Want to know how to get income tax return copy online? Well you have landed on the right article!

The article speaks about the process of downloading an Income Tax Return copy online. Let us understand what an Income Tax Return is and how to download XML files for filing returns, copies of filed returns, and other matters related to return filing.

The Income Tax department was in the news recently due to difficulties taxpayers face in filing returns to the new e-portal of the department.

As individuals have to file all returns online, the department extended the time for filing returns till 31st December.

Taxpayers should know how to access the tax department's website and use the various facilities available in it for itr copy download with relevant forms, file returns, access filed returns, and check the status of filed returns.

All individuals should have the user ID and password to log in to the website instead of consulting or depending on the chartered accountant or lawyer for every small information regarding Income Tax on them.

They should know how to access their tax status themselve

What is an Income Tax Return copy

The Income Tax Return copy or Form V is the acknowledgment available online after the return is submitted. The Income Tax Return shows the income declared by an individual or any other person for a financial year, which is April to March in India.

However, validation requires one to take the printout of the IT return, sign it, and send the itr copy by ordinary post or speed post to the Central Processing Center (CPC) at Bengaluru within 120 days of filing the return when it is filed offline.

But you should preserve a it return copy because it is an important legal document required for various purposes.

Uses of IT returns:

Many citizens, particularly senior ones, have a significant amount of tax deducted at source (TDS) on the interest from fixed deposits and on the dividend income from companies. This fact is despite them not having any taxable income. Filing an IT return will enable them to claim a refund of the tax deducted.

IT return is proof of income for business people whose books are not audited for taking business loans.

Any person having losses from business or loss from the income head capital gains from equity shares or mutual fund investment has to file a return to carry forward losses, which can then be adjusted against future profits.

For taking housing loans or vehicle loans, bankers insist on a copy of the IT return before processing the loan.

The IT return is an important document for persons traveling abroad for business or personal purposes. The immigration authorities want to ensure that the trip is not for tax evasion purposes.

How To Get Income Tax Return Copy Online?

