Want to know how to transfer money from one account to another? Well you have landed on the right article

With emerging technology, demand for flexibility, and security needs, a number of methods have been introduced in the banking system for transferring money.

The need to transfer funds from one person’s account to another has increased over time due to:

- Increased trade nation-wide

- Remote connectivity to global network

- Upgraded requirements

- Privatisation

- Urbanisation

So let's understand more about it and know how to do account to account money transfer.

How to Transfer Money From One Account to Another via NEFT

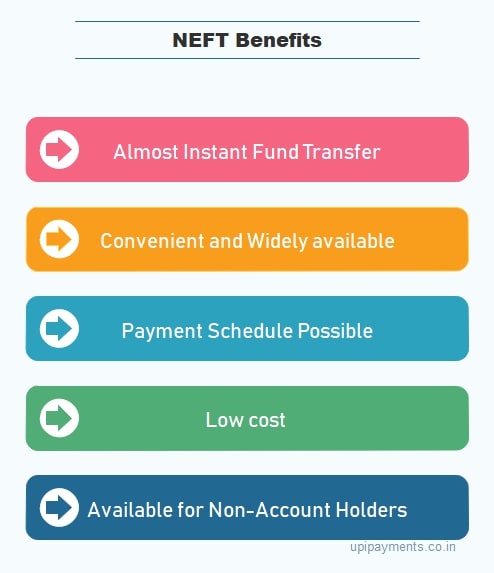

The National Electronic Fund Transfer, also popularly known as NEFT, is among the easiest and favourable methods of transferring money from one account to another account.

For successfully executing the transactions, you require:

- An account in any recognized bank with balance more than the amount you want to transfer

- Details such as account number, Indian Financial System Code (IFSC), which is a unique 11-digit alphanumeric code

Follow these steps to execute a transaction:

- Open your bank’s official net banking site/application, log in with your customer ID, select the option of fund transfer, and select 'Transfer using NEFT'.

- Add the details of the recipient you want to transfer the funds to.

- Enter the amount you wish to transfer and ensure your balance is not below the minimum account balance prescribed by the respective bank.

- Accept all relevant terms and conditions by checking the box.

- Enter your one-time password or passcode.

And, you are done with the transaction!

At times, to transfer funds using NEFT:

- You are required to add to the list of beneficiaries the receiver bank details to transfer on the internet banking portal/bank application of your bank.

- Further, validate through a one time password (OTP) sent to your registered mobile number.

- Sometimes a fee is charged based on applicable NEFT transactions; the amount differs from bank to bank and transaction to transaction.

As per guidelines provided by the RBI, the payments conducted using NEFT are settled every half an hour, in batches.

Such a transfer is also possible through an offline mode over the counter (OTC) at the bank.

- By filling out the form at the bank

- Mentioning all relevant details about recipient

- Enter the amount and other details, and your transaction through NEFT is complete!

Transfer funds from one bank account to another account bank account via RTGS

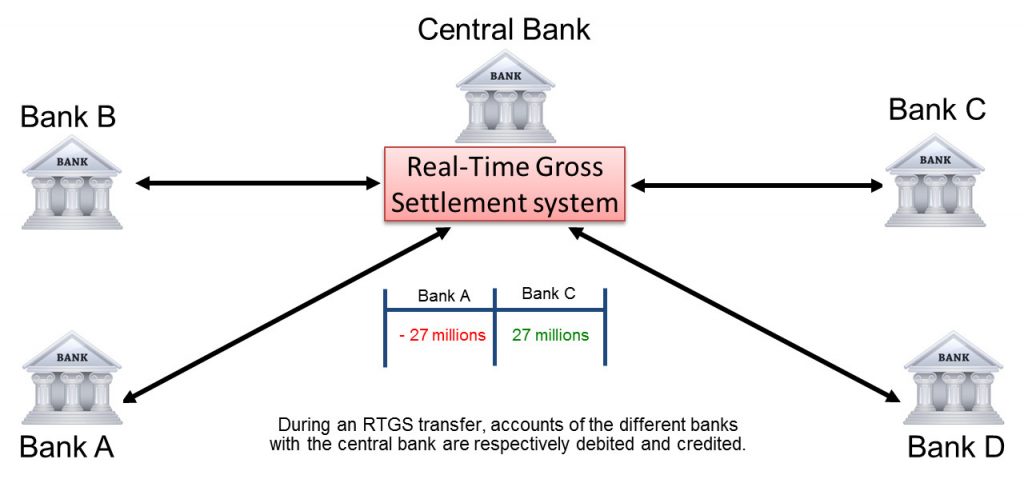

Real-Time Gross Settlement, popularly known as RTGS, is another way for transfer which is similar in nature to NEFT of money from one account to another.

