Looking for a best health insurance in India? Great! You have reached the right place.

A contract between an insurer and a policyholder in which the insurer provides medical coverage to the insured up to the maximum amount covered is known as health insurance or medical insurance.

Pre- and post-hospitalisation coverage, medical examinations, room rent coverage, a cashless facility, and other health plan benefits are all offered.

In this guide, we ranked and reviewed the 10 best health insurance policies in India, along with our top 3 choices, so that you can pick the best one for you.

Benefits of Buying Health Insurance Plans Online

There are several advantages to buying health insurance plans online. Take a peek at the following sections to see what they have to offer:

- It is easier to compare plans: Websites like Policybazaar.com make comparing health insurance plans from different insurers and making an educated selection much easier.

- More convenient: Purchasing coverage online is more convenient since it eliminates the need to visit an insurance company or schedule an appointment with a representative.

- Discounts for online insurance purchases: You may be entitled to a discount if you purchase your insurance online.

Top Reasons to Buy a Health Insurance Plan

Medical inflation is growing every day, raising the cost of treatments. You may lose all of your assets if you are hospitalised for a serious illness or a lifestyle issue.

Getting health insurance is the only method to afford adequate medical care in the event of a medical emergency. Here are some compelling reasons to get health insurance:

- Health insurance may help you pay for medical bills now and in the future, including pre- and post-hospitalisation fees, despite escalating medical prices.

- It enables you to get the greatest medical care and attention possible, allowing you to concentrate only on your recovery.

- It enables you to pay for long-term treatment of lifestyle diseases such as cancer, heart disease, and other illnesses that have become more common as a result of changing lifestyles.

Key Benefits of health policy in india

Depending on the plan, health insurance policies provide a range of health benefits to the insured. The following are the main advantages of purchasing health insurance in India:

- Hospitalisation Expenses - A health insurance plan will cover the medical expenditures associated with being admitted to a hospital for longer than 24 hours. The cost of room and board, as well as doctor's fees, prescription charges, and diagnostic test costs are all covered.

- Pre- and Post-Hospitalisation Expenditures - This category covers any medical expenses spent before being admitted to the hospital, as well as any post-discharge treatment costs.

The insurance agreement specifies the number of days for which pre-hospitalisation and post-hospitalisation charges are covered. - ICU Fees - Depending on your health insurance plan, ICU care may be covered throughout your hospital stay.

Things You Must Consider In best health insurance policy

Every health insurance business in India has its own distinct characteristics that distinguish it from its competitors. There is also no such thing as a one-size-fits-all insurance provider.

Depending on their circumstances and health objectives, each person defines the best health insurance provider differently.

Some customers may choose one insurance company over another because of its extensive network of partner hospitals that provide cashless claim services, while others may value the quality of services provided or the availability of customer support.

When evaluating multiple best health insurance companies in India that match your demands, keep the following points in mind:

1. Availability of Health Insurance Plans

One of the most significant elements of best family health insurance plans in India to consider when comparing various health insurance providers is the sorts of health plans provided by insurance firms.

While some insurance firms specialize in coverage for women, children, and the elderly, others provide just basic health insurance plans such as individual health insurance and family health insurance.

Choose an insurance provider that has a plan that meets your needs.

2. Cashless Network Hospital

To provide cashless claim services, every health insurance carrier has partnered with a number of hospitals.

Consider how robust the insurer's cashless network hospital is when picking a health insurance provider.

If the network is large, you're more likely to be able to file a cashless claim at a local hospital.

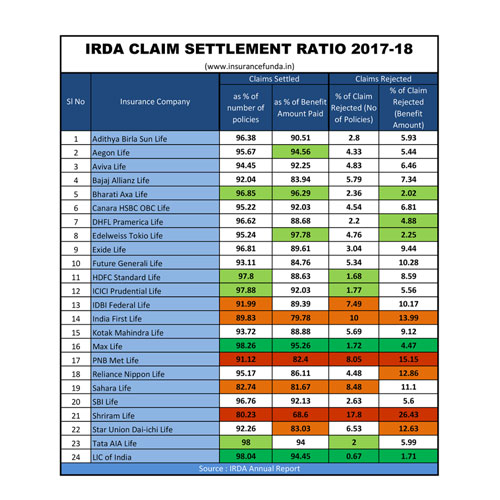

3. Claim Settlement Ratio

A health insurance company's claim settlement ratio is the proportion of claims it settles out of the total number of claims it receives in a given fiscal year.

