example

Mr. Ram invests Rs 10,000 for 60 months at an interest rate of 10% per annum compounded quarterly.

In this case, the Principal amount of investment would be Rs 10,000, Rate of Interest= 10%, the Number of compounding in a year = 4 (once every quarter), and the number of years of investment is 5 years

A (maturity amount) = 10,000 (1+0.10/4) ^ (4*5)

A (maturity amount) = Rs 16,386

Interest amount = Rs 16,386 – Rs 10,000 = Rs 6,386

Different Types of Kotak FD

- Normal Fixed Deposits: Almost all the banks in India offer the standard fixed deposit to their customers. A standard or normal fixed deposit is when an investor invests his money for a fixed period of time, at a predetermined interest rate.

The standard FD time vary from a week to 10 years. It is the most common FD option chosen by investors.

- Tax-Saving Fixed Deposits: Unlike regular fixed deposits, tax-saving FDs cannot be booked for less than 5 years’ time. The amount invested is exempted from tax under section 80C, but the interest the investors get from FD is taxable.

- Special Fixed Deposit: Special Fixed Deposits are known as special as they are deposited for a fixed period. A special time can be anything, like 295 days or 395 days, etc.

These kinds of FDs have a higher interest rate and are quite popular among various investors.

- Floating Fixed Deposit: Under this kind of FD, the interest rate changes quarterly or yearly, and investors can enjoy the benefits of a changing interest rate. RBI decides the change in the rate of interest.

- Senior Citizen Fixed Deposits (FDs): Senior Citizen FDs are deposit plans with special interest rates offered by renowned banks. This kind of FD is provided to individuals above the age of 60.

These fixed deposits offer, senior citizens various benefits to senior citizens including a higher rate of interest and a regular interest payout option.

How does the Fixed Deposit Calculator work?

The FD Calculator is a simple tool to calculate the rate of interest one can earn by investing in a Fixed Deposit for a particular period. The kinds of Interest payment on Fixed Deposit varies as per the choice of the investors.

The details regarding the same are mentioned below:

- Cumulative: Cumulative is something one must avail of if wanting more returns on FD over a regular interest payout.

- Quarterly Payout: Under the Quarterly Payout option, the investors will get the sum of interest at the end of a quarter (3 months)

- Monthly Payout: In this, the interest is paid at the end of every month

- Invested Amount: It is the amount investors want to put as a one-time investment; the investors can invest any amount of 5,000 INR and above.

- Date: The date when investors want to sign up for your investment in Fixed Deposit.

- Tenure: It is the duration for which the investors want to invest their amount for.

Benefits of Kotak FD Calculator

Kotak’s Fixed Deposit calculator offers several advantages out of which a few are listed below:

- FD calculator helps save crucial time and gives freedom from making long calculations. With the help of the Kotak FD interest rates calculator, one can easily estimate the returns and make a better investment decision.

- Since the interest earned on any fixed deposit varies on investment amount, interest rate, compounding frequency, etc. The factor affecting the desired maturity amount can easily be judged using the Kotak Bank FD calculator.

- Since there are no better other investment alternatives to FDs, so one can easily compare the rate of interest among various fixed deposits.

- The results are precise and help decide an ideal investment amount.

- With the help of an FD calculator, the investors can easily compare various terms of the investments and the gains after that.

- Kotak FD calculator offers a clear representation of results periodically in years. It provides the opening balance, interest earned, and closing amount every year. This helps you know the balance in real time after every interest payout.

