Want to know how to open a bank account? Well you have landed on the right article.

Out of all the fundamental decisions related to cash management, the top decision is opening a bank account. This decision is crucial as the smooth functioning of every financial task is related to it.

So, to make a wise decision, you need to get familiar with all the requirements of opening a bank account. While opening a bank account, you may come up with several questions starting from selecting the bank to collect bank documents.

Let us get answers to all these questions by reading this article that requires an investment of only a few minutes. In this article, we have covered the 7 steps in detail to help you learn how to open bank account.

How To Open A Bank Account

who can open bank account/who can open individual bank account

To be eligible, the person must be at least 18 years old. If their account is to be opened by a parent or legal guardian on their behalf, bank requires identification documents of both them and the minor, as well as proof that the government has approved of all pieces of identification.

Document requirements for opening a bank account

To open a bank account, you must provide a few documents. These documents will serve the purpose of proof of authenticity for any personal information you provide.

Document compliances will vary from bank to bank. Also, for opening specific kinds of accounts, sometimes you may need to give plenty of details regarding your financial status.

However, in general, the following document you need to submit:

Identification proofs disseminated as per government guidelines such as driver's licence, passport, and voter card. Also, it should have your photo printed on it.

Address proof, like a utility bill, birth certificate, or any official statement that specifies your full name and address.

Proof of citizenship, such as the Social Security number, income tax identification number, and identification number provided by employer or firm.

In case you want to open an NRI accounts, you may need to produce documents such as

- An OCI/PIO card

- Marriage certificate, if any

- Passport

- Passport or PIO/OCI of the nominee or guardian, along with a copy of your birth certificate

You need to submit these documents as photocopies. And in a case when asked, you need to produce it in its original form.

Submission of the above-given documents will assure the bank that the government approved you as a country's citizen. You must submit the correct documents to the bank to avoid any constraints. It is because submission of fake documents and information could attract the case of forgery or fine.

procedure to open a bank account in 7 Easy Steps

When your all documents get ready and verified, your bank requires you to proceed with the following steps to open your account:

1. Selection of the bank

All banks are not the same when opening ordinary personal accounts. So, it is wise to contact the banks beforehand. You can select banks as per your budget, place of residence, the interest rates they provide on different bank accounts.

Your decision can also depend upon some additional facilities that you may get after becoming a bank's customer. Banks can be of two kinds:

Public Sector Banks

The banks act as per the laws proposed by the state government. The primary source of liquidity of these banks is accepting deposits from the public.

Private Banks

The banks in which the entire control vests with an individual or a firm. Generally, these banks offer massive amounts of interest in place of opening accounts.

Foreign Banks

These banks work according to the regulations of both countries. Accounts in these kinds of banks help you transfer money from and into other nations.

Rural Banks

These banks provide banking facilities to the agriculture and the rural sector at a low-interest rate or fee. Besides this, these banks disburse pensions, locker facilities and UPI services to rural people.

Small Finance Banks

This form of bank provides financial facilities to small industries, farmers, and the underprivileged sector of the community. These banks act as per the guidelines provided by the central bank of the respective country.

2. Choose the kind of bank account

In this stage, you are required to visit the bank's branch physically. Your banker will inform you about different types of bank accounts there. Following are the kinds of bank accounts that banks offer you to open:

- Savings Account

It is a bank account that offers you regular deposits in your account. This kind of account incurs a minimum rate of interest. And provide the facility of doing a number of transactions each month. - Salary Account

The salary account refers to the bank account that your firm opens in which you work. Generally, your employers open these accounts. This account is the same account where they credit the salaries of every employee at the end of every month. - Current Account

This kind of account lets you make and get payments more frequently than others. Likewise, this account allows you to hold more liquid deposits at zero limits. One more feature of this account is that it permits its holder to keep an overdraft facility. - Fixed Deposit Account or FD

These bank accounts permit you to get a fixed interest for the money deposited. But your money will get deposited in it for a specified time. The tenure of these accounts can range from 7 days to 10 years. - Recurring Deposit Account or RD

A deposit account is to be recurring when available for a fixed period. Moreover, you need to deposit a specified amount at regular intervals from each month to a quarter. - NRI Account

Non-resident accounts are for people who are Indian or have Indian origin but live overseas. Most banks specify these accounts with the name of Overseas Accounts.