Having a greater claim settlement ratio is advantageous.

4. Customer Support Service

It's also vital to consider the company's customer service availability and quality when picking a health insurance provider.

Finding a firm that provides customer service 24 hours a day, 7 days a week is usually a good idea so you can receive answers to your questions whenever you need them.

5. Business Volume

The total number of policies sold and premiums collected by an insurance firm is referred to as business volume.

An insurance firm that sells more policies has a higher market share, and, as a result, the general public is more inclined to trust it.

Business volume may be used as a factor for assessing health insurance firms, with a larger volume reflecting more customer trust.

6. Claim Settlement Process

It's critical to choose an insurance provider that pays claims quickly.

This is because, amid a crisis, no one wants to be engaged in time-consuming or difficult duties.

As a result, choosing an insurance provider with fewer claim requirements is suggested in order to save time and effort.

7. Reviews And Ratings

Knowing what past policyholders have to say about a certain health insurance provider may assist you in making an educated selection.

This may be done by looking through customer evaluations on InsuranceDekho for a variety of insurance providers and choosing the one with the best comments.

Consider the insurance firms' star ratings, which you can obtain on InsuranceDekho's website. You might also do some research to get the finest insurance provider.

8. Awards and Accolades

Every insurance company's website includes a section dedicated to awards and honours.

You may find out how many awards a certain insurance firm has received there. The more honours and awards a firm receives, the more respected it becomes.

So, when picking an insurance business, seek for one that has won several accolades and honours throughout the years, proving that they are a genuine all-rounder.

9. Customer Support

A reputable insurance company's customer service department will be superb.

As a result, you'll want insurance that is accessible 24 hours a day, seven days a week.

They should establish a hotline where you may contact and get your problems resolved.

You should be able to reach out to them not just via phone, but also by email, chat, and other means.

When the insurer is pleasant and accessible, it is easier to handle a variety of issues with health insurance coverage.

10. Digital Presence

The bulk of insurance-related tasks are now completed online.

This means you won't have to go to an insurer's office, search for insurance brokers and pay a large brokerage fee, or fill out a mountain of paperwork to receive health insurance.

All of this may be done quickly and easily by checking in to the insurer's official website and obtaining health insurance services or other relevant information.

As a result, if you want to easily get and maintain health insurance coverage, you'll need to select an insurance provider with a strong internet presence.

The leading health insurance firms in India are shown here, along with their claim settlement ratios for FY 2019-2020.

Rank | Health Insurance Company | Health Claim Settlement Ratio | Network Hospitals |

|---|---|---|---|

1 | IFFCO Tokio General Insurance | 96.33% | 1416 |

2 | Care Health Insurance | 95.47% | 2500 |

3 | Magma HDI Health Insurance | 95.17% | 5016 |

4 | The Oriental Insurance Company | 93.96% | NA |

5 | New India General Insurance | 92.68% | 1256 |

6 | Bajaj Allianz General Insurance | 92.24% | 6277 |

7 | Max Bupa Health Insurance | 89.46% | 5270 |

8 | Navi General Insurance | 86.98% | NA |

9 | HDFC ERGO General Insurance | 86.52% | 9414 |

10 | Manipal Cigna Health Insurance | 85.72% | 6509 |

11 | Edelweiss General Insurance | 85.57% | 4803 |

12 | National Insurance Company | 83.78% | NA |

13 | Future Generali General Insurance | 82.96% | 2584 |

14 | Royal Sundaram General Insurance | 81.50% | 4115 |

15 | Liberty General Insurance | 81.03% | NA |

16 | ICICI Lombard General Insurance | 78.67% | 4252 |

17 | Star Health Insurance | 78.62% | 9279 |

18 | United India Insurance Company | 78.03% | NA |

19 | Reliance General Insurance | 76.43% | 7190 |

20 | Tata AIG General Insurance | 76.04% | 4994 |

21 | Bharti AXA General Insurance | 76.01% | 1912 |

22 | Kotak Mahindra General Insurance | 75.45% | NA |

23 | Acko General Insurance | 74.09% | NA |

24 | Aditya Birla Health Insurance | 70.81% | 5734 |

25 | Universal Sompo General Insurance | 70.75% | 4700 |

26 | SBI General Insurance | 66.08% | 1606 |

27 | Go Digit General Insurance | 63.56% | 5928 |

28 | Cholamandalam MS General Insurance | 56.25% | NA |

Top 10 best health insurance in india Based on CSR

The following are the top ten health insurance companies, as determined by the Claim Settlement Ratio:

1. IFFCO Tokio General Insurance

In the year 2000, Indian Farmers Fertiliser Cooperative Limited (IFFCO) and Tokio Marine Group formed IFFCO Tokio General Insurance as a joint venture.

