Ever wondered how you might change that extra syllable on your PAN Card? It’s been bothering you, but you don’t know how to rectify it. We’re here to help you in how to update pan card online.

The Permanent Account Number (PAN) is required not just for tax purposes but also for establishing one's identity with the government. As a result, any incorrect details on a PAN Card may cause a host of issues going forward.

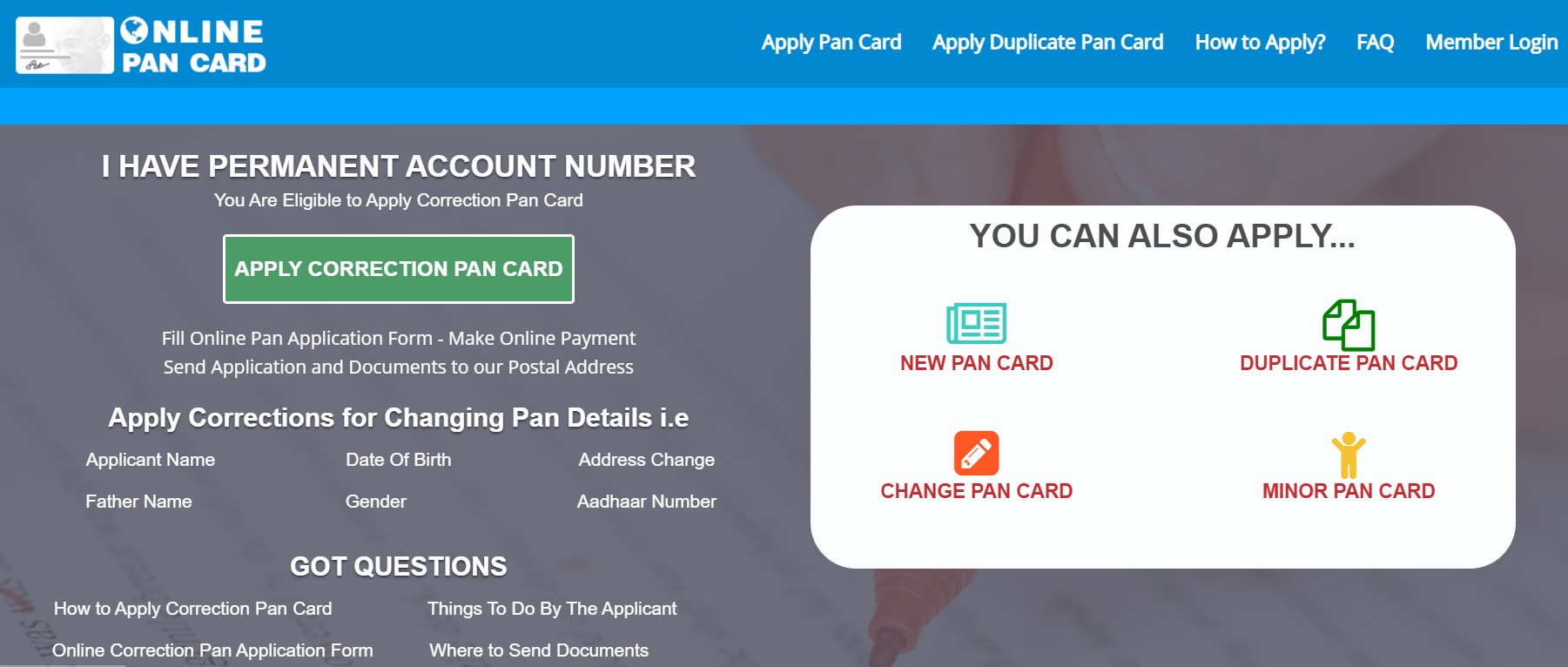

To sidestep such issues, you should make the appropriate adjustments to your PAN card. Changing PAN card details is a straightforward process that can be completed both offline and online.

how to update pan card online

Methods to apply for PAN card correction

Online

- Go to the websites of NSDL or UTIITSL.

- Complete the PAN Change Request Form.

- Always provide an accurate PAN number since an erroneous number may cause your request to be delayed.

- Select the checkboxes beside the options you want to modify.

- Let’s assume that you want to change the spelling of your name, enter the correct spelling and tick the box beside the left margins. The modification will not be performed if one fails to choose the checkbox.

- Check all of your information before submitting the form.

After your PAN adjustments are accepted, you will be given a 15-digit acknowledgement number. This number should be kept handy if there’s a need to contact someone in the future or follow the status of your application. - Pay the fee, print the acknowledgement, including necessary documents, and mail it to the NSDL headquarters.