You can choose any of the above-given bank accounts as per your needs. A basic rule of thumb that you can follow while selecting an option is that all the features and fees match your needs and budget.

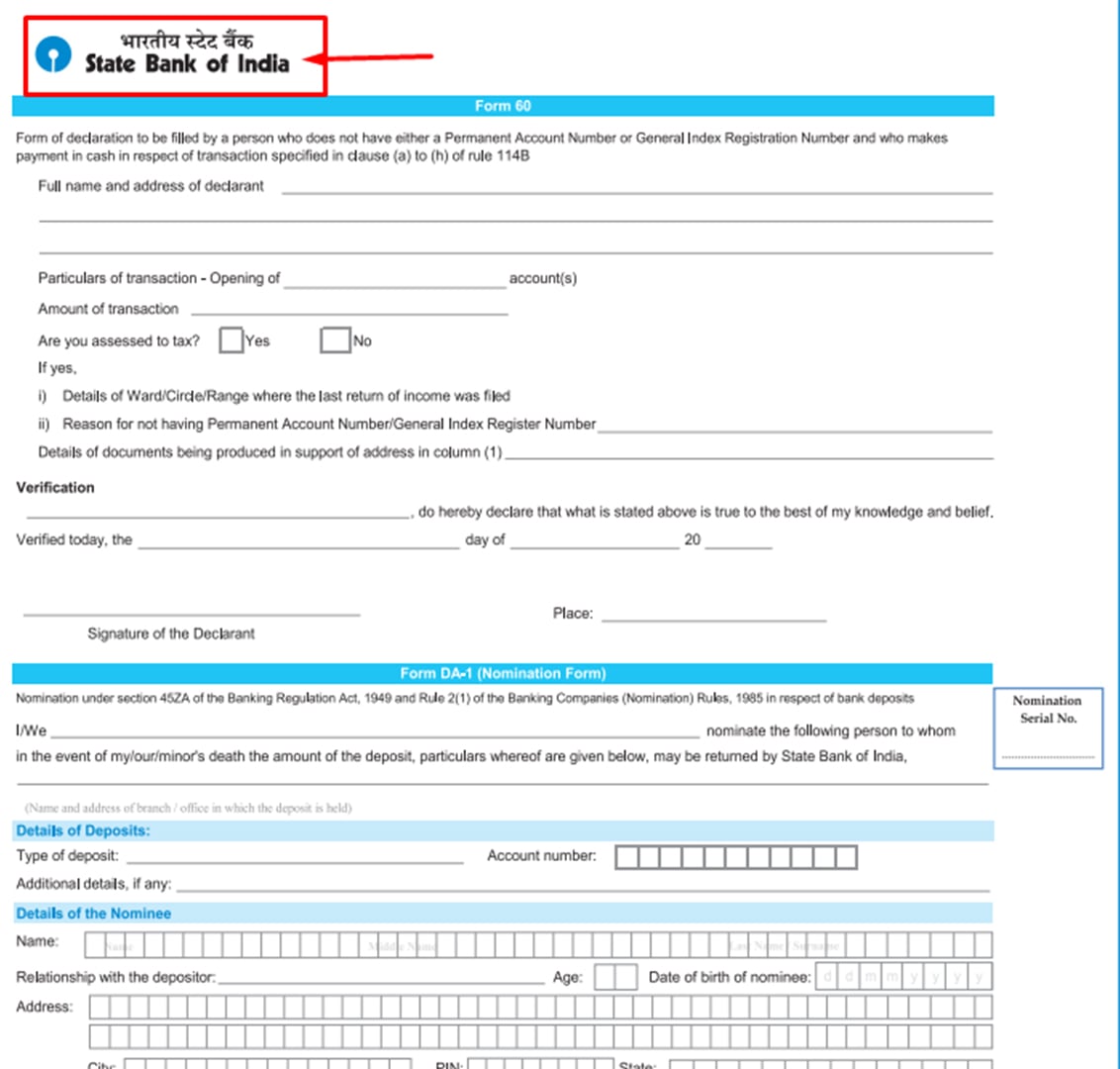

3. Filling of bank account opening form

When you make the decision about the type of account, a bank employee will give you a bank account opening form. The form will need you to provide personal details such as your first name, last name, permanent address, postal address, date of birth, and the names of parents/ guardians.