The former is the world's biggest fertiliser manufacturer, while the latter is a major Japanese insurance corporation.

The Tokio Marine Group owns 49 percent of the corporation, while IFFCO owns the remaining 51 percent.

It is a general insurance firm that sells car, motorbike, travel, and house insurance, as well as corporate products including property and liability insurance and health insurance.

Individual health insurance plans, family floater health insurance plans, and senior citizen health insurance plans are among the options available from the company.

2. Care Health Insurance

Reliance Enterprises Limited, Union Bank of India, and Corporation Bank formed Care Health Insurance, which was formerly known as Religare Health Insurance.

The organisation is a stand-alone health insurance provider that provides a variety of health insurance options to meet the needs of customers.

Individual health insurance plans, maternity health insurance plans, family floater health insurance plans, senior citizen health insurance plans, and critical illness health insurance plans are just a few of the options

Care Freedom, Care, and Care Senior Policy are the insurer's most popular health insurance products. To meet the needs of customers, these plans provide a wide variety of features and coverage advantages at reasonable pricing.

3. Magma HDI General Insurance Co. Ltd.

Magma HDI General Insurance Co. Ltd. is a well-known insurance firm in India. It is a joint venture between Magma Fincorp Limited and HDI Global SE Company.

It has a high claim settlement rate and a diverse choice of health insurance policies to meet the needs of a diverse group of customers.

It also provides other insurance products such as fire insurance, marine insurance, and vehicle insurance, in addition to health insurance programmes.

With over 135 offices in India, the insurance is well-represented. The insurer's health insurance policies cover in-patient hospitalisation, pre-hospitalisation and post-hospitalisation charges, childcare fees, and so on.

4. Oriental Insurance Company

Oriental Insurance Company, founded in 1947, provides consumers with a comprehensive variety of health insurance products.

The insurer's headquarters are in New Delhi, and it has around 29 regional offices and 1,800 offices across the nation.

In addition to Nepal, Dubai, and Kuwait, the insurance firm has operations in Nepal, Dubai, and Kuwait.

The insurer's health insurance plans will assist customers who live in both rural and urban locations. The insurer provides a large network of hospitals where you may get cashless treatment for any of the policy's approved services.

Many people like this insurer as it provides low-cost health insurance plans.

5. New India General Insurance

New India General Insurance is a global general insurance firm based in Mumbai, India, with operations in 28 countries.

The insurance firm offers approximately 250 products, including various forms of health insurance coverage for various demographics.

The plans are reasonably priced and cover a wide variety of healthcare costs, including in-patient hospitalisation, pre-hospitalisation and post-hospitalisation fees, childcare costs, organ donor costs, and road ambulance costs, among other things.

The plans are affordable, and you may be able to get cashless care at participating hospitals.

6. Bajaj Allianz General Insurance

Another well-known insurance provider with a high claim settlement percentage is Bajaj Allianz General Insurance.

Bajaj Finserv Limited and Allianz SE have created a partnership. Bajaj Allianz is a leading private insurance with offices in over 11 cities and towns.

The firm provides a variety of insurance products, including health insurance.

The insurer provides cashless treatment to its customers via its health insurance policies, which cover a network of over 6,500 facilities.

There are also floater health insurance plans for individuals and families, senior citizen health insurance plans, maternity health insurance plans, and other types of health insurance plans available.

The organisation has received several accolades and honours throughout the years, proving that it provides dependable services to its consumers.

7. Max Bupa Health Insurance

In India, Max Bupa Health Insurance is a well-known independent health insurer.

This insurer is preferred by those looking for low-cost health insurance for themselves and their family.

To meet the needs of people and families, the insurance firm offers a variety of health insurance packages at accessible pricing.

The plans have a variety of features and coverage advantages that you may customise to match your budget and other needs.

Health Premia, Health Companion, ReAssure, and MoneySaver Policy are some of the insurer's most popular health insurance products.

These are available in a variety of insured amount choices, which you may choose depending on your need.

8. Navi Health Insurance

Navi Health Insurance is a cutting-edge online insurance firm that provides a wide range of health insurance products to meet the demands of a diversified consumer base.