- You must mail the necessary documents to any of the UTIITSL offices in Kolkata, Mumbai, Chennai, or New Delhi if you submit the document through the UTIITSL website.

Offline

- Go to the websites of NSDL or UTIITSL.

- The PAN Correction form can be downloaded and printed.

- Fill it out and return that to a local NSDL or UTIITSL centre.

- Send all necessary papers as well.

- Remember to check the box beside the left margins for the data you want modified in the PAN card while filling out the form.

KEEP IN MIND!!

Keep these pointers in mind when applying for changes in your PAN :

- People's first and last names should not contain abbreviations.

- People should write their full names exactly as they want them to appear on their business cards. Individuals must mention their complete names precisely as they want them to appear on their business cards. Non-individuals (companies and partnerships) must write their names exactly as it appears on their business cards.

- Let’s assume that your firm’s name is 'ABCD Corporation,' you need to type 'ABCD Corporation' in the last name/surname area.

- If the first row is already taken, continue the corporation's name in the second row.

- Make certain that the name of the company has no abbreviations.

- If the image or signature on their PAN card is damaged or uncertain, individuals must additionally produce their authentic PAN card when submitting the acknowledgement.

Required Documents for PAN card correction

Different kinds of documents are required for PAN card correction, based on the type of company or business, whether it's an individual or a business or a foreign citizen. You need to pay due attention to ensure that you possess all the required documents before filling the PAN card correction application.

Here are the details about various required documents based on the category of your business:

Indian Citizens and Hindu Undivided Family (HUF)

Identity Proof | Address Proof | Date of Birth Proof |

Copy of | ||

Aadhaar card | Aadhaar card | Aadhaar card |

Voter ID | Voter ID | Voter ID |

Driving licence | Driving licence | Driving licence |

Passport | Passport or the passport of your spouse or partner | Passport |

Arm's licence | Postal passbook including the address of the applicant | It is essential to have a matriculation certificate or mark sheet from a recognised board |

Ration card with the applicant's photo | The most recent order for property tax assessment | Birth certificate |

Any picture identity card issued by the central government, a state government, or a government-owned corporation. | A letter of allocation of accommodations that is no more than three years old (issued by a state or the central government) | Any picture identity card issued by the central government, a state government, or a government-owned corporation. |

A pensioner's card with the applicant's picture on it | A domicile certificate issued by the central government. | Central government issued domicile certificate |

Contributory health scheme card for ex-servicemen along with a photograph or Central Government health service card | Paperwork for property registration | Contributory health scheme card for ex-servicemen along with a photograph or Central Government health service card |

Electricity bill, landline bill, broadband connection, water bill, piped gas bill (not older than three months old) | Order for Pension Payment | |

Bank account and credit card statements (not older than three months) | Affidavit that has been sworn in front of a magistrate | |

Gas connection card (Not older than three months) | Marriage licences granted by the Registrar of Marriages | |

Original of | ||

Identity certificates must be signed by a Member of Parliament, a Member of the Legislative Assembly, a Member of the Legislative Council, or a Gazetted Officer. | Address certificates must be signed by a Member of Parliament, a Member of the Legislative Assembly, a Member of the Legislative Council, or a Gazetted Officer. | |

Bank certificate on the bank's official letterhead, including the seal and name of the issuing officer (must contain an attested photograph and details of your bank account) | Employer certificate | |

For HUF | ||

A document signed by the Karta that describes all applicants' identities, fathers' names, and addresses on the day of application. | ||

Foreign Citizens

Identity Proof | Address Proof |

Copy of | |

Passport | Passport |

Person of Indian Origin (PIO) card | Person of Indian Origin (PIO) card |

Overseas Citizen of India (OCI) card | Overseas Citizen of India (OCI) card |

The applicant's citizen identification number (if they possess citizenship of another country) | The applicant's citizen identification number (if they possess citizenship of another country) |

Taxpayer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised representatives of scheduled Indian banks with operations abroad | Taxpayer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised representatives of scheduled Indian banks with operations abroad |

Statement of bank accounts (in the country you reside in) | |

NRE bank account statement | |

Permit for Indian Residency | |

The Foreigner's Registration Office issues a registration certificate (must show an Indian address) | |

A visa, an appointment letter from an Indian company, and proper evidence of Indian address from the employer are required. | |

Indian Companies

Type of Company | Documents (Copy of) |

Company | Registration certificate |

Partnership | Registration certificate or partnership agreement |

Limited Liability Partnership | Registrar of LLPs issued registration certificate |

Association of Persons (Trust) | Charity Commissioner granted trust deed and a certificate of registration number |