Furthermore, you need to give information about marital status like the name of the spouse, number of children you have. At last, you need to verify furnished information with the signature. Your signature verifies the respective bank that you comply with the basic terms and conditions of the bank.

4. Submit documents of proof for verification

The documents of proof may vary from bank to bank. However, in this step, you may need to obtain authorization for the documents you are proceeding to submit with the form.

For opening a new account, you need to submit documents such as a PAN Card, Ration Card, Social Security Number, Voter ID. These are necessary to submit as proof of identity. Along with these, you also need to submit two recent passport-size photos of yourself.

5. Wait for bank to approve documents

Usually, banks take 1-2 days to approve new accounts. When the bank approves all your submitted documents, the bank employee will contact you to clarify any errors.

The bank employee may also ask for several more details as banking guidelines. After resolving all the issues, they will approve your account.

6. Get your bank account documents

Usually, banks take 1-2 days to approve new accounts. When the bank approves all your submitted documents, the bank employee will contact you to clarify any errors.

The bank employee may also ask for several more details as banking guidelines. After resolving all the issues, they will approve your account.

- Bank A/C. Number: That you require for doing any financial transactions.

- Pass Book: The document which will keep a record of all your banking transactions.

- Debit And Credit Card: Debit And Credit Card

- Social Security Number: You will use it for making various tax payments.

It is the duty of the owner of a bank account to keep these details in safe custody. And do not let others access these documents other than the trusted persons. Sharing of this information may lead to facing any fraud or theft.

7. Avail the cheque book facility

You can also avail cheque book facility. Under this, you will get a book of cheques that enables you to transfer funds from one account to another. The validity period of the cheque is six months, which makes it very useful for making future payments.

Besides this, after starting a bank account, you will get several other facilities, such as loans and certificate deposits. You can also avail locker facility for keeping financial documents.

Make a wise and better decision

That is how you can open your bank account. Selection of the bank and the kind of account you want to maintain entirely depend on your financial objectives.

Likewise, your right decision will save you from paying thousands as costs for availing the banking facilities.

I hope you liked our article on how to open a bank account, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Question

Q1. What do you need to open a bank account?

For opening a bank account, you need to provide at least two photo identification certificates approved by the government. These certificates can include your driver’s license and passport. After that, you may also need to give your taxpayer identification number, a utility bill that shows information about your residence.

Other details that you need to furnish are contact information such as phone number, mobile number, email address, name of the nominee.

If you are going to open a student account, you may need to provide proof of enrollment furnished by the school. This proof of enrollment certifies your

registration. It can be your student ID and acceptance letter.

Some banks also ask for a minimum deposit requirement and that you require to deposit after collecting bank documents.

Q2. How can I open a bank account online?

You can also open a bank account by going to the bank's website. Nowadays, many banks provide an online facility for opening a bank account that is very quick and easy. It typically takes a couple of minutes to open an account.

Follow these steps to open a bank account online:

- Select the kind of account.

- Now, submit all your documents and information by typing in a computerized bank opening form.

- Then, furnish all the personal details.

- Click on Verify and Save. The website will take a few minutes to process the information.

It's done. You are ready to make a deposit in your new account.

Q3. How much money do you need to open a bank account?

Mostly, you need to pay any cost for opening an account except the portion of the minimum deposit. This deposit is an amount you need to pay to your bank at the start.

Some banks do not even ask to submit it and open an account with zero balance. Also, some banks charge a fee to maintain the minimum deposit of cash in your bank account.

Q4. How much time does a bank take to start an account?

Generally, the process of opening a new account is fast. It usually ranges from 15 minutes to 30 minutes. But, to verify the details, the bank may take several days.

But in case you ask for a cheque book, debit card, or credit card, these items will usually take eight to 12 business days by post.

Q. Can you make international money transfers with your regular bank account?

Yes, you can transfer money internationally. Most banks charge fees for making payments.

The remittance fees for overseas payments depend on the total amount you need to send. Sometimes, also charge for taxes that you need to pay while transacting on an international basis.

But before making any payment, you need to keep an eye on exchange rates so that the recipient will get the sufficient amount after getting deductions as per international standards.

Q5. Which are the best banks to open an account?

As per the financial magazine Forbes, the following are the top 5 banks that provide the best facility for opening bank accounts.

You can select any bank after comparing the interest rates provided by banks to their customers. You can also consider other bank facilities while making the preference.