The insurance firm, which is a completely owned subsidiary of Navi Technologies, was created in 2017.

Its goal is to make health insurance easy, inexpensive, and accessible to Indians.It is a general insurance firm that provides health insurance, vehicle insurance, motorcycle insurance, home insurance, gadget insurance, and business insurance.

It's a network of more than 10,000 hospitals where you may obtain cashless treatment with ease. Because it provides a quick claim settlement technique, many individuals trust the insurance business with their health insurance requirements.

9. HDFC Ergo General Insurance

HDFC Ergo General Insurance is a well-known health insurance provider.

Individual health insurance policies, family floater health insurance policies, senior citizen health insurance policies, maternity insurance policies, and children's health insurance policies are just a few examples.

The insurance firm has a large network of hospitals where the insured may get cashless treatment without worry.

The insurer's friendly customer service staff answer client complaints.

10. ManipalCigna Health Insurance

As a stand-alone health insurance firm, ManipalCigna Health Insurance was founded in 2014.

The insurance firm provides a variety of health insurance plans that fully protect the insured and are tailored to meet the needs of different people.

It is a well-known insurance firm that offers a wide range of insurance products, including personal accident insurance, top-up health insurance, individual health insurance, daily cash plans, and more.

Top health insurance plans offered by the Indian Government

The following are some of the best health insurance policies offered by the Indian government:

1. Rashtriya Swasthiya Bima Yojana

The Indian government's Ministry of Labour and Employment launched the Rashtriya Swasthiya Bima Yojana to provide health insurance to the underprivileged.

Those who enrol to the plan are covered for medical expenses up to Rs.30,000 (mostly hospitalisation).

Participants in the Rashtriya Swasthiya Bima Yojana must pay Rs.30 in registration fees, with the premium paid to the health insurance provider by the Central and State governments.

The initiatives are usually chosen by state governments via a competitive bidding process. The programme may cover up to five family members, including the family's head of the house and his or her spouse, as well as up to three dependents.

The cashless hospitalisation option, which is accessible if treatment is obtained at one of the scheme's network hospitals, is one of the essential components of the Rashtriya Swasthiya Bima Yojana.

2. Central Government Health Scheme

The Central Government Health Scheme of the Government of India provides medical insurance to Central Government employees and their families.

This programme is also available to retirees. To be eligible for this insurance, people must reside in cities that are part of the Central Government Health Scheme.

In CHGS dispensaries, also known as wellness centres, pharmaceuticals from the Unani, Homeopathic, Ayurvedic, Allopathic, Sidha, and Yoga systems are provided.

3. The Universal Health Insurance Scheme (UHIS)

The Universal Health Insurance Scheme (UHIS) was established in order to offer healthcare to low-income Indian families.

Four public sector general insurance firms teamed together to make this coverage available to Indians.

Under the Universal Health Insurance Scheme, the covered individual and his or her family are entitled to a Rs.30,000 reimbursement for medical expenses incurred during hospitalisation.

This insurance pays out Rs.25,000 to the family if the breadwinner dies in an accident. In such cases, the breadwinner's family would also get Rs.50 each day for the following 15 days after the breadwinner's death.

The majority of the plan's beneficiaries will be low-income households. Individuals are required to pay Rs.200, families with up to five members are required to pay Rs.300, and families with seven members are required to pay Rs.400.

4. Employment State Insurance Scheme

The Employment State Insurance Scheme was established to offer multi-dimensional healthcare security to employees and their families.

The plan covers the medical needs of the insured individual as well as his or her dependents.

The method also awards a monetary incentive to the insured and his or her family.

5. Ayushman Bharat Yojana or Pradhan Mantri Jan Arogya Yojana

The Ayushman Bharat Yojana, or Pradhan Mantri Jan Arogya Yojana, is a government-funded healthcare initiative.

Around 10 crore poor residents in India are covered by the National Health Protection Scheme, which pays up to Rs.5 lakh per family every year.

The advantages of the plan are accessible across India, and Ayushman Bharat Yojana members may get cashless benefits at any of the scheme's empanelled hospitals.

What is Covered in a Health Insurance Plan?

The majority of health insurance firms in India cover the following medical charges as part of a health insurance policy:

- If the hospitalisation lasts more than 24 hours, expenses spent for the treatment of an illness or injury are reimbursed.

- After the waiting time has passed, you may make a claim for any pre-existing sickness or condition.

- The insurance company pays for blood tests, x-rays, and other medical examinations that are necessary prior to hospitalisation.