Artificial Juridical Person, Body of Individuals, Local Authority, or Association of Persons | Copy of the agreement, certificate of registration number issued by the Charity Commissioner for the registration of cooperative societies, or any other document submitted by a central or state government department |

Companies having their office only outside India

Identity Proof | Address Proof |

Taxpayer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised representatives of scheduled Indian banks with operations abroad | Taxpayer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised representatives of scheduled Indian banks with operations abroad |

A registration certificate issued in India or permission provided by Indian authorities to open an office in India | A registration certificate issued in India or permission provided by Indian authorities to open an office in India |

Supporting Documents for Changes in PAN

Applicant Type | Document Applicable for Change in Name |

Married women (change name on account of marriage) | Certificate of Marriage |

Invitation of Marriage | |

Passport with the name of husband | |

Publication of the new name in a government publication | |

A certificate from a gazetted officer | |

Applicants other than married women | Publication of the new name in a government publication |

A certificate from a gazetted officer | |

Companies | ROC's certificate for name change |

Firms, Limited Liability Partnerships | Revised partnership deed |

Registrar of firm or LLP's certificate for name change | |

AOP/Trust/BOI/Local authority/AJP | Revised deed or agreement |

Revised registration certificate |

How to Check PAN Card Correction Status?

- The acknowledgement number may be used to check the progress of a PAN Card correction after it has been filed.

- Go to the NSDL or UTIITSL portal and click 'Track PAN Card.'

- Enter the 'Tracking number' in the new pop-up window. The tracking number is the

- Acknowledgement number on NSDL and the application number on UTIITSL.

- To view the status of PAN Card correction, click the 'Submit' button.

Frequently Asked Questions

1. How can I fill my PAN card correction form?

Here are the steps that you can follow to fill a PAN card correction form online :

- Go to the websites of NSDL or UTIITSL.

- Complete the PAN Change Request Form.

- Always provide an accurate PAN number since an erroneous number may cause your request to be delayed.

- Select the checkboxes next to the options you want to modify.

- Check all of your information before submitting the form.

- After your PAN adjustments are accepted, you will be given a 15-digit acknowledgement number. Keep this number handy if the need to contact someone in the future or follow the status of your application arises.

- Pay the fee, print the acknowledgement, attach the necessary documents, and mail it to the NSDL headquarters.

- You must send the required documents to any of the UTIITSL offices in Mumbai, Kolkata, New Delhi, or Chennai if you submit the document through the UTIITSL website.

Here are the steps that you can follow to fill a PAN card correction form offline:

- Go to the websites of NSDL or UTIITSL.

- The PAN Correction form can be downloaded and printed.

- Fill it out and return it to your local NSDL or UTIITSL centre.

- Send all necessary papers as well.

- Remember to check the box on the left margin for the data you want modified on your PAN card while filling out the form.

2. How can I change name in PAN Card as per aadhaar for free?

You can’t change your name on a PAN card for free. Here’s how you can do pan card name correction online by paying a fee:

- To begin, click here.

- On the following screen, select Apply Online, followed by Submit. Under Application Type, choose Changes or adjustments to existing PAN Data/Reprint of PAN Card (No changes in existing PAN data).

- Select Individual from the drop-down menu. Fill in the following blanks with the appropriate information:

Last name/surname

First name

Date of Birth

Email ID

Citizenship status in India

PAN Number - After inputting all of your information, you must select information "by giving data to us and/or via our NSDL e-Gov TIN website.

- Click the Submit button after entering the Captcha code.

- You must now select the Continue with PAN Application Form option. You'll be taken to the Online PAN application page.

- You must now follow the on-screen instructions. An acknowledgement slip will be created once all of the data has been entered, and payment has been completed.

3. Can we make a PAN card without Aadhaar?

You can apply for a PAN even if you do not have an Aadhaar card if you are required to submit residential documentation or picture identification. If you have an Aadhaar card, it will have all the necessary documentation, making the process easier.

4. Where do I send my PAN form for NSDL?

You can send the documentation to the NSDL headquarters to Mantri Sterling (5th floor), Model Colony, Pune 411016.

5. How to update mobile number in PAN Card?

- First, sign into your PAN tax account on the official website. Enter your PAN number and password. If this is your first time visiting the site, you'll need to register for an account.

- After signing in, click on Profile Settings from My Profile.

- Next, add for a new sub-account under my profile titled: Mobile Details with a contact number option for mobile.

- Select Contact Details then click Edit.

- Finally, enter your new mobile number and email ID then confirm by clicking Save Changes! New changes will be updated to your profile and you’re all set to go!