REGISTRATION

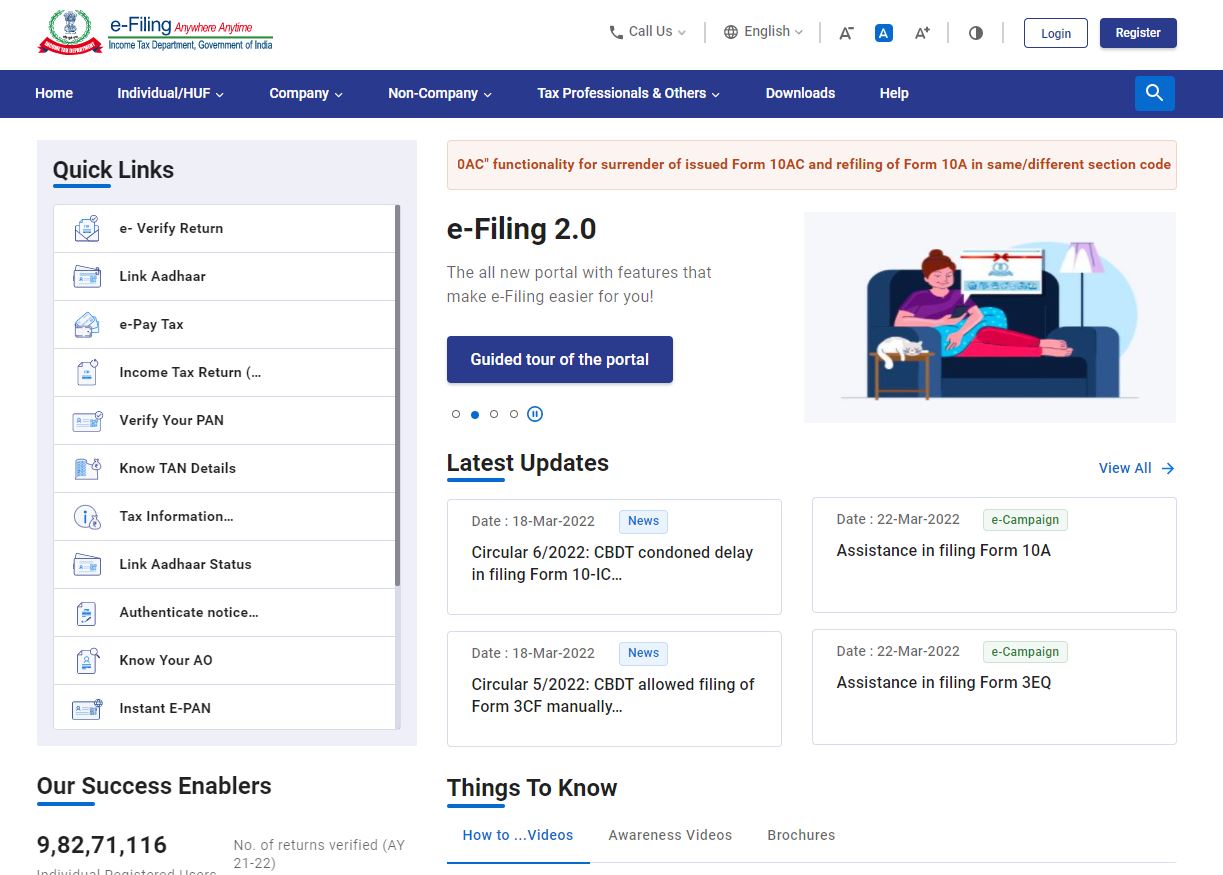

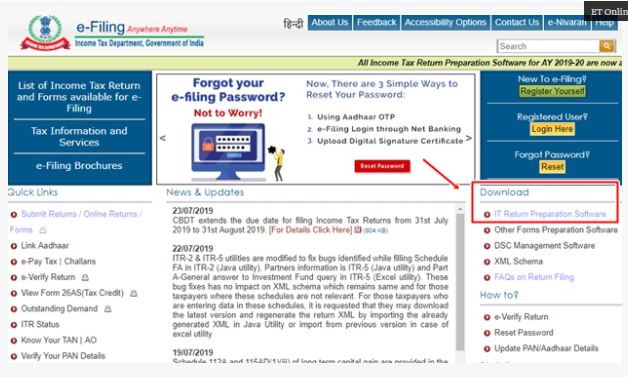

An individual has to register on the Income Tax website (https://www.incometax.gov.in) for itr download online.

The user ID is the individual's PAN number, and they have to generate a password for registration.

Individuals can create their user profiles by entering personal details like address, Aadhaar number, email address, and mobile number. Then confirm the registration by using the one-time password (OTP) sent to the mobile number given at the time of registration.

The mobile number is useful to access the account if one has forgotten the password.The IT department will send all correspondence, including acknowledgments and assessment orders, to the email address used during registration.