Similarly, after you've been discharged from the hospital, your health insurance plan will cover the cost of medications as well as preventative health checkups. - While the amount covered by each insurer varies, most medical insurance policies pay emergency ambulance fees.

- Maternity coverage covers medical expenditures incurred during pregnancy and delivery, as well as expenses for a newborn infant.

- Certain health insurance policies in India provide regular health checkups as a bonus.

- Procedures that need less than 24 hours in the hospital are covered as day-care procedures. According to your insurance paperwork, it covers eye surgery, dialysis, and other typical child-care operations.

- It also covers the costs of medical care received at home on the recommendation of a doctor.

- A health insurance plan may cover Ayurveda, Unani, Siddha, or Homeopathy treatments up to a certain maximum.

- Some Indian health insurance plans include medical expenditures for the treatment of mental illnesses like depression.

What is Not Covered in a Health Insurance Plan?

Health insurance does not cover the following medical bills or conditions:

- Claims made during the first 30 days of purchasing a health insurance plan are not covered unless they are caused by accident.

- Pre-existing illness insurance has a two- to four-year waiting period.

- A 90-day waiting period is commonly required for critical illness insurance.

- War, terrorism, and nuclear power have all resulted in injuries.

- The most prevalent sorts of self-inflicted injuries include suicide attempts and self-inflicted injuries.

- AIDS and other similar diseases are examples of terminal illnesses.

- Other operations such as aesthetic and cosmetic surgery, hormone replacement surgery, and others are available.

- Costs of dental and eye surgery

- Bed rest, hospitalisation, and rehabilitation must all be considered, as well as common ailments.

- The therapy procedure includes treatment/diagnostic testing, as well as follow-up therapies.

- These claims are based on injuries sustained while participating in adventure sports.

Health Insurance Riders

Riders are optional supplementary benefits and coverage that may be added to your health insurance policy to make it more comprehensive.

The cost of a health insurance rider is influenced by your age, the amount covered, the kind of coverage, and other factors. Take a look at the top five most common riders that you may want to consider including in your health insurance policy:

Maternity Cover Rider

Some of your pregnancy expenditures, such as birth, pre- and post-natal care, and so on, maybe covered with the maternity insurance rider.

Certain insurance may reimburse expenditures for newborn babies up to the policy's expiration date. Depending on the health insurer, this rider may come with a 2- to 6-year waiting time.

Critical Illness Rider

The critical illness rider ensures that serious illnesses, such as heart attacks and cancer, are covered by your health insurance policy if they are found for the first time during the policy's term.

Regardless matter how much money you spend on medical treatment, you will get a lump sum reimbursement.

It has a 90-day waiting period and a 30-day survival period, and it covers anywhere from 10 to 40 catastrophic illnesses, depending on the insurer.

Personal Accident Rider

If you are crippled or killed as a result of an accident, the personal accident rider may help you get compensation from your insurance.

It will pay you the whole amount covered in the case of permanent complete disability, but only a portion of the sum insured in the case of partial disability, depending on the nature of the accident.

Because it provides your family with an extra death payment if you die in an accident, it's also known as the double indemnity rider.

Hospital Cash Rider

The hospital cash rider allows you to get a daily cash allowance from your insurer to cover unforeseen expenditures while in the hospital due to an accident or sickness.

Your coverage is doubled for a set number of days if you are hospitalised to the critical care unit. The daily cash amount varies depending on the insurance terms and coverage chosen. To activate this rider, you must be in the hospital for at least 24 hours.

Room Rent Waiver

The room rent waiver assures that your health insurance policy will cover the rent for the hospital room of your choosing while you are in the hospital.

It assures that you are not restricted by a room rent limitation, allowing you to choose a room with more sub-limits or none at all without incurring additional costs.

Eligibility Criteria to Buy a Health Insurance Plan

The qualifying conditions for obtaining a health insurance plan are influenced by a variety of circumstances, such as the policyholder's age, pre-existing illnesses, and so on.

The following conditions must be satisfied in order to be eligible for most health insurance plans:

Age Criteria - Adults and children have different admission ages, which range from 18 to 65 years old for adults and 90 days to 25 years old for children. From one medical insurance plan to the next, a person's admission age may vary.

Pre-medical Screening - Applicants over the age of 45 or 55 must undergo pre-medical screening. Pre-medical tests are required for most senior citizen health plans before a policy is issued.

Pre-existing Conditions - Any pre-existing condition is covered after the waiting time, which is usually 2-4 years.