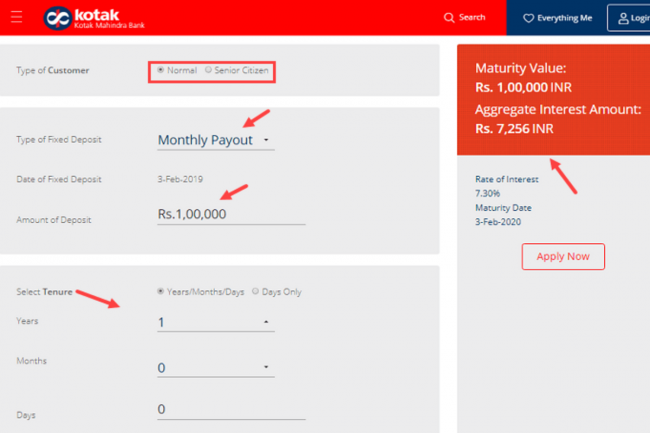

How to use Kotak FD Calculator?

The step-by-step process to using the Kotak FD calculator is mentioned below:

- Refer to the official website of Kotak Mahindra Bank FD Calculator, https://www.kotak.com/en/personal-banking/deposits/fixed-deposit/fixed-deposit-calculator.html

- On the calculator, click on the option ‘Type of Customer’ - ‘Normal’ or ‘Senior Citizen’.

- Under the ‘Type of Fixed Deposit’ option, select the desired option from the drop-down box.

- The date of the fixed deposit will be pre-defined.

- Tap on the ‘Amount of Deposit’ of your choice.

- Click on the tenure in ‘Years/ Months/ Days’ or ‘Days Only’ under the ‘Select Tenure’ option.

- Post filling in all the details, the calculator will automatically display the ‘Maturity Value’ and the ‘Aggregate Interest Amount’.

Conclusion

The Kotak Mahindra Bank FDs offer several benefits to investors, from the safety of investments to tax benefits to attractive FD interest rates; one can get numerous advantages from their investments.

So, whether you want to save for your older age or for your child’s education, investing in a Kotak Mahindra Bank Fixed Deposit is the most secure and effective way to make your dreams come.

So if you have a Savings or Current account with Kotak Mahindra Bank, log on to your Netbanking or Mobile Banking and avail yourself of a fixed deposit for an amount and tenor of your preference.

Invest in Kotak Mahindra Bank Fixed Deposits right now to make your future safe and secure.

Frequently Asked Questions (FAQs)

1. How is the Kotak FD maturity amount is calculated?

One can calculate the interest amount using any of the two methods, including simple interest and compound interest.

Under the Simple interest method, the interest is earned on the principal amount at a predetermined interest rate for fixed investment tenure.

While the Compound interest is the interest earned on the principal amount of investment and the interest earned on such investment so far.

2. What are the factors that affect Kotak FD interest rates?

The interest on a fixed deposit investment is decided by considering various factors. The factors based on which the fixed deposit interest rate is decided include the investment amount, tenure, compounding frequency, & rate of interest.

3. Is Kotak FD 100% safe?

Fixed Deposits in Kotak Mahindra Bank are a source of fixed income in the future. The customers can deposit an amount for a particular period of time and at a predetermined interest rate.

Therefore, FDs in Kotak Mahindra Bank are the safest medium for investment. Even the entire process of opening an FD account is straightforward.

4. What is the minimum tenure for fixed deposits?

The flexibility in tenure is the USP of Kotak Bank FD. The tenure for fixed deposits varies from 7 days to 10 years. So, even the depositor can open a fixed deposit account with just Rs. 5,000.

The amount is fixed for a particular time against the promise of the mentioned interest rate.

5. Are there separate Kotak FD calculator for different banks?

The FD Calculator is an easy and simple tool to calculate the rate of interest one can get by investing in a Fixed Deposit for a specific time.

The fixed deposit is calculated using the same formula (either simple interest or compound interest) while calculating the interest rate across all the FD interest rate calculators.

6. What is the difference between RD and Kotak FD?

Though both Recurring deposits (RD) and fixed deposits (FD) run over a particular time tenure, in FD, the investors can deposit an amount once while RD investors have to deposit a fixed amount at regular intervals.

The customers opting for a fixed deposit can decide the tenure, which in most cases varies from 7 days to 10 years, and must deposit an amount once.