Home Loans are available from Axis Bank at a competitive interest rate. From the time you meet with an Axis Bank loan executive until the loan is disbursed,

The complete house loan application process is uncomplicated and takes up to 15 days at Axis Bank. This post will be very useful if you are buying a house and need financial assistance from the country's third-largest private bank.

Axis Bank Home Loan EMI Calculator, eligibility requirements, and other relevant facts about Axis Bank Home Loan Calculator will be discussed here. You can also look up the Axis Bank home loan eligibility requirements on the internet.

Axis Home Loan Calculator

A home loan is a type of financial assistance provided by various financial institutions and non-banking financial companies to help people purchase a property.

The majority of people prefer to repay their debts through EMIs. The EMI Calculator determines the total amount of money owed by the borrower after a certain period of time, as determined by the lender.

The principal loan amount, as well as the interest paid on it, are included in the EMI, or Equated Monthly Installment. This payment is fixed for a specific term and is paid on a monthly basis.

The interest component is paid at a greater rate in the early years of the term, but as the term progresses, the higher paid portion is gradually replaced by the principal component.

Benefits of Axis Bank Home Loan emi Calculator

Both salaried and self-employed individuals can apply for loans. Special pricing is available for women, senior citizens, and non-resident aliens.

- It will assist you in determining the appropriate amount to make your EMIs affordable.

- It allows you to choose the appropriate tenor to guarantee that the monthly payments are manageable.

- Axis bank offers loans to people between the ages of 24 and 60.

- At 6.90 percent to 8.30 percent, the interest rate is compatible.

- It eliminates the need for manual calculations, which might produce wrong answers and take time.

- It can be used anyplace.

What is the Axis home loan emi calculator Formula?

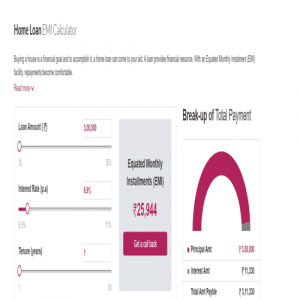

The Axis Bank Home Loan EMI Calculator allows you to quickly calculate your EMI. Every time you use this simple financial calculator, you will get 100 percent correct results.

All you have to do now is enter the loan amount, interest rate, repayment period, and processing fee. The Axis home loan calculator is more convenient to use and saves time than manual calculations in terms of EMI amounts.

The following is the formula for calculating a home loan:

EMI={P*R*(1+R)^N}/{(1+R)^(N-1)}

In this above-mentioned formula:

- P is the principle or loan amount

- N is the repayment tenure in months

- R is the rate of interest.

Axis Home Loan EMI

Purchasing a home is a financial goal, and a home loan can help you achieve it. A loan is a form of financial assistance.

Repayments become more manageable with an Equated Monthly Instalment (EMI) arrangement. Always calculate the EMI before taking out a house loan as part of a wise loan planning procedure.

After all, taking out a home loan is a significant financial investment. Your loan's EMI (or Equated Monthly Instalment) is made up of the principal and interest payments.

As a result, the EMI equals the principal plus the interest paid on the loan. The EMI is normally fixed for the whole term of your loan and must be returned on a monthly basis.

What are the Axis Home Loan Eligibility Requirements & Documents Required?

An individual can comprehend his or her house loan eligibility based on income and repayment ability with the help of the Axis Bank Home Loan Eligibility Calculator.

The following criteria can be used to establish an individual's eligibility for an Axis Bank Home Loan:

- The borrower's age must be between 21 and 60 years old.

- The minimum work experience for salaried staff is two years.

- The minimum work experience requirement for self-employed workers is 05 years.

- The amount of the loan is determined by the borrower's income.

- The EMI Calculator repayment schedule can be prolonged for up to 30 years, with a fixed monthly payment.

Documents required for Axis Bank Home Loan are as follows:

- Identification proof

- Proof of address

- Certificate of Birth

- Proof of income

- Cheques for processing fees

- Documentation for a loan arrangement

- Documents related to real estate

- Proof of your own contribution

- Letter of sanction

Why should You Use the Axis Home Loan Calculator?

Once you've taken out the loan, calculating your EMI (equivalent monthly installment) will help you organize your finances. You can use the Home Loan EMI Calculator to figure it out.

This simple online calculator allows you to quickly calculate your monthly payments. All you have to do is enter all of your loan information, such as the loan amount, term, interest rate, and processing fee.

After that, press the "calculate" button to see the EMI amount.

What are the Factors Affecting Axis Home Loan EMI?

After you've taken out the loan, calculate your EMI (equivalent monthly installment) to assist you to organize your finances. Use the home loan EMI Calculator to figure it out.

With this simple online calculator, you can quickly calculate your monthly payments.

Simply enter the loan amount, term, interest rate, and processing fee, as well as the loan amount, duration, and interest rate. Then press the "calculate" button to see the EMI amount.

- If you need to apply for a larger loan, your EMI will be greater. Axis Bank offers a home loan with a minimum of $30,000 and a maximum of $2,000,000.

- Your Axis Bank Loan EMI will grow as the interest rate rises, increasing the overall cost of the loan.

- The current Axis bank home loan interest rate is 7.15 percent.

- The loan tenure is the amount of time you have to repay your Axis bank house loan.

- If you obtain a 30-year loan from Axis Bank instead of a 5-year loan, your EMI will be lower.

Frequently Asked Questions (FAQs)

1. When does the interest rate of Axis home loans change?

The interest rates will change at the quarterly intervals on the 1st day of the calendar quarter subsequent to the change in RBI’s Repo Rate.

2. What are the processing fees for Axis home loans?

Axis home loans provide interest rates as low as 6.90 percent per annum. A one-time house loan processing fee of up to 0.50 percent of the loan amount.

3. Does Axis give pre-approved home loans?

Yes, Axis Home Loan is considered the country's largest and most reputable mortgage lender. By providing a diverse selection of products, the company has assisted over 30 lakh households in realizing their dream of owning a home

0.4% of the loan amount + applicable GST, with a minimum of Rs.10,000/-.

4. Does an Axis home loan take the salary of the spouse into consideration?

If the home loan is acquired as a combined loan with more than one applicant, Axis will take the spouse's salary or income into account.

5. How can I decrease Axis home loan EMI?

You can reduce your Axis home loan by following the below-mentioned ways:

- Make an extra payment at least once a year.

- Increase the number of EMIs issued each year.

- Make a larger down payment.

- Select a Loan with a Longer Repayment Period. Tenure

- Negotiate a lower rate with the bank.