When applying for health insurance coverage, most health insurers question whether the applicant has any medical disorders, such as high blood pressure, diabetes, cardiovascular disease, renal difficulties, and so on.

If you are a smoker or an alcoholic, you must inform your insurance provider.

Why Compare Health Insurance Plans Online?

You'll be able to get the finest plan for your requirements by comparing health insurance quotes online. Because so many insurers provide a range of health insurance packages with wonderful features, it might be difficult to pick the best health insurance plan.

Thankfully, Policybazaar.com recognises clients' perplexity and provides a platform for comparing the features, coverage levels, and quotations of different health insurance policies online.

The following are some of the most significant benefits of comparing and purchasing health insurance coverage online:

- Access to Accurate Information: It gives you quick access to every medical insurance plan on the market. It also saves buyers the time and effort of dealing with insurance brokers, who are notorious for providing inaccurate and biased information.

- Several healthcare schemes may be easily compared: Comparing health insurance coverage online saves time and work. You will not be required to meet with the agents on a regular basis in order to compare and choose the finest plans.

Several duties, such as paying premiums, renewing health insurance, and so on, become simpler to do when done online. - Find a Policy with Reasonable Rates: When a person purchases a health plan online, they may compare prices and choose the one that best meets their needs. Furthermore, since there are no brokerage or agency costs, the buyer saves a large amount of money.

- Reviews of providers and plans are available: Compare Claim Settlement Ratios on our website to evaluate whether an insurance company has the resources to handle your claim.

This may assist you in gaining a general understanding of an insurer's reputation, allowing you to make an educated selection.

Some Myths about Health Insurance

Make certain that you understand how health insurance works before you get it. The following health insurance misconceptions are widely believed by the general public:

I am Healthy, and I Don't Need Medical Insurance

Even if you take excellent care of your health, unanticipated events such as seasonal illnesses, dengue fever, malaria, or an accident may strike at any moment and to anybody, regardless of their health. In these difficult economic times, affording the costs of hospitalisation might be difficult.

Simply being in the hospital for two days may cost you anything from Rs 60,000 to Rs 1 lakh, if not more (depending on the type of illness and hospital). In certain cases, medical insurance policies might aid you in paying the expenses of a lengthy hospital stay.

My Health Insurance will Cover all the Medical Expenses

It is mandatory for all health insurance policies to adhere to the IRDAI criteria, which include a list of exclusions and limits. You should double-check the policy's specifics as well as the coverage given by the plan before signing anything.

Only expenditures that are covered by the policy and are up to the maximum amount insured will be reimbursed by the insurance company.

Declaration of Pre-existing Diseases

Please be sure to include any of your pre-existing medical issues on the proposal form. Before you may get health insurance coverage, you must disclose any pre-existing medical conditions.

An insufficient amount of information may lead to a claim being denied, which will result in a higher cost than expected.

Smokers are not Eligible to Buy a Health Insurance Plan

According to a poll, more than half of individuals who use alcoholic beverages are reluctant to get health insurance coverage for themselves and their families. Certain health insurance companies do, however, reimburse the costs of these procedures.

Drinkers and smokers would be required to submit to a detailed pre-medical assessment and pay a higher premium in order to get health insurance coverage as a result of the dangers involved.

Medical Insurance will only Cover Hospitalisation Expenses

Although most health insurance policies cover hospitalisations lasting longer than 24 hours, some policies include a limit on how long you may stay in the hospital.

When a hospital stay of at least 24 hours is not necessary, most insurance policies now cover the cost of childcare operations as well as the treatment itself. A wide range of medical treatments, including cataract surgery, varicose vein surgery, and other operations, are covered.

I am Covered Under a Group or Corporate Health Insurance Plan!

Health insurance coverage supplied by their employers is relied upon by the vast majority of the population. Group health insurance has its limits, and it is vital to acknowledge this.

In the majority of situations, it will not cover your family members, the sum assured will be modest, or the insurance will not cover critical illnesses. Obtaining health insurance after you retire or lose your work may turn out to be too costly.

How to Calculate Health Insurance Premium?

You must pay a certain premium on a regular basis in order for your insurance to remain in effect. Have you ever given any attention to the method by which this charge is determined?

Health insurance premiums are influenced by a variety of variables, including your family's medical history, the amount of coverage you choose, the cumulative bonus you get, and your own medical history.

Use this to find out how much your insurance premium will be if you choose one. You may find it helpful to use a health insurance premium calculator in this process.

