Want to know how to delete groww account? Well you have landed on the right article! No need to be frustrated.

There are many reasons people might decide to remove their Groww account, and email spamming can be one of them. You can find all the instructions you need below.

Overview of Groww

An online investment platform, Groww is based in Bangalore, India. The company offers technology that allows first-time investors to open an account and make stock purchases online.

Users can also find the best investments made by other users on the investing platform. They can compare them to get an idea of which stock would be ideal to purchase.

How To Delete Groww Account?

When users sign up for Groww, they must provide a lot of private information like personal data and bank account details. Hence, it is important to know that your financial information is safe once you stop using the Groww app.

To learn how to close groww demat account, you have to follow the below-mentioned steps.

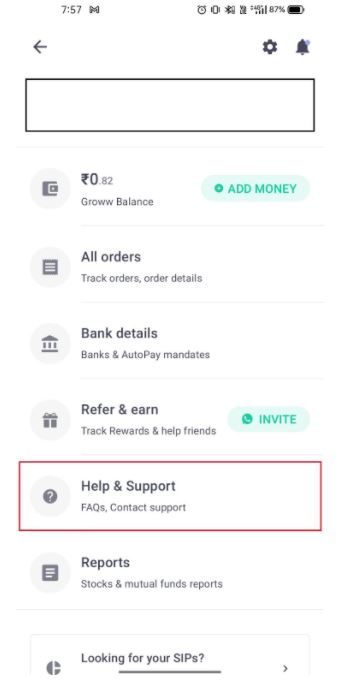

1. Open the “Help & Support” section in your Groww App.

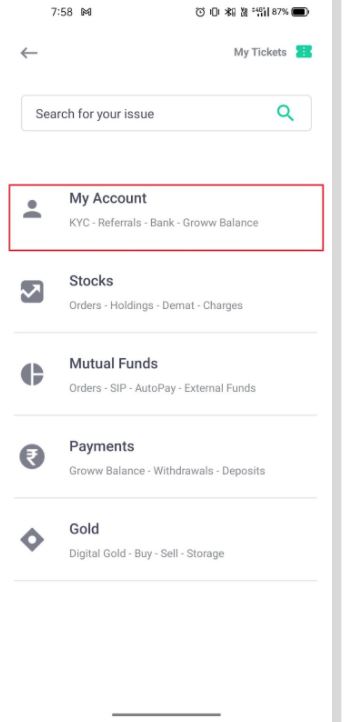

2 .Amongst different categories, select the “My Account” section.

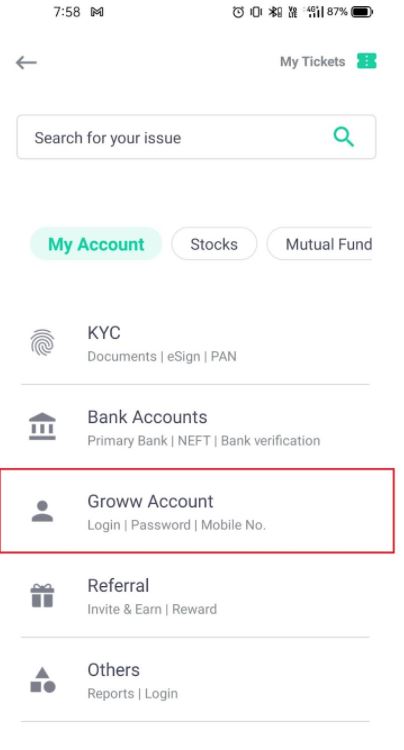

3. In the “My Account” section, select the “Groww Account.”

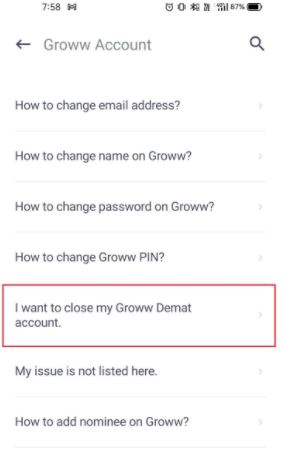

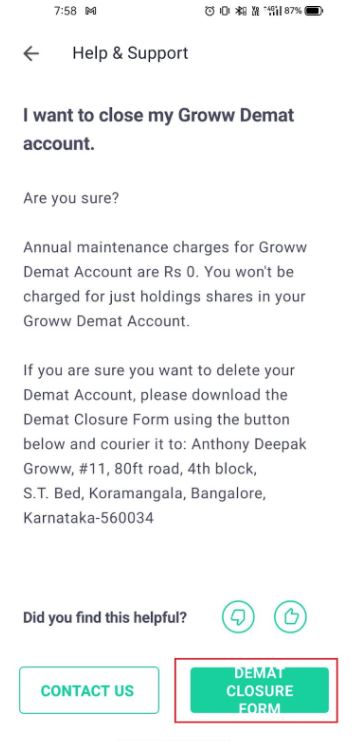

4. Now, you can see the option of deleting your Groww Account. Select “I want to close my Groww Demat Account.”

5. Choosing the option will redirect you to a new page. Click on the green button “Demat Closure Form” and download the document.

