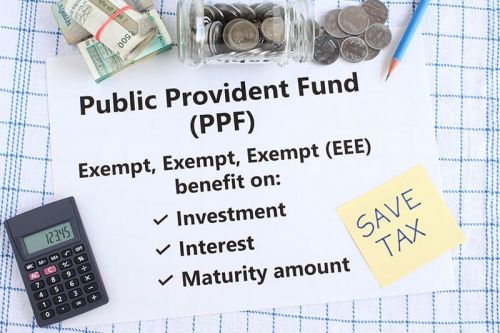

A PPF account pays a competitive rate of interest, and the gained interest is not taxed. PNB is one of the top banks in India that offers PPF.

A minimum deposit of Rs. 500 is required to start this account, and the current PPF interest rate for Q1 FY 2022-23 is 7.1%.

This article gives an overview on PPF Calculator PNB.

How can PNB PPF Calculator help you?

The Punjab National Bank's PPF Calculator makes it simple for investors to calculate predicted returns at maturity.

The PNB PPF Calculator is a simple and easy-to-use online financial tool that allows you to calculate the maturity value of your PPF in seconds without having to do any complicated manual calculations.

The returns are estimated using the PPF Calculator, taking into account the investor's contributions during the tenure, the current interest rate, and the PNB PPF scheme's tenure.

How to open a PPF account in PNB?

Step 1: Fill out form A and submit it at any PNB branch.

Step 2: Attach documents required for the PNB PPF Account opening process, such as ID proof (Aadhaar, PAN, etc.) and/or address proof (latest utility/phone bill, etc.).

Step 3: Make the initial deposit for a PNB PPF account by filling out a deposit slip.

Step 4: Bring the original documents for verification, and these must be self-attested.

When the account is opened, you will receive a PPF passbook with information such as the account number, nominee, credit/debit if PPF funds are available, balance, branch code, and so on.

Advantages of using PNB PPF Account Calculator

Investors benefit from the PNB PPF Calculator in the following ways:

- It gives you a clear idea of how much money should be invested to attain the desired result.

- Based on current investments, it calculates and forecasts the total amount an investor will invest till the end of the term.

- Calculates the total amount of interest earned at maturity.

- Calculates the whole amount that will be received upon maturity.

How to withdraw money from PPF?

A PNB PPF account matures after 15 years. Some amounts can also be withdrawn after 7 years of PPF account opening.

However, you can withdraw the entire amount after the account reaches maturity. You must submit a completed Form C to the bank branch or post office where you hold your PPF account in order to do so.

Following that, the PPF will be dissolved, and the funds will be transferred to your bank account.

How to take a loan on PPF?

PNB PPF members can take out a loan against their PPF account balance if they meet the following criteria:

- After three years from the account starting date, a maximum loan amount equal to 25% of the PNB PPF account balance can be authorised.

- PNB PPF loan repayment duration is 36 months with an interest rate equal to 2% + applicable PPF account interest rate.

- The repayment of a PPF loan can be done in a lump sum or in instalments.

Frequently Asked Questions: FAQs

1. How much I will get in PPF after 15 years?

PPF accounts are available in all PNB branches and has a 15-year lock-in period. With an investment of Rs. 10,000 for 15 years at a 7.1% interest rate, you can get a maturity value of Rs. 2,71,214.

2. Is PNB PPF good?

The Public Provident Fund (PPF) of Punjab National Bank is an excellent investment opportunity that yields a good return on investment while also providing tax advantages.

With high-interest rates and tax-free returns, a PNB PPF account provides complete assurance.

3. What is the PPF interest rate in PNB?

The interest rate on a PNB PPF account may change from quarter to quarter according to decisions made by the Finance Ministry. The interest rate on PNB's PPF account has been set at 7.1% for Q1 (April-June) FY2022-23.

4. How is the PPF amount calculated?

The PPF interest rate is calculated on a monthly basis using the government's pre-determined rate of interest. However, at the conclusion of the fiscal year, the interest is credited to the account.

PPF is calculated using the following formula:

F= P[({(1+i) ^n}-1)/i]

F - PPF Maturity

P - Annual instalments

i - Rate of interest

n - Tenure

5. Can I have 2 PPF accounts?

It is not possible to have more than one PPF account. If two or more PPF accounts are opened, they will be cancelled and no amount will be paid.

These accounts can not be merged either. This has been ruled for PPF as of December 12, 2019.

6. Which bank is best for PPF?

Here are some of the banks that offer the best interest rates on PPF accounts:

Bank | Interest Rate | Tenure |

PNB Housing Finance FD | 7.25% | 60 Months |

Bajaj Finance FD | 7.25% | 60 Months |

Yes Bank Savings Account | 5.50% | N.A. |

7. Is PPF available in Punjab National Bank?

Yes, PPF is available in PNB. You can easily open a PPF account at any branch of the Punjab National Bank. Here are the steps to open a PNB PPF account online:

You must have access to the PNB Net Banking platform.

Visit pnbindia.com and log in using your user ID and password.

Next, go to the 'My short-cut' option and click on the PPF account tab.

Then simply click on 'Open a PPF Account' and your account will be opened.

8. Can I withdraw PPF after 5 years?

After five years, you can make partial withdrawals from your PPF account.

The maximum amount you can withdraw is 50% of the balance at the end of the fourth financial year or 50% of the balance at the end of the previous year, whichever is lower.

9. Which is better, PPF or FD?

It depends on some factors. For example, the tax-saving FDs have a 5-year lock-in period, which is significantly less than the PPF.

However, FDs come with considerable risk, and the interest you earn is taxed. So, if you're okay with a 15-year lock-in, PPF could be a good alternative after considering these factors.