It is similar in nature to NEFT. RTGS is a system which allows a minimum transfer amount above ₹ 2 lakhs; however, there is no maximum limit defined for RTGS.

How to transfer money to another bank account:

- Log on to a dedicated internet bank to bank transfer site/application, login to your ID, select tab of fund transfer on the screen of your internet bank transfer site/bank application, and option to select is 'Transfer using RTGS'.

- Mention the receiver’s name and enter the required details.

- Enter the amount and ensure your balance does not go below maintainable level money balance (as prescribed by your bank).

- Accept all relevant terms and conditions applicable.

- Enter your prescribed password or passcode.

And, you are done with the money transfer to another account!

The word real-time signifies that the activity of execution of transactions through RTGS are initiated exactly at the time they are processed from the sender’s side.

Further, ‘gross settlement’ means that the volume of the transfer of amount occurs on a one time basis. Transactions through RTGS are initiated on a one-on-one basis.

Thus, such a method could be used for a higher amount of transactions and could be executed only during the banking hours, since it is processed real-time.

Such bank money transfer can be done offline also over the counter (OTC) at the bank:

- By filling out the form at the bank

- Mentioning all relevant details about recipient

- Enter amount and other details

Transfer funds from one account to another via IMPS-Immediate Payment Service

Immediate Payment Service, popularly also known as IMPS, is a fund transfer which is available at your service anytime and anywhere from your bank’s website/application.

IMPS was introduced to control fraud in the financial system, and detect the same at the earliest. IMPS can be said to be a combination of NEFT and RTGS. Limits for transactions are executed using IMPS prescribed by the bank.

Also, with IMPS the limitation of executing transactions only during banking hours was a great obstacle for users for transferring money, and with the introduction of IMPS this limitation was conquered.

For IMPS transfers, you just require the receiver's mobile number and IMPS ID, also known as MMID.

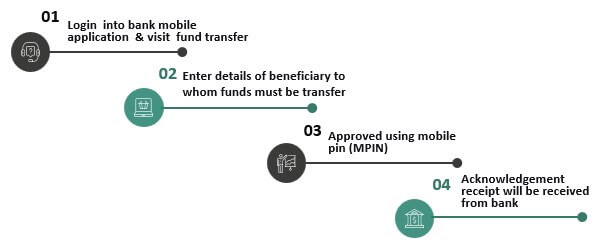

To execute the transaction, follow these steps:

- You are required to log in to your bank account ID and with a password into the Bank application/Mobile Banking/Net Banking.

- Next, choose the option of “Funds Transfer” on your Net Banking/Mobile Banking/Bank application.

- Click on your proposed account, select the transfer mode as IMPS and select the account of the beneficiary.

- State the amount proposed to transfer to the recipient and hit submit.

- Click the submit option, by confirming everything.

- Ensure all the information and confirm the transaction with verification through OTP (one time password) sent on your mobile number.

- And finally, confirm everything by clicking on ‘submit’.

That’s all, you are done with the transaction!

Immediate payment service is a quick, real-time transfer of fund option that allows 24/7 interbank facility for fund transfer, which is secured and accessible to all account holders.

The transactions of IMPS have a maximum amount defined as ₹ 1 Lakh. In certain cases additional tax if any could also be required to be levied.

Banks at times also levy certain charges on transactions conducted through IMPS; these charges differ from bank-to-bank and transaction-to-transaction.

Transfer funds from one account to another via Unified Payment Interface (UPI)

A Unified Payments Interface, popularly also known as UPI, is a payment system that helps execute transactions with the help of VPA (Virtual Payment Address) on a real-time basis through any mobile device.

The transactions can be executed anytime and anywhere in the world; the recipient’s name or mobile number are only requirements for transfer through UPI.

UPI is restricted to a limit of ₹1 lakh per day transaction, and a maximum of twenty transactions per day are allowed as per UPI. Transfer through UPI requires UPI ID,

Which is a distinct identification code for a dedicated bank account used to send and receive money from one bank account to another bank account.