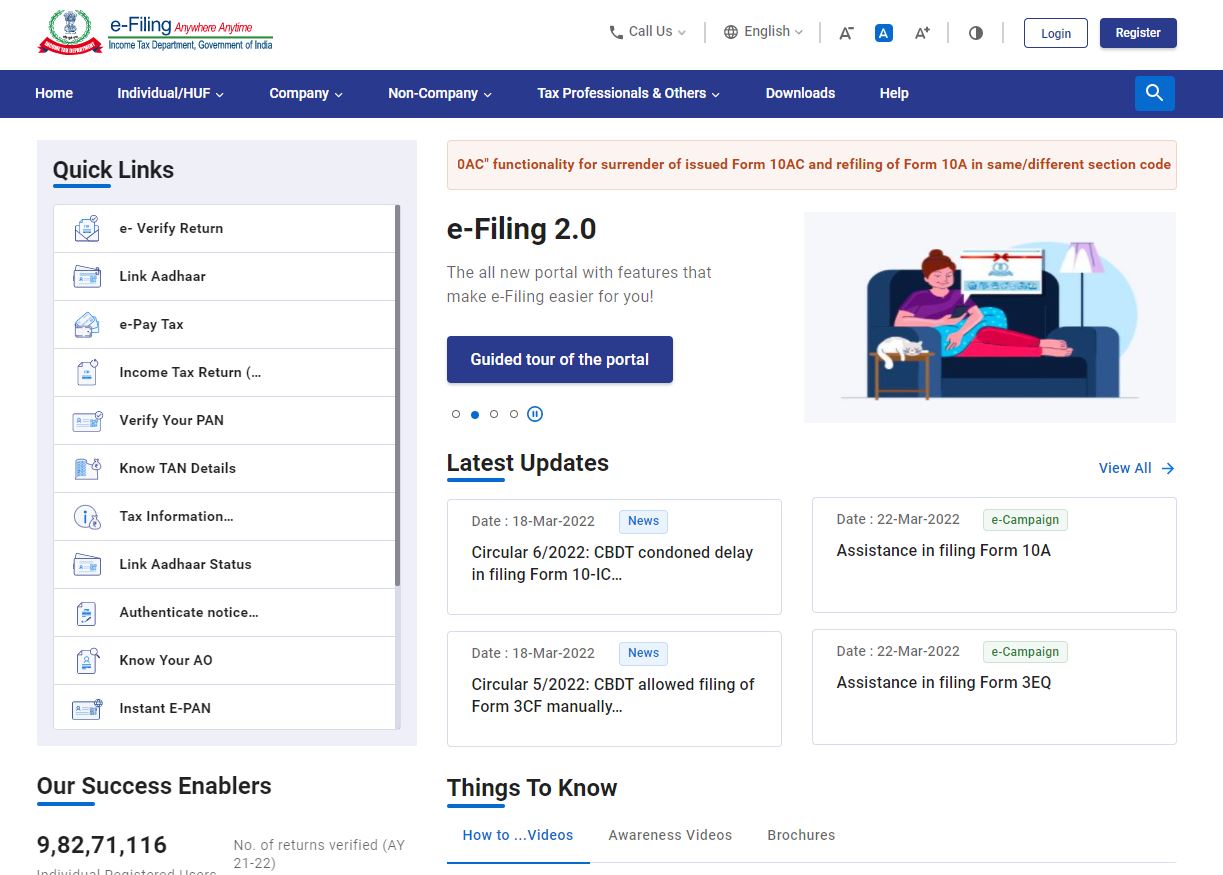

After registration, an individual can log in by entering the user ID and the password. After logging in, an individual has to select the IT Form he has to use to file his return.

Types of ITR Forms

- ITR 1 is for an individual having a salary or pension income, income from any single house property, and income from other sources up to a limit of Rs 50 lakhs.

- ITR 2 is for individuals with salary or pension income, capital gains, income from more than one house property, and income from other sources with the amount exceeding Rs 50 lakhs. Those liable to file ITR 2 include those having foreign assets, foreign income, holding a company directorship, and those holding shares that are not listed on any stock exchange.

- ITR 3 is for persons who make profits from a business or a profession, are partners in a firm, and have any presumptive income up to Rs 50 lakhs.

- ITR 4 is for presumptive income from salary, pension, other sources, and one house property with the total income not surpassing Rs 50 lakhs.

- The individual has to select the assessment year in which one wants to file the return. He has to download the pre-filled XML and also download the appropriate form in Microsoft Excel format.

- The information to be filled in includes the personal information of the individual, income details, TDS and bank account, and any other information.

- One thing to remember before filling the IT form is to collect all supporting documents. These records include bank statements, Salary Form 16s, that is, Form 16A, 16B, and 26As that give all tax deducted information, and any other supporting documents.

- After all the information is filled in, the calculate button is used to calculate tax and interest payable. One then comes to know the net tax payable or refund after adjusting the tax already paid.

- After all the changes are saved, use the 'Generate XML' option and save the generated file on the computer in the desired folder.

- Check the generated file for its accuracy.

- Upload the generated XML file after logging on to the Income Tax portal. The return filing is completed successfully.

How to download income tax return XML files

An Income Tax Return can be filed online or offline. For filing an online return, one has to fill in the details in an online form and submit it.

But while filing the return offline, the individual has to download the Income Tax utility, which has to be used either in java or Excel format. Then, they have to fill the form, save the changes, and generate the XML file. They have to upload this final file to the website.

Steps in downloading XML files for Income Tax Returns

Press and hold an item to delete it.Types of ITR Forms

An XML file is a language file. It is an extensive markup file used to structure data for storage and transport.