It is possible to calculate your premium using a premium calculator online, which is based on the information you enter, such as the amount of coverage you want, as well as the age of the insured, among other things.

Which Factors Affect Health Insurance Premium?

Healthcare prices have risen in lockstep with advancements in medical technology over the last several decades. The most important advantage of health insurance is that it compensates for medical bills.

It provides financial protection for you and your family in the case of a catastrophic sickness or tragedy that might result in the loss of all of your assets. The following is the formula for calculating your insurance premium:

Medical History

In order to determine the cost of your health insurance, it is necessary to consider your medical history. Pre-medical testing is required by almost all health insurers in India prior to the purchase of a health insurance policy (after a certain age).

However, even though some insurance companies do not require medical screening, they do take into account your present medical issues, lifestyle-related health risks, and medical history in your family when issuing coverage.

As a result, smokers pay a higher premium for medical insurance than nonsmokers do.

Gender and Age

The cost of medical insurance is also determined by a person's chronological age. When it comes to insurance premiums, the age of the covered person has an impact. As a result, it is preferable to get insurance when still in one's youth, since the rates for young applicants are quite cheap.

Those over the age of 65 are more prone than those under the age of 65 to suffer from cardiovascular disease and other major conditions such as cancer and renal disease.

As a result, medical insurance prices for older folks are sometimes higher than for younger people. Besides that, since women are at a lower risk of having a stroke or heart attack than males, their health insurance premiums are less costly than those of their male counterparts.

Policy Term

The cost of a two-year health insurance plan will be higher than the cost of a one-year health insurance plan. For long-term medical insurance policies, on the other hand, practically every insurance provider provides a discount.

Type of Health Insurance Plan

The kind of health insurance coverage you choose has an influence on the amount of premium you must pay each month. The more insurance coverage you have, the more money you'll have to pay out.

A health insurance premium calculator on the internet may be used to evaluate the prices for many different health insurance plans prior to purchasing insurance coverage.

No-Claim-Discount

It's possible that you'll be eligible for a No Claim Bonus if you didn't file any claims during the previous insurance period.

Depending on how many claim-free years you have on your insurance policy, you may save anywhere from 5 to 50 percent on your premiums (known as a cumulative bonus). It's also one of essential considerations when determining the premium amount to take into account.

Lifestyle

If you use alcoholic beverages or smoke on a regular basis, you will almost certainly be charged a higher premium. Occasionally, your request for medical insurance coverage may be refused by the insurer under specific circumstances.

How to File a Health Insurance Claim?

Two further advantages of health insurance programmes are the ability to get cashless treatment and the payment of medical expenses. It is possible to submit a claim for medical expenditures up to the amount covered by the health insurance policy's coverage limit.

There are two sorts of claim processes, which are as follows:

Health Reimbursement Claims

The policyholder may submit a claim for reimbursement of treatment expenses spent in hospitals that are not affiliated with the insurance company.

The insured must pay the bill, gather all necessary documentation, and then submit a reimbursement claim to the insurer or third-party administrator (TPA).

Cashless Claims

It is possible that the treatment may be acquired in a network or cashless hospital, in which case the policyholder would be eligible for cashless care. The hospital receives payment from the insurance company immediately upon the completion of the therapy.

It is possible to submit cashless or reimbursement claims for both scheduled and emergency hospitalisation using one of the following methods:

In Case of Planned Hospitalisation

- If you are planning to be admitted to the hospital, you must notify your insurance provider at least 48 hours in advance of your admission.

- Once your claim has been approved by the TPA, you may submit a claim using the claim form to request reimbursement or cashless claims.

- Medical bills, reports, and discharge summaries, among other things, should be supplied.

- When you file a reimbursement claim, the insurance company pays you the amount of the claim once you have given your approval.

- A cashless claim is one in which the hospital bill is paid directly by the insurance company rather than by the patient.

In Case of Emergency Hospitalisation

- If you are admitted to the hospital as a result of an emergency, you must notify your insurance carrier within 24 hours of being admitted.

- In the hospital, be sure to flash your health card.

- Fill out the pre-authorisation form in order to get TPA approval for emergency hospitalisation for cashless reimbursement claims.

- If the claim is authorised, the insurer will pay the network hospital as soon as the claim is approved.

- It is possible that you may have to seek compensation later if the TPA does not grant approval.

- To be considered complete, all necessary documentation, including hospital bills and discharge bills, must be provided.