You are also required to set in a UPI PIN, which is the 4 to 6-digit number decided by you as a personal identification number (PIN). You are required to enter this PIN to transfer funds using UPI.

Following are the executing steps for UPI:

Method 1: Using Mobile number – Select from contact number from your phone book or state the mobile number to whom you wish to transfer funds on your UPI linked payment bank application, enter the amount which you propose to transfer and enter your UPI PIN as set in earlier. That’s all! Your transaction will be done in just a few clicks.

Method 2: Scan through a UPI QR (Quick reference code) – You can avail this service to transfer money using UPI by simply scanning the receiver’s quick reference code.

Further, you are required to launch the payment bank application on your mobile phone, hit the ‘Pay’ option, and scan the receiver's QR code.

Enter the amount to be paid, enter your secret UPI PIN as set by you earlier, and your transaction will be done in just a few clicks.

Method 3: Transfer using UPI user ID – To send money through UPI ID, all you are required to do is to launch the payment bank application on your mobile phone. Enter the UPI user ID of the receiver.

Further, you are required to enter the amount that you prefer to transfer and cross tally the transaction once and enter your UPI set in PIN. And that’s it, your required payment will be settled within just a few clicks.

Method 4: Enter the recipient’s account number as well as IFSC – This is a very conventional way of payment, where such payment is also possible using UPI through payment bank application.

You are just required to enter the account number as well as IFSC of the recipient. Mention the amount, enter your secret UPI PIN as set by you earlier. Your transaction will be done in just a few clicks.

Transfer funds from one account to another via Cheque

You can also transfer the amount from one account to another by cheque. Cheque is a form of Negotiable Instrument and is among the oldest and safest methods used to transfer funds.

Cheque is the instrument provided by your bank in the form of a booklet on which you will find all your bank details – account number, bank name, bank branch, your name, cheque number.

While issuing a cheque to transfer money, you are required to fill in a few details such as:

- Payee name

- Amount payable (in numeric and words)

- Date

- Your signature

- After placing all the details you can issue such a cheque to the recipient, and the recipient is required to present the cheque to their respective bank.

If the cheque is presented from the same bank, the transfer typically gets executed within one working day. However, where a transaction involves more than one bank, meaning the recipient’s bank is other than the sender’s,

A clearing house comes into the picture. Thus, the entire process can take 2 to 3 days, depending on the banking hours and banking days. Also, different types of cheques can be issued depending on user to user and bank-to-bank.

Conclusion

The transactions executed through online mode are more favored, taking into consideration the convenience and facilities provided with the emerging technology in transferring money.

Almost all the types of transfer, other than cheque, can be used to transfer funds online. In all the options described above, RTGS and NEFT allow you both ways of service online and offline mode.

However, from all the above, UPI method has become the most well-known and preferred method, with quick usage and convenience. Moreover, many banks offer attractive offers on your UPI payment.

Also, usage of plastic money, meaning debit and credit cards, is an indirect way of transferring money. The only mechanism required for it is the payment terminal also known as the point of sale terminal.

Also, during the pandemic, online transfers have helped users to be socially distant and yet connected.

This was a detailed guide on how to transfer money from one account to another. I hope you get some useful information. If yes, please do comment below. Also you can check frequently asked question below:

Frequently Asked Questions

1. What bank details are needed for a transfer?

The only bank details needed are bank account number and IFSC of the receiver bank. It is important to have details of the sender's bank for cross verification. However, if you are using UPI, at times you require a QR code or UPI ID.

2. Do you require an address for bank transfer?

An online address such as the beneficiary’s UPI address or mobile number is the only requirement; no specific location address is required for bank transfers.

3. Is account name significant for bank transfer?

Account name, at times, is asked in some bank interfaces; however, generally, the account number and IFSC suffice. At times, the account name is significant for user verification since each account number is linked to its account holder name.

4. Is an account number enough to transfer funds?

No, just the account number is not enough: IFSC code is also required. IFSC is assigned by the Reserve Bank of India (RBI) which is useful in identifying each bank’s branch through which the transaction is supposed to be executed.

5. Can you transfer funds from a savings account to any other bank account?

Yes, transferring funds from a savings account to any other bank account is definitely possible.