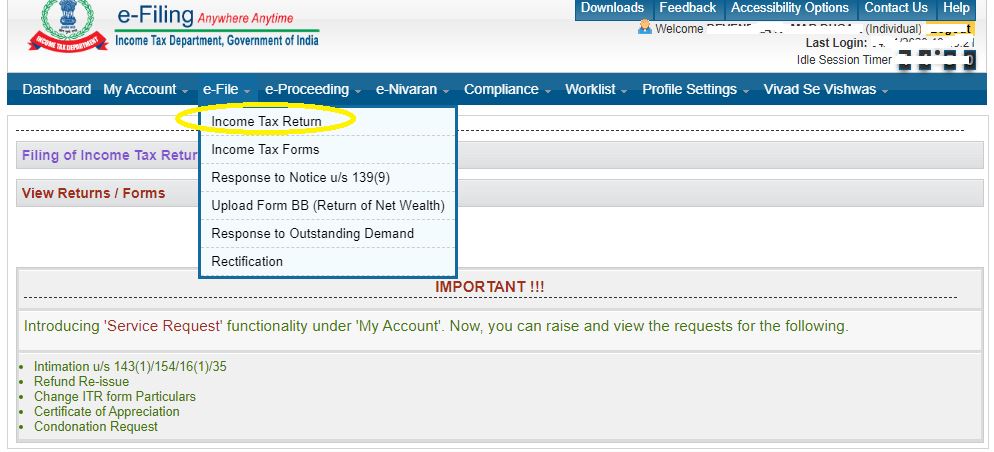

Step 1 An individual has to visit the Income Tax portal www.incometaxindiaefiling.gov.in. Then download IT return preparation software in the download section.

Step 2 The website will redirect the individual to the Income Tax Utilities screen, where they have to select the assessment year and the appropriate ITR form from the Excel utility hyperlink.

Step 3 As soon as one clicks on the suitable ITR form number, one downloads the ITR Excel utility zip file in the 'Downloads' section of the computer. Right-click the zip folder to extract the files on the computer.

Step 4 Open the folder where the zip file is extracted and double click to open the ITR Excel utility. Then import the personal tax and income details from the pre-filled XML file to the ITR Excel form.

Step 5 For accessing the pre-filled XML file, visit the Income Tax website again and login under the registered user option.

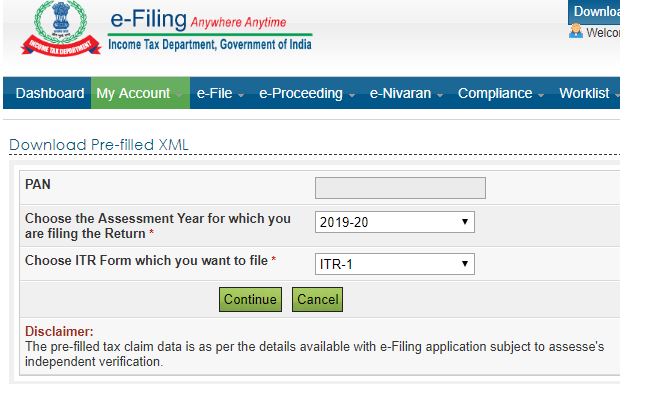

Step 6 Go to the 'My Account' menu and download the pre-filled XML.

Step 7 In the pre-filled XML file, auto-populate the PAN. Then, select the assessment year and the appropriate IT form. Click on the 'Continue' tab.

Step 8 Here, one has to choose the bank account to receive the refund. Then click on the 'Download XML' button for downloading the pre-filled XML file to the computer.

Step 9 Now, one can access both the ITR form and the pre-filled XML file from the 'Downloads' folder in one's system.

Step 10 Open the downloaded ITR Excel utility. Click on the 'Import Personal and Tax Details from Prefilled XML' button from the right-side panel of the general information schedule of the ITR form.

Step 11 The above step will import all personal and other details from the pre-filled XML file to the ITR Excel form.

Procedure for downloading Income Tax Returns from the Income Tax website

An individual has to log on to the Income Tax website and go to the 'My Account' menu. Here, they can access information about all filed returns in the 'View E-filed Returns/Forms' link.

- All filed returns by the individual are available on the website.

- Select the assessment year to be downloaded from the 'Recent Filed Returns' section on the dashboard. One can see an option called 'Download Form' where the acknowledgment is available in PDF format.

- The latest information about all filed returns are available on the website. For example, for the previous year ended March 2020, an assessment of the individual would have been completed and a refund order issued. This data will be available easily on the website.

- One can download the return copy at any time and submit it to any authority.

- This facility is not available for physically filed returns that were filed manually, which used to be the case earlier.

- Acknowledgment number, date of filing, and type of return filed (original or revised) are available on the website.

- A revised return can be filed if an individual wants to make corrections to the data submitted in the original return.The revised return will be the file considered by the concerned assessing officer for assessment.

CONCLUSION

The Income Tax Return is an essential document that is required for various purposes. It is useful for securing a housing loan, personal loan, or any other loan as it is conclusive proof of income. It is crucial even for visa purposes.

The availability of online download of forms means that an individual does not have the burden of keeping physical forms and the risk of losing them.

All information about filed returns is available at the click of the button and the downloaded forms can be easily sent to the concerned legal, financial authorities by email.

I hope you liked our article on how to get income tax return copy online, if you have any comments or suggestions do share them in the comments below.