Fill in all the required details asked in the downloaded form and send them to the head office of Groww. The processing will take around 5-7 working days.

By following the above mentioned steps you can learn how to close groww demat account online.

How to Close Groww Account by Filling Demat Account Closure Form?

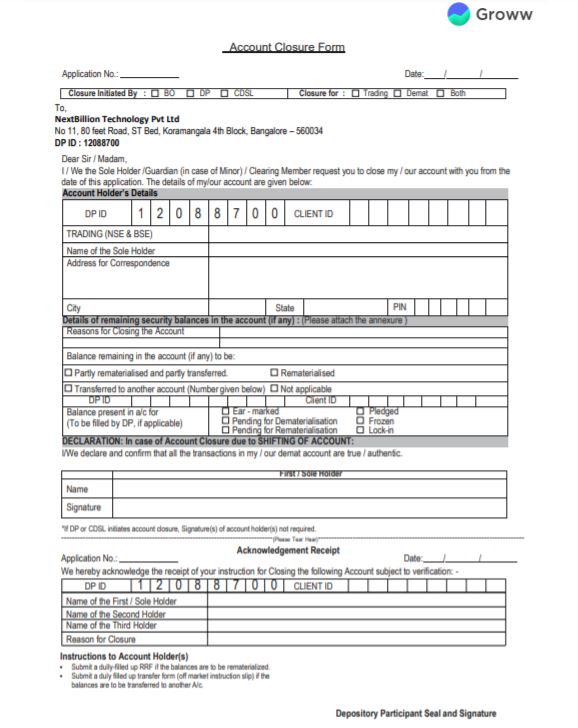

After downloading the Account closure form, fill in the information asked.

- First, you need to enter your application number and date. After that, set a closing date based on whether or when a bank initiated it. Then select an account type to close (trading account or Demat account or both).

Remember that you will receive any amount due on the finalization of the closure. - The form already highlights your Demat Partner ID. You only need to enter your Client ID.

- Enter your details and state the reason why you are closing it.

- You need to mention the share and holdings details and the alternative Demat account number to move your share investments.

- After completing the form, print it, and send it to the following address:

- Groww Headquarter,

- No. 11, Second Floor,

- 80 ft Road, 4th Block,

- S.T. Bed, Koramangala,

- Bengaluru-560034

It will take around 5-7 days to close the Groww account.

Conclusion

Groww is a mobile app that helps you with your investment portfolio by keeping track of the markets and monitoring your investments.

You can use this app to ensure you are aware of the overall status of your assets, which is helpful for those constantly investing in stocks themselves.

However, everyone has their preferences when it comes to money management products. If you aren’t too fond of this platform, you may remove your account by following the steps above.

I hope you liked our article on how to delete groww account, if you have any comments or suggestions do share them in the comments below.

Frequently Asked Questions

Q1. How many AIFs are there in India?

There are over 750 Alternative Investment Funds registered with SEBI. When the AIF regulations came out in 2012, there were some tax issues. Consequently, investors were worried about the pass-through status of trusts. But things are clear now.

Q2. Who can invest in AIF funds?

Investments in these funds are open to both Indian and foreign investors per the February 2016 budget. One may only make foreign investments under specific conditions defined for each fund.

These terms are based on how much capital is being raised, who will be investing, and the presence of a minimum contribution for investors above the age of 18.

Some of the additional rules that apply are:

- Each alternative investment fund must have a corpus of at least 20 crores.

- The minimum amount that an alternative investment fund will accept for an individual investor is Rs 1 crore.

- The fund manager should have contributed at least 2.5 % of his own money in the initial capital investment, or at least Rs 5 crores.

- No alternative investment fund will have more than 1000 investors. The fund will not collect funds except for private placement.

Q3. Can NBFC invest in an AIF?

According to SEBI, AIF’s are not permitted to invest more than 1/3rd of their investible corpus into entities that do not qualify as venture capital undertakings, including NBFCs.

Q4. Does SEBI regulate AIFs?

Yes. The Securities and Exchange Board of India (SEBI) regulates AIF in India. They are established as trusts, limited liability partnerships, and corporations and fall under three categories:

- Category I

Angel funds, Infrastructure funds, Venture Capital Funds, etc. - Category II

Private Equity, Debt Funds - Category III

Hedge Funds, Pipe Funds

Q5. Can AIF give loans?

AIFs are investment funds registered with the capital market regulator, SEBI. They are Indian entities, and hence, have more flexibility to debt investment from a regulatory perspective.

However, AIFs are not permitted to give any kind of loan exposure. Accordingly, they largely lend by way of debenture instruments since they can be converted into equity shares if necessary.