- Your claim will be processed and reimbursed to you.

I hope you liked our article on best health insurance in India, if you have any comments or suggestions do share them in the comments below.

frequently asked question

Q1. What is the right age to buy health insurance?

The optimal time to get health insurance is when you're in your late twenties or early thirties. Your health will most likely be at its best at this age, and you will be financially independent of your family.

It is critical that you purchase health insurance as soon as possible. If you can afford it, you should acquire health insurance as soon as you turn 18.

Q2. Is a medical test mandatory to buy a health insurance policy?

Most health insurance companies will provide you with a policy without requiring you to have a medical examination if you are under 45 years old. For those above the age of 45, a medical checkup is required. The fee of the pre-medical test is the responsibility of the customer.

Q3. What is the sum insured in health insurance?

In health insurance, the maximum limit on the expenditures that may be reimbursed in a year against any bad occurrence is known as the amount insured. In the event of a claim, the bigger the amount covered, the more the insurance company would give you.

Q4. Can a person have more than one health insurance policy?

Health insurance policies are available to policyholders in any quantity. They can't, however, seek reimbursement from numerous insurers for the same expenditure.

If one cover is insufficient to pay the expenditures, the second cover might be employed. Every person needs health insurance.

Q5. How to add my family members to my existing medical policy?

At first glance, a single floater plan that covers four people — you, your spouse, and either pair of elderly parents – seems to be a good deal. Because of the increased advantages, many insurers will attempt to persuade you to enrol your parents in your family floater health insurance policy.

Don't fall for it, no matter how hard they try to sell it to you. It's also a poor idea to add your parents to your current insurance coverage. Have you looked into why this is the case? For a number of reasons, it is suggested that parents get independent insurance rather than add-ons.

Additional parents will significantly boost your premium if you already have or are seeking a family floater plan. This is because such plans are based on the age of the family's oldest member. When the person reaches the insurance's maximum age limit, the coverage will be terminated.

You'll have to purchase individual health insurance policies for each member of your family, each with a distinct premium and none of the claim history or pre-existing illness coverage that your previous policy provided.

Q6. What are pre- and post-hospitalisation expenses in health insurance?

Medical expenditures spent by the insured before admission to a hospital are known as pre-hospitalisation expenses. Medical fees spent after being discharged from the hospital are known as post-hospitalisation charges. Most health insurance companies cover them.

Q7. Will duplicate policies be issued if the original is lost?

If you misplace your policy bond, notify your insurance provider right away. Comply with the procedures to get duplicate insurance. The rights granted by the duplicate policy are identical to those granted by the original insurance bond.

Q8. What is the difference between health insurance and mediclaim?

Only hospitalisation, accident-related treatment, and pre-existing conditions are covered by a mediclaim plan, subject to a certain maximum. A health insurance plan gives you the option to increase or decrease your coverage.

Q9. What are some of the top myths about health insurance?

One of the most misunderstood financial items is health insurance. People in India, in particular, have a variety of misunderstandings regarding health insurance, which come from a general lack of awareness and understanding of insurance.

A few popular fallacies concerning health insurance policies, as well as the truth behind them, are described below. If you're young and healthy, you don't need insurance.

The reality is that getting health insurance while you are young and healthy is the best time to do so. Getting health insurance at a young age may save you money since the likelihood of being hospitalised is low. The best insurance is the one with the least amount of coverage.

Many consumers base their insurance selections on the price of coverage. While getting low-cost health insurance is appealing, you should be aware of one of the most basic health insurance facts: these plans have limited coverage options.

While the cheapest insurance covers the obvious, you should go for a plan that is both reasonable and comprehensive to ensure that you are covered in the event of a medical emergency.

Smokers are not eligible for health insurance. The bulk of health insurance providers is more concerned about pre-existing medical issues, which you must disclose on your application.

If you smoke and have developed a medical issue as a result of smoking, such as respiratory problems or lung cancer, you must report a pre-existing sickness. The insurer will not refuse to cover you even if you pay a hefty premium.

Q10. What is the minimum and maximum age at which one can enter and buy a health insurance policy?

Insurers are required by IRDAI guidelines to offer health insurance to those under the age of 65. Most private insurers, on the other hand, do not have such age limitations in their health plans, while most state-owned general insurers require applicants to be at least 65 years old.

Health insurance is available to every child above the age of three months.

Here are my best picks:

Also Read: Check out my reviews of the best image editing software, the top choices for video editing software, and my full guide to start a